The First $1 Million Dollars Is Always The Hardest

Published on July 15th, 2024

Last week I became a multi-millionaire.

20 years ago I expected it to have a different meaning, and I don’t think I am alone here.

Pop the champagne bottles, let’s hop in the Lamborghini and head to the Yacht!

Amirite?

Is $2 Million A Lot Of Money?

50 years ago it was.

And if you don’t have much to your name, it will seem like a huge amount.

Hell even a few years ago, when I was just a single millionaire, two seemed like a lot. I recall reading a fellow financial blogger’s website who had reached that point and remember thinking that he was so far ahead of me. Recall one of my earlier articles written a few years ago was to retire with $2,000,000.

Well, of course, that was before the dollar “officially” lost 25% of its value since the last election as the government started dumping money into the economy and interest rates remained at zero while the economy was robustly recovering from COVID nightmare.

The “experts” kept saying that inflation was “transitory” and hoped the problem would go away on its own. But of course it wasn’t and I wrote about why back in 2021 and offered some suggestions for what assets to buy to keep up with it (it’s hard!).

But here we are.

It Takes Money To Make Money

The observation about wealth is that the more you have, the more you make. This is probably obvious to many people who repeat the idiom, “It takes money to make money” but going from 0 to $1 million takes so much more time and effort than going from $1 million to $2 million.

There are ways you can make a lot of money from a small initial outlay of capital, but they are mostly longshots for most people. That doesn’t stop people from trying. Some get lucky, and everyone hopes it is going to be them!

I was a college student for what seemed like forever, collecting a bunch of degrees in Math, Economics and Computational Finance, and I didn’t start pulling a real paycheck until I was in my late 20s (I had worked full time for a year in between, but dumped my earnings into my living expenses during my final degree program).

When I started re-investing during the start of my career in finance and digging myself out of my student loan hole, I recall thinking back then about how the $500 I made on an individual stock felt so good.

That’s $500 I can spend to buy a better computer, or better clothes, or spend on a vacation!

It’s all relative.

I set a goal for myself, based on the amount I projected that I would save and invest, to reach $1 million before age 40, with a stretch goal of getting there before age 38. Well, I ended up beating the stretch goal, but it still took 9.5 years, which seems like an eternity for everyone who hopes to “get rich quick.”

It even took 6 years to reach half of it and was such a slow slog of a time.

Millionaire Dreams

Back when I was on the lowest rung, I was looking up and thinking that $1 million was so much money, I told myself I would fulfill my college dream and buy an exotic car.

When I finally crossed that millionaire threshold, it took me a while wrap my head around spending that much on a car; It just seemed like an unjustifiable chunk of money to drop on a toy. Being an investor at heart, I always thought about the opportunity cost – the cost of how much I won’t earn from investing it.

But then the pandemic happened and there was nowhere to go and nothing to do for a year, and so it seemed like as good time as any to finally check that box.

But at first, during the market meltdown of spring 2020, I briefly “lost a comma” as my brother said to me.

I was annoyed at him for saying that because it reminded me that I had moved away from my accomplishment and it was depressing to be losing so much money at the same time being locked out of restaurants, shops and places to go because of the government imposed lock-downs.

Of course, it didn’t take long for the market to roar back with all the government stimulus that flooded the economy and the stock market soared to new heights in short order. Pretty soon I regained my comma, and then some, and in spring 2021, I finally bought one of my dream cars, an Aston Martin.

And life went on.

Two Million Dollars

The interesting thing is that it only took about 5 years to gain the next million.

Of course, this makes sense since it only requires a 100% gain to go from $1 million to $2million and when you are starting out going from $100,000 to $1,000,000 requires a 1,000% gain, or a 2,000% gain starting from $50,000 (assuming no dollar cost averaging for simplicity).

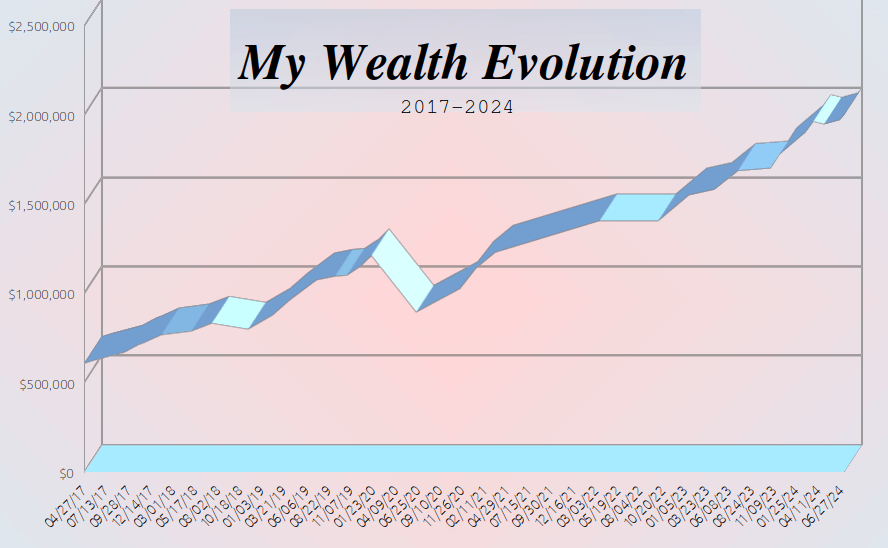

I started keeping a log back in 2017 and this is the evolution of my net worth over time:

Visually it looks pretty linear, but I only take snapshots every 1-3 months. In my next article I will break this down a little more the type of investments I prefer and show that I have historically “beat the market” through the cycle.

PRO-TIP: I rolled over a 401k into an IRA, and Capitalize‘s FREE service couldn’t have made it any easier to do. They work with all the major brokerages and handle the paperwork for you.

Wealth and Happiness

It may seem like a cliche, but while it’s a great personal accomplishment and a goal that many people strive for, wealth is not the most important thing in life.

What every person who achieves wealth learns is that it’s not the money that makes you happy, it’s the enrichment of your life that does: the partner you choose, the fulfilling ways you spend your time together, your family, your health, and the time you devote to yourself for your personal enrichment and hobbies that you love.

Obviously money doesn’t hurt, but if you aren’t happy with $100,000, you’ll probably not be any happier with $1,000,000, or $10,000,000. People have a tendency to come up with things to be unhappy about and always think someone else’s life is “better.”

Ben Affleck proves the point that you can have it all and still be miserable:

Money’s greatest utility is a safety net that provides a peace of mind that you won’t be living on the streets and that you have some buffer in case you need it.

Going from $1 million to $2 million wasn’t life changing for me and I doubt the next million or two will be either. Do I plan to retire soon? No. Do I plan to buy a Lambo soon? No.

Ultimately, it’s just another Monday.

Free Investing Tools

- Have Capitalize handle the paperwork for your 401K rollover to any brokerage, for FREE!

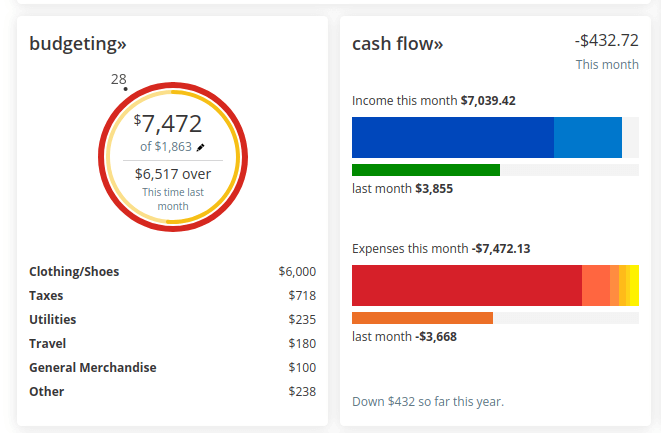

- Where does your money go each month? Track all your accounts and see if you are on track to retirement with Empower, for FREE! I use it myself to monitor my mom’s accounts to make sure she isn’t falling for scams or being defrauded.