Robinhood Investing Review: 4 reasons to avoid this broker

Updated on January 14th, 2025

Update: SEC charges Robinhood with securities violations… again.

You may be surprised that I am actually not recommending Robinhood trading. Everywhere you look on the web it seems that everyone is singing its praises. Millennials and beginning investors have flocked to it; I’ve had 2 or 3 of my friends ask me if I wanted to sign up through their referral link.

Below I explain why I do not recommend this brokerage trading account and why you should consider other options when investing in the stock market or cryptocurrency.

Robinhood Trading History

As a quick introduction, Robinhood trading was founded in 2013 by two developers who had previously built systems for high-frequency trading. This is your first clue.

Contrary to popular belief, Robinhood was NOT the first brokerage to offer commission free trading. That honor goes to a now defunct brokerage called Zecco Trading. They died the year before Robinhood started up basically the same service, this time on an App.

Why Robinhood is Popular With Millennials

Robinhood is popular with millennials because of the commission-free aspect, its slick app-only interface, and it has a heavily promoted referral program.

Free Stock Trades

This has always been its biggest selling point. Who doesn’t like free?

I like free stuff too, but as frugal as I am, I deliberately never opened a Robinhood account because I had been down this road before with Zecco Trading and I am acutely aware of the flaws of these startup brokerages. Sometimes free is not really worth it.

About the only good thing I can say about Robinhood in this regard is that because of their success in signing up millions of new accounts, this eventually set the stage for all major brokerages to cancel their commissions to compete. In Oct 2019, almost all major brokerages followed suit, and this removed Robinhood’s main competitive advantage.

Your 2025 Goal:

Create a new side hustle and start a blog on something you are passionate about! I’ve tested out a dozen hosts and the one with the fastest speeds and lowest costs is the one I host my site on.. Get this deal for less than the price of a coffee one a month.

The problem here is that people are mistaking free commissions with cost–less commissions. When it comes to trading and investing, what you pay actually comes down to execution quality in addition to any commissions and exchange fees.

Problem: Execution Quality. Why Free Isn’t Free

What I mean is say that you are interested in buying 100 shares of a stock currently trading at $20. The market currently has a Bid of $19.95 and an Ask of $20.05 in the order book. What this means is if you wanted to sell the stock using a market-order you would receive $19.95 and if you wanted to buy the stock using a market-order you would pay $20.05.

Often there are shares offered off the exchange either in dark pools or sitting in the brokerage’s inventory from other customers who recently sold them. So if you place a market order you will get something known as price improvement that will execute your trade somewhere in the middle of that bid-ask spread.

For exposition, let’s say your trade executes at $20 even. This is a price improvement of $0.05 and you saved $5 on the trade.

Now, you can target this price improvement directly by using a limit-order. And placing your limit price at $20.00 directly. But herein lies the problem with Robinhood, your trade will likely just sit there and not execute at all. As the market starts moving away from your limit order you will probably start chasing the market until you get aggressive and place your order really close to the Ask price.

Why? It’s because your order isn’t going to the exchange, it is going to a high-frequency trading (HFT) firm.

Payment For Order Flow

Robinhood has to make its money somewhere and didn’t create the service out of the goodness of their hearts.

How they make this money is known as Payment For Order Flow. What this means is that they don’t send your order directly to the exchange, they send it to a third party that executes the trade on their behalf.

In a split second, the high-frequency trader will buy your stock (or pull it from inventory) and turn around and sell it to you for a slightly higher price, netting them a few bucks profit in the process. Multiply this by millions of traders making a few trades a week and you can see why these are highly profitable businesses.

Famed financial author Micheal Lewis wrote a book about high frequency traders called “Flash Boys” that explains this process in depth. I’m not a huge Micheal Lewis fan because he frequently presents the topics he writes about in a very biased, negative light, but this book seemed more fair than his usual writings and he managed to present a good look at a very secretive industry.

High-frequency traders don’t have your best interest in mind either and you can place a limit order near the mid all day long and they will not execute your order unless they have made a minimum amount of profit off of you. The profit they make, is what they take… from you.

Now, payment for order flow is not unique to Robinhood. In fact almost all brokerages do this to some extent. The only brokerage that does not routinely do this is Interactive Brokers Pro, which charges around $1 per trade to send orders directly to the exchange.

However, each brokerage has discretion in where they send their order flow and which high-frequency trading firms they do business with. Major brokerages like Schwab and Fidelity make money in a multitude of ways including ETF and CEF products they sponsor or run directly, margin and short-interest lending, and their integrated traditional banking & lending services. Therefore, they are not entirely dependent on order flow to run their business and don’t need to shake down each investor to the maximum extent.

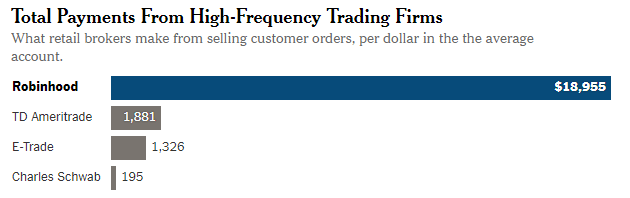

Well guess what, Robinhood chooses the HFTs that offer the largest kickbacks to them. Here’s a comparison of the major brokerages revenue from this practice.

Robinhood received a fine in Dec 2019 for best execution violations.

Well guess what, they received another fine, this time $65 million in December 2020.

Are you surprised that Robinhood has been fined multiple times for this behavior?

Cryptocurrency Trading

Cryptocurrency, like Bitcoin, is widely popular with millennials as the newest investment craze. In 2019, they rolled out free Bitcoin trading and added additional cryptocurrencies later.

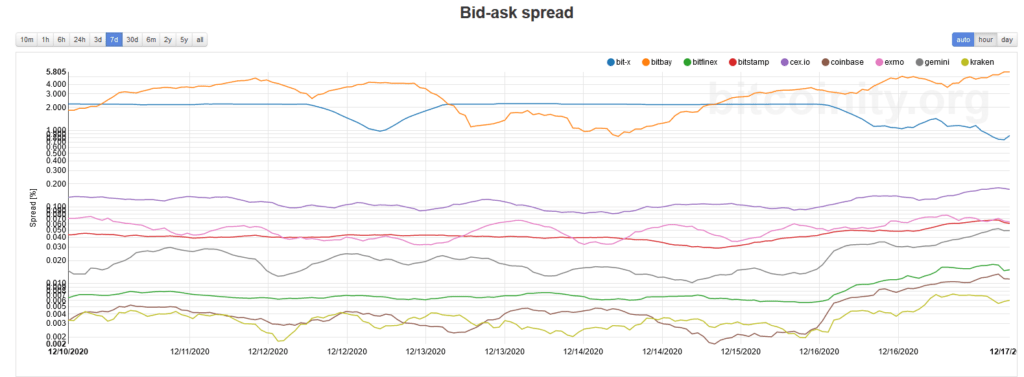

Cryptocurrencies are fragmented across multiple exchanges and there isn’t a National Best Bid Offer (NBBO) system. Arbitrage is the only thing that keeps the prices on different exchanges relatively close to one another, but the differences can be significant. Here’s a snapshot of the bid-ask spread on the various Bitcoin exchanges:

Connecting the dots here, as we’ve seen how they handle stock trades, how do you think they handle cryptocurrency trades?

Another disadvantage of using Robinhood for crypto is that unlike coin dealers and coin brokerages described in my cryptocurrency guide, the crypto stays in their hands.

You can’t spend it. You can’t exchange it to a currency they don’t support. You can’t withdrawal it to your cold storage. You can’t send it to your friend’s wallet. You basically can’t do anything that makes it part of the decentralization revolution. Bitcoin enthusiasts will say that you don’t really own Bitcoin for these reasons, and they have a point.

Free Stock With Their Referral Program

Referral programs generally lead to an explosion of signups due to the incentive of earning money for signing up each one of your ‘friends.’

They advertise that your referral bonus will be a share of stock, randomly chosen from a list, worth up to $225 per referral. Can you imagine signing up 10 friends and earning $2,250? It sounds like easy money. However, in the fine print, they disclose that “approximately 98% of the participants will get a stock reward having a value between $2.50 and $10.00.” I’d be willing to bet that 99% of those 98% receive closer to the bottom $2.50 area as well, but they have not disclosed this.

Referral programs are not necessarily bad, but your Robinhood friends are being incentivized to tell you how great it is.

More Robinhood Problems

They’ve suffered multiple outages, security problems, and lawsuits by states. And guess what, there isn’t even a phone number you can call them at if you encounter a problem.

Problem: Repeated Outages

Now, some of the big brokerages have had trading or login outages as well, so I am not trying to overly pick on them for this, but Robinhood being a newer and smaller company, has not been prepared for the surge in trading activity during periods of high volatility.

When everyone was logging into their accounts in March 2020, the whole service went down for multiple days and their customers were locked out of trading, seeing their positions and funding their accounts.

You know how stressful this is to be locked into a position when the market is dropping 10% in a day? I’ve been there when I had Zecco Trading back in 2009 and know the feeling of that panic.

Some might see this lockout as a good thing to prevent you from over-trading, but they also had another outage on the largest up day as well! The buy the dip investors couldn’t even get in.

Not surprisingly, these account lockouts led to a class-action lawsuit.

With today’s cloud computing services offered by both Google and Amazon, there are few excuses for not planning for a surge in activity and utilizing their cloud providers that can ramp up extra servers at a moment’s notice.

Problem: Security

In today’s security conscious age, there is really no excuse for storing passwords in clear-text in the database. The founders are developers for crying-out-loud!

As a result of this amateur hour move, 2,000 accounts were compromised and had money stolen from them. I’m sure that Robinhood reimbursed the accounts, but frustrating to get it sorted out if you were a victim.

And how many other accounts did they expose for those customers who use the same email address and password for other services, or were their banking account numbers exposed? It’s not a hassle I’d want to deal with, for sure.

The worst part was that they downplayed it instead of owning up to it.

In November 2021, they also had information for 7 million users stolen. You can bet these users will be crypto-phished for the next few years.

Problem: Gamification

Robinhood has a bad knack of using nudges to get people to trade on their platform. Remember they make their money every time you trade so they want you to do it often.

They send out reminders, and notices of how trades are performing on their app which nudges you to check out your brokerage account and balance frequently.

When you place a trade, there is confetti and animations that make the whole processes seem like a video game. It has led to an explosion of trading activity.

They also have a lotto style ‘scratch off’ for which free stock you get when you sign up with a referral promo.

They also allow riskier trading strategies for inexperienced investors such as options or leveraged ETFs with minimal disclosure of the risks of those products. Of course there is a certain element of buyer beware here, but every brokerage is required to act in the best interest of their clients and make the client sign scary sounding disclosures that they can lose all the money they put into those vehicles. Basically the goal is to deter you from engaging in those riskier things.

Some brokerages won’t even approve your extra privileges unless you have demonstrated some experience with them. And some major brokerages don’t allow their clients to trade any leveraged ETFs/ETNs at all!

To a young inexperienced investor, which is the core of who they target, they should be made very aware of the risks of trading some of these leveraged products.

The state of Massachusetts is suing them for these oversights.

Alternative Stock Trading Platforms

The biggest problem with Robinhood is their execution quality that ends up costing you a lot more than ‘free.’ But they have had a lot of other issues in security, outages and encouraging unnecessary trading which demonstrates a lack in their fiduciary duty.

My advice is to choose another brokerage.

Now that almost every brokerage offers free trading, it’s really hard to pick the best stock trading app because there are a plethora of them and each has various pros and cons.

Stock Trading Platform Services Vary

Some brokerages are geared toward neophytes and place a lot of guard rails on what you can do. For instance, you might be limited to trading once per day, you might not be allowed to engage in after hours trading, you might be restricted from buying leveraged ETFs/ETNs, they might not offer penny stock trading or might not offer stock options trading.

If you are new, many of these won’t concern you, but don’t expect that every brokerage you happen to come across will offer all services by default. But remember, you can always add another brokerage later if you feel that you need to grow. I personally have 4 active brokerages that I use for different things and have had a few others that I later jettisoned; you don’t have to just pick one.

Integrated Banking & Investing

If you are looking for an integrated banking and investing solution, go with Interactive Brokers. They are a one-stop shop where you can even borrow money against your stock portfolio.

Free Investing Tools

For advanced traders who want direct access to exchanges without “payment for order flow” shenanigans choose Interactive Brokers.