Why PulseChain is Another Richard Heart Scam

Updated on December 24th, 2024

December 2024 Update:

Richard Heart’s legal troubles continue. In addition to the ongoing SEC suit he is a defendant for, he was recently added to Europe’s Most Wanted Fugitives list and Interpol has issued a Red Notice for him. I guess he is going to be keeping his $50,000 “Outrage Marketing” trips to Louis Vuitton to a minimum for a while.

July 2023 Update:

SEC charges Richard Schueler with securities fraud.

PLS dropped another 50% immediately after.

It all started with the Hex cryptocurrency scam and created a community of get-rich-quick adherents ready to become the next millionaires created from buying an asset whipped out of thin air. This community was primed and hyped up by their creator Richard Heart for almost two years for their next shearing with the Pulsechain Ethereum fork copy/paste chain.

Below we discuss the goals of the project, its marketing angle, and why I call it a scam.

The Sell: Pulsechain “Airdrop”

Pulsechain’s big marketing push was that everyone would get “free” copies of all their Ethereum tokens held in wallets at the time of the checkpoint. It was marketed as the “largest airdrop in history.” Problem is, you can’t just copy and paste a chain and expect those assets to have actual value.

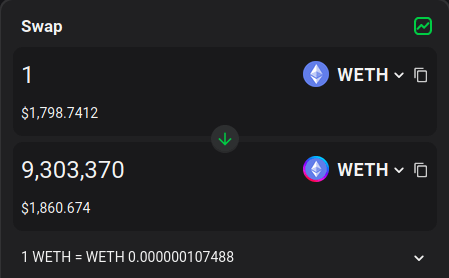

What is the value of a copied Ethereum asset? Comically, almost zero. For instance, you can trade one Ethereum, from the actual Ethereum chain, to buy 9.3 million wrapped Ethereums on the Pulsechain. Why? Because the Pulsechain Ethereum isn’t actually Ethereum!

This would be like me going to Kinkos and photocopying a $100 bill and trying to pay the bill with it.

What Pulsechain users fail to understand about tokens on another chain is that value comes from exchanging an original Ethereum asset for the other chain’s (wrapped) token through a bridge. It’s supposed to be like getting a receipt that you can trade with but you only get to use one at a time. You don’t get the original asset and also a photocopy and expect to have two assets of equal value. Otherwise, you could just create blockchain forks all day long and mint new money.

I think this is common sense to most people, but the concept appears to be lost on this Hexican crowd. Pulsechain is essentially a digital counterfeiting printing press of cryptocurrencies.

Pulsechain Hex (pHex)

The value proposition to Hex users is a little different than to everyone else. Pulsechain was announced after users of Hex started paying $100 to lock up $500 of Hex back in 2021 when Ethereum gas fees spiked. Inside the Hex community, everyone talks about Pulsechain, so they will use either chain based on the price and gas fees at the time, and in this case, the duplicate Hex tokens acts like a stock split.

Double the quantity of something while holding demand constant and the price will halve. Or in Hex’s case, drop 75%.

There is no mechanism to arbitrage one for the other, so they will both trade for different prices.

Most Important Point: Not Decentralized

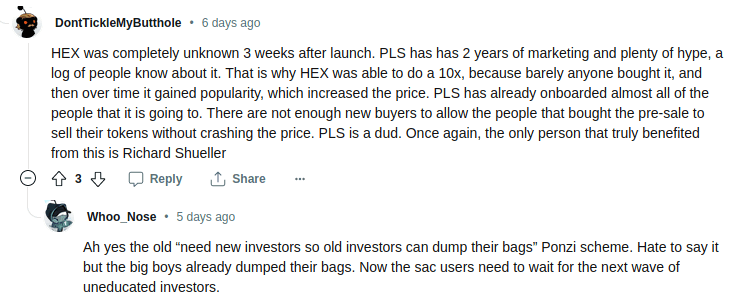

The number one reason what makes Pulsechain a scam is that just like with Hex, Richard Heart controls about 90% of the supply of Pulsechain and PulseX. He obtained this control through his PLS initial coin offering (ICO) which he called a “Sacrifice.”

Note: The SEC deemed ICO’s illegal without a valid security registration, therefore, he coined the term “Sacrifice” where “you give up your tokens and expect to receive nothing in return” (wink wink). Remember as explained on my Hex article, these Hex tokens were also obtained for free, but more comically, since he controls the addresses that one had to donate assets to, he essentially donated to himself and sacrificed nothing.

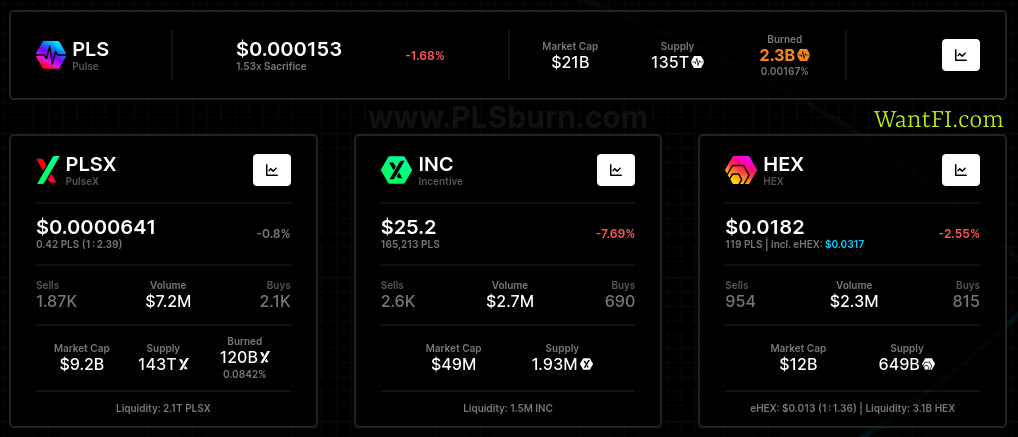

Here’s the value including Richard Heart’s share:

And here is without:

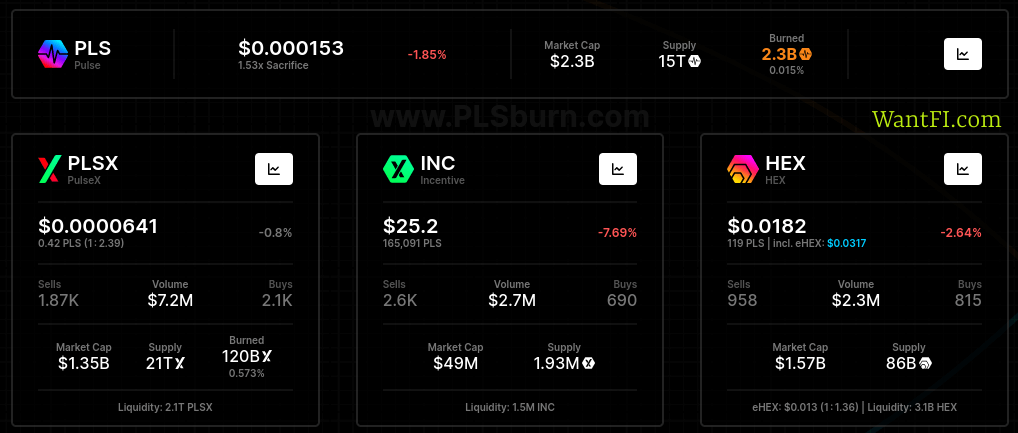

Big difference: $21 billion versus $2.3 billion for Pulsechain and and additional $20 billion in the other Pulsechain assets. Again, the real value of these assets are substantially less than these figures imply because there isn’t any significant trading volume to support any real quantity of selling. Coinbase has the 24 hour volume of $983,902. Any significant selling at this point would drop the price of PLS to zero faster than an asteroid colliding into Earth.

Anyone can create a token with four quadrillion supply and then make one trade with himself at $0.25 and call himself a quadrillionaire. Only when you try to sell a quantity to other buyers does the price discovery really determine its worth.

But not only does it inflate the market cap to make it appear more relevant than it really is to show up on coin ranking websites, but the bigger issue is that Richard Heart has ultimate control of every transaction that occurs on his chain.

With Hex, the main risk of owning so much supply was the risk of a rug pull, but now you have a rug pull risk and a theft of assets risk.

Why even have a blockchain at this point? It would be far cheaper and faster to just run a SQL database off an Amazon cloud website and move around all the Richard Heart monopoly tokens without validators. Anyone who uses Pulsechain clearly has no understanding of the point of blockchain: decentralization!

It doesn’t matter how many validator nodes exist when a single entity controls more than 50% of the PLS supply because all Richard has to do is setup a single node and stake just over 50% of it to that node and then he can approve any block into the chain he wants. What this means is that Richard Heart has the ability to reallocate assets (steal or ‘redistribute’) or undo transactions.

Pulsechain is basically the antithesis of what blockchain is about.

The Hexicans call him the “benevolent whale,” and trust him to do the “right thing,” but what happens when this benevolent whale is kidnapped and starts getting repeatedly hit in the head with a wrench? Or maybe greed just gets the best of him and he decides one day to fully cash-out after enough suckers… ahem… investors have entered the ecosystem and he wants to buy a yacht.

You’d basically have to be an idiot to put the trust of your funds into the hands of a single man…. a man who can’t seem to get enough Louis Vuitton, Rolexes, McLaren’s and Ferrari’s to satisfy an entire village in Monaco.

Marketing Pitch, Pulsechain Goals

Despite the wild claims of “improvement” on the website, it’s mostly FOMO marketing per usual with terms like “gold rush” and “whale” littered around the bullet points.

Let’s run through them:

Increase Ethereum’s value

Ethereum’s fees will be lowered by sharing its load.

PRO-TIP: I rolled over a 401k into an IRA, and Capitalize‘s FREE service couldn’t have made it any easier to do. They work with all the major brokerages and handle the paperwork for you.

So your project is designed to increase another chain’s value? Well then, I guess I should be investing in that other chain! In all seriousness, Ethereum has plenty of L2’s and L1 competitors to share its load. Pulsechain is going to attract a particular niche of Hexicans and the improvement to Ethereum’s value will be negligible.

Enrich ETH users

PulseChain will re-enable priced out use cases: Instead of launching empty, PulseChain brings the ETH system state and ERC20s, this rewards holders and founders of Ethereum based projects.

These next two points are almost identical and the only reason why I think he added both points is because the original intention of the copied system state was to copy everything, including dApps, over.

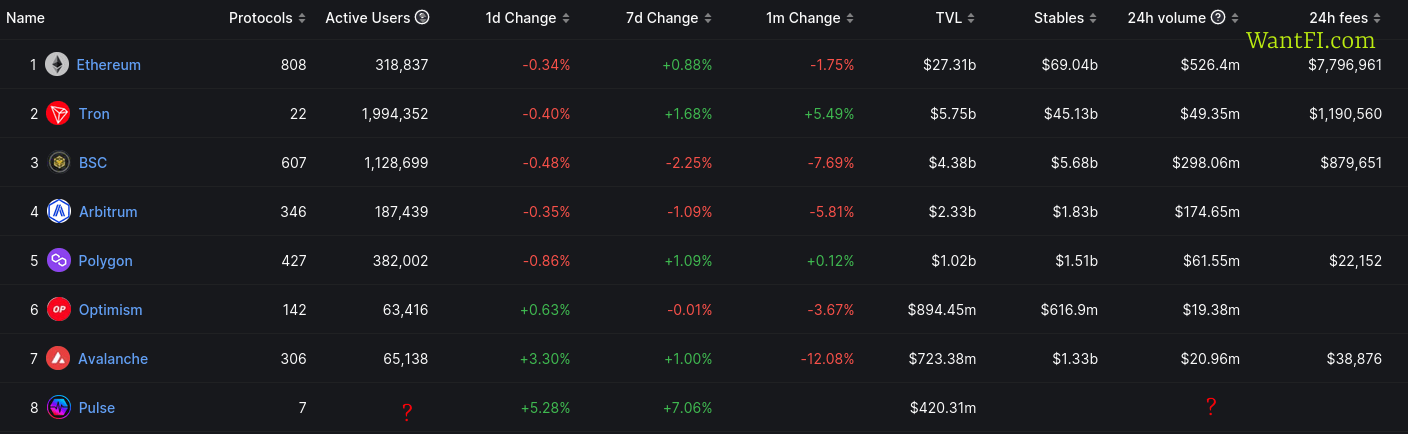

That doesn’t appear to be the case though as of this writing there are only 7 dApps in the ecosystem.

This would be technically convenient for adoption to have everything “built-in” to the new chain per se, without requiring any additional effort on the part of project developers, but how well will dApps work with few other users interacting?

Generally blockchains start off with a few dApps with users concentrating into those projects while they gain a following and grow the ecosystem and then start branching out with additional projects. It’s value stems from the network effect of users interacting with each other.

There would be hundreds of thinly used Ethereum projects with minimal Pulsechain users engaging with each another. Imagine a liquidity pool somewhere where a user sells a bunch of his assets creating an impermanent loss in that pool and there is no other Pulsechain users to bring it back into balance.

Furthermore, since Pulsechain is a fork, any recent changes to a dApp on the Ethereum chain would still need to be redeployed on Pulsechain. Likely many developers won’t have an interest in maintaining the Pulsechain copies so the dApps will grow stale over time anyway.

Enrich ERC20 and NFT users

The launch of PulseChain is the largest airdrop in history. Thousands of Ethereum based tokens and NFTs receive their free PulseChain versions. This new gold rush contains the value discovery of thousands of tokens and NFTs on PulseChain. If you always wanted to be a whale in a certain ERC20 or NFT, maybe now you can be.

We already discussed this above: copy and pasting an asset isn’t a value proposition.

Easy to use

Your MetaMask wallet just works, you only have to change a single setting to access PulseChain. ETH holders can transact for free with freemium PLS.

I’m not sure why this was included. Firstly, I don’t think that for most people Metamask is easy to use, at least not initially. You need to setup RPCs, and flip back and forth across networks and maintain a list of wallet addresses inside a tiny little browser add-in.

Secondly, it’s not like this was an innovation of Pulsechain. If I go start up a car company, would it make sense to start advertising that the vehicle is easy to use?

Lower PulseChain fees and serve more users

PulseChain is 17% faster than Ethereum with 10 second blocks instead of 12.

Wow, hold the presses! We saved 2 seconds on each transaction!

Or I can just go over to Binance Smart Chain and get 3 second block times and be 70% faster than Pulsechain!

Remove pollution

By replacing proof of work miners with proof of stake validators PulseChain doesn’t burn “waste” any energy making it environmentally friendly.

Newsflash, Heart, when you copy-and-pasted the Ethereum fork, it had been Proof-of-Stake for over 6 months! Pulsechain is no more environmentally friendly than any other Proof-of-Stake coin.

Improve game theory

PulseChain reduces the issuance of PLS by 25% per block, compared to Ethereum.

When a project starts talking about Game Theory to be their value proposition, you should be wary because that usually means its a Ponzi.

And what is he really saying here? After the tenth block (100 seconds in Pulsechian’s existence) produced in the chain the issuance is only 5% of what it originally was and after the 50th block (500 seconds) its essentially no longer inflationary?

I don’t think this bullet point was written correctly.

But anyway, Ethereum itself is basically deflationary now after the Proof-of-Stake upgrade, so its moot.

Empower PulseChain holders

PulseChain’s native token $PLS can be used to activate validators to earn PLS for helping to secure the network.

Nothing new here with any other Proof-of-Stake coin, but again, when a single entity controls more than 50% of the supply, it’s only as secure as that entity.

Total Value Locked (TVL)

In an attempt to market the chain to create value for their PLS bags, Hexicans are running around and advertising that Pulsechain is a “top ten chain” in terms of TVL or volume.

Almost the entirety of this TVL is on PulseX. The problem is, what assets are locked? Uniswap allows you to view liquidity by pool, but Pulsechain doesn’t have a breakdown.

Are $400 million face valued monopoly tokens controlled by Richard Heart locked? Are valueless copy and pasted stablecoins locked? Without knowing what is locked, we really can’t make a valid comparison.

Perhaps bridged assets are a better reflection of TVL value because actual assets from other chains have to be locked. L2Beat has them pegged at $134 million, or 68% less; it’s still substantial but outside the top 20 and less of a marketing point to try and drive engagement of the next great chain.

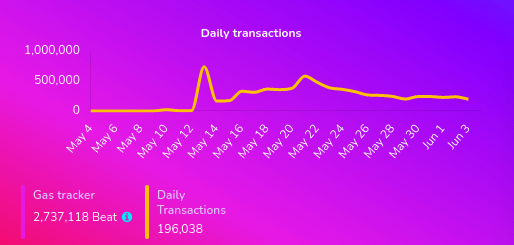

Volume Spike

At launch there was a volume spike, as to be expected from a long multi-year wait for Hexican users, but it has been declining over the last two weeks.

It’s still too early to draw any conclusions here.

Pulsechain’s Value Proposition

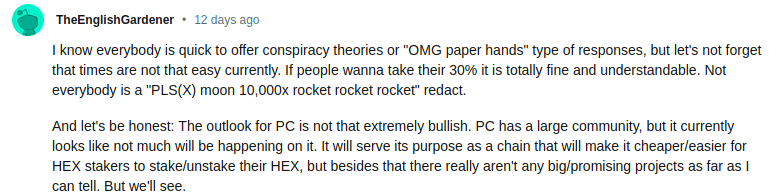

For anyone outside of the Hexican circle, there doesn’t appear to be a real use case for Pulsechain and a few are honest with themselves about it:

The graveyard is littered with “Ethereum Killers” and those projects actually made a real attempt to compete. Copy and pasting Ethereum isn’t a value proposition and trying to get users by copying over their existing Ethereum assets with Pulsechain photocopies is gimmicky.

Most importantly: Pulsechain isn’t decentralized and users risk not only rug pulls of PLS itself, but risk of loss for bridged over assets.

This just appears to be the second coming of Richard Heart’s ongoing scams to enrich himself.

Free Investing Tools

- Have Capitalize handle the paperwork for your 401K rollover to any brokerage, for FREE!

- Where does your money go each month? Track all your accounts and see if you are on track to retirement with Empower, for FREE! I use it myself to monitor my mom’s accounts to make sure she isn’t falling for scams or being defrauded.