Honest Coinbase Review 2025: My Money Is Being Held Hostage

Updated on January 19th, 2025

Update: Coinbase eventually released my funds after months. I ended up closing my account afterwards. The company is unacceptable and I haven’t had this issue with the other 3 crypto brokerages that I have used.

Read the full story below.

Crypto has started going crazy again with the expected January Bitcoin ETF approval and the BTC Halving on deck in the first quarter of 2024. This has brought a lot of people such as myself out of hibernation to start adding to holdings, and of course the first step in this process is using a USD Fiat to Crypto exchange on-ramp.

In this article I review my experience with Coinbase Global, the most well known exchange in the US.

Coinbase Has Never Been Competitive

Coinbase is the most well known crypto exchange in the US because they have been around since the early days of crypto and offer a referral program that always encourages people to signup to a platform because their friend is recommending them, in a biased fashion to get a commission, of course.

Furthermore, since they are a publicly traded company, it gives them some clout and some expectation that they will run the company above board.

I never bothered to sign up with them before because every year or so I evaluate which on-ramp options are available to USA customers and every time I have looked, they were always at the top of the list for the most expensive and highest fee’d avenue levied against the trader.

Converting fiat USD to crypto always costs something, but minimizing fees (relative to execution) in an investment is an important aspect of retaining profits whether it be crypto trading, stock investing or real estate investing.

There Is Only One Benefit Of Coinbase

I recently signed up with Coinbase because they advertise that they are trying to increase the adoption of USDC, their USD based stablecoin, and offer you the opportunity to convert USD fiat to USDC for free, and send it externally for free.

Your 2025 Goal:

Create a new side hustle and start a blog! I’ve tested out a dozen hosts and the one with the fastest speeds and lowest costs is the one I host my site on.

That’s a significantly valuable offer that shaves anywhere from 0.25%-1% off the cost of other platforms and its highly useful for people remitting payments to family members abroad, sending to other exchanges and reducing trading costs, or engaging in DeFi transactions with your own private keys.

I asked one of the crypto aficionados in the WantFi telegram chatroom if he had used them to send USDC to one of his other exchanges and he said that he hadn’t yet had a problem, so I decided to jump aboard with the technique.

However, I soon regretted it.

Account Restricted

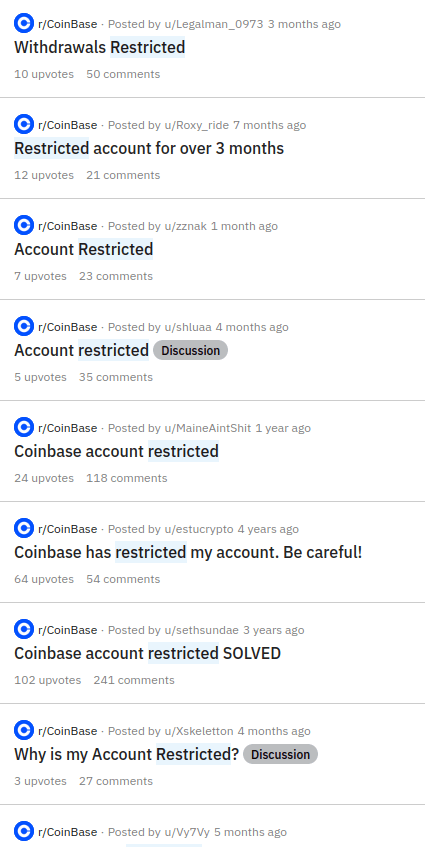

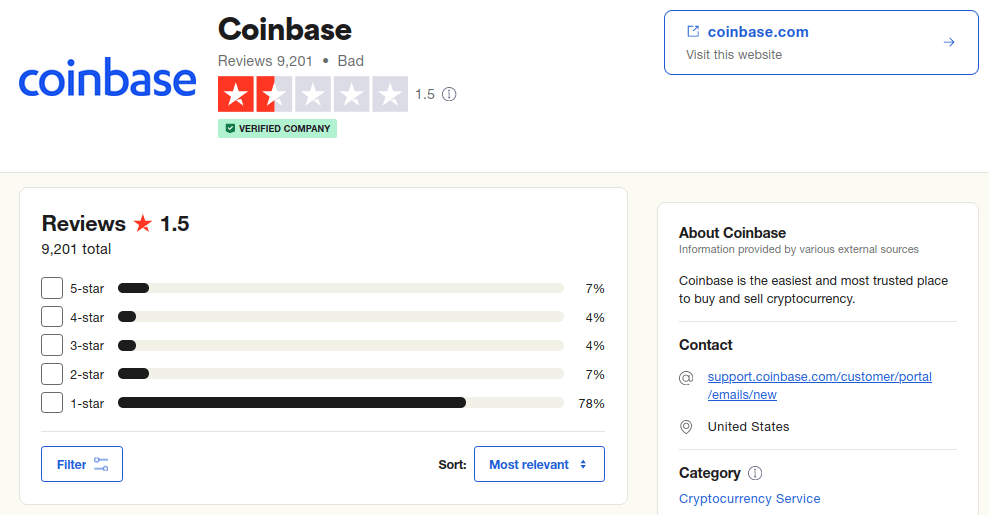

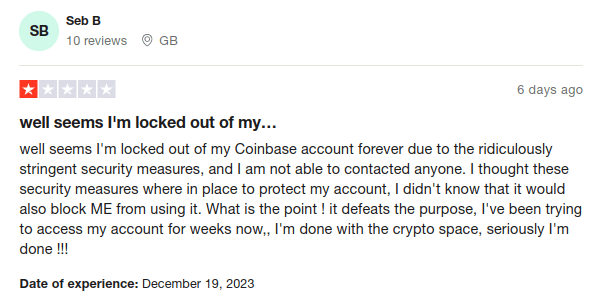

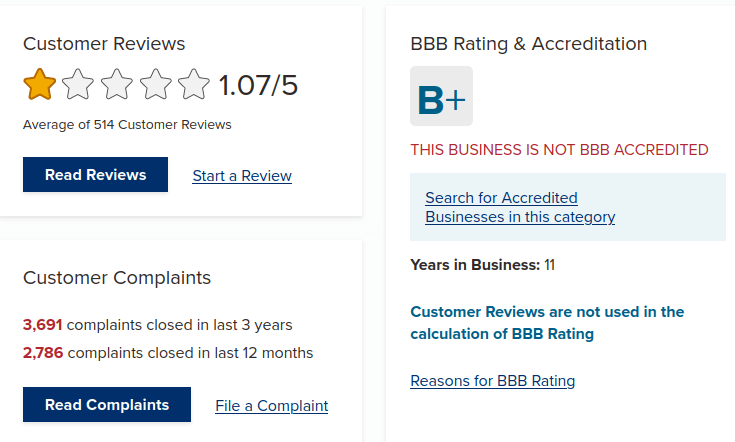

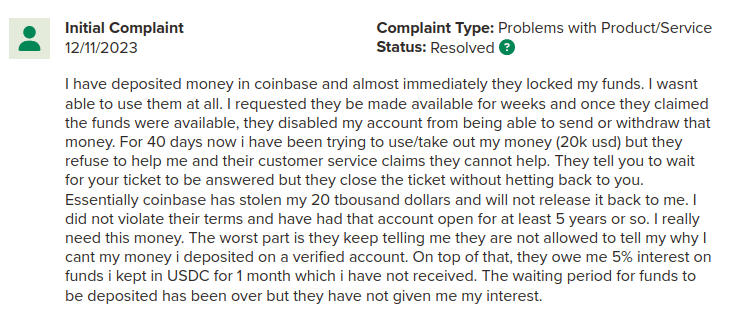

A quick search on Reddit or Trustpilot and other review platforms will document the mass struggles of having one’s account restricted and locked for no apparent reason and being unable to withdraw funds.

And then there was this class action lawsuit filed against Coinbase for the same reason.

Well, the same thing just happened to me.

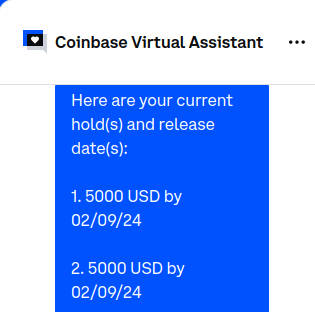

Now the strange thing is that it happened right after they raised my ACH contribution limits from a measly $250 a day to $5,000 a day.

I contributed $5,000 two days in a row and then they locked my account with the generic reasoning of “fraud prevention.” So then why were my limits raised? Why am I flagged when I use my allowed limits? Why don’t the selfies and pictures of my ID alleviate the “fraud prevention” issue? I can’t get any answers.

The Coinbase Support Sucks

Coinbase customer service is basically non-existent.

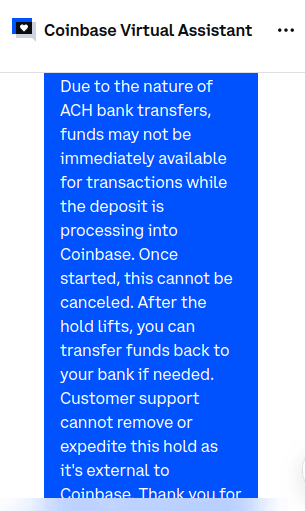

After multiple support inquiries I cannot get any straight answers. They refuse to tell me why my account was suspected of “fraud” or why I was flagged. No answers given except “wait 2 months, peasant!”

Two months is an outrageous amount of time for “fraud prevention.” No bank account or brokerage service would attempt the same stunt since they are regulated.

You can get a human by typing “operator” into the virtual chat, usually multiple times and then waiting 20 minutes, but don’t expect any answers. Just platitudes about “being patient” and “I understand your frustration.”

The worst part is at they won’t even just send the funds back to the original source. Surely if the concern was “fraud prevention” wouldn’t sending the funds back to the original bank account alleviate the concern?

They claim it is an external flag but I contacted my bank and they said there was nothing wrong with the ACH transfer. Coinbase is just trying to provide cover for holdings my funds hostage for some unknown reason.

The name on the bank account is mine and matches the name on the Coinbase account and I have verified my identity multiple times with selfies and pictures of my ID, so there should be no concern about fraud.

Someone had suggested that they do this to prevent money laundering, but money laundering is not electronically transferring funds from a verified bank account to another account. Money laundering is concealing the source of bad, criminally obtained funds and making them appear from legitimate business operations using cash or bearer instruments.

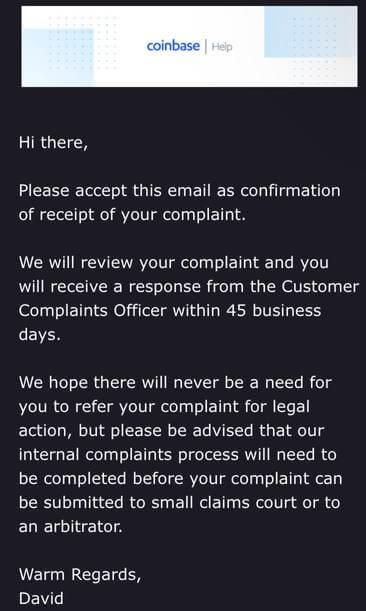

I filed a formal complaint, which is a prerequisite step to starting the mandatory arbitration process and their reply email said that they will take 45 BUSINESS days to get around to reviewing it. Like what the actual F#%&@! What company responds to customers after 2.5 calendar months?

Coinbase Is Much Of The Public’s First Encounter With Crypto

Coinbase is supposed to be spearheading the adoption of crypto, but I’ve never had a single legitimate financial service treat me the way that they have and refuse to send back my funds until they are good and ready in the name of “fraud prevention.”

How many people new to crypto are having this experience as their first experience? If they want their industry to flourish, they certainly aren’t doing a great job with the same experience they have offered to hundreds of people in a similar situation. It’s not a good look and probably has stopped a lot of people from continuing further into the space.

Could you imagine a bank account or stock brokerage doing this to you? No wonder why senators are calling for massive regulations on this space.

Coinbase Preys on Ignorance With Their Fees

Coinbase basically caters to the crypto newbie and treats them accordingly by preying on their ignorance about the industry and raping them with fees.

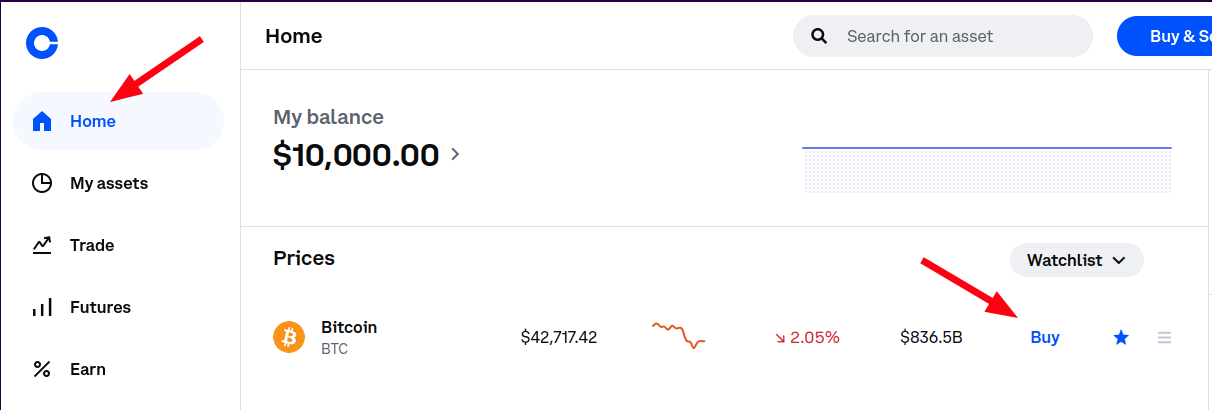

Here’s what I mean about the Coinbase fees. If you just signed up and don’t know anything about buying crypto other than you can buy Bitcoin or other cryptos there, you’ll login and be presented with a screen to do just that.

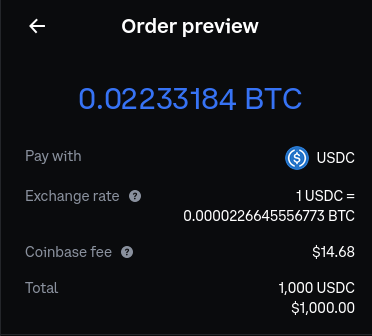

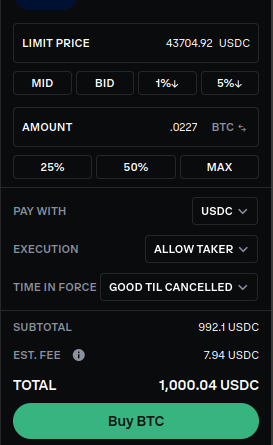

You’ll quickly find that it costs ~$15 to purchase $1000 worth of Bitcoin, which is high by any standard. Even before commission free stock trading, commissions used to top out at $8 a trade.

Given your newness to the industry, or potential referral link recommendation from a friend, you might think its the norm and acceptable.

What you won’t notice is the additional spread they bake into the purchase price which puts another ‘variable’ fee right into their pockets. Sneakily, they show you the exchange rate, not the price of BTC that you are buying at which hides the added spread.

And that’s only one side of the trade, you’ll have to pay another 1.5% + spread when you sell.

What you probably won’t find very easily is that you can cut this fee in half if you can make your way to the Coinbase Advanced Trade screen. If you are a crypto newbie, that might sound too “advanced” and you might not click on it in the first place if you can find it through the menus.

But 0.8% is still too high for the options available out there. And remember, that is on both the buy and the sell, so you are eating at least 1.6% on every round-trip trade.

Coinbase Front-Runs Crypto Exchange Listings

Another reason why they can cost you money is that they know which coins they are going to list onto the platform. Not only do they have to buy up some supplies to offer to customers, any employee who knows what coins are about to be listed can go elsewhere and front run the listing, which raises the price that their customers pay.

Several of their product managers were caught doing this, referred to as insider trading, and were charged and eventually plead guilty. However, Bloomberg reports that the problem likely goes much deeper than just the few individuals busted since coins and tokens start to appreciate long before Coinbase lists them.

Who knows how much this has indirectly cost Coinbase traders.

Does Coinbase Have Financial Problems?

The first rule about holding crypto is that you should NOT HOLD IT ON EXCHANGES. The rule of thumb is that you conduct your transaction, and then withdrawal your crypto to a private wallet. Not your keys, not your crypto.

So many exchanges have either been hacked or have turned out to be frauds or misused customer funds, leading to bankruptcies and customers being hung out to dry.

When a crypto exchange starts restricting your withdrawals, that is a very concerning situation and makes you question if they are using your customer funds to run their operations and are playing hot potato with deposits.

I really hope that is not the reason here, but one quick look at their SEC financials shows that they lose a lot of money every single year and have amazingly never managed to turn a profit even though they are the largest US exchange and have very high fees.

Everyone thought that FTX was above board until the truth came out. I feel very uncomfortable that Coinbase is forcing me to holding money on their platform against my will.

US Citizens Unfortunately Have Limited Options

There are exchanges that offer 0% fees or spreads to the crypto transaction, but some of the better options are limited to non-US citizens.

Unfortunately, the US government treats everyone like a terrorist or drug cartel kingpin until proven innocent so a lot of the better exchange options aren’t available to Americans. The US requires financial entities to Know-Your-Customer (KYC), but Coinbase likes to take it to heart that they are the enforcement arm of the US government and will demand to know details about where your funding came from, where it’s going, what employment you have, letters from your bank, and screenshots of statements. It’s really not their job or place to ask for such details once they have verified identity documents for their legal requirements.

No bank or stock brokerage has asked me for the kind of stuff that Coinbase has. They are deliberately going above and beyond the call of duty here, and to what end?

Ultimately I think they are just trying to trap me onto their platform since they won’t let my funds exit.

What Do I Plan To Do?

About the only thing that I can do right now is file complaints to the various review platforms, blog about my experience, and file a complaint with the Financial Regulator in my state since the money is too small to invoke other legal avenues.

It’s quite unfortunate it has to come to this but services like Coinbase need to be fined or shutdown if they are going to treat their customers this way. They are doing the industry a disservice.

Once I get my funds back, I will close my account because holding my funds hostage for 2 months is completely unacceptable.

Have you had a similar situation? Comment below and join the Telegram chatroom.

Free Investing Tools

For advanced traders who want direct access to exchanges without “payment for order flow” shenanigans choose Interactive Brokers.

I use Axos Bank for its no-fee business account with free bill pay.