Lively: The HSA for Life

Updated on January 23rd, 2022

Traditional Health Care Model

Traditionally, employers have offered only two types of health care plans: Preferred Provider Organization (PPO) and Health Maintenance Organization (HMO) plans. The differences between the two are minor and it’s mainly that in an HMO you have to obtain referrals to specific providers by your primary care doctor, but with PPOs you can go to any health provider anywhere. HMOs were designed to save money and were therefore cheaper plans.

These are the two offerings that most people with healthcare provided by their employers are familiar with.

It’s simple: you pick your plan, find a doctor in the network of this plan (or get a referral), get treatment and pay a marginal fee of $20, known as a co-pay. You can go to the doctor as often as you like and always pay the same low fee. You may have to pay a co-insurance for the services rendered, but generally the percentage paid is relatively low. But there’s never an incentive to shop around for services and find cheaper rates of care.

This has been the model for healthcare for about 75 years in the US.

This model came into existence in the US by a failure of economic policy inadvertently formed from government price controls. During World War II, congress passed the Stabilization Act of 1942 to control inflation by limiting wages. Employers were unable to attract the talent they needed given the wage ceiling and therefore began offering fringe benefits, including health care. It was a success and so other employers started rolling out the same red carpet to to compete and hire the talent they needed.

It was so successful that even when the wage controls were no longer in existence, employers continued offering health care benefits. Employees loved them and started to ask why other employers weren’t offering the same benefits. It was further cemented into American culture.

This model has led to side effects, of course. Without concern for price, doctors and hospitals were able to charge third party insurance companies increasing amounts year after year. Since the consumer was only paying $20 and never had to deal with the provider, it really wasn’t a concern to them what the final charge was.

Insurance companies fought back of course to cap the costs they were facing, but doctors routinely perform many unnecessary tests just to rule everything out. When someone else is paying, this is something the patient can get behind.

Now Americans spend more per capita on health care than any other industrialized nation and our insurance model takes a lot of the blame.

PRO-TIP: I rolled over a 401k into an IRA, and Capitalize‘s FREE service couldn’t have made it any easier to do. They work with all the major brokerages and handle the paperwork for you.

To illustrate the absurdity of the concept, if employers had decided to pay for their worker’s grocery bills instead of health care, you would walk into a grocery store today and there would be no prices; a stick of butter would probably cost $45 dollars!

New Health Care Model

While PPOs and HMOs are still widely offered by employers around the country, many employers have started to phase out these traditional health care models in favor of the newer High-Deductible Health Care Plans (HDHP).

In fact, my current and my previous employer no longer offer the traditional model plans at all.

What is a High Deductible Health Care Plan (HDHP)?

The HDHP is a health care plan that puts more of the upfront costs onto the employee. You have to pay the deductible before the insurance kicks in and covers the rest. These are much cheaper for employers and employees alike and is part of the reason that HDHP’s have been growing rapidly since they were introduced in the early 2000s.

When I first started out in my career, I was faced with the option of choosing a traditional health care plan or choosing the HDHP. For a young, healthy person, it is a slam dunk to choose the HDHP because the costs are usually less than half the expense of a PPO. The deductible you are faced with paying is covered within a year or two with the difference in plan savings.

But that’s not even the best part.

What is a Health Savings Account (HSA)?

With the HDHP a nice perk was created in 2003, the HSA. The Health Savings Account is a savings and investing vehicle that is specific to paying for medical expenses, pre-tax, with the convenience of a debit card.

HSA vs. FSA

Many people are familiar with the Flexible Spending Account (FSA) where you similarly put pre-tax money into the account and can spend it on medical expenses by the end of the year, but unlike the FSA, the money in the Health Savings Account is never forfeited. This allows you to accumulate money every year to plan for any medical expenses you will need in the future.

Another sharp difference between the FSA and the HSA is that you can invest the money you save every year into stocks and bonds, leading to higher rates of return and long term growth. Since the average 65 year old will need almost $300,000 for medical expenses in retirement, it’s truly a great way to plan ahead and invest over the long term for the money you might need.

How Do Health Savings Accounts Work

You might be concerned that if you are a healthy person that you might save too much into this account and lose the money, but there is another bonus: When you hit age 65, you can still pay for medical expenses tax free, but you are also allowed to withdraw money for other purposes, and then you just pay regular income taxes on it. It’s like a backdoor IRA.

I’ve had my HSA for ten years and I have contributed the maximum since its inception and it currently has around $40,000 in it after shelling out a couple hundred a year on routine visits. The health savings account contribution limits are $3,600 for 2021.

The HDHP and HSA combo has saved me a ton of money!

The Benefits of the HDHP/HSA Model

I am a big fan of the HDHP/HSA model. Firstly, its cheaper for young and healthy individuals who don’t have a lot of medical expenses. And paired with the HSA, it provides another long term savings vehicle. Since the money in the account is pre-tax, the outlay for any medical expense is effectively cheaper by your marginal tax rate.

HSAs also provide an avenue for more aggregate economic benefits by:

- Reducing unnecessary office visits for minor colds and coughs that increase waiting times and drive up costs.

- Giving an incentive for the patient to shop around for services, putting pressure on physician’s costs.

- Providing an incentive for the consumer to save, invest and plan towards future health care expenses instead of risking insolvency at the first major medical bill.

Many of the things that my favorite economist Milton Friedman advocated for in ‘curing’ healthcare start with the HDHP and HSA concepts.

Health Savings Account Rules

To be eligible for an HSA, you must must have a HDHP to open and contribute to one and:

- You can’t have any other supplemental health insurance coverage

- You can’t be claimed as a dependent on someone else’s tax return.

- You can’t be enrolled in Medicare (Part A and Part B) or Medicaid.

- You must be under the age of 65

Which HSA Bank To Choose?

Unfortunately when HSAs were first getting started, the fee grab on these accounts was insane. It was not uncommon to have monthly ‘maintenance’ fee of $5 and $15 commissions to buy and sell mutual funds. My early HSAs lost several hundred dollars from these unnecessary fees.

Luckily there are now better options for health savings accounts that don’t treat your health care money as prime picking grounds.

Lively HSA Review

In 2020, Lively was rated in the top HSA custodian category from the investor-centric Morningstar.

And it is easy to see why, here is their fee schedule:

Lively HSA Fees

Investment Options

Lively HSA offers three options for the money you place in the HSA:

- The cash account earns regular interest and is FDIC insured up to $250,000.

- Guided Portfolio by Devenir, which provides suggested low cost funds based on your risk preferences.

- The self-directed brokerage account option that provides you with the opportunity to invest in ETFs, CEFs, stocks, preferred shares, bonds, and mutual funds all commission-free. They have partnered with one of the largest brokerages, TD Ameritrade for this.

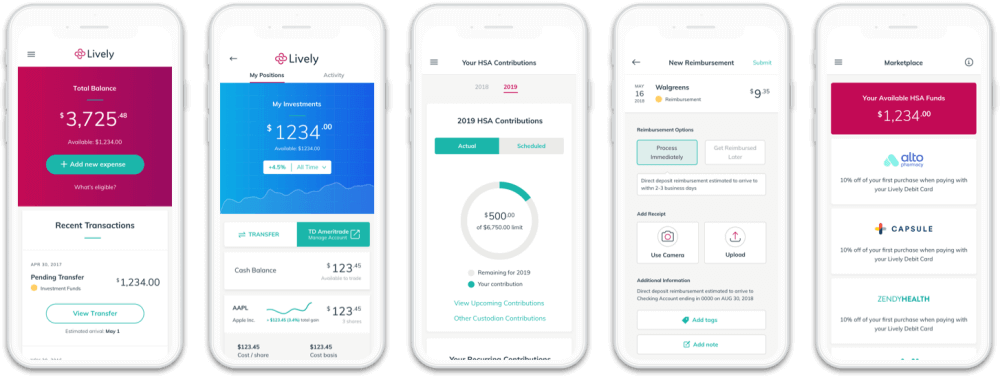

Smart Phone App

Not many HSAs have an app, but Lively does and you can keep track of your account, spending, and a super helpful feature is being able to upload receipts. Traditionally you have had to hold on to your receipts for years in case the IRS asked you to provide proof of spending. Who wants to have carbon paper receipts all over the place? Yuck.

You can fund your HSA account either through your employer or through your bank account. You can also transfer existing HSA accounts to Lively.

There’s still time to fund your Lively HSA account and receive your debit card before the end of the tax year if you haven’t already. The signup process only takes a few minutes.

Free Investing Tools

- Have Capitalize handle the paperwork for your 401K rollover to any brokerage, for FREE!

- Where does your money go each month? Track all your accounts and see if you are on track to retirement with Empower, for FREE! I use it myself.