Roth IRA / 401k Retirement Accounts Suck: 2025 Disadvantages

Updated on January 8th, 2025

Retirement planning does not come easy for most people and there are a plethora of choices to make in the process.

When the decision comes whether you should choose a Roth 401k or IRA or a traditional tax-deferred type, I make the case here why you should skip the Roth account, unless you are in the lowest of tax brackets. I also demonstrate with some examples why the biggest concern about choosing a Roth or a traditional retirement account, that taxes will increase in the future, does not favor the Roth.

The conclusion is clear, for a typical person, a traditional retirement account will make you more money over time than a Roth will. Continue reading to understand how tax arbitrage can benefit you with actual financial examples.

What Is The Difference Between a Roth and Traditional IRA / 401k?

For a quick recap on the difference between the two, it comes down to when you pay the taxes. Yes, Uncle Sam always gets his cut eventually. Your options are to either choose a Roth, where you pay taxes upfront, or a traditional account where you pay taxes later. In retirement, the Roth accounts pay no taxes on distributions, while the traditional accounts pay ordinary income taxes.

The Roth variation has only existed since 1997.

Tax Arbitrage: What Makes The Traditional Retirement Account Better Than The Roth

Almost all the personal finance gurus out there favor the Roth account type and tout the benefits of having tax-free income in retirement after decades of compounding. But there is nothing magical about paying taxes upfront that somehow leads to more money in the future. In fact, quite the opposite.

I go against the herd and explain why most people should skip the Roth option and pick the traditional type because, for most people, it will lead to more money. This is explained through the concept of tax arbitrage.

The fundamental idea is whether you pay taxes now or pay taxes later.

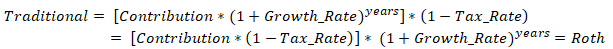

Mathematically, if the tax rate is the same in the contribution period and the withdrawal period, the after-tax value of both account types will be exactly the same from the commutative property of multiplication:

How Tax Arbitrage Works

If you wonder why your tax rate will be lower during retirement, it’s because when you contribute to a traditional retirement account during your working years, the deduction is applied against a single bracket, your highest marginal tax bracket, but when you take a distribution during retirement, your money is spread out over several lower tax brackets, each bucket being filled with a higher tax rate along the way, creating a lower average (effective) tax rate.

This is the concept of tax arbitrage: You contribute during your peak earning years, taking a higher income tax rate deduction (saving more tax dollars now) and take distributions during retirement paying a lower average tax rate.

The valuation formulas become:

Since Retire_Avg_Rate <= Marginal_Rate, mathematically the value of the traditional account will be greater than or equal to the Roth account type. The worst case scenario is that the accounts have the same after-tax value if you are in the lowest tax bracket in both the working and retirement periods.

Of course, by retirement, the assumption is that you are actually retired. If you continue working while taking distributions from your retirement accounts, your regular working income will push up your marginal tax rate reducing the tax arbitrage benefit being described. The thesis of this article is more for the typical retirement scenario where you stop working and start relying on retirement accounts.

The only way the Roth could have more after-tax value is if your average retirement tax rate is higher than your marginal tax rate during your working years, such as if future tax rates increase substantially, or if your ‘retirement’ income is greater than your peak earning years. The possibility of higher future tax rates is a commonly cited reason for choosing the Roth; it’s risk aversion for the unknown and I address this possibility in a later section below.

Let’s work out some financial examples.

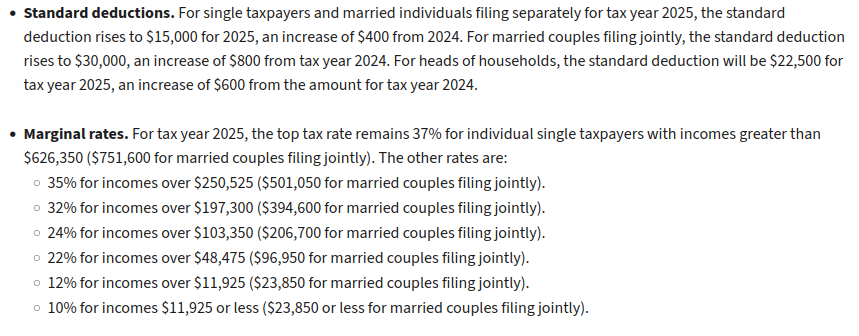

2025 Tax Brackets

These are the relevant figures we will need for our tables and calculation examples below.

Example With Median Earning Family

Let’s say you are a median working family in America earning $80,610 annually and taking the standard deduction (ignore tax credits and other deductions here, such as those for children, which drop your tax bill further regardless of which retirement account type you choose).

Most financial advisors will advise that you target enough funds to be able to withdraw 80% of your working year salary. The idea here is that you will have paid off your mortgages and cars and have lower expenses in retirement. But to make it a fair comparison, let’s assume you saved and invested enough to pull out 100% of your working salary.

Tax brackets are adjusted by inflation so you can ignore the effects of inflation here, or you can think about it in a simple two year period: your last working year and your first year of retirement.

For a married household earning a median $80,600, after subtracting the $30,000 standard deduction, the remaining income is $50,600 and the marginal federal income tax bracket is 12%.

A $10,000 contribution to a traditional retirement account would save 12%, or $1,200. The max 2025 401k contribution is $23,500, so this median family example could save $2,820 in taxes this year if they have the capacity to contribute the maximum.

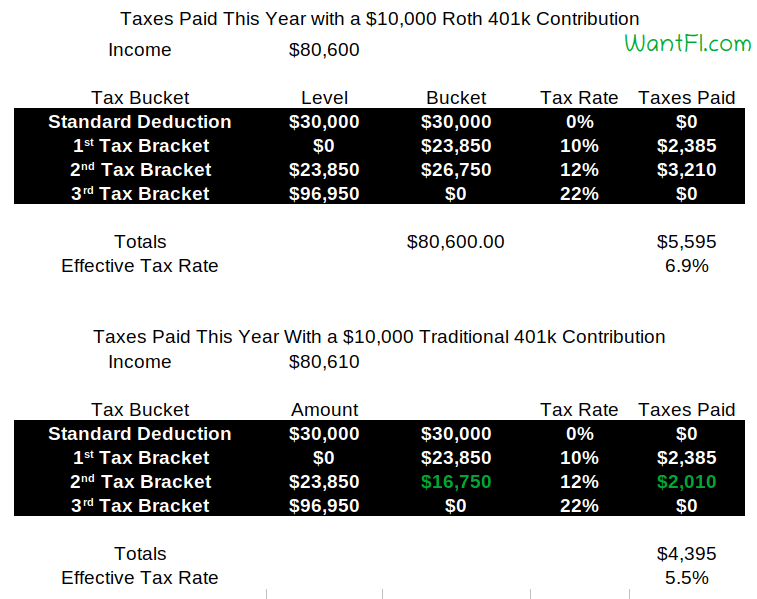

The tax table below shows that you first subtract the standard deduction per family (halve everything for singles). Then the next bucket of funds is taxed at 10%, and the rest is taxed at 12%.

The difference is $1,200. Both of these tax totals will be reduced when credits such as those for children are applied.

Retirement Years

Since tax brackets are indexed to inflation you can apply the same table above to your retirement withdrawals. Withdrawals from traditional accounts are ordinary income.

A portion of that money will be tax free due to the standard deduction, then a portion will be subject to the lowest tax bracket, and the next portion will apply to the next highest tax bracket and so on, just like during the contribution years.

The key point to recognize is that the income you pull out of your account in retirement will have a lower effective tax rate than the marginal rate it was saved at.

If you chose the Roth account, you will pay 12% taxes upfront, but with the traditional account, 6.9%.

In this median case you can save 21% in taxes by choosing a traditional, standard retirement account.

PRO-TIP: I rolled over a 401k into an IRA, and Capitalize‘s FREE service couldn’t have made it any easier to do. They work with all the major brokerages and handle the paperwork for you.

Tax Optimization Strategy

The long term capital gains rate is 0% for families who earn under $96,700 a year (in 2025), which is an extremely valuable benefit. The traditional account gives you options to throttle your income as you choose and take advantage of this.

In retirement, what if you only need to pull out of your retirement accounts an amount equal to your standard deduction? Zero taxes.

What if you invested extra funds earmarked for retirement into the S&P500 in a regular brokerage account and only pull out of your 401k the amount you qualify for 0% long term capital gains taxes? You can pay zero taxes.

What if you maximize the last point? Withdrawal only enough from your 401k to keep you under the limits and sell enough S&P500 investments to live off of, paying zero capital gains taxes, and then immediately contribute the leftover 401k funds to a Roth IRA for 20 years. Never pay taxes on that money ever again. Cheat code!

See, the traditional account allows you to strategize. In contrast, the Roth taxes are already paid upfront by the time you get to retirement and there is no improvement you can do to the rate you already paid.

When is there no extra benefit to a Traditional account?

If you are married and combined earn $53,850 or less, this puts you into the lowest tax 10% bracket after the standard deduction, and then both accounts will pay the same amount of taxes, ceteris paribus, and there is no tax arbitrage (if you have kids, you will need to account for child tax credits as well).

When is the Roth IRA better?

The Roth is better when one’s household is in the lowest income earner bracket making $30,000 annually, or when one’s deductions wipe out their taxable income to below this level. Then go all in on the Roth since you can contribute to a Roth and never pay taxes on those earnings ever again.

Additionally, if you are on the edge of the 0% tax bracket, you can contribute to a traditional 401k to drop your income down under the marginal bracket and then contribute the rest to a Roth at 0% (another assist from the traditional account, yay!). Respect the yearly contribution limits across both accounts, of course.

Common Roth Fear: What if Taxes Increase?

The most commonly cited reason for choosing a Roth account is the risk that tax rates will increase in the future because of the massive national debt, or taxes just being low by historical standards. Both are valid concerns as taxes almost certainly will need to be increased in the coming years if we ever want to start being responsible with the national credit card.

Exact future tax rates are hard to forecast because it’s an extremely political decision that both parties are diametrical on. Taxes have been decreasing in the United States for decades now, so if someone chose a Roth account out of fear back when the Roth style was introduced in 1997, they left a lot of money on the table during their retirement today.

It’s impossible to know what congress has in store for future generations, but you can get a pretty good idea for the next 4-8 years by observing which party is in power, since tax rates generally only change with presidential cycles.

But let’s really push the limits on what could happen.

Big Tax Increase Examples

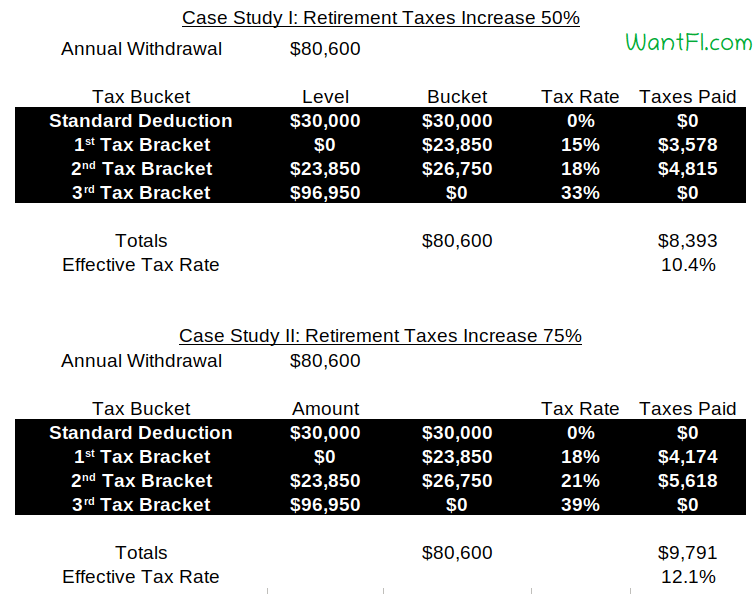

There are two parts to taxes, the rate and the bucket. Tax increases typically push more of the burden to the highest earners so typically the brackets widen and the top rates increase.

If the width of the brackets increase (and they automatically do every year because of inflation adjustments), it just means more money is taxed at lower rates before hitting the next marginal tax rate. Since we are trying to challenge the traditional account type, we will just assume that the width of the tax brackets stays the same for the analysis and the tax rate goes up.

If tax rates increase during your working years it only strengthens the case for the traditional account since you will be deducting at a higher marginal rate today.

The worst case scenario is that tax rates increase immediately after you retire and start to withdrawal from your accounts. These are the scenarios I put forth below.

In scenario I, taxes increase 50% and in scenario II taxes increase 75% the year after you retire, respectively. I keep the tax bracket widths the same to challenge the assumptions.

What this shows is if taxes increase 50% during your retirement after contributing at the lower tax rates throughout your whole working years, you would still be paying a lower tax rate on the retirement account funds than the immediate tax contribution rate. If taxes increase 75%, then the Roth would have a slight tax advantage of 0.1%.

But again, this assumes that the bracket width doesn’t adjust with a tax increase, which would be unlikely, and that you are taking out the same amount of money each year that you contributed.

Also, I want to point out that this is a highly punishing and unrealistic scenario. The US government wouldn’t just pass a bill one day and raise rates 75% for everyone starting the next year; they would gradually increase them over many years, and your traditional contributions would benefit from the higher deductions along the way.

A Roth account is highly unlikely to outperform a traditional retirement account for a typical family even if you factor in dramatically higher federal income taxes in the future.

What are Disadvantages of a Roth?

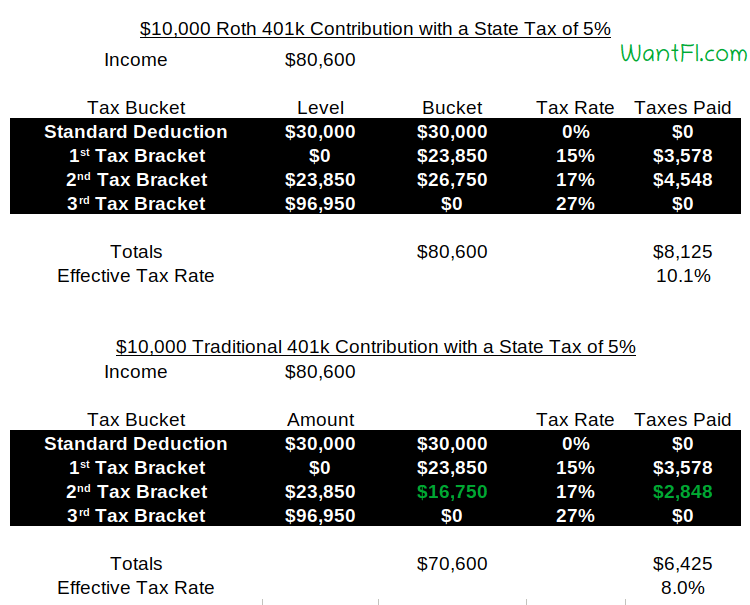

So not only will you pay a higher federal effective tax rate if you choose a Roth account as we showed above, you will also pay state taxes today if you live in 1 of the 42 states that has a state income tax. Of course, this really only factors in if you plan on moving to a state without a state income tax (or a lower average rate state) when you retire.

It can get a little complicated though. Some states, like Pennsylvania, tax your contributions regardless of account type, but don’t tax distributions during retirement. Most other states treat contributions and withdrawals the same way the federal tax code does, but there are some exceptions to the rules and you should double check your state’s retirement contribution handling.

For instance, Massachusetts doesn’t tax contributions into the regular 401k, but does tax deductible IRA contributions. It makes no sense, but these kinds of state nuances is what makes the Roth or traditional IRA / 401k decision difficult and hard to prescribe a one-size-fits-all.

However, if you live in a state that follows the federal method and plan on retiring to a state with lower or no state income taxes, this decision strongly favors the traditional retirement account since you’ll be saving both the marginal federal rate and the state rate on top of it, which is usually an extra 5% or more.

That 12% marginal rate becomes 17% in Massachusetts, for example, and using a Traditional 401(k) there reduces one’s tax bill 21%. You pay $1,700 in taxes upfront with the Roth.

If you plan to move to a tax free state when you retire, federal income taxes would have to increase 145% to make the average effective rate for the retirement account equal to today’s marginal rate!

Account Balance Example

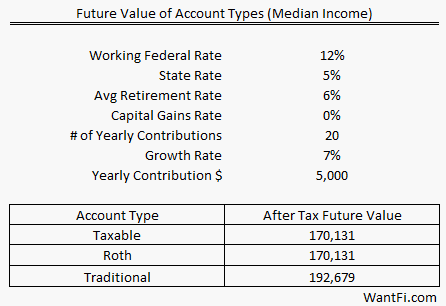

To illustrate the complete picture, say your family earns $71,000, makes 20 years of contributions of $5,000, invested in index funds and earns a conservative 7% a year. Your state tax is 5% but you will move to Florida in retirement and have no state income tax. The following table shows the value of each account type, after tax.

The previously mentioned 0% capital gains tax rate for families under the limit is why the taxable account and the Roth account are equal in this scenario. How much retirement income will you have in retirement? If your taxable withdrawals are under the limit, you’ll still benefit (assuming existence then, of course)

But the results are remarkable, at the end of the 20 years, the after-tax value of the traditional account will be worth 13% more than the Roth or taxable account and that is all based on the tax arbitrage savings.

Let’s push the limits with a higher income family example.

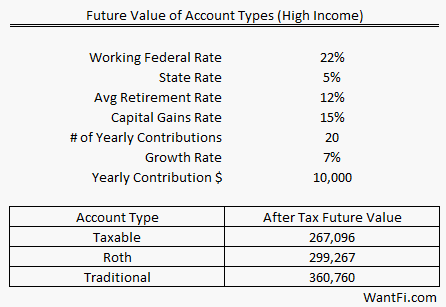

Higher Income Family Example

For a higher income family where the 22% tax bracket applies, and a 15% federal capital gains tax rate applies with a $10,000 yearly contribution, the Roth is worth 12% more than the taxable account, after-tax, and the traditional account is worth 20% more than the Roth, after-tax. That’s a full $60,000 more!

Again, the value of the traditional retirement account is hard to beat.

Risk: What if tax laws change unfavorably against the Roth?

Another point to consider is that with a traditional account, you get to take a tax deduction this year. It’s money in your pocket and it’s locked in, there’s no taking it back.

With a Roth you are betting that the future government, the one racking up trillions in debt every year, won’t look for a way to squeeze out more revenue and start changing the rules around.

What Are The Advantages of a Roth IRA?

Fringe Roth Benefits

Roth accounts do have some other advantages, such as a lack of required minimum distributions (RMDs) in retirement (the Secure Act 2.0 lessens this already minor issue by raising the age to 75), being able to withdrawal contributions for specific purposes without penalty (nice to have, but you shouldn’t be using retirement funds), and income that doesn’t count towards Medicare Plan B payments (a minor surcharge).

When you stack these all up, you find they are don’t skew the analysis away from the biggest expense which is the tax you actually pay. Head to the comments below to understand why RMDs, Medicare Plan B and Social Security issues don’t change the result for most people.

My conclusion is the same, the traditional account style wins.

The Roth Has an Effectively Larger Contribution

One subtle benefit of the Roth is that even though both the traditional and Roth accounts have the same contribution limits, funds for paying the taxes on the Roth comes from outside the retirement account. As such, the Roth account technically allows for greater retirement contributions.

But don’t pretend that the taxes you have to pay today are not a real cost. They are. If you contribute $19,500 to a Roth 401(k) today you will have to pay an extra $4,290 in taxes today, so your equivalent traditional 401(k) contribution is $15,210 ($19,500 – $4,290). Another way to look at it is that the federal government is loaning you $4290 towards retirement.

The fact is not changed that you are paying a high tax today with a Roth instead of a low tax tomorrow with a traditional.

When Should You Contribute To a Traditional IRA / 401(k) Instead of a Roth?

If you are saving for retirement and you make enough income to pay over 0% in capital gains, you should use a tax advantaged account because Uncle Sam takes a cut on both ends: first when you earn it, and second when you grow it. The whole pre-tax vs Roth discussion is moot if you decide not to use a retirement account at all.

But the overriding conclusion from the analysis is that most people will have more money in retirement if they first maximize their traditional 401k’s and IRA’s before considering Roth accounts.

You should consider Roth accounts only after you’ve maximized your traditional accounts. If you are a high income earner and are above the traditional IRA income limits, first maximize your traditional 401k and then maximize your Roth IRA account. And if you are above the income limit for the Roth IRA account, consider a backdoor Roth conversion by first contributing after-tax money to a traditional IRA and then immediately converting it to a Roth. You are paying the tax dollars anyway in this situation, so at least you can save on the back end with the backdoor IRA Roth option.

Final Thoughts

This article puts some analysis to the Roth vs traditional IRA / 401k decision instead of just making assumptions that not paying taxes in the future is the preferable route.

Future tax rates are uncertain, but even using penalizing assumptions show that the traditional 401(k) or IRA outperforms the Roth because you are banking a higher tax savings today.

The Roth can be beneficial to the lowest income earners whose earnings don’t spill over into the second tax bracket, however.

Are you interested in learning about another tax favorable investment structure that has a deferred tax feature like a retirement account? It’s the high-yielding Master Limited Partnership (MLP). In that article, I show that the hassle of the K-1 tax form is actually worth the benefits the structure provides.

Drop into the Telegram chat room and read the lengthy comment discussion below.

Free Investing Tools

- Have Capitalize handle the paperwork for your 401K rollover to any brokerage, for FREE!

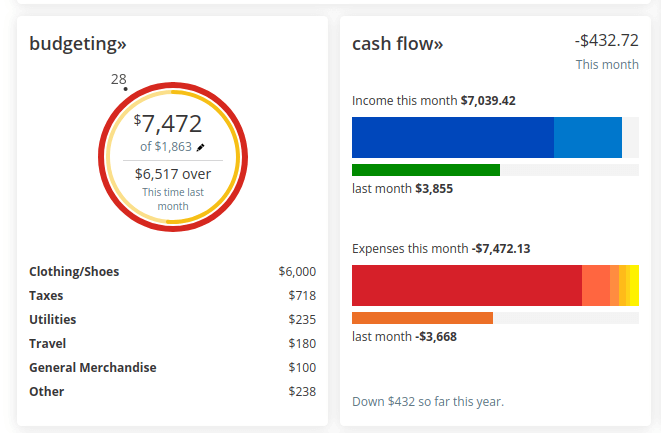

- Where does your money go each month? Track all your accounts and see if you are on track to retirement with Empower, for FREE! I use it myself to monitor my mom’s accounts to make sure she isn’t falling for scams or being defrauded.