Preferred Stock Investing Guide: 11 Rules For More Yield and Less Risk

Updated on April 19th, 2023

What is the bond-like asset class with yields that blow bonds out of the water with residual income? One of my favorite and the most overlooked high yielding asset classes: preferred stock.

These are not regular dividend stocks.

What’s the Definition of a Preferred Stock?

Even though they are labeled as equity, it’s a bit of a misnomer because their features have more in common with bonds than stocks. Basically they are the second most subordinated in the capital structure, ahead of common stockholders, who are last in line, but after bondholders. They are usually pretty boring and don’t move around that much, which is perfect for income investors such as myself who are just looking for consistent cash flow in the portfolio. Preferred dividends are usually fixed, although variable rate preferred shares have become more common now with rates tied to an index like LIBOR that undergo a quarterly rate reset.

One of the best features of preferred shares is that you can get a high yielding asset that qualifies for the qualified dividend 15% tax rate, since most of them are issued by regular corporations. It is not uncommon to find pretty safe yields of 5-7%. Plenty of them are issued by REITs, LPs and MLPs, however, which means that they usually have a higher yield. The K-1 form for preferred shares in LPs and MLPs also is usually much simpler than the common equity counterpart.

Preferred equity owners get paid before common stockholders get paid. The common shares can’t receive a dividend unless the preferred shares do. So if the common stock has been paying a dividend for decades, the likelihood of having a pretty secure preferred dividend is pretty high.

Additionally, most of preferred share issues are cumulative. If the dividend payments ever stop, before a common share can receive a dividend, all the back payments for the preferreds that were missed must be paid in full. This is actually a loose benefit here since if the company is so distressed that they can’t pay dividends, then you are not likely to get back payments for the ones missed in the end anyway because the company is likely on the road to bankruptcy.

But the benefit is that there is less flexibility for the board of directors to skip a quarter or two so save cash at their discretion. I’m not aware of any non-cumulative preferred shares that have skipped a payment here and there, unless the company was distressed, because that kind of activity would be a death kneel for that type of funding. Needless to say, if you come across any non-cumulative preferred shares, check the history to see that it isn’t something they have done in the past.

An important point is that preferred stock equity issued by banks is almost always non-cumulative. They do this because of regulatory requirements post-financial crash and as a result they don’t have to include it in their Tier funding ratios since the dividend is “optional.” However, they take these preferred shares pretty seriously and most didn’t cut off their preferred dividends even if they stopped paying out to common shareholders during the financial crisis back in 2008.

Additionally, there are some preferred stock issues that have some more exotic features such as conversion to common shares if certain conditions are met, but these are less common and you will have to evaluate these for each situation differently. Depending on where the common stock is trading, it could be an advantage or a liability.

Your 2025 Goal:

Create a new side hustle and start a blog! I’ve tested out a dozen hosts and the one with the fastest speeds and lowest costs is the one I host my site on.

The most unfavorable feature of preferred shares is that they are almost always callable. While they are usually perpetual without a maturity date, having a call means that the issuer has the right to buy them back from you at par (what they issued them at). Usually they do this to issue a new preferred share series with a lower yield, at which point you can buy back in if you choose.

Because of this call feature, preferred shares aren’t expected to have much capital appreciation and generally don’t trade more than $1-2 above their par price. This is why I refuse to buy any preferred stock shares above par because of the capital loss risk (unless it is convertible and it the terms suggest a capital gain is likely). I prefer to wait until turbulent market conditions return and buy them at a discount. Not only will the yield go up, but when you throw in some capital appreciation potential, and the fact that they usually snap back pretty quickly, your total return has the potential to get juiced for the right opportunities.

A preferred stock is ripe for redemption if it is in the callable period, usually 5 years after issuance, is trading above par, meaning there is strong demand for them, and is the preferred series with the highest interest rate that the corporation has issued. The issuer will always obviously redeem their highest interest rate obligations first.

A frequently cited disadvantage to preferred stock shares is the lack of voting rights, which is something that a lot of people get fixated on. But frankly, when was the last time you submitted a proxy for any of the individual stocks in your portfolio? And when it came down to certain proposals or directors you had two options: Vote For it, or Abstain from voting on it. Not exactly a democratic expression of the owners. Anyway, when institutional holders own millions of shares on behalf of their ETFs interests, your vote won’t amount to much one way or the other. Voting rights are a pretty minor consideration for the individual investor.

Liquidity: Advantage or Disadvantage?

Most investors don’t even consider preferred shares at all when it comes to their portfolios and so it is an overlooked asset class and are much less liquid that common stocks. This is bad for trying to buy and sell large blocks of it, but good in the sense that it’s an inefficient market that can lead to excess return.

Instead of all the buying and selling for a particular company being funneled into a single class of common equity, when it comes to preferred shares there are usually multiple issues each with a letter designation (series A, B, C, etc..). When an already thin amount of volume is spread across multiple preferred share series, the volume for each is even thinner still.

The Bid-Ask spread can easily be $0.75 with a thousand shares traded on a particular day. Each series can have vastly different effective yields, which some of the difference is inefficiency and some of the difference relates to the call feature.

About a year ago, I owned a Capital One preferred share that got mentioned in the Barron’s financial newspaper. It was bid up well above my buy price, but the other series were trading with a higher yield. I sold the one that was mentioned and purchased another series that had higher yield and kept the difference in capital gain.

11 Rules To Pass Before Adding To Your Portfolio

- First and foremost, do earnings and operating cash flows cover the debt service comfortably? Since preferred share owners are further down the capital hierarchy, you want to make sure that the company is not at risk of a default on their senior bond obligations.

- Is there a good tangible asset coverage ratio? Can enough assets be sold off to pay off existing debt and have more than enough left over for preferred shares?

- Would the assets on the balance sheet still have good coverage if there is an impairment of their value? Looking at you, oil stocks!

- Is the net income and cash flow stable or volatile across time?

- Is a recession likely to severely impact the earnings and cash flows?

- Have they ever suspended a dividend payment?

- Have they been paying and raising common dividends for multiple years consistently?

- Is there a large common dividend buffer that could be used to instead pay the preferred holders if the company is stressed?

- Is the current preferred price under the call price it is redeemable at?

- Is the preferred stock cumulative?

- Are they issuing lots of common stock to pay their dividends?

If most of the answers to the above questions lead to favorable answers, the preferred stock is probably a good candidate to hold for the long term yield.

Buy Preferred Equity Fund or Individual Names?

Like any investing exercise, it will take some time to dig through the financial filings and answer the above questions and not everyone will be willing or able to do so.

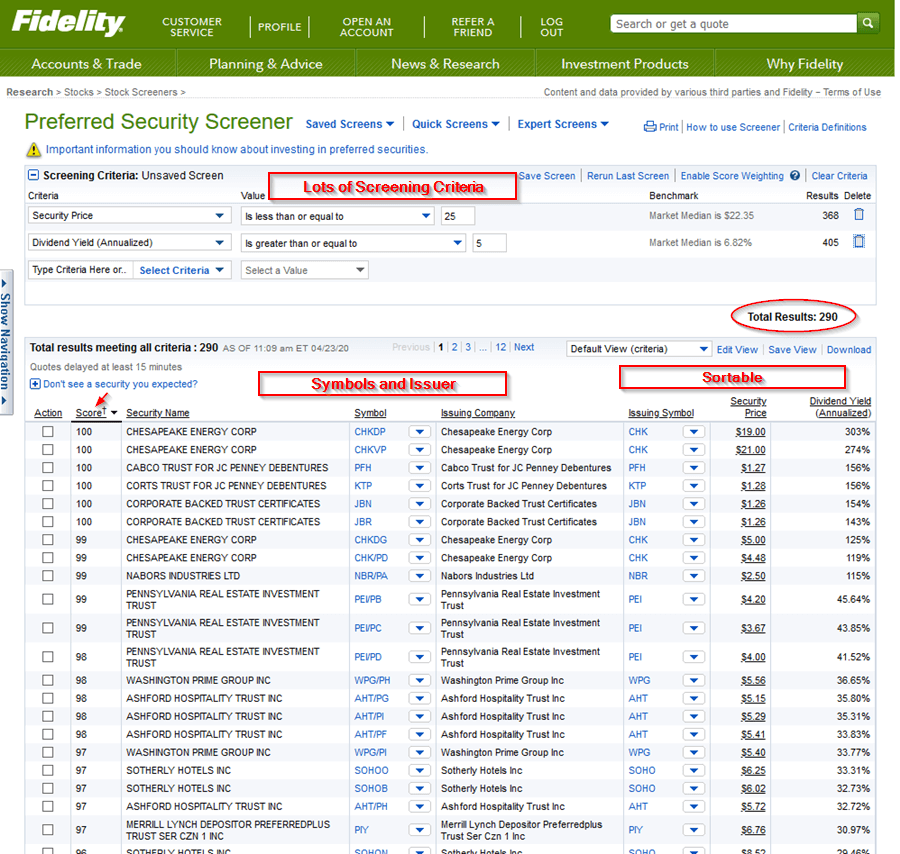

Various screeners and lists of preferred shares are available around the web. I particularly like Fidelity’s screener and the free information available at QuantumOnline.com. You can sort to find the top stocks adhering to your criteria.

I personally prefer to add individual names to my portfolio since I can use a screener to target yield and discounts-to-par, and make a decision on the underlying business but the best way for most people is to buy a mutual fund or ETF of them. This is much safer, albeit a lower yielding route.

Popular ETFs are the iShares PFF, Invesco PGX and VRP. There are also dozens of Closed-End Funds that add a twist of leverage to a basket of preferred stocks, juicing the yields. I have owned both PGX and VRP in the past, but I have preferred (pardon the pun!) VRP because they only buy variable rate securities. This was important during the short rising interest rate period we had over the last few years, but it looks like interest rates are trending back down after the emergency rate cuts and the potential for the global economy to enter into a recession stemming from COVID-19.

Preferred Stock Screeners

I really like Fidelity’s preferred stock screener because it is dedicated to preferred stocks and doesn’t mix in other types. There is a plethora of sorting criteria and you can sort based on the best match to your criteria or by highest yield. It’s not free though, so if you don’t have a 401(k) or other account with them you’ll need to use another.

Run Preferred Stock Screeners Often

During market misallocations such as these, almost all preferred shares start to become more attractive and develop discounts that may later become capital appreciation. More opportunities will present themselves as this COVID-19 story unfolds in 2020, especially if panic really sets in.

However, if you are interested in individual names, it pays to search frequently because deals crop up randomly from time to time. Last year NGHC preferred shares dived off a cliff for no apparent reason while the common stock was basically stable. I hadn’t encountered that situation before. After searching tirelessly and reviewing the financials of the common more than a couple of times, and not finding a good reason why the preferred shares would tank so much, I bought an allocation that at the time was a little uncomfortable. And then I bought some more.

There is always the assumption that someone out there knows more than you and they are selling because they have better information than you. I read this kind of sentiment on the financial message boards all the time. “Someone must know something!” But in reality, the answer could be as simple as a large pension fund reallocating away from an industry or asset classes that has nothing to do with the fundamentals of the company. Alternatively, a large seller could be affecting the liquidity either purposely or inadvertently by creating a chain reaction triggering other investor’s stop losses. Going against the herd can pay off bigly if you can have reviewed the company yourself and have confidence in your decision. With the NGHC preferred, not only did I secure a 9% dividend with a 15% tax rate, I also got 30% long term capital appreciation in a year which I sold half of recently.

Some examples of some preferred equity positions I added to my portfolio recently were shippers Costamare (CMRE) and Safe Bulkers (SB) which face risks of a slowdown in the global economy and correspondingly yield a much higher 9-10%. I’m also a fan of LNG shippers which have been whacked lately for the same reasons even though LNG is a growth industry. These aren’t slam-dunks and the yield reflects that risk, but I am willing to crawl up the risk-reward spectrum for these certain industries that sell off at every hint of a recession. It may pay off or it may not, but don’t forget that diversification is important and you shouldn’t put too much into any individual name.

Free Investing Tools

For advanced traders who want direct access to exchanges without “payment for order flow” shenanigans choose Interactive Brokers.

I use Axos Bank for its no-fee business account with free bill pay.

I think the reason why preferred stocks aren’t popular is because everyone is going for the lotto ticket of capital appreciation. I’ll take income any day! Thanks for the great article!

Excellent, great content!

Ryan thanks! This is the best preference stock article I’ve seen. Most of them write about investing in stocks, but there are many correct ideas here and everything is very accessible. Thanks!