Market Tops and 5 Good Reasons for Cash on the Sidelines

Updated on January 15th, 2023

Should you buy stocks now?

Wall Street and the mainstream financial publications have brainwashed the public to be fully invested at all times. “You can’t time the market,” they say. They often share studies and quote academics who basically say the same thing.

Financial publications routinely publish meaningless statistics that say trite things like “If you were out of the market the best 10 days over the last 30 years, you’d have a negative return today!” Okay, so how about if you missed 10 of the best days and 10 of the worst days, what would your gain or loss be then? It’s very convenient to assume that you’d miss only the best days.

Continue reading about some times when you should raise cash or buy bonds.

When You Should Have More Cash In Your Portfolio

There are plenty of times when you shouldn’t be fully invested in the stock market and should be raising more cash (or buying bonds) in your portfolio:

- You are within 5 years of retirement.

- You don’t have several months of emergency cash.

- You have a large purchase coming up.

- The stock market has gained significantly over the prior year and you need to re-balance your risk allocation.

- You have been paying attention to the various signs of an impending drawdown and want to reduce risk.

Reallocation Is Not a Market Timing Strategy

Ulterior motives aside, the arguments against taking risk off the table are exaggerated straw-man attacks, suggesting that the only way to do it is to switch from 100% stocks to 100% cash or bonds on a regular basis. “Timing the market” gets a bad rap and is framed that you need to have a perfect market timing strategy where you must pick the exact top and the exact bottom to obtain any benefit from it. That is clearly impossible. I’m not advocating an all or nothing approach and I’m certainly not suggesting money is moved back and forth frequently.

The buy and hold strategy is completely fine. It doesn’t require your attention and you’ll eventually get back to record highs. It just sometimes takes a few years such as the market corrections of 2000 and 2008.

However, when the market has soared as much as it had up until the end of 2019 and 2020, your allocation to stocks would have been a lot more than your allocation to bonds and cash, and therefore, raising cash or buying bonds would be a prudent function of proper asset allocation.

What’s worse, longing for paper wealth you thought you had, or having peace of mind that a portion of your assets had zero volatility but didn’t earn you much? Various studies have shown that losing wealth hurts a lot more than not gaining as much as you could have.

Your 2025 Goal:

Create a new side hustle and start a blog! I’ve tested out a dozen hosts and the one with the fastest speeds and lowest costs is the one I host my site on.

I’ve shown that missing the worst days has more potential to work on your side when you take risk off. If you move a portion of your portfolio to cash and the market ascends 30% over the next year, but then drops 30% the following year, that cash is actually ahead of the game by 9% (130%*70%=91%).

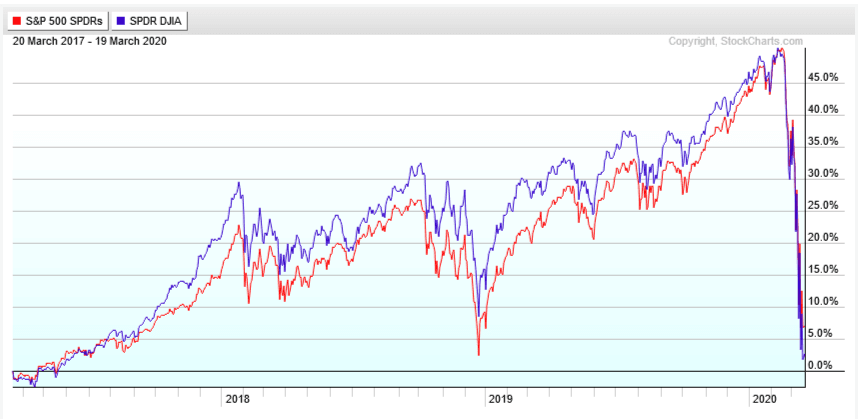

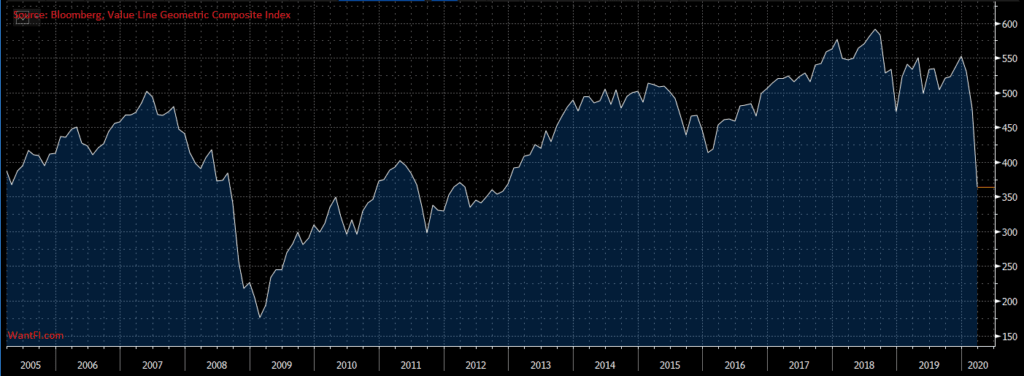

In fact, if you had chosen to sit out the market anytime in the last three years prior to March 2020, you would have been ahead of the game because that rout has wiped out 3 years (and rebounded very quickly). The key lesson is that when the market corrects, it usually takes out several months to years of market gains and market corrections occur quite frequently about every other year or so.

But it is important not to capitulate to the Fear-Of-Missing-Out (FOMO) where you put the money back in after taking it out because the market continues to churn higher. The goal is to re-balance your risk and asset allocation and keep it that way until it is necessary to re-balance again.

To Protect Against Market Downside, What Are Other Options?

1) Buy puts

2) Short stocks (hedging)

But neither of these options is free and they expose you to other risks like losing your option premium or the shorted stocks continue to ascend higher. The cheapest thing to protect against downside is to just sell some of your equity and raise cash. Lock in some gains.

When is a Good Time to Raise Cash?

In “A Random Walk Down Wall Street,” Malkiel points out that news by its very nature is random, so therefore the market movements in reaction to the news will be random. While I can agree with that statement, there are times when the market is setup to react more negatively to bad news than other times. The market becomes a “coiled spring” ready to snap. These are the times when you want to have extra cash waiting on the sidelines ready to swoop in and pick up some severely discounted assets.

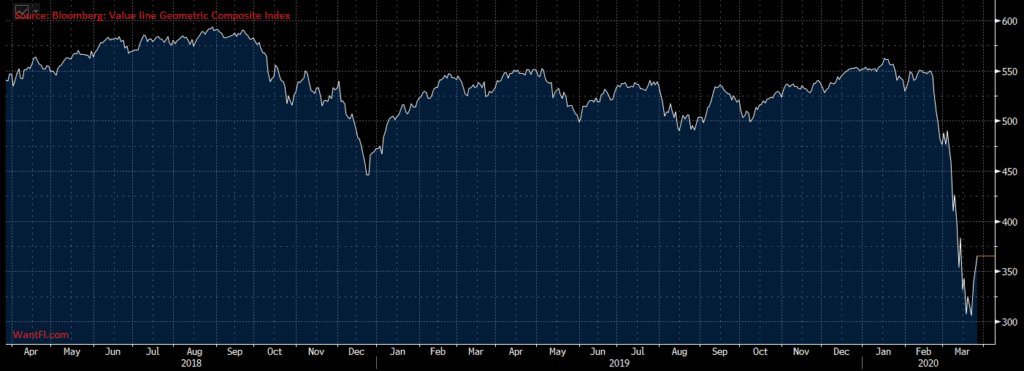

While some corrections appear to come out of left field, other ones are pretty obvious. The draw-down going into Feb 2020 was the easiest call in history. Every measure of valuation had showed that it was extremely overvalued and the S&P 500 had risen 14% in less than 5 months. I recall reading opinions in Barron’s where the ‘experts’ were doing mental gymnastics to justify the valuations. “Well, you see, with the ten year bond yield so low, equities are not so overvalued when you subtract the equity yield from it…”

Basically it becomes another “this time is different” argument.

All the market needed was a pin prick. If it wasn’t the pandemic, it would have been the oil price war between Russia and Saudi Arabia. If it wasn’t either of those, it would have been something else. People needed a reason to sell, and either of those reasons gave them one.

What Were Some of the Biggest Signs That a Correction Was Coming In 2018 and 2020?

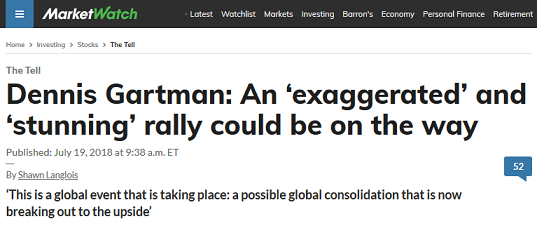

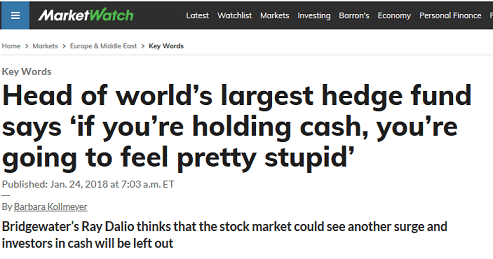

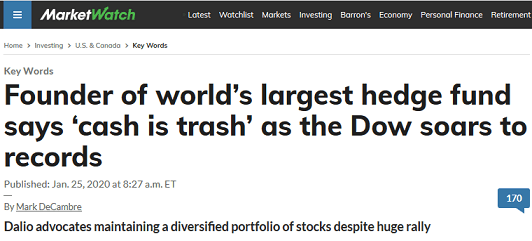

- Ridiculous headlines from ‘experts’ telling you to buy. Hedge funds talk their book and it’s almost criminal. They will tell you what to do and take the opposite side of the trade.

They do it on the downside too:

When you see headlines like this, exercise extreme caution.

2. Magazine covers start telling everyone how great or bad the situation on Wall Street is. This has the effect of bringing in new buyers or sellers for anyone who wasn’t previously paying attention.

3. Price-to-Sales, Price-to-Earnings, Forward P/E, CAPE P/E, Put/Call Ratio, Fear and Greed Index, AAII investors survey, cash sitting in Berkshire Hathaway, etc. were all at extremes.

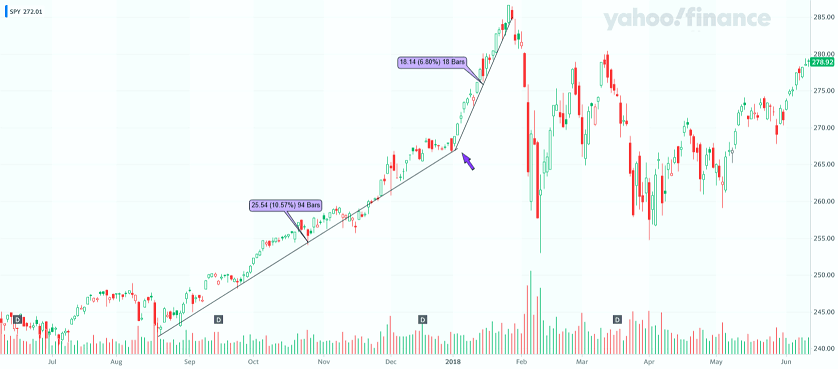

4. 2018 had an extra tell where the trend line suddenly accelerated upwards, indicating panic buying. This one is less common in the index, but happens all the time in individual stocks.

Market Top Signs in 2021

There were so many signs but it took until 2022 to finally start deflating. Read what was obvious.

Why Bother To Reallocate Your Portfolio?

You may be comfortable with the buy-and-hold approach and feel you don’t have to pay attention because “it will eventually come back.” While historically that is true, and there is nothing wrong with buying and holding stocks, it certainly feels better to lose less than the market did. More importantly, some of the great bumps in wealth can come from the troughs of bear markets by taking advantage of some amazing deals from sellers willing to get out at any price.

If you don’t have any cash on the side, you could use margin to buy the market, but of course you never know where the bottom will eventually be and you are exposing yourself to additional risks. If you have cash on the sidelines you can just start buying a little bit here and there and wait for the return.

The Median Stock Dropped a Lot More Than The Index

The drawdown in 2020 led to some great deals in the market that were ripe for picking. Even though the S&P 500 index only lost about 30%, the median stock actually dropped 50%. Quality companies. Companies that will survive and eventually return to their old highs and beyond once the pandemic is long gone.

The divergence between the index and the median stock occurred because the mega cap stocks like Amazon, Apple, Google, and Facebook, which make up a big portion of the index, didn’t drop as much because the pandemic doesn’t really affect these businesses and can actually help them.

The reason why the smaller companies dropped so much more than the megacap stocks was because of forced liquidation. Lots of people in the market use leverage and short options to increase their returns. Of course this also increases their risk. When the market falls and the value of their accounts fall, so does their margin. Rapidly. They will either have to wire money into their accounts to maintain their positions or the broker will forcefully liquidate holdings. This indiscriminate selling causes retail traders to get out at any price… at the worst possible time.

In the spring of 2020, some of the best deals I had ever seen in less liquid Preferred Stocks, energy stocks and MLPs came about and I backed up the truck.

Final Thoughts

While buying-and-holding before and throughout the ordeal will get you back to even, buying in the trough can get you that extra 50-100% on those new purchases. You won’t get the exact bottom, of course, but you don’t have to. You just have to make sure that you don’t deploy all your cash at the same time. Buy a little bit here and there and aim for quality companies at a nice discount.

If you had 10% of your portfolio in cash that you deploy in the trough and those assets return 30% over the next year (frankly, I have seen some of the stocks I follow return 50-200% in a day after the panic selling ended), that is an extra 3% gain on your portfolio for the year. Over time, small percentage gains can amount to large sums of money through the power of compounding.

The time to raise cash is when the market is hitting record highs and the time to deploy cash is when it is hitting yearly lows, not the opposite which is what the average investor does.

Free Investing Tools

For advanced traders who want direct access to exchanges without “payment for order flow” shenanigans choose Interactive Brokers.

I use Axos Bank for its no-fee business account with free bill pay.