New Microstrategy (MSTR) Analysis: Bitcoin Ponzi Scheme?

Published on January 12th, 2025

Feb 6, 2025 Update: The debt issuance since the last filing was better than expected and the company only added $3 billion in debt, while dumping on common shareholders with $15 billion in issuance. Bitcoin would need to drop 83% to make the company technically insolvent in this scenario. This kind of move has happened before, but below I explain why I am not greatly concerned if that happens.

I picked up some preferred shares this week, but as I describe below, this has a large chance of devolving into a Ponzi Scheme.

Jan 31st Update: The company has issued a massive preferred share offering ($584 million) soon to be trading under the symbol of STRK. They are also convertible, but MSTR would need to triple in value to reach that threshold, so the optionality is quite moot.

As I show in the analysis below, the risk of default on debt is quite low, so I am generally positive on this offering. What I don’t like is that Microstrategy has the option to pay you in cash or common shares. I’m almost certain they will pay you with common shares, since they issue so many of them for free, and that would make the nature of this preferred offering very Ponzi-like. I would suggest immediately selling any common stock payouts for cash if you buy into this offering.

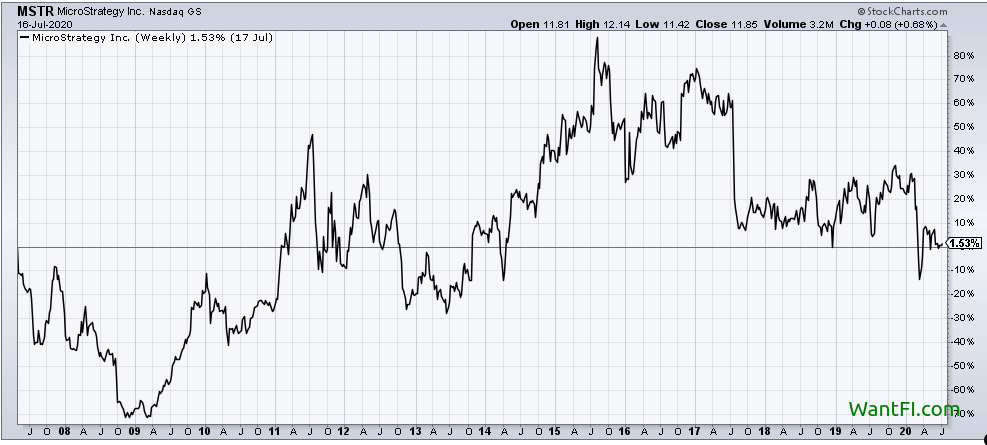

Microstrategy Inc Was A Dog For Years

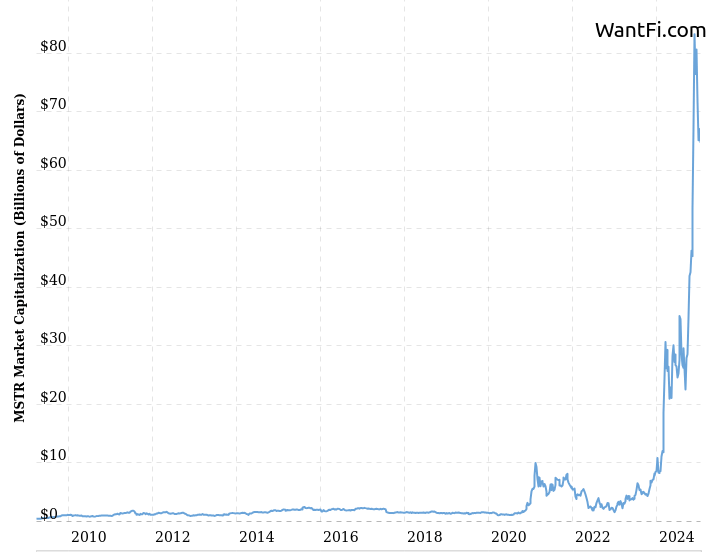

For 13 years before the summer of 2020, the Microstrategy stock price went literally nowhere:

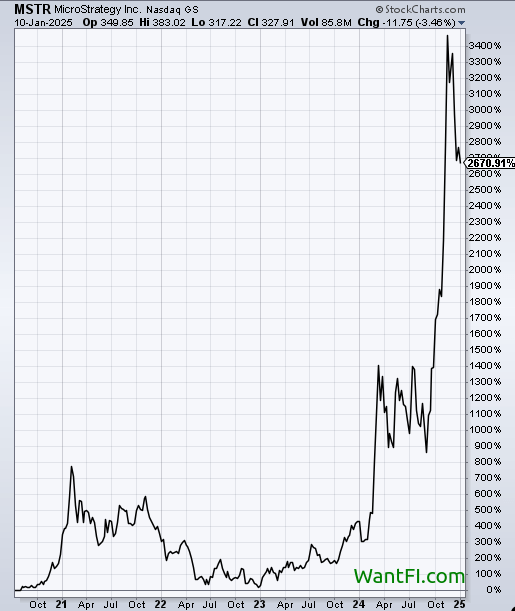

But then after COVID-19, it took off like a rocket-ship and at one point was up 3400% in less than 4 years (now ‘only’ up 2670%).

What changed? What does Microstrategy do?

The CEO Michael Saylor started buying Bitcoin for the corporate treasury.

I was instantly reminded of the 2000 Dotcom Bubble when stocks started to soar after putting a “.com” into their names.

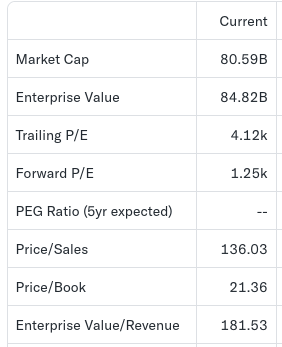

I decided to take a gander at their Yahoo Finance statistics page, and was not totally surprised to see outrageous statistics like a Price/Sales of 136, meaning that it takes 136 years of revenue to break even for the price currently being paid, and a forward P/E of 1,250, meaning it would take 1,250 years to get paid back in earnings for the current stock price.

Is it a bubble?

In fact, this stock WAS one of the OG DotCom bubble stocks that soared 3600% in early 2000 before plummeting back to earth 6 months later and losing 99% for anyone who decided to buy into the center of mass. After the Microstrategy stock crash, if they held on to that stock, it would take them 20 years to recoup their losses! Ouch.

The Microstrategy Performance Mystery

The only thing that seemed to have changed for the stock was that the company started to stack Bitcoin into its treasury and they have been buying it for 4 years now. The latest financial filings show that they own over 252,000 Bitcoin, but they have purchased more since then, shown later.

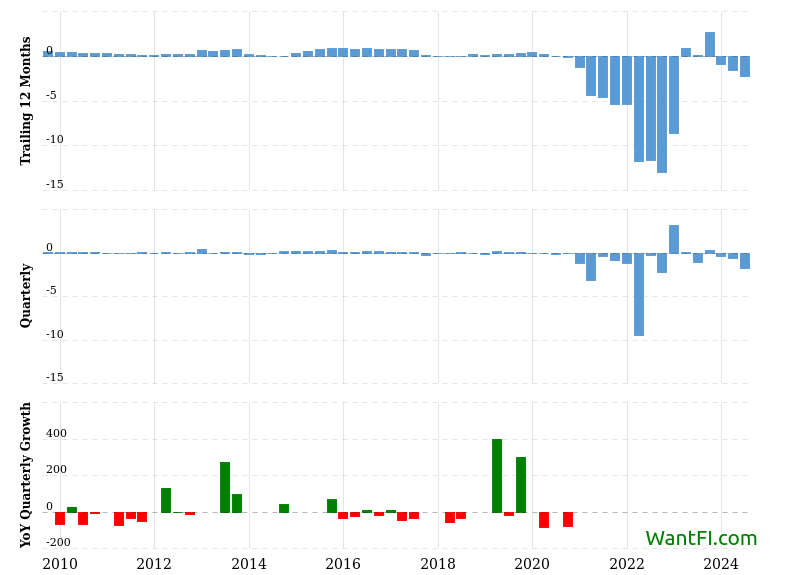

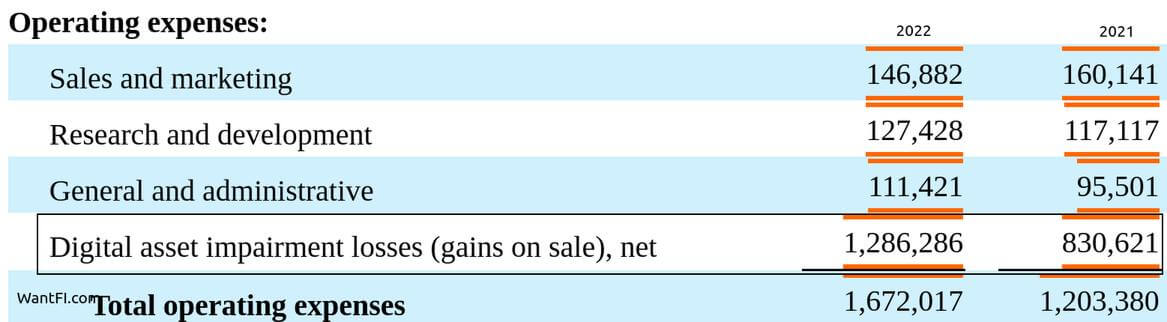

For most of the last 15 years, the company earnings show that it has technically lost more money than it has made:

But upon a deeper dive, you can see that these were actually recorded losses on the value of their Bitcoin during the crypto winter and the stock was making meager profits on the underlying business for most of the other years.

But one disconnect is that for the last two years the underlying business has lost money while the stock price has soared to record highs. That’s definitely not the norm and the reason is obvious:

Investors are buying Microstrategy as a proxy for Bitcoin and Bitcoin only.

Now, ignoring the valuation statistics for a moment, this could have been a reasonable way to get exposure to crypto a few years ago since investors would have been able to buy the stock with their existing brokerage accounts and didn’t need to open a crappy Coinbase account, dealing with the hassle of account lock-ups and infinite selfies to trade. Also, one could buy the stock in an IRA since it was even harder to get exposure to crypto in retirement accounts.

But that’s quite an irrational way to get exposure today. Anyone who can buy MSTR can instead buy Bitcoin ETFs that hold it directly. Dozens of Bitcoin ETFs launched in Jan 2024.

It got me wondering if maybe the Bitcoin on their balance sheet was worth more than what the market was assigning to it and that could be the reason the stock was soaring. Let me add some context.

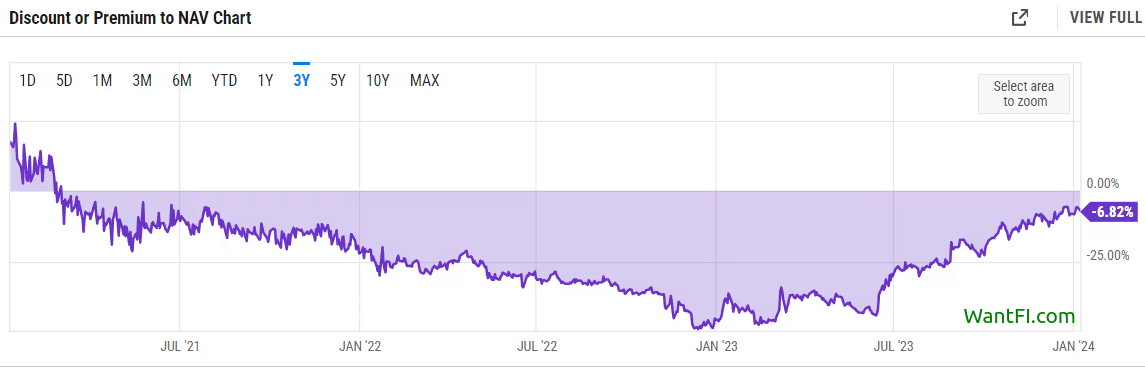

The Benefits Come From Buying Under Market Price

Before Grayscale’s GBTC converted to an ETF, I was advising everyone I knew inside and outside the WantFI telegram chatroom to buy it instead of direct Bitcoin in 2023. GBTC had a massive 50% discount to the underlying holdings and it was a near certainty that the SEC would approve ETFs within a year or two. Grayscale had also promised to convert their fund into an ETF once allowed to do so, which meant that the discount would immediately evaporate due to the ETF capital structure.

The discount to NAV was like free money laying on the ground waiting to be picked up.

But this is not the case for this company. In fact, it is the exact opposite.

How Much Bitcoin Does Microstrategy Own?

Now, there is an accounting quirk that Microstrategy uses to value their Bitcoin holdings on their balance sheet and it dramatically undervalues their real value because it is based on the price paid, not what it is currently worth, so you can’t use their SEC filings.

The Price-to-Book value of 21, shown in the Yahoo finance statistics implying that the the price of their assets is 21 times overvalued, is not real. The Microstrategy Bitcoin holdings are significantly more. This is another reason why you can’t rely solely on financial statistics and must perform due diligence to understand the context of a company valuation.

The accounting standard changes in 2025, so this undervaluing issue will be going away shortly by their next filing and their crypto will be valued appropriately.

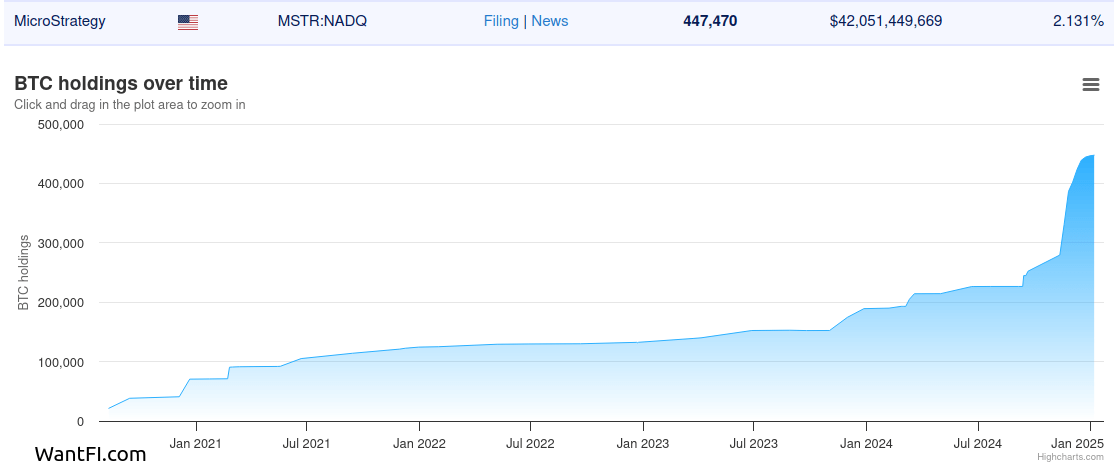

In Sept 2024, they had 252,220 Bitcoin, but they continuously issue debt and stock to buy more of it and in 3 months they have almost doubled their holdings to 447,470 as of the latest January figures.

It is valued at $42,051,449,669 at today’s prices.

If you divide the value of Bitcoin by the number of shares you get a value of $213 per MSTR share, but there are $4 Billion in liabilities on the last balance sheet (and certainly more since they just had a Bitcoin buying blitz) which implies that the value of each share is worth $191. With a current stock price of $327, the ‘real’ price-to-book value appears closer to 1.71, meaning that investors are paying a 71% premium to buy proxy Bitcoin.

PRO-TIP: I rolled over a 401k into an IRA, and Capitalize‘s FREE service couldn’t have made it any easier to do. They work with all the major brokerages and handle the paperwork for you.

To be fair, the value of the underlying business is worth something, although it hasn’t had much in earnings over the last couple of years. Before the pandemic and their crypto buying spree, their market capitalization was just over $1.5 billion.

We could get all fancy and try to value the business from a DCF standpoint, but its really a minor detail standing next to the $42 billion pile.

So, if we give it a $2 billion valuation today, the ‘real’ value per share is $201 per MSTR share, which implies that the stock is ‘only’ 62% overvalued (without factoring in newly issued debt since the last filing, meaning 62% is the floor).

The MSTR End Game

It’s a weird business model.

- Saylor uses the MSTR corporate treasury to buy Bitcoin

- Investors rejoice and buy MSTR stock, pushing the stock higher

- Saylor issues more stock and debt to buy more Bitcoin, now with a higher stock price

- Investors clamor and buy more stock, pushing the stock price higher

- the cycle repeats

Nothing really comes to mind for a public company that behaves the same and it is bewildering to me why a company gets massively rewarded for doing something that an investor can do on their own without a middle man.

It’s not a Ponzi scheme because investors aren’t getting paid by the company. They are simply buying and hoping that more people buy and push the stock higher than they paid for it. Maybe many of the investors don’t know what the value of the Bitcoin the company holds is worth? Maybe many of the investors are just buying the stock because its performance has been off the charts in recent years?

If you own MSTR, please add a comment to the bottom of this article, I’d genuinely like to know why you own the stock.

Will Microstrategy Implode or Go Bankrupt?

It got me thinking to what would happen if Bitcoin had a usual 50% drawdown this year. Would the stock plummet back to earth? Would Microstrategy go bankrupt? Maybe MSTR is a short candidate? About 10% of the stock is being shorted which implies a lot of people seem to think so.

It’s a perfectly expected scenario that the stock will plummet if crypto tanks, but it doesn’t appear that Microstrategy itself is at risk of a bankruptcy anytime soon.

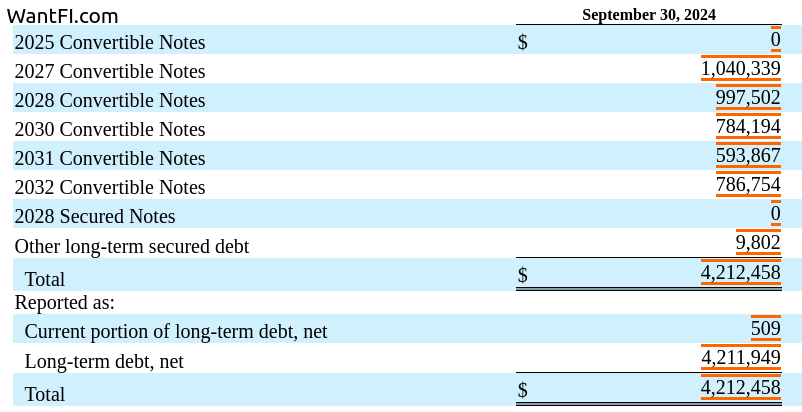

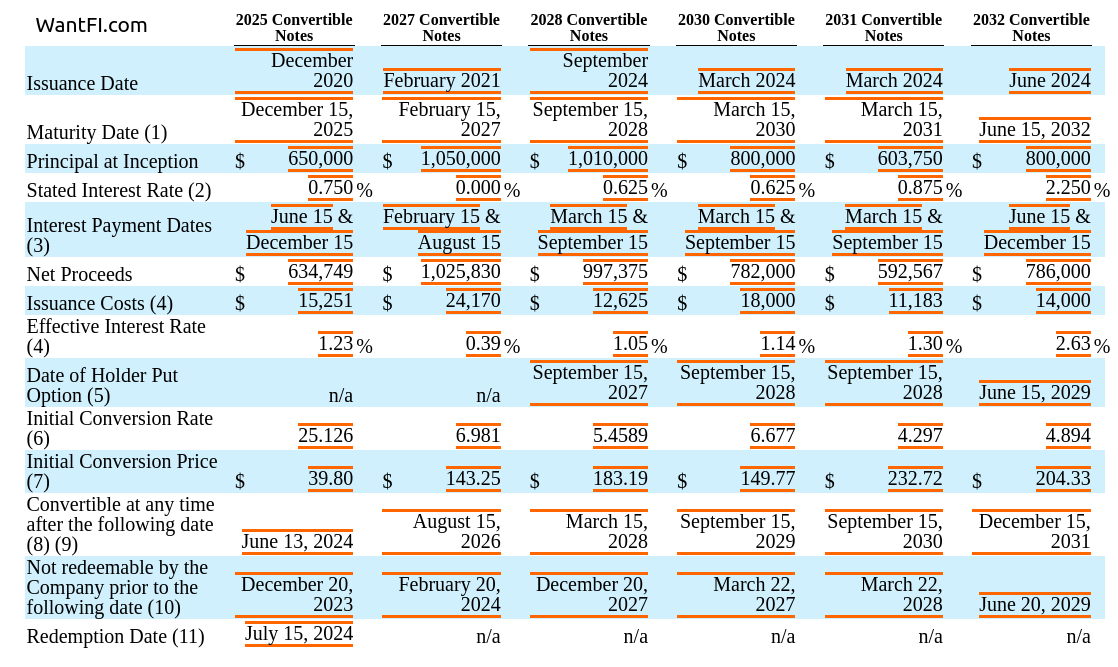

As of their latest filing, they have $1 billion due in about 2 years (Feb 5th press release announced they gave notice to redeem) and another billion the year after that. But it’s a pittance compared to their $42 billion Bitcoin stash. Even if Bitcoin nosedives towards earth like an asteroid, they should still have enough value left to pay this off in a worst case scenario.

In a typical scenario, I’d have no doubt that they would be able to refinance this, possibly at junk bond rates, but certainly not a default and a bankruptcy.

Since the Bitcoin buying blitz from the last filing they added only $3 billion in debt (according to the Feb 5th earnings release) and issued $15 billion in common stock, and that leaves a lot of cushion for the value of their holdings even if Bitcoin falls off a cliff.

With the assumption that their total company debt is now about $7 billion, Bitcoin would need to drop 83% for the value of their Bitcoin to match the valuation of their debt to be technically insolvent. Even if that happened I checked the debt covenant (Dec 2020 filing), and there doesn’t appear to be a redemption accelerator for asset coverage ratio. And since the maturities are staggered across many years, there is high confidence that MSTR would be safe from catastrophe.

Of course this is a moving target and Saylor is aggressively issuing stock and bonds to buy more Bitcoin, so these figures could change very rapidly from this article’s publication.

The ultimate risk is if Bitcoin drops a substantial amount below the value of their debt and stays down for many years while their debt is maturing and they have difficulty in rolling it over.

Investors May Get Shafted Though

The structure of their debt is an interesting choice. On one hand, the interest rates attached to convertibles are super low, making the debt service exceptionally easy for Microstrategy to manage, but on the other hand, it leads to dilution for shareholders when the stock goes above the conversion prices (if the bond isn’t redeemed beforehand).

There is a incentive for insiders to dump their own holdings of stock before a bond is converted into more shares and they would have perfect knowledge of whether to do that since they can choose whether or not to redeem the bonds or let them convert into more shares.

As such, the risk to Microstrategy is quite low, but to investors, the risk becomes exponential the higher the stock price goes. The higher it goes, not only is the investor overpaying for something they can buy directly themselves, but dilution erodes the underlying value of Bitcoin per share making the over-payment even more substantial.

The ultimate risk to this stock is that investors wake up one day and ask why they need Microstrategy to buy Bitcoin for them when they can do it themselves. If Bitcoin doesn’t even move, expect the stock to lose 40% in that scenario alone.

Micheal Saylor Has Ultimate Control

Have you ever wondered who owns Microstrategy?

Typically being a shareholder gives an investor a voice depending on how much of the company they own. But Microstrategy doesn’t give shareholders a voice and Micheal Saylor has ultimate control because he has “special shares.”

We have two classes of common stock: class A common stock and class B common stock. Holders of our class A common stock generally have the same rights as holders of our class B common stock, except that holders of class A common stock have one vote per share while holders of class B common stock have ten votes per share.

As of October 21, 2024, there are 19,640,250 shares of class B common stock outstanding, which accounts for approximately 51.8% of the total voting power of our outstanding common stock. As of October 21, 2024, Mr. Saylor, our Chairman of the Board of Directors and Executive Chairman, beneficially owned 19,616,680 shares of class B common stock, or 51.7% of the total voting power.

Accordingly, Mr. Saylor can control Microstrategy through his ability to determine the outcome of elections of our directors, amend our certificate of incorporation and by-laws, and take other actions requiring the vote or consent of stockholders, including mergers, going-private transactions, and other extraordinary transactions and their terms.

Source: SEC Filings

So, you have no say in the outcome of the company even if you buy up every share trading on exchanges. Well, that seems fair.

Saylor’s Motivation

This leads me to another conclusion: Saylor is doing this to enrich himself.

I mean this is not a revolutionary insight, as most CEOs want to enrich themselves, but usually they are entrepreneurs at heart and actually want to create a new product or service to change the world.

Saylor’s stock was worth a few hundred million before Microstrategy started buying Bitcoin, but now his allocation is worth $6.4 billion! That is a massive windfall for not creating anything new or innovative and doing something that anyone else can do.

I’m betting he saw the stocks like Riot and Long Island Iced Tea that popped in 2017 from very simple press releases announcing they were getting into Bitcoin or blockchain and wanted to give it a go.

Why struggle with your core business when you can just buy some hot commodity and investors stupidly reward you for it?

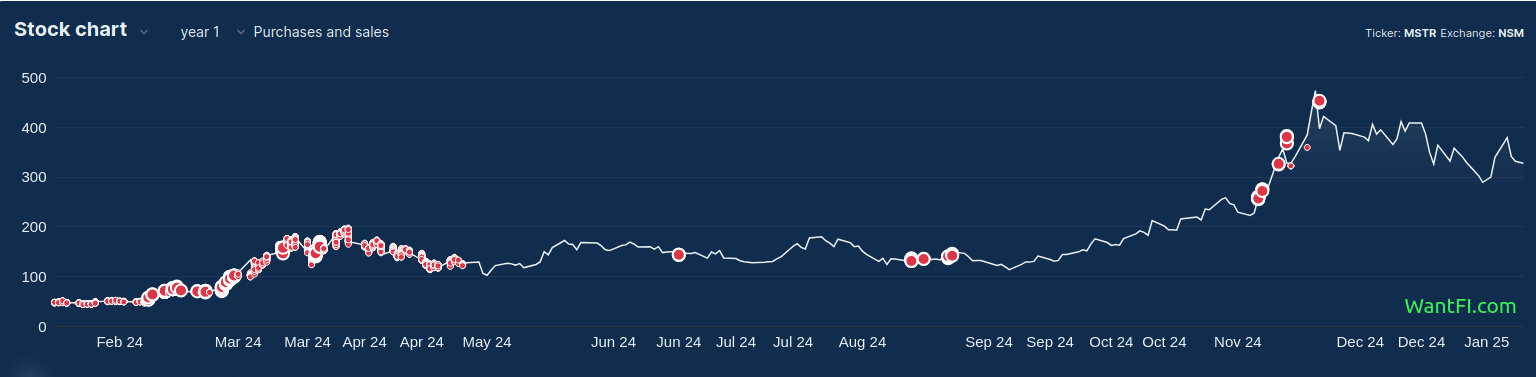

Insider Sales

One thing you won’t see is an insider or corporate director actually ponying up money to buy the stock. All you’ll see is a sea of red sales to the tune of hundreds of millions of dollars a year. Saylor alone cashed out $400 million in Q1 of 2024.

Cash out while you can, right? I don’t blame them, but there is going to come a time when a lot of inexperienced investors lose a boatload of money while these insiders were taking their cash.

Saylor Doesn’t Seem Like The Most Standup Guy

In 2024, he had to pay $40 million to settle a tax fraud case against him for not paying taxes for 15 years.

In 2000, he had to pay an $8 million fine to the SEC for fraudulently overstating revenues and earnings for Microstrategy.

Since he has a history of cutting corners, ask yourself what corners are possibly being cut today? Are any of the BTC being skimmed off or are they reported correctly? Are there any more financial shenanigans? Will Saylor be a good steward of the BTC reserves or will he use the reserves to his advantage?

What if Saylor takes out a $1 Billion perpetual short position in BTC and then dumps Microstrategy’s holdings on the open market causing the price to plummet? I don’t think it’s a good thing that he has control over as much Bitcoin as he does, simply from exploiting retail investor idiocy.

In Closing

I wouldn’t buy the common stock because it’s a dumb way to buy Bitcoin, but I also wouldn’t short it because Saylor has single-handedly proven that there is a never-ending parade of dumb investor money willing to finance his Microstrategy Bitcoin purchases.

Basically Saylor has tapped into some weird investor psychology to buy something on behalf of something investors can do for themselves directly and is enriching himself in the process. He owns a chunk of equity of the company and basically is able to obtain Bitcoin for himself for free by exploiting retail investors who don’t seem to understand the jig.

If investors smarten up and stop rewarding Saylor for doing what they could do on their own, MSTR will fall by 40-50%, removing the premium they are currently assigning the company.

In the meantime, the only reason investors seem to like the stock today is because “number go up.”

When the time comes and Bitcoin is out-of-favor again, investors will start dumping this stock hard and the NAV will likely plummet well under the fair value of its BTC holdings. That might be the time to buy it and then wait for the next 4 year Bitcoin cycle to ride the train again.

Until then, watch out!

Free Investing Tools

- Have Capitalize handle the paperwork for your 401K rollover to any brokerage, for FREE!

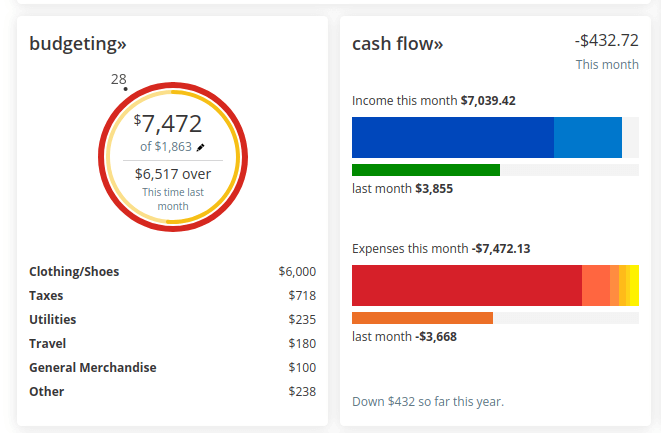

- Where does your money go each month? Track all your accounts and see if you are on track to retirement with Empower, for FREE! I use it myself to monitor my mom’s accounts to make sure she isn’t falling for scams or being defrauded.