2025 Best Investments To Capitalize On the Strong Dollar

Updated on February 3rd, 2025

As I have been discussing in the WantFI telegram chatroom, the time is upon USA investors to start thinking about buying international assets while the dollar is at multi-decade highs. This article discusses the pros and cons of various asset classes that will rise in value when the dollar peak is reached.

Jan 2025 Update:

The US Dollar is roaring against with the prospect of international tariffs and higher interest rates. It hasn’t broken out beyond the former high, but this dollar strength again makes the suggestions below germane once again.

Oct 2023 Update

The dollar is has been gaining strength again this year, but hasn’t blown out its old high yet. Needless to say, I still feel that buying international assets and things discussed below still makes sense. If a recession happens and rates drop that could cause the dollar to weaken (depending on what happens with rates in other countries).

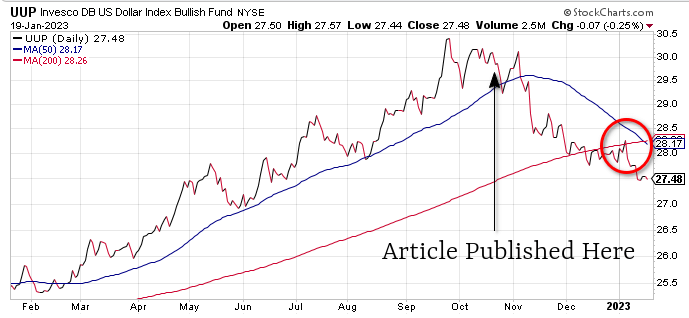

January 2023 Update

It looks like for now, when I first published my article back in October, I called the peak in the dollar. It was the best time in the last twenty years to buy international assets, but the dollar is still historically high and there is still time for some of the trades I discuss below. Things can change pretty fast as we can see though.

First, we show the context of how the dollar strength is measured.

What Does It Mean The Dollar Is Strong?

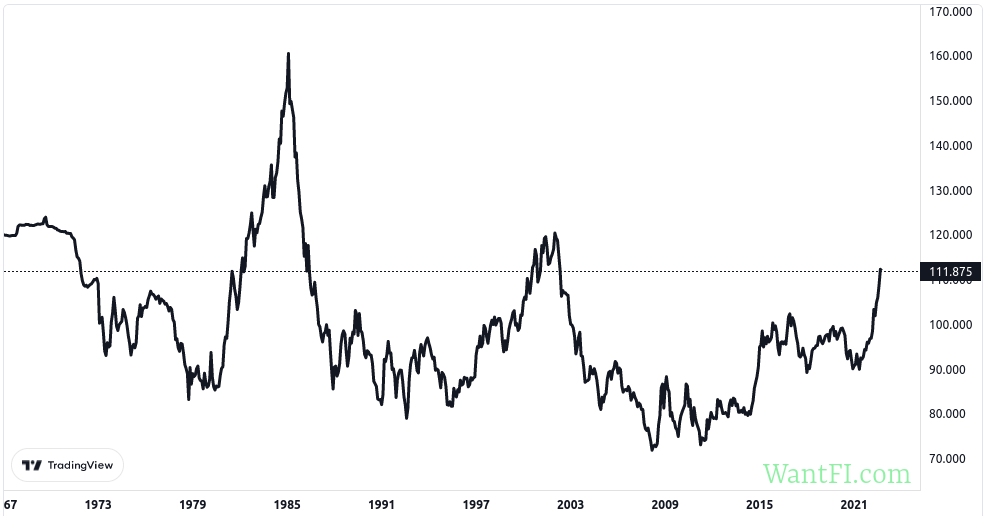

The dollar is stronger relative to another currency when it can buy more of a foreign currency than it could in the past. One way to measure dollar strength is to take a basket of currency majors and create an index relative to the dollar to compare how much it can buy today relative to its history. The DXY index chart shows the strength of the dollar over time.

There is another concept of purchasing power parity that values a basket of goods across different currencies and compares them, but it’s subject to the design and basket members, so taking the index is just an easier way to showcase a majority of the concept.

While the dollar has been stronger in the past as in the early 1980s and at the beginning of the new millennium, it weakened significantly going into the Great Financial Crisis, before turning back up over the last decade. As you can see on the chart, the dollar cycles from low to high and the trends take years to decades to play out. The dollar is now at a 20 year high.

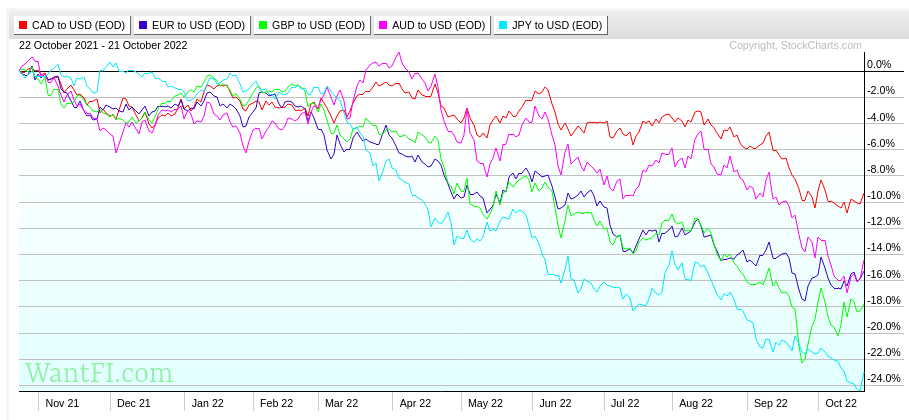

Here is how the individual major developed currencies have performed against the dollar over the last year:

The Japanese Yen has lost 24% and the GBP lost 22% before rebounding a bit. The Canadian dollar has been the strongest relative performer and only lost 10% of its value relative to the dollar. The Canadian and Australian dollar are “commodity currencies.”

Why Is The Dollar Index Rising Today?

Forex relationships and their relative values stem from supply and demand in the world economy and many macroeconomic factors are at play to determine these relationships.

Right now there are three major reasons why the dollar is strengthening relative to the rest of the world.

The first reason is that the US dollar is considered a safe haven and when there is geopolitical chaos going on in the world, global investors pare back risk. Right now there is the Russia-Ukraine war, Russia’s natural gas pipelines being blown up by unknown actors, Russia threatening nuclear war on anyone who interferes with its new claimed territory, and China making veiled threats to retake Taiwan (with the US’s new microchip curbs, I think the odds of this happening went up dramatically for 2023).

Additionally, with the prospect of a global recession on deck due to central bank tightening, capital flows away from riskier assets.

Surging Interest Rates To Combat Inflation

The primary reason for dollar strength is a differential of interest rates between nations since the Federal Reserve in the United States has been aggressively raising rates to combat surging inflation. One of the ways to combat inflation is to slow down the economy. Most other developed nations are still playing catch-up and are offering lower nominal interest rates and dealing with higher levels of inflation (more on that later).

Large institutional investors will follow the yield.

Additionally, a common tactic of hedge funds and speculators is called the carry trade where a currency pair relationship is pressed even further apart by borrowing money in a currency that charges low rates and then investing it in another currency with higher rates. In other words, the borrowed currency is sold and the higher yielding currency is bought.

Inflation Is a Global Phenomenon

Since the relationship between interest rates and inflation is important, I want to briefly discuss today’s inflation (I discuss inflation in-depth and how to hedge against it in another article).

There are several reasons why inflation is surging around the world and one key theme of everything discussed below is the concept of knock-on effects: Actions by one country can affect the whole world.

Energy

Energy, which is the major component that affects all downstream operations in manufacturing and transportation, is being produced less than before the pandemic. The United States became the number one oil producer in the world a few years ago and the pandemic led to many changes:

- Refineries were decommissioned due to a lack of profitability and future uncertainty.

- Over 100 oil drillers declared bankruptcy in 2020 due to oil prices that fell way below the capital necessary to stay afloat.

- The 2020 elections led to a political party that has traditionally had an unfriendly stance towards the energy industry leading to the fewest federal drilling leases issued in 70 years, the canceling of a permit for a major pipeline already under construction, and plenty of anti-oil political rhetoric that provides a disincentive for energy companies to undertake multi-year projects whose future profitability is uncertain.

Combined with a recent 2 million barrels per day OPEC+ production cut announcement, Russia’s halt of gas flows (and now complete loss of a blown up pipeline), there’s less supply of oil and natural gas which, of course, leads to higher costs of energy around the world.

Money Printing and Stimulus

During the pandemic, there was a massive coordinated pandemic stimulus response by developed countries resulting in trillions of new dollars, euros and British pounds to be minted by their respective governments.

Plenty of this money ended up as direct stimulus checks to individuals. In the United States, for example, there were multiple direct checks issued to households and at one point the government paid employers to pay employees not to work during the lock-downs with the Paycheck Protection Program resulting in trillions of extra dollars in the economy.

The Federal Reserve also printed trillions to buy assets leading to asset inflation and the “wealth effect” to spur consumption.

Putting extra currency into circulation only debases it in the end.

Supply Chain Issues

Households used this extra money to buy consumer goods and stocks.

China, being the world’s manufacturing hub, was already locking down multiple cities for COVID, but then they were flooded with new orders, which raised demand and maxed out production leading to backlogs and price hikes. Containerships for transporting the goods to the western world were then maxed out. Port activity was maxed out, so instead of empty containerships returning home to load up for the next batch of consumer goods, they waited at sea for weeks until there was port capacity, which further reduced the supply of logistics and increased costs of transport.

For some unclear reasons, China is still enforcing lock-downs in many of their cities which means that much of the world’s manufacturing is still disrupted.

All of these reasons for inflation are interconnected and there is a lot of blame to go around.

PRO-TIP: I rolled over a 401k into an IRA, and Capitalize‘s FREE service couldn’t have made it any easier to do. They work with all the major brokerages and handle the paperwork for you.

Has The Dollar Peaked?

Trying to call the exact peak or trough of any price is a fool’s errand in any asset class, but if there were one law of finance, I would say it would be mean reversion: the relative valuations of assets cycle back and forth across time, but always return to the mean eventually (and generally overshoot to the other side).

The strength of the dollar is no different and while it will trend in a direction for a while, it will eventually reverse course. The timeline of currency trends can span years or decades, of course, but reversals can be swift as the first chart at the top shows.

The reason why I think we are near the summit is that other central banks will start to catch up with rate increases as the Fed slows theirs down as inflation starts to slow.

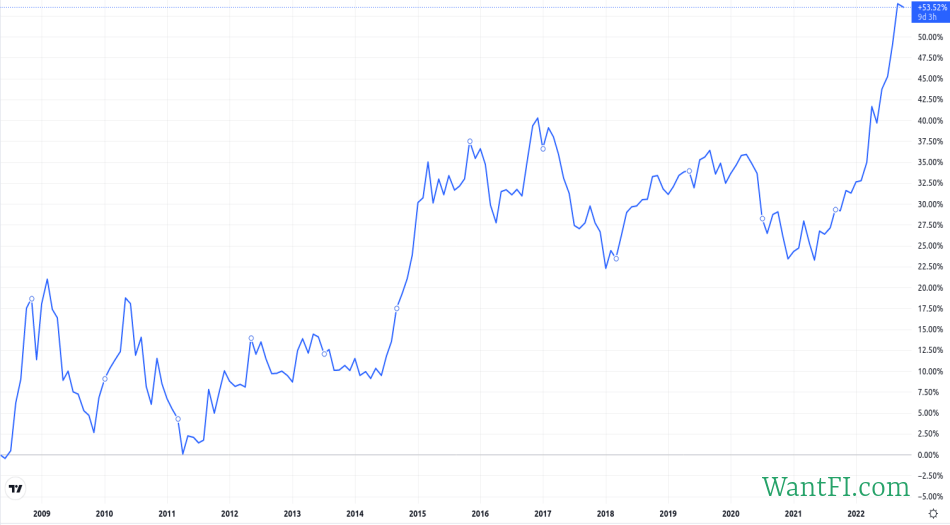

Look how far from the trough reached in April 2008 we are; the dollar has risen 55% since then.

There are several other reasons why as well.

Inflation Appears To Be Slowing (at least how the government measures it)

The dollar’s strength has been great for holding down inflation in the US since we import most consumer goods, but even with that advantage, the last several inflation reports were bad and showed a lack of progress. When one report didn’t look good, like CPI-U all inflation, government officials would then pivot to another metric like core inflation which strips out some inflationary, volatile items. When the more favorable inflation indicator got worse, the jig was up.

However, surging interest rates and inflation are starting to impact US retail sales and home sales. As economic activity slows, so will price pressure; we are probably turning the corner. The last three months of reported inflation were lower than the prior 8 months before it, for instance.

Everything else being equal, as other nations raise interest rates and catch up to the nominal US Fed rate, their currencies will again become attractive, in a relative sense, which will slow down or halt the dollar’s advance.

Market Sentiment

One of my favorite contrarian indicators is the cover of magazines which are usually very late to the party:

It seems that journalists are the last ones to know about a trend and when the story is so good that the editor decides to place the story on the cover, it’s usually the end of the line soon after. AlphaCubed maintains a comprehensive stack of the action after select covers were published since 1929 if you want to get a feel for how it works.

Intervention

And lastly, foreign governments have started to intervene in the Forex markets to strengthen their own currencies. Just this week, Japan started to sell dollars to buy yen. And earlier this month, the Bank of England intervened in their bond markets which abated the collapse of the pound. Often these interventions are a temporary fix and the currency continues the trend it was on after a pause, but it means that other countries are starting to take action. Further coordination could mean the peak of the dollar.

How To Take Advantage of the Strong Dollar Today

So here we get to the meat of the article: how to take advantage of the strong dollar and make some money!

International Equities

The first thing that people’s minds gravitate towards when they think of international assets is international stock.

It’s probably the most painful asset to think of buying too, because the performance of international equities has been horrendous for 15 years. Our hindsight bias will focus on these poor performances because we probably all have international stocks in our 401(k)s and we are all cognizant of the funds we have in there that haven’t been growing for over a decade (other than fresh contributions).

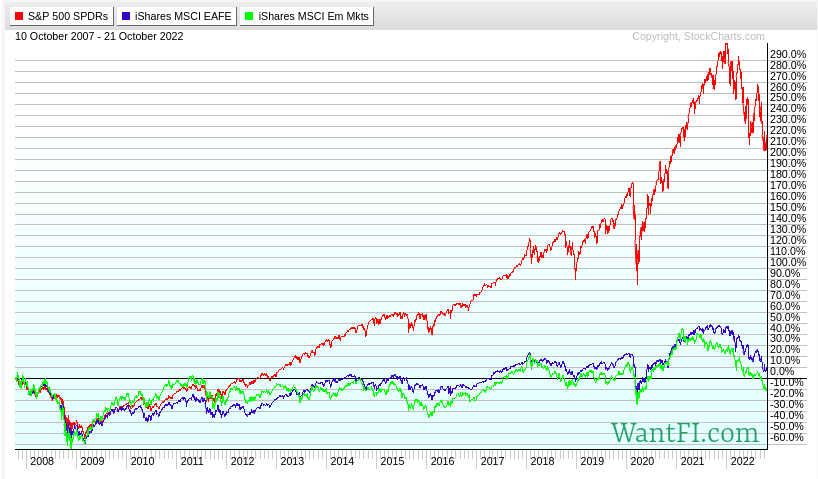

As the next chart shows, the total return of EAFE, the international developed markets index, since October 2007 was 9.7% and for Emerging Markets was -10%. This contrasts to the total return of the S&P500 of more than 200% over the same time period. Ouch!

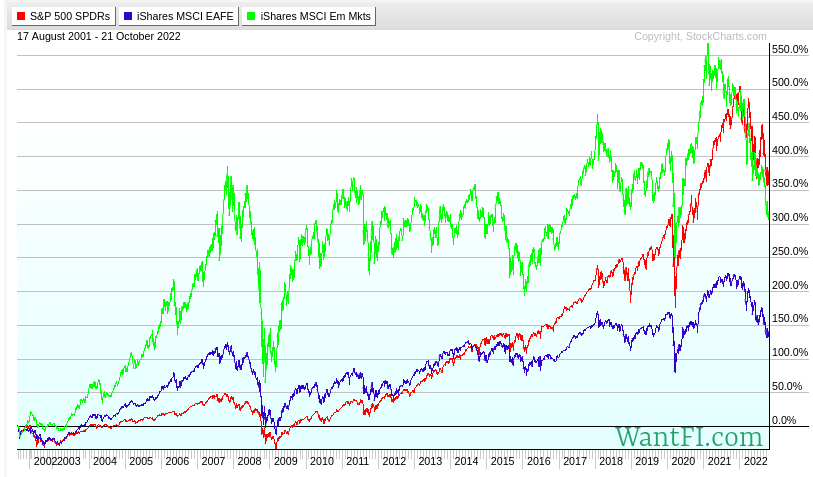

But when you zoom out, things don’t look as dire. In fact, emerging markets were outperforming the S&P 500 for twenty years up until 2021, even after not going anywhere for the last 13. Developed international stocks also outperformed US stocks for the first 14 years of the millennia:

It is likely that your international exposure is lower than it should be just from a total world market cap weighing framework, where about half the world’s GDP is. Assets move in cycles, and the easiest way to be a passive investor is to just buy a fund like Vanguard’s Total World Index (VT), which has 40% of its assets in international equities.

Research has proved that most investors are overweight the country they live in, known as the home country bias, and since your international equity exposure lingered for over ten years, you are probably well below that. By adding international stock, you can view it simply as re-balancing to a proper asset allocation.

Valuation

By itself, valuation measures make for horrible timing indicators and they can stay depressed for years while overvalued markets continue to rise. However, I want to point out the other advantage of adding to international equities.

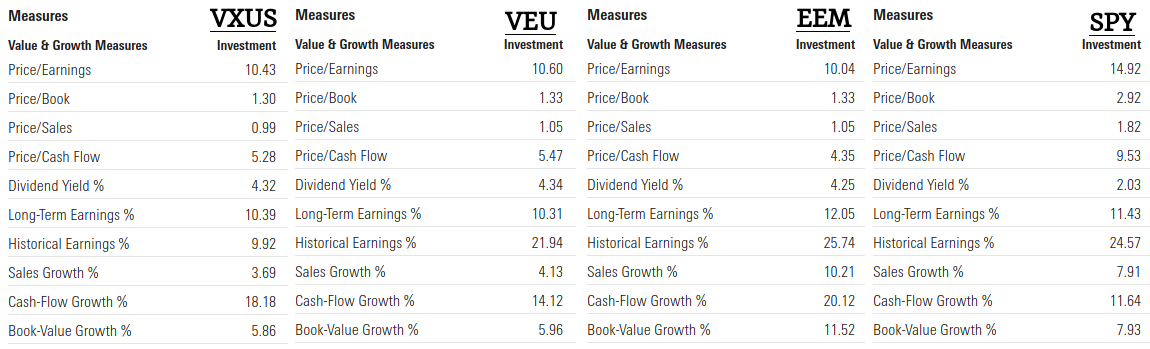

Below I show the Morningstar portfolio measures for VXUS, VEU, EEM and SPY. Both VXUS and VEU are total international funds, EEM is the largest emerging markets fund, and SPY is the largest and oldest S&P500 fund.

The Price/Earnings ratio is about 30% less than the S&P500, the Price/Book and Price/Cash flow is half, and the dividend yield is double. If you think of investing like a business where you put money in and then later get more money out, your dollars are buying more value here.

The difference between VXUS and VEU is the benchmark with VXUS having almost twice a many stocks comprised of international small caps. The performance difference is minimal however, and if you compare the total returns, they have almost a perfect overlap because the extra small cap exposure doesn’t amount to much.

Mean reversion will eventually take charge and at some point international equities will come into favor again.

Investing in the Japanese Stock Market Hedged and Unhedged

Where is the US dollar strongest? Japan because they have had low rates for decades.

One of the things that people don’t realize is that most international stock ETFs are not hedged against the dollar so much of the recent poor performance has been tied to the moves in currencies and not necessarily the index of the country itself.

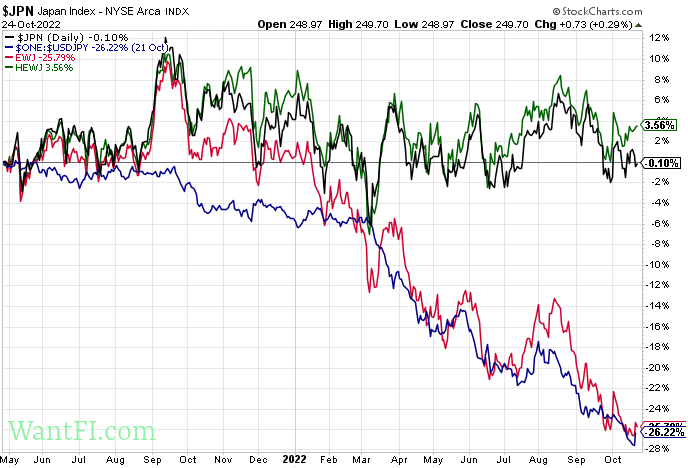

To illustrate this point, check out the MSCI Japan ETF, EWJ, and its hedged equivalent, HEWJ on the following chart.

- The black line shows the performance of the NYSE Arca Japan index.

- The red line shows the performance of the largest MSCI Japanese fund, EWJ.

- The green line shows the performance of the currency hedged version of MSCI Japan, HEWJ.

- And the blue line is the performance of the Yen against the dollar.

If you were a typical US investor and only looked at the EWJ ETF, you would likely surmise that the Japanese stock market performance over the last year and a half had been abysmal. But in reality it has been relatively flat in Japan. The difference in performance is explained by the dramatic devaluation of the Japanese Yen relative to the US Dollar.

While the performance of the unhedged Japanese ETF, EWJ, closely replicated the performance of the USD/JPY relationship, the currency hedged version of the fund, HEWJ, closely replicated the performance of the index itself. Quite remarkable.

Investing in the U.K. Stock Market Hedged and Unhedged

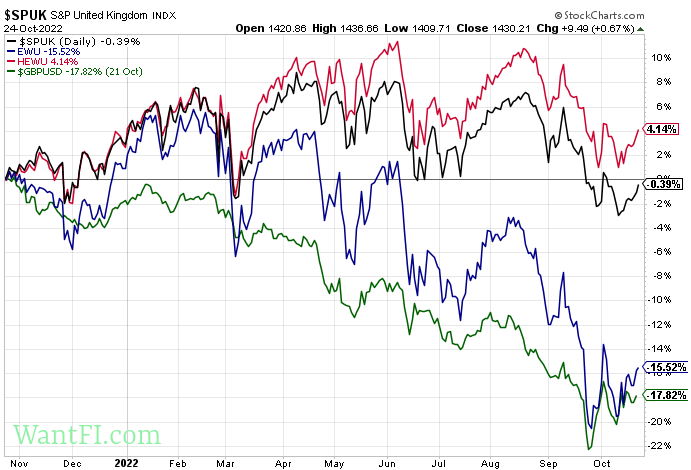

The same story pans out in the United Kingdom.

- The black line shows the performance of the S&P UK index.

- The blue line shows the performance of the MSCI U.K. ETF, EWU.

- The red line shows the performance of the hedged MSCI U.K. ETF, HEWU

- And the green line is the performance of the British Pound against the US Dollar.

The U.K. stock market performance over the last year from the perspective of a US investor was a money loser, whereas the U.K. index performance was actually flat.

The currency hedged version of the fund slightly outperforms the index because the methodology of the index differs slightly from the makeup of the MSCI fund, but you can see they are strongly correlated and the point is the same.

International Bonds

I have been thinking about writing an article about fixed income because since the summer, the options have expanded quite a bit as rates have risen rapidly. The yield on many international bonds was actually negative for half a decade and not worth owning, but that’s all changed this year.

Now, the thing with bonds is that they will respond more to the effect of rising interest rates rather than the effect of currency appreciation or depreciation, even though the two effects are directly co-mingled. Since rates have risen rapidly in most developed countries (Japan is still holding out), bonds prices have dropped to equalize the yields to the off-the-run par bonds (a concept known to us finance nerds as duration).

International Bond ETFs

One way to play the international bond market would be to buy international bond ETFs, but unfortunately for this dollar peaking thesis, it won’t do you any good because almost all bond funds are hedged against the dollar. Of course it makes sense why the portfolio managers do this because the currency effect has a tendency to overpower the income gains you’d earn by holding it.

For instance, if your international bond fund is yielding 3%, but your currency appreciates 20% relative to the world currencies of the bonds that the fund holds, the bond fund will lose almost 7 years of gains if it’s unhedged!

Another snag is that because the US dollar is the world reserve currency, a lot of foreign countries and corporations issue debt in USD. Institutional investors around the world have more confidence that a country won’t be incentivized to turn on the money printers to meet their debt obligations when the currency is issued by a third party they have no control over.

The major problem for USD issued debt, however, is that as the dollar strengthens relative to a country’s local currency, the value of the debt appreciates and is more expensive to service. That actually increases the default risk, which is not great for you. In contrast, if the dollar weakens, you have more confidence that the country can repay it, but you don’t get more yield.

So to play the peaking dollar thesis, it really only makes sense to buy local currency bond funds or individual foreign bonds. Unhedged international bond indexes are surprisingly rare. In fact, I was only able to find a handful of them and most are issued for emerging market debt which adds a another dimension of risk that I am not looking to partake in. I prefer the developed sovereign debt due to the relatively risk free nature of it.

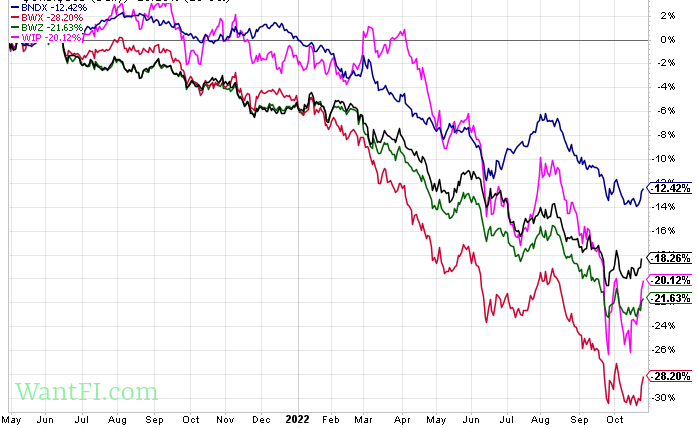

I was only able to uncover a handful of funds that invest in sovereign debt unhedged: the Bloomberg international treasury ETF (BWZ), the Bloomberg short term international treasury ETF (BWX), both of which still have very sad yields, and the FTSE international government inflation protected bond ETF (WIP), which I started buying in October. There are a few others like ISHG and IGOV that basically mimic the first two, so I didn’t include them in the comparison.

I include the Vanguard international bond fund, BNDX, which is a dollar hedged fund, to show you the impact of currency and rates together. I couldn’t find a pure sovereign debt USD hedged fund, so it includes corporates and emerging markets debt and is subject to credit spreads widening. This means that market stress will cause it to lose value unlike international government securities would, but I wanted to have at least something to compare to.

But as we can see all three funds performed much worse than the dollar hedged bond index and underperformed the dollar itself as well.

For those astute fixed income readers, you’re probably wondering if I got the symbols mixed up since the intermediate term bond fund, with an effective duration of 8, outperformed the short term bond fund, with an effective duration of 1.9. The country proportion of both funds is similar so the currency effect doesn’t explain the difference and yield curve didn’t flatten to the degree that the charts would suggest, so frankly, I don’t have an answer to this quandary.

Individual International Bonds

Unfortunately trading bonds, other than treasuries, in a retail brokerage account leaves much to be desired as much of what you might actually want is not there for immediate purchase. Usually what you find available for purchase is junk that institutional traders are trying to dump on unsuspecting retail investors who don’t see red flags on a bond yielding 11%.

Furthermore, neither Schwab nor Fidelity offer international bonds on their website. I called their fixed income trading desk and they said that they could procure international bonds, but the minimum would either be $25,000-$50,000 depending on the issue. For government issues I don’t necessarily see this as a problem, but most investors probably aren’t spending that much on a single bond.

The reason for thinking about individual international bonds anyway is so that you can hold to maturity and get the exact yield you buy it at. Bond funds are subject to large portfolios with bonds rolling off and new ones coming in, so your yield is always moving around.

Your yield is juiced if the dollar weakens after you purchase the bond. For instance, recently 5 year UK Gilt yields were yielding 4%, and since the pound has suffered a big depreciation hit this year, if the GBP/USD exchange rate were to go back to last years high of 1.40, then the yield would jump to 5% after converting it back to USD.

International Real Estate

If you have the dream of buying a pied-à-terre vacation home in a foreign country, now is probably a good time to start pulling the trigger on it. Americans are setting records buying foreign real estate.

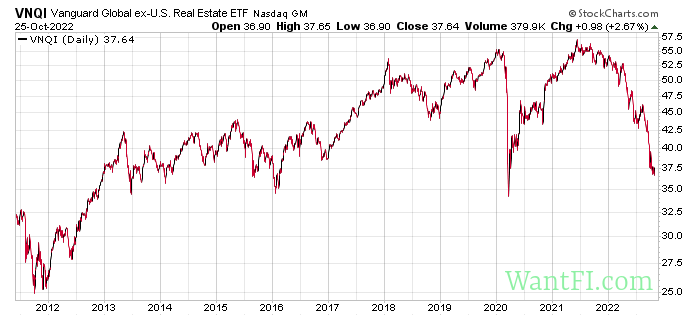

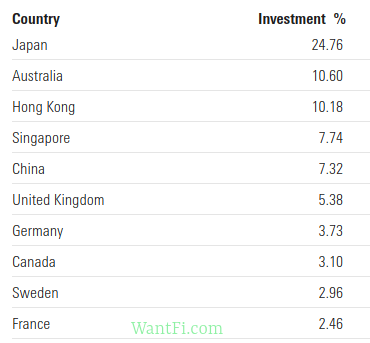

Most of us probably don’t have the large cash available to buy a property since obtaining a foreign mortgage is non-trivial, so I’d say the next best thing is to buy international real estate investment trusts (REITS). Vanguard’s VNQI ETF is the obvious choice for it.

Given that it has a forward yield of ~8%, it fits very nicely into my cash-flow investing preference.

It’s near 2013 lows on a total return basis and at record lows on the price basis.

Much of the damage has been from the increase in rates since REITs are bond-like and the assets depend on mortgages to acquire property, but 25% of the portfolio is Japan REITs whose currency has been hit the hardest. So buying this fund now is a double whammy fire-sale since both rates and currency moves have whacked the portfolio.

Direct Currency Investments

There are various ways to make a pure currency investment through funds on exchanges and Forex brokerages, but these are not my preferred method of taking a position because I prefer to invest in something that is yielding cash-flow. These currency trusts pay nothing.

Additionally, buying raw currency and holding it is still subject to inflation losses and the exchange traded products that hold currency charge hefty management fees.

I don’t recommend this route. It’s cheaper to use your own brokerage and do a conversion. Interactive Brokers even pays interest on most foreign currencies.

Commodities

Most of the world’s commodities are priced in dollars, so while commodities from a US perspective have gotten cheaper, for the rest of the world they have gotten more expensive. This has definitely helped reduce inflation in the US.

As I argued for previously, commodities and commodity producers are generally great inflation hedges on their own and if the dollar weakens from here, the price of the commodities will increase, which will add to the bottom line of producers.

For oil in particular, tack on the end of the Strategic Petroleum Reserve midterm election program, the OPEC+ cut scheduled to start in November, and the eventuality of China ending its lockdown program and oil is set for future gains. It’s a 1-2-3 punch.

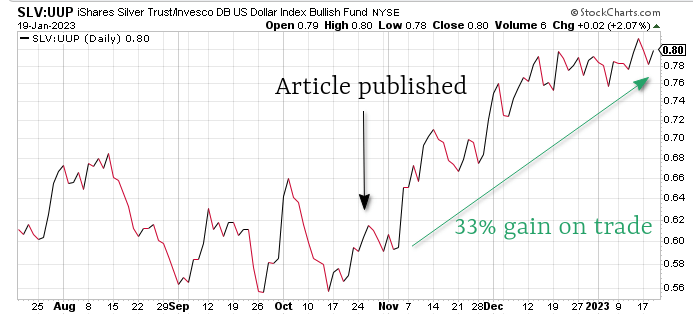

Silver also appears to have a shortage right now, but that needs an entire article to flesh out the case for it. I’ll leave you with this nice chart:

As previously written about, I prefer the commodity funds that are strategic about how they hold commodity futures contracts. Funds like COM and CCRV are preferable to GSG in my eyes due to the way the funds choose commodity futures instead of just holding a fixed basket. GSG will be more responsive to dramatic commodity moves, but the other two funds lose less when commodities soften.

The Final Consideration

The only risk of losing money from foreign government debt is the exchange rate, so that would be the safest way to play the dollar strength.

Given that the world might enter a global recession (“hard landing”) from the coordinated central bank tightening, you shouldn’t make any dramatic moves into equities or commodities all at one time, unless your portfolio is completely out of its proper allocation. These asset classes would be negatively impacted regardless of dollar strength, but a recession may not happen and with most markets already down 20-30%, the risk at this time is much less than it was a year ago.

As such, I’ve started building a position in many of the funds I have mentioned here. I prefer to build a position slowly and carefully adjust my portfolio towards a target over many months. This way, if the dollar continues to strengthen or the underlying assets get cheaper, the new money I allocate will capture some of the benefit and I won’t feel like I deployed everything too soon.

Do it doucement… do it very slowly.

Subscribe to my newsletter or join the telegram chat to keep up to date on investing research.

Free Investing Tools

- Have Capitalize handle the paperwork for your 401K rollover to any brokerage, for FREE!

- Where does your money go each month? Track all your accounts and see if you are on track to retirement with Empower, for FREE! I use it myself to monitor my mom’s accounts to make sure she isn’t falling for scams or being defrauded.