Phemex Crypto Exchange Review: No longer recommended.

Updated on January 2nd, 2024

I no longer advocate for this cryptocurrency exchange because they recently moved to the KYC model and don’t serve USA customers.

Is Phemex Legit?

Over the years I have tried out quite a few cryptocurrency exchanges and apps. Phemex used to be my favorite exchange available almost everywhere including the USA and UK and I will explain why I like it the most in this article.

Convenience, No KYC

One of the most annoying things about setting up typical cryptocurrency exchange is that you have to submit a bunch of personal information to abide by Know-Your-Customer (KYC) laws. If you are paranoid like me, you prefer to minimize your exposure to hackings and data leaks and would rather not do it unless completely necessary (i.e. you don’t currently have another cryptocurrency exchange).

If you currently already have a fiat onramp somewhere else, then you are all set. Phemex only requires an email address to trade, so you can deposit cryptocurrency into Phemex from your existing crypto brokerage and be up and running within a few minutes.

In fact, it is a good way to try out this platform without making a commitment to decide if you want to eventually go full KYC and dump your other exchange.

If you are totally new to cryptocurrency and don’t currently have a brokerage or exchange elsewhere, be warned that in order to buy cryptocurrency, you need an on-ramp that verifies your identity. Also read this cryptocurrency guide to get a handle on things.

200 Coins Offered

Phemex is a one-stop-shop for most of the popular cryptocurrencies that you might be interested in trading.

For the longest time, places like Coinbase only offered a handful of cryptocurrencies to buy and sell on their platform. It was annoying as you would have to open up a new exchange if they didn’t offer one you wanted to buy. That situation is less of a problem now, but their fees are still too high, which brings us to the next point.

Phemex Fees

Trading Fees

A crypto exchange just isn’t worth it if you have to pay ridiculous fees on every transaction.

Phemex is the cheapest I have encountered. They employ a -0.025% maker fee and a 0.075% taker fee.

They even have a premium membership option that takes your fees to 0%! The premium membership is offered for free for the first 7 days of everyone’s membership and you can share on social media and get an additional month free. If you trade a lot or with large volume, the yearly $60 premium membership fee is definitely worth it. It’s a good deal.

Withdrawal Fees

Usually the cheaper exchanges will play the game of “gotcha” when it comes time to pull your money out. Those cryptocurrency exchanges may offer cheap spot trading fees but then ding you with a $50 withdrawal fee, for instance. This used to be one of my biggest complaints about the “dumb money” services like Coinbase where users didn’t know any better and paid fees on everything from deposits, trading to withdrawals. They’ve gotten a little better over the years, but still cater to those who refuse to do any research and therefore can command a higher fee premium.

The withdrawal fees at Phemex are very competitive. Even withdrawing Ethereum is only $10 when it typically costs $30-45 on other exchanges.

Trading View

Standard cryptocurrency apps like Crypto.com and Coinbase don’t have a trader’s interface and sometimes you are forbidden from using the exchange features due to regional compliance issues.

I once signed up to Crypto.com based on their webpage marketing showing an exchange and only after submitting all the KYC personal information did I find out that you could only use the app in the US, limiting you to market orders and a 1.5% markup fee! You can’t even see what the market is trading at unless you go elsewhere or preview an order inside the app. It’s inefficient and annoying.

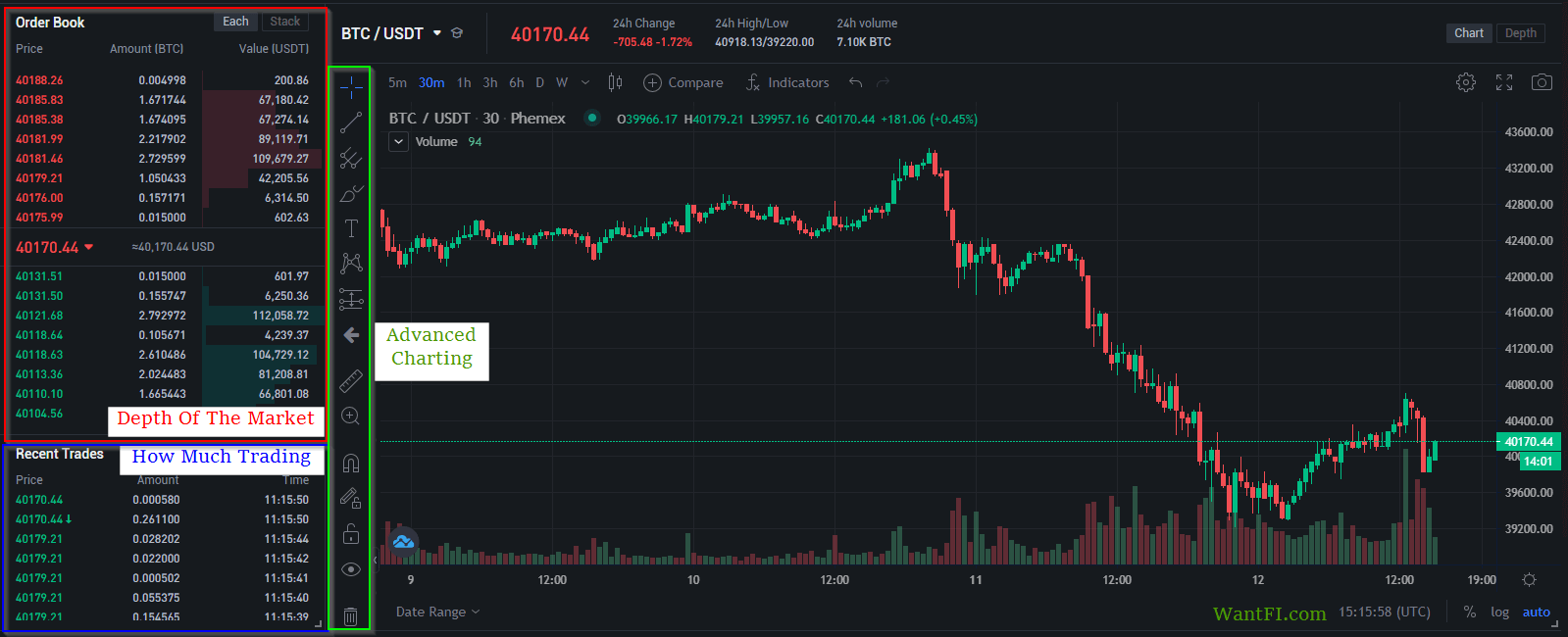

That’s not the case with Phemex as you get a live market view when you choose the pair you are interested in trading. Everything you need is right in front of you:

- The live order book. How much impact will your trade have? (for large traders or illiquid cryptos)

- How much trading is currently happening?

- Advanced charting, where has the crypto been and where does it look like it is going?

Limit Orders, Market Orders, Conditional Orders

This is more important than a lot of traders realize. In some cryptocurrency markets and exchanges, the spread between the bid (the price you can sell at) and ask (the price you can buy at) can be up to 7%. If you just place a market order, you will overpay for that trade on average by 3.5% and that is before even tacking on the trading fee.

Don’t be that amateur – use a limit order or conditional order if the market liquidity isn’t deep.

Crypto Earn

With the advent of staking, cryptocurrency speculators have the ability to setup specialized web wallets which they then withdrawal their coins to and get yields from 3-15%, depending on the crypto. While this is the safest way to store crypto when combined with a hardware wallet, there are a lot of extra steps and you generally need to maintain spreadsheets to determine the location that you placed it, wallet addresses, any wallet passwords or seed phrases, cost basis and other metrics. It can be a whole lot of side work to manage.

Phemex has a crypto earning functionality built right in that provides the opportunity to keep your crypto on their platform and then loan it or stake it right from their website at some pretty awesome rates.

Now a word of caution here. What are they doing with the money to get those rates? If you read their FAQ, they say that they are making markets and your capital doesn’t leave the platform, but you really have no control over what they are really doing with your money. You should not put a lot of trust into keeping money on exchanges, as exchange failures have shown time and time again. FTX was the third largest and had millions of dollars in commercial advertising, yet it failed recently.

I therefore only put a small amount of money into the Phemex earn feature, and so should you, if any at all.

When I am ready to make a trade, I send my crypto in, make the trade and withdraw the crypto out. My exposure is less than an hour.

Security and Phemex Withdrawal Time

Phemex has never been hacked.

Of course there is no guarantee that it can’t happen in the future, but the way they have eliminated hot wallets from their systems contributes to the security profile.

Part of the reason why they have never been hacked is because withdrawals are processed 3 times a day and require offline multi-sig approval. Therefore, the withdrawal time is much slower than automated exchanges.

If hackers gain access to their systems, the chances of them stealing funds is nearly impossible since it would require a human cold wallet operator to also sign off on the withdrawal. Any unusually large withdrawals will instantly raise suspicion. Not being able to get instant access to your crypto is a slight disadvantage, but the security makes it worth it, especially if you are using the crypto earn functionality.

Some Additional Features Worth Mentioning

Sub Accounts

Phemex allows you to segregate your funds into different buckets. Maybe you bought some cryptocurrency for your mother and want to keep it separate from your funds, or maybe you use the API to build trading bots and don’t want to comingle it with your other funds. Phemex makes it simple.

Cryptocurrency Derivatives and 100x Leverage

These aren’t allowed for USA customers but these types of instruments provide an avenue for leverage.

PRO-TIP: I rolled over a 401k into an IRA, and Capitalize‘s FREE service couldn’t have made it any easier to do. They work with all the major brokerages and handle the paperwork for you.

I don’t really recommend leverage since the losses can stack up as fast as the profits can and you risk blowing up your account but its always nice to have options when you are looking to get in and out within a short time when your chart pattern emerges.

Learning Academy

Anyone new to crypto will appreciate their extensive library of cryptocurrency guides.

Phemex Review Summary

Overall this is the lowest fee exchange, doesn’t require the annoying KYC process and has exceptional security for your funds.

But again, always keep the bulk of your funds off exchanges with keys secured in hardware wallets.

Free Investing Tools

- Have Capitalize handle the paperwork for your 401K rollover to any brokerage, for FREE!

- Where does your money go each month? Track all your accounts and see if you are on track to retirement with Empower, for FREE! I use it myself to monitor my mom’s accounts to make sure she isn’t falling for scams or being defrauded.