About Ryan and WantFI

I’ve been performing investment research for over 25 years in various public and private capacities. I’m one of the few financial writers that has actually had a professional financial services career with a direct role in asset management, strategy research and hedge fund consulting.

Additionally, my educational background consists of an M.S. in Computational Finance, an M.A. in Economics, and a B.S. in Mathematics. Unlike many career paths, finance was not something “I fell into,” it was something I specifically studied for and chose.

On WantFI (pronounced “want-fye”), I write about topics that span personal finance and investing ideas.

Back Story

It took me less than ten years post-education to become a millionaire after originally graduating with $75,000 in student loan debt. I became a millionaire the “old fashioned way” by getting a bunch of degrees, starting a career, being frugal, living in small apartments, and investing everything left over. I’ve never stopped reading books on investing and strategy.

I have also never inherited any money and don’t expect to in the future either.

I spent the majority of my twenties in college developing the ‘degree collection’ and didn’t start working in my career until I was in my late twenties. I was a serious student and spent the majority of my spring breaks studying for the next exam. Life basically sucked. I did this because it was the only way that I thought was a sure path to success. Neither of my parents went to college and I had to figure out my own path on my own.

My passion for investing started young. I bought my first mutual fund when I was 14 and opened my first brokerage account to buy stocks when I was 17. I made money on the mutual fund after a number of years, but lost all the money I had placed into my stock brokerage account within a year or two after day trading all the high-flying, popular tech bubble stocks like everyone else was doing back then. It felt like a devastating loss at the time because it had taken me my whole life to accumulate what I had up to that point. But blowing an account early taught me a valuable lesson and encouraged me to aggressively learn more about investing and financial markets.

Why did I create this personal finance site?

Most finance writers aren’t practitioners of finance and only rehash the same generic advice given basically everywhere else and their sole purpose is to push affiliate sales. They have basically three types of categories:

- A personal account of getting out of debt and/or their personal journey to the FI path.

- Rehashing weak advice that you’ve probably read on financial websites 50 times already.

- Affiliate advertisements masked as reviews.

Sadly, many people have created finance websites to solely push affiliate sales. They read the the book “5 Hour Workweek” about how its easy money to just repackage information, so making money for themselves is their only goal. They do not provide any original analysis or criticism of the subject. They write fake reviews on “investing in art,” “investing in wine,” opening brokerage accounts on Coinbase or Robinhood and the common theme is that they get paid when you buy through them. Most of my reviews of alternative investment platforms have been criticisms informing you why you should avoid them.

Most of their very general material reads like a Suze Orman book who tells you are going to become a millionaire if all you do is skip drinking coffee every morning. No, you won’t, because the assumptions are ridiculously improbable with the time frame and the returns required. Heck, you might as well stop eating out! Hey, take the bus to work! I know, live like a hermit without spending any money on life’s pleasures or conveniences at all and you’ll die a multi-millionaire! Fun!

Suggestions like these are really thinking small. Seriously, a $3 coffee is only $1095 a year. You could instead lease or buy a cheaper car for $17,000 instead of a $30,000 one and save $13,000. And if a coffee gives you a small amount of enjoyment out of life, why not indulge a little bit? The focus should be on increasing your income and saving multiples more on big purchase items.

Another category of blog shares with you a very personal account with unique circumstances that won’t help you very much. One of the largest personal finance bloggers in this space only exists to push affiliate products and his backstory is comical. He made a million dollars buying real estate in San Francisco with his grandfather’s down payment funds and couldn’t sell it so decided to rent it out in 2012.

Coincidentally 2012 is right when the real estate market started to take off and SF market prices doubled over the next few years. That sounds more like good fortune than foresight and perseverance to me. What’s the advice going to be: a) have a rich grandpa and 2) go back in time and buy SF real estate?

On the same blog he talks about how he bought a tech stock in 1999 for a few thousand and it turned into over a hundred thousand dollars within a few months. Great, let me fire up my time machine.

These stories don’t help you because there is nothing actionable in them.

Where are the Japanese and European FI bloggers?

More on the luck topic, much of the net worth of today’s financial independence writers is a result of good luck from starting careers at the beginning of the 2009-2020 Bull Run and investing in the USA markets (the well documented home bias). From March 4 2009 to Jan 22, 2020, the total return of the S&P500 is up 477%. That’s a compounded return of 17.5%.

International and Emerging markets have been basically flat over the same time period. All they had to do was invest in S&P500 index funds and then write about what investing geniuses they are. Statistically, the next ten years will be less generous.

I Write About a Range of Financial Topics

Index fund investing is no longer a secret. I don’t think there is much else to write about that hasn’t been written before, but people keep rehashing the same articles time after time as if it is a new and exciting concept.

Don’t get me wrong, I invest a portion of my funds in index funds too. But index funds now create a crowding danger where the largest companies get larger for no reason other than being already large enough to be in the index. The top 10 companies now represent 30% of the index and all of them are tech companies. I see many problems in the future because of this crowding.

There is a whole world of investing strategies out there to diversify or generate income.

Furthermore there is a new world of potential investments or speculation in the cryptocurrency space which most finance bloggers don’t even touch on. Unfortunately the cryptocurrency world is rife with scams and Ponzis so most of the things are not worth allocating money towards, but a tiny amount of speculation in coins that aren’t blatant Ponzis might add some upside diversification to your overall portfolio. Bitcoin is the most well known, of course, but it’s so much deeper than that now.

I also write educational pieces to explain concepts like what Quantitative Easing is and its impact on the markets when it turns to Quantitative Tightening.

What is your style of investing?

My style of investing is predominantly cash flow and investing for passive income.

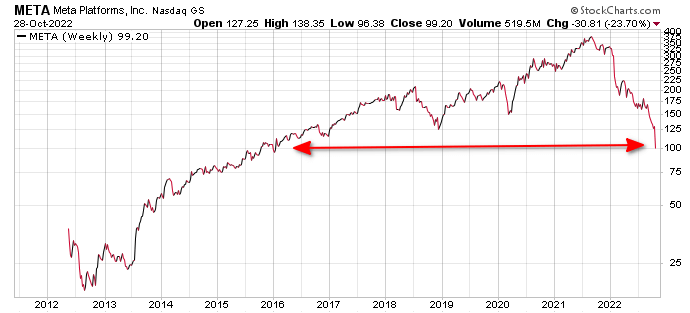

I’m looking for passive income that I can retire early off of. I’m interested in businesses that generate a lot of cash flow today and return a decent amount of it to shareholders. Investors today only seem to be concerned about capital appreciation, and businesses that might earn a lot of money far out in the future. It works until it doesn’t and then knocks off 6-8 years of gains in less than a year like Facebook (META) did in 2022.

I feel it is a more speculative way to invest that depends on bringing in more stock market buyers in a Ponzi-like fashion.

Relying on P/E expansion is riskier because it can ebb and flow over time with interest rates, which are now on the upswing. When you’ve been paid a dividend, it’s yours forever and if you bought it for a good value, there won’t be much P/E deflation. If the stock drops, but you’ve bought a solid business, you get paid to wait for the recovery.

I also speculate for some asymmetric upside bets with some small cap stocks and cryptocurrency.

Will you share actionable ideas?

I spend a significant amount of time researching stocks and running analysis on investing ideas, such as using a moving average to condition your buys into the S&P500 to reduce risk and increase return. I’m already doing this for myself, but it does take some extra effort to write up the investment case, so I don’t write about everything I am investing in. I discuss some ideas that I don’t have time to write up in the Telegram Chatroom.

What is my other passion?

Travel. 43 countries and counting since 2012.

I love interacting with locals, eating local foods and walking my way through cities and towns.

Free Investing Tools

- Have Capitalize handle the paperwork for your 401K rollover to any brokerage, for FREE!

- Where does your money go each month? Track all your accounts and see if you are on track to retirement with Empower, for FREE! I use it myself to monitor my mom’s accounts to make sure she isn’t falling for scams or being defrauded.