The Complete Bitcoin & Crypto Guide: Pros, Cons, Reviews

Updated on February 13th, 2025

First, I want to tell you what bitcoin is in a balanced light and first discuss the negative features of Bitcoin and cryptocurrency (also referred to as tokens). This is not an article about why bitcoin is bad or good, but in order to have a balanced discussion you need to be aware of its less desirable features. I just present the facts, features and the best ways to participate.

All too many bitcoin investors and promoters extol its benefits and completely ignore anything negative about it because they have their own interests in mind (usually getting referrals to Coinbase, which I don’t recommend, by the way) or perhaps they don’t really understand it.

This article assumes you know the basic Bitcoin definition that it is a “digital currency” or investment. I don’t waste any time discussing the Bitcoin history since there’s no need for page filler when this article is already packed full of relevant, useful material for buying, trading, exchanging or storing it.

The cryptocurrency world is constantly changing with services coming and going. I will try to keep this updated as much as possible.

Is Bitcoin Really a Currency?

No. To be a bona fide currency it would need to be widely accepted for payment. Sure, there are a few niche websites that accept it for payment, but right now there are very few places that do so. Bitcoin adherents always point out that once in a while a large online store starts accepting it, and that as the technology matures it will become widely accepted. But Bitcoin has already been around for more than ten years at this point. How much longer does it take to become a widespread payment option?

There are services that online retailers can use to accept Bitcoin payment, but the retailer doesn’t hold crypto on its books, the crypto is immediately converted to USD. And the bitcoin converter they use charges for this service, so usually you have to pay a premium to purchase with Bitcoin anyway.

It has to be easy (and potentially cheaper) for both consumers and retailers to use as a payment option and it certainly isn’t there yet and might never be. There are some new layer two innovations, such as the lightning network, that are trying to alleviate some of these concerns around conversion and fees. But again, what is the incentive to pay with a new currency when your credit card suffices?

There are a whole host of issues with using cryptocurrency as payment.

Bitcoin Costs Money

The first issue is that Bitcoin and cryptocurrency is not free to acquire. What is going to motivate a consumer to first buy cryptocurrency to spend when they already have a bank card that costs nothing to use? Using those little pieces of paper adherents like to refer to as “fiat” works just as well.

Here’s the process to get Bitcoin and other tokens. You first create an account at a fiat exchange (more below), which requires all kinds of personal information like your social security number, a copy of your ID and a creepy selfie, due to Know-Your-Customer (KYC) laws. Then you deposit USD into your account, which often has a fee, then you buy your preferred cryptocurrency, for a fee. Then you send your payment, for a fee. Seriously, who wants to go through that hassle just to buy a pair of sneakers online?

It’s Not Cheap to Send, Nor Faster Than Other Services

One of the early selling points of cryptocurrency and other digital currency investments was that it was supposed to be cheaper than the credit card fees charged to merchants and sending money in other ways such as Western Union. It’s also supposed to be much faster to send the money.

Those points might have been true in the beginning when it was an emerging technology and mining fees (more on this later) were much lower and there were fewer transactions, but those benefits fell apart as more speculators started trading it.

The fees and transaction times to send Bitcoin became enormous due to the sheer number of transactions.

Would you spend $28 dollars and wait 30 minutes for your coffee transaction to go through? Of course not. That episode showed how impractical it was at the time, and the developers have since made some changes to the block sizes to reduce that problem, but can it really support a worldwide payment system involving billions of transactions an hour? No.

Other cryptocurrencies and tokens have been created to try and improve on both the cost and the transaction throughput on the original Bitcoin technology.

It’s Unstable

A currency would need to have stability in price. Just look at these massive swings in the bitcoin price history:

Today my coins are worth $10,000, no wait, today they are $7,000…. Nope, $5,000. You don’t need a lot of bitcoin price analysis to see that it is volatile.

It trades more like a tech stock.

BTC is Not Anonymous

Bitcoin was originally thought to be like cash and be anonymous since the Bitcoin wallet addresses are random numbers. But it’s actually more of a pseudo-anonymous currency where every transaction can be traced to a wallet. So, is bitcoin traceable? Yes, to a degree.

The problem is, in the US and Europe, those pesky KYC laws that always seem to be fighting terrorism by assuming anyone who opens a bank account or cryptocurrency exchange account is a terrorist until proven innocent.

The way the blockchain works is that the entire flow of money is traceable from origin to destination. So if there is a KYC on either the deposit of funds or withdrawal of funds, the money is tracked. This is not a theoretical point either as there are dozens of “block chain explorer” companies that have businesses setup to trace the movement of money.

There are many reasons why anonymity would be valued, including not having an intelligence agency, either government or private following your every shopping trip, knowing the balance of your wallet, and creating taxable events every time you spend it (due to the way the US government treats it as property, more later)

Only a limited type of altcoins, or coins other than Bitcoin, like Monero, have actual privacy safeguards built in. With Monero, coins can be received, spent or stored and no prying eyes are the wiser. There is some utility in that kind of privacy, but governments have been pressuring exchanges to remove those altcoins from their platforms, so extra steps are required to acquire it.

No Payment Reversals

Say someone doesn’t deliver the goods that you paid for, or someone hacks your computer and unloads your entire wallet. What can you do about it? Nothing. At least with banks, they can stop payment on a transaction or reverse it in many cases.

Few One Stop Shops

The desegregation of services can be confusing to consumers which limits mass adoption. This is mostly a result of government regulation around KYC rules. Firms will only offer services they have the licenses for and getting licenses to move money around isn’t routine after 9/11.

But if I go to to JP Morgan’s website, I’m quite certain I know what I will find there. I’ll see credit card offers, banking accounts and home loans. If you enter the website of a random cryptocurrency operator, do you know what you will get? You might get a wallet provider and a place to buy coins. You might get an exchange that has no fiat on-ramp. Or you might get a payment processor for retailers. There are few one-stop shops that cater to the whole ecosystem.

Ask any random person how to buy 10 shares of Apple and they will probably say Robinhood. Ask them how they can buy cryptocurrency, and I’d wager 99 out of 100 would have no idea (although that is changing with the Coinbase IPO).

Furthermore, when you do visit the webpages of the various service providers, the fees are generally not right at the front. You usually have to dig down multiple levels to determine how much the funding fee will be, how much the conversion fee will be and how much the transaction fee will be. It’s not a consumer friendly experience.

And then since this space is largely unregulated, when you go to trade fiat for your cryptocurrency of choice, you often have the token marked up by a hidden spread. It’s a fee grab.

PRO-TIP: I rolled over a 401k into an IRA, and Capitalize‘s FREE service couldn’t have made it any easier to do. They work with all the major brokerages and handle the paperwork for you.

Is It Like Digital Gold and Rare?

One of the main selling points of a Bitcoin investment is that the number of coins that will ever enter production is limited. Some say its the only reason why bitcoin has value.

Millions of computers participate in validating transactions across the network and part of this is mining for new coins. The fact that there is a finite limit to the number of Bitcoin that can be in the system is a major selling point for many. It would theoretically keep up with inflation and increase in value as more users and participants join the system.

After the media started beating the drum about it nonstop towards the end of 2017, it became sort of a 1849 gold rush. Some of the earliest speculators bought in under pennies and rode it up to $20,000 a coin, creating vast fortunes. Then it rode up again to over $60,000 in 2021. That’s the kind of story that gets around – FAST.

Altcoins and ICOs Are Born

With these kinds of returns, everybody wanted in on the action, but of course, those returns were already in the past. What are scam artists to do to bilk people out of their money? Introduce new altcoins with grand promises about why they are so great. Coins started multiplying like rabbits and Initial Coin Offerings (ICOs) started raising millions of dollars based on nothing other than white papers or concepts of how their coin was much more special and worth your money.

How many coins are there now? Over 22,000. How many coins have a possible legitimate use? Maybe 50, depending on what you consider a legitimate use. Each one has some extra feature that supposedly makes it the next best thing or does something that the other ones don’t do so well.

Most of them are just forks upon forks off of Bitcoin (where the old coin exists, and a new coin is born) or Ethereum tokens and it takes 5 minutes of time to create a new token with no development experience required through various websites.

Some Altcoins are just Platform Tokens

These tokens are like a quasi-coin for use only on a particular platform. Usually you have to exchange another crypto asset into it which are then used on that platform. Say if you had a video site, you could buy or earn tokens, say by recruiting others, to have a certain number of viewing hours. The tokens are only usable on the specific platform and are not transferable. As of today there are 238,000 different tokens in existence.

Scarcity

So since there are so many places for a consumer to put their money, the main tenet of scarcity of Bitcoin and other cryptocurrencies is lost. There may only ever exist 21 million Bitcoins once they are all mined, but when the dollars are being spread out over Bitcoin, Ethereum, Litecoin, Bitcoin Cash and all the hundreds of variants, its value is watered down.

What is needed is a convergence to a smaller subset of coins, weeding out the junk, but that would require a centralized platform to do so. Obviously, that would defeat the purpose of its decentralization principle in the first place.

The problem is that there is a sucker born every minute and scamcoins are minted all the time to take their money.

It’s also possible that the number two coin, Ethereum, will supplant Bitcoin in the future. I think it is only a matter of time based on its utility, but the “flippening” has been called for years and hasn’t occurred yet.

Bitcoin Is a Tremendous Waste of Electricity

You have these mining farms burning through megawatts of energy just basically guessing numbers. During 2018, article after article was coming out comparing the bitcoin energy consumption to small countries.

It stresses energy grids creating the potential for fires and raises the cost of electricity for everyone in the area. Ethereum at least attempts to put this computational power to good use through its distributed cloud based architecture and smart contracts.

Rebuttals flood the web about how the banking industry uses so much more electricity, but does anyone really think that banks are going to disappear?

Bitcoin and Cryptocurrencies Are Not Going Away

Cryptocurrency is not going away unless governments around the world attempt to ban it (as China just did) in unison and seize mining farms. They are decentralized by construction, so even that might not stop them if enough people run mining equipment out of their homes (more on that later).

Will it change the world in another 10 years? Nobody really knows. There is some benefit to having full control of your own money especially with modern government surveillance that seizes assets if you’ve only been suspected of a crime. If you don’t think it could happen to you, think again.

Bitcoin as a Speculative Asset

It’s for those who are willing to make the bet that more people will come in to buy it after they do because maybe it does change the world and obtains that mass adoption. Or maybe the media just prints article after article on it raising awareness.

It’s the the greater fool theory, or mass adoption theory, depending on how you view it. It’s not a bad strategy as there are legitimate ETFs and hedge funds that follow momentum strategies based on the same principles, but it does require more people to come in after you for it to have more value than you paid for it.

This thesis has been pretty successful for Bitcoin during its ten year existence. It’s hard to find many assets that have gone up 100,000% in a ten year period. The more the media talks about its rise, the more awareness that comes and the more consumers come in to buy it. Entire businesses now exist with revenues in the billions just to service this crowd in buying, selling, spending and trading cryptocurrencies.

Bitcoin is often thought of as digital gold. It’s sole purpose is to have a limited supply and be secured by millions of computers crunching numbers.

Gold itself has few uses outside of jewelry and governments stocking up on it due to its perceived value (unlike Platinum which is a commodity that has some industrial usage).

Which Altcoins are the Best and Have the Most Potential?

Everybody will have a differing opinion here and there will be people out there who will tell you why coin number #475 is the best coin out there. But I would advise you to only focus on the top 50 unless you are extremely risk seeking. Anything lower than the top 100 is getting into scam territory, but even having a large market-cap is no assurance of legitimacy; see Hex for example.

Most of these tokens just exist to be a pyramid scheme (not in the MLM sense), with massive pumping on twitter and other social media, and hope more and more suckers will buy in and drive the price up, so the scammers can cash out. It doesn’t help when the world’s second richest man in the world pumps a cryptocurrency designed as a joke many years ago and then the lemmings rush in to buy it.

What really gives an alternative coin value?

- Some unique and real benefit (faster or cheaper transactions, anonymous, puts computational power to use.)

- Wide adoption

- Solves real world problem

- Liquid market

- Not just a clever name (SolarCoin, GreenCoin, etc..)

I only think a particular altcoin or token is worth looking at if it has a real world application. Ask yourself, what problem is this altcoin trying to solve?

I’m actually more bullish on Ethereum than Bitcoin due to its smart contract ecosystem (and lots of other tokens are built on top of Ethereum and it gets fees for that). I’m pretty convinced that Ethereum’s market value will cross over Bitcoin’s market value in the couple of years or so. It would have to double in value today just to match Bitcoin, so it has a long way to go.

I also love the idea of Monero because it fills in the gaps of what Bitcoin originally set out to do which was create fungible, anonymous money.

There are also a few derivative platforms like Synthetix and Synthetify that are being built to replicate services that generally only large wealthy clients could partake in with traditional finance. That to me is really cool to be able to speculate on the price of a real world asset without opening another brokerage account to do so. It’s also a potential way to circumvent the nanny state regulations that prevent you from buying exposure to a particular asset.

There are also a bunch of tokens and altcoins that feed the Ethereum ecosystem as “oracles” to bring real world information into the smart contracts, or connect the various blockchain networks together.

It’s a fast changing world, and it is hard to keep a Bitcoin article like this up to date because new stuff is coming online all the time. And when the laymen refer to Bitcoin, they often mean it in the Xerox or Kleenex sense of the word and mean cryptocurrency in general.

How to Get Cryptocurrency?

Here’s the main question probably on everyone’s mind, where do you buy cryptocurrency and not overpay for fees?

Trade Bitcoin Through a Traditional Stock Brokerage

If you are only interested in speculating in the price of Bitcoin, Ethereum or a couple of other altcoins there are some cheap and convenient options, but be careful, cheapness and convenience usually comes with a hidden price.

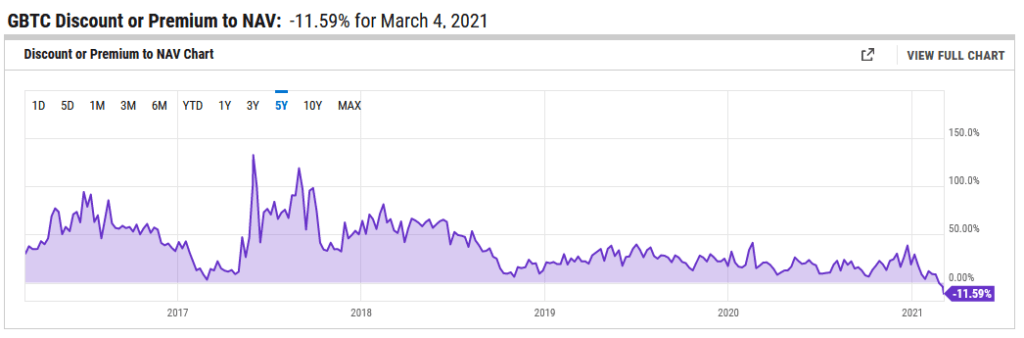

GBTC trades OTC and you can buy it with your existing stock brokerage account. Some people call it a Bitcoin ETF, but it is actually a holding trust, the same as the gold trust GLD is. The trust buys and holds Bitcoin on its balance sheet. This is a very simple way to get exposure and you can put it into your IRA. Not having to open additional accounts and submit extra identity paperwork to some shoddy crypto exchange with lax security is definitely a feature.

I have generally recommended avoiding this trust for two reasons. The first is that it has a high 2% annual management fee. However, when compared to services like Coinbase (discussed below) that charge you 1-2% fees to do everything including funding your account, it doesn’t seem so bad.

The second reason is that it usually trades at a steep premium to the net asset value (NAV). Sometimes the premium can be 100%+ of the value held in the trust. What that means is that people are buying Bitcoin at $100,000 when they can buy it off a coin exchange for $50,000.

Since 2021, it has been trading at a large discount! Meaning you are buying $50,000 of bitcoin for $44,500! This is the first time in the trust’s history it has traded at a discount to NAV. Why is this happening? I theorize that people are selling the fund and buying the actual Bitcoin because it is so much easier to acquire these days.

If you are looking to buy Bitcoin but aren’t interested in doing anything other than speculating on its price (you don’t plan to buy goods with it or want to hold it in your own secure wallet), this has become a good way to play it.

Robinhood Stock Brokerage (Avoid)

Read my Robinhood Trading Review article for why you should avoid them. This brokerage is the absolute worst.

Traditional Commodities Brokerage (Good)

Another way to purely speculate on price is to trade Chicago Mercantile Exchange Bitcoin futures and options on futures. Most major brokerage houses offer a futures and options on futures account if you fill out some waivers on investment risk. Usually to trade a single futures contract for 5 Bitcoin, the cost at a typical brokerage is less than $3.

Of course, the size of the trade might be too large for what most people are considering for their Bitcoin exposure and you can’t trade a basket of cryptocurrency or anything other than Bitcoin.

But another bonus of going to futures route is that futures contracts generally qualify for favorable 1256 tax treatment, and it is PwC’s opinion that Bitcoin futures do qualify, but there hasn’t been an official ruling by the IRS.

Buy It Through a Cryptocurrency Exchange Brokerage

This is what is known as the “Fiat Onramp” where you convert fiat dollars and euros into cryptocurrency.

These are similar to opening up a stock brokerage account, but they only cater to Bitcoin and other cryptocurrencies. Some of them do or plan to offer stock purchases as well to become more general platforms in the future.

Coinbase (Avoid)

Read my review on Coinbase.

They were one of the first to start marketing bitcoin to newbies and therefore became the most well known fiat-to-crypto dealer. They used to only offer a handful of coins in the beginning, but with the explosion of cryptocurrency trading, they have gotten with the times and added dozens of coins.

They’ve also gotten a lot better with the fee grab as competitors have entered the market but you can still expect ACH funding fees (usually free elsewhere), hefty exchange spreads and high withdrawal fees.

They capitalize on people being lazy, getting referrals from friends and not performing any crypto brokerage research on their own.

CoinSmart (Canada)

For Canadian readers, CoinSmart has a very wide selection of coins to choose from and offer instant verification and 0% fees on wires and bank drafts, which is about the best I have seen.

Cryptocurrency Exchanger

Getting your fiat USD into cryptocurrency is the hard part. But once you’ve done that you can use a plethora of services to change to any coin that you can possibly imagine, for a small fee. Some of these services also let you use a debit or credit card to buy directly the coin of interest, but usually the fees don’t make it worth the price.

Changelly

Changelly is another exchange service that has hundreds of complaints on Reddit that they steal user funds. Avoid them like the plague!

Decentralized Exchanges (DEX)

It’s a little more advanced to use a Metamask wallet to complete these exchanges so I don’t go into detail for readers here.

These are newer platforms that remove the trust process of sending your cryptocurrency to a centralized exchange. You need to already have cryptocurrency to use them, however. With these, the process is automated and the exchange does not have the ability to steal your funds. Each token type can only be exchanged for tokens on the same network, but there are some cross chain DEXes being worked on.

How to Mine Cryptocurrency?

You can buy a ‘bitcoin miner’ that converts electricity to bitcoin or other cryptocurrencies through mining. Mining is the process of verifying the blockchain ledger that underlies the technology. Millions of computers are guessing random numbers trying to match the target hash, which is a one-way encrypted number. If the miner guesses the hash correctly, they are rewarded with a specified number of the coin they are mining for. This is what makes mining attractive because the reward can be large and it’s akin to growing money in your basement.

The earliest adopters could just run software on their home computers and participate in the mining operations and trade electricity for Bitcoin. Unfortunately it is not so easy anymore due to massive server farms running specialized hardware that finish computations far faster than bloated personal computers can. To compete against them with a PC is like trying to race an Insight against a Ferrari.

The exception to this specialized hardware requirement is for the altcoin Monero. Developers behind the algorithm deliberately change it regularly to limit the spread of these pre-programmed hardware units. They do this to enforce more of a decentralized democratic environment to prevent large mining farms from taking over 51% of the computational power, which has power over the blockchain ledger that records transactions.

The earliest examples of specialized hardware for mining had a prerequisite that you were a technical person and required the assembly of various parts from a mining kit. You had to know what you were doing.

Individual miners need to join a mining pool so that the whole team mines blocks and spreads them out proportionally, otherwise you’ll be waiting a long time to get rewards if you go the solo route. The reward is divided among the team, but the chances of being rewarded is also higher, so it can be more steady, but smaller payouts. Each pool has its own fees they charge for being the captain.

If your city charges an expensive electricity rate, if won’t be profitable for you to mine, so run some analysis.

Where to Store Your Bitcoin and Altcoins?

This section is very important.

Cryptocurrency works through the principle of public and private key cryptography, where one links to the other. A wallet, hold the private keys, and public key addresses for your various crypto. This controls the functions of receiving and spending it, which is why they call it a wallet.

Exchange Wallets Where You Bought Them

Most people choose the convenience of storing Bitcoin and other cryptocurrencies right in the wallets provided by the exchanges or brokerages where they were purchased from. This is known as a custodian.

While you can store them in a wallet on the exchange where you bought them, you run the risk of the exchange getting hacked and losing your assets. This happens all the time, and probably the largest was at Mt Gox where $2 billion was stolen.

Major banks have been hacked in recent times, so it’s a real possibility that another exchange will be hacked in the future. There is really no benefit for you to store them at an exchange unless you want fast access to your assets, or you are actively trading them.

Therefore, it is only recommended that you keep your trading capital on these and not large sums of money.

Hot Wallets

There are various apps and computer programs that you can place on your own computer or smart phone that are not connected to the exchanges or large caches that are enticing targets for hackers.

If the exchange where you bought them is compromised, your cryptocurrency is stored in another location and won’t be affected by the mass security breach. However, since your device is connected to the internet, you still run the risk that a computer trojan (virus) will copy your private key and send it across the internet.

If you download a lot of random stuff to install on your computer and don’t think about security, you are putting your funds at risk.

Exodus is a popular one for crypto beginners because the interface is easy to use and attractive. However, it’s closed source so you can never be sure there isn’t a bug that puts your crypto at risk.

If you trade Bitcoin only and want a privacy wallet (slightly technical) the Wasabi wallet is an open source solution.

Cold Storage Wallets

So while hot wallets are better than keeping your funds at the custodian, the best option for large holdings is cold storage.

What cold storage means is that you store your private keys to your wallet somewhere without access to the internet. You could technically do this with a separate computer without an internet connection, but even that isn’t a secure method.

Paper Cold Storage Wallets

There are online paper wallet generators, which is a low tech solution of printing the private keys on pieces of paper and storing those in a safe place. The paper route isn’t convenient to type in when needed and is susceptible to fire risk.

Also there is a trust issue.

There are a few paper wallet generators online, but I can’t really recommend any of them because it was discovered that some of them were hacked in the past creating deposit accounts for the hackers. So be very cautious here.

Hardware Cold Storage Wallet (Best)

In response to this threat, some specialty hardware manufacturers have created these devices about the size of a USB stick, with a lot of secure elements that keep your funds safe.

And really, if you plan on buying more than $1,000 of it, there really is no excuse to not go this route because the average cost is under $100. It’s a small price to pay for security. Only buy it direct from the manufacturer so the device hasn’t been compromised. Avoid the Ledger, and get basically anything else like a Trezor or Tangem, because the Ledger company has had multiple data breeches and their latest “recovery” feature shows that it is possible to extract the seed word from the devices, which was previously said was impossible.

It’s not time to be cheap with your money.

Crypto Lenders

As of November 2022, a plethora of these services have declared bankruptcy. I was heavily against these services and showed that many of them were Ponzi schemes many months before they finally collapsed.

Why would you want to take a loan against your own assets instead of just selling them? For two reasons:

- You want to continue to speculate on the cryptocurrency.

- If you sell your asset it becomes a tax reporting event.

Therefore, the argument goes, borrowing allows you to free up some liquidity without incurring taxes and allows you to keep speculating on the price of Bitcoin and other cryptocurrencies. It’s the whole Bitcoin pizza argument; why buy 2 pizzas for 10,000 Bitcoin that later becomes worth millions of dollars?

You have to decide if getting 7-9% ‘interest’ is worth that risk. I don’t think it is.

Is Cryptocurrency Taxed?

One last thing, don’t forget that Bitcoin and Altcoin events including sales and transfers to another wallet outside of a coin broker are reportable to the IRS. All profits are taxable, so you will have to report cost basis for covered transactions to the IRS. All regulated US coin brokers will send you a 1099 form at the end of the year.

The IRS has made some additional cryptocurrency commentary in this guide around the various activities that covers things like Bitcoin mining profits or receiving cryptocurrency as payment and how to handle it.

In 2020, there was a section added by the IRS to the 1040 form that asks you direct questions about any cryptocurrency transactions you partook in.

Taxes and government reporting are one of the many reasons that altcoins like Monero are important. It’s really the only option you have for privacy and minimizing your tax paper trail. Once you buy Monero, the paper trail ends as long as you keep it in that altcoin medium.

Bitcoin Self-Directed IRA

An alternative is to avoid tax reporting using a self-directed IRA. And if it is setup as a Roth IRA, you can avoid paying taxes on your gains forever, legally.

While you can always put GBTC or ETHE into your regular stock brokerage IRA, you are paying 2-3% annual fees and you don’t own the crypto directly, and those trusts are subject to premiums and discounts which may not align with your trading or sales goals.

Summary

I know this was a very long article to read through, so I applaud your tenacity. I’ll highlight the major points here:

If you are interested in trading your cryptocurrency from time-to-time or plan to buy multiple altcoins to diversify your altcoin portfolio, buy a cold storage wallet to secure your funds.

Is Bitcoin a good investment? Only you can decide after reading all this information.

Read the next article in this series, How to Spot Cryptocurrency Scams.

Free Investing Tools

- Have Capitalize handle the paperwork for your 401K rollover to any brokerage, for FREE!

- Where does your money go each month? Track all your accounts and see if you are on track to retirement with Empower, for FREE! I use it myself to monitor my mom’s accounts to make sure she isn’t falling for scams or being defrauded.