Closed-End Fund (CEF) Investing: 14 Criteria For Better Yield

Updated on February 7th, 2024

What are Closed-End Funds?

One of the many tools in the passive income investor’s toolkit is the Closed-End Fund (CEF). A closed-end fund is like an exchange traded fund (ETF) in that it trades throughout the day just like a stock, but there are some major differences with both advantages and disadvantages.

The money a closed-end fund manages is raised through an initial public offering (IPO) and the assets remains fixed, unless they offer more shares to the public through a secondary offering at a later date. This is in contrast to a typical ETF or mutual fund where a creation and redemption process adds new funds on a daily basis, which are then spread across the asset base proportionally according to the underlying stocks weights.

When you buy a closed-end fund, you are buying it from another participant in the marketplace; the price is determined purely through supply and demand. It gives rise to a unique feature of CEFs where they can trade at a premium or a discount to Net Asset Value (NAV), which is one of the features I discuss in more detail below.

There are many pros and cons, so before investing in closed-end funds you need to be aware of the specific CEF risks. This guide will help you with closed end fund research and give you criteria to choose the best closed end funds.

Why Buy a Closed-End Fund?

There are several reasons which make closed-end funds appealing.

Firstly, they often target niche areas of the market and they have no limit on the amount of illiquid securities that they can hold. This can provide you diversification and potentially alpha if the closed-end fund manager has skill since they are generally actively managed.

For example, PIMCO, a leading fund manager that has a lot of closed-end funds, scooped up thinly traded asset-backed securities shortly after the Great Financial Crisis (GFC) that were trading at a heavy discount to par value. Since market participants were willing to sell at prices far below fair value, after PIMCO gorged on these assets, their closed-end funds performed enormously well over the subsequent years when market volatility cooled down.

Another potentially appealing reason for closed-end funds is that they can employ advanced strategies using derivatives, often swaps and option strategies like covered call overwrites (which I am not a fan of). Of course, this can be a hindrance to the performance if the manager isn’t skilled at employing these strategies, but the structure allows them to expand the toolbox.

Probably the most appealing reason for passive income cash-flow investors like myself, is that closed-end funds almost always offer a high yield. This is what makes closed-end funds for retirement income very popular. They offer high yield through two avenues:

PRO-TIP: I rolled over a 401k into an IRA, and Capitalize‘s FREE service couldn’t have made it any easier to do. They work with all the major brokerages and handle the paperwork for you.

- Trading at a discount to Net Asset Value (NAV)

- Using leverage

Why Do Closed-End Funds Trade At a Discount?

The closed-end fund discount is one of the most appealing features of them, but it is not the only thing to consider! In “A Random Walk Down Wall Street,” Burton Malkiel dedicates an entire chapter to this unusual price anomaly. With some closed-end funds, you can buy a basket of assets at a 10-15% discount by buying them through a CEF instead of buying them directly in the market.

The theory is that the asset class is mispriced and the gap will eventually close and you’ll be able to capture that 10-15% in free money, since one could arbitrage a risk free profit by buying the fund and selling the underlying assets.

I recall reading about that concept in his book 20 years ago, but alas, the discounts are still widespread today and still haven’t closed. Why might this be, you ask?

Firstly, there is no mechanism for you to exchange your closed-end fund for your short sales to capture that arbitrage directly. You can’t just call up the fund and say, “I want to close my position in your fund, send me the stock certificates of my share of the holdings.”

Secondly, closed-end funds are less liquid than typical ETFs and have been bleeding assets for years. They typically each only have a few hundred million dollars of assets under management and don’t trade that many shares throughout the day. This lack of liquidity is a real cost when buying and selling assets, especially during times of market stress, and efficient markets practitioners like Malkiel would suggest that the closed-end fund discount is the true cost of the liquidity of getting in and out of these funds.

Thirdly, passive investing in SPY and other mutual funds or ETFs has really captured the investor attention. Not as many investors as in the past are chasing after closed-end funds and it has been drilled into investor’s heads that anything yielding over 4% is high risk.

Closed-End Fund Terminal Date Policy

There is no guarantee that a closed-end fund with a large discount will be squeezed back to NAV, therefore, you can’t just assume that the ones with the largest discount are going to be the best picks. In fact, during normal non-volatile times, a large discount is usually a prescient omen that the fund is going to lose a lot of value over the next year based on some points we hit on in a later section.

The only exception to this large discount rule is when a CEF has a scheduled termination date, or maturity date.

These are newer funds that have decided that on a specific date 5-10 years in the future, the fund will wrap up and sell everything to pay out owners, unless investors vote to extend the deadline.

Usually CEFs with these term dates don’t trade at big discounts because as the termination date approaches, any large discount becomes enticingly attractive and more buyers push the share price to NAV.

If the closed-end fund reaches its termination date and the fund still has a discount of 10%, for instance, it would be prudent for everyone in the fund to vote to close it so that they can capture that immediate extra 10% risk free return and then reinvest in something else or restart the fund.

The Z-score

The Z-score is a measure of the closed end fund discount or premium, relative to its own history and is more important than the absolute discount of a fund. If you compare two funds, one with a 20% discount and one with a 5% discount, you really can’t say which one is cheaper than average. The fund with the 20% discount might just be horribly managed and it loses 10% of NAV every year or might have a risky asset base.

That’s where the Z-score comes in, and it’s just like the normally distributed Z-score in statistics, computed as:

Z = (current discount – average discount) / standard deviation of the discount

Discounts and premiums do fluctuate with market conditions and it is helpful to know if it is trading at 1-2 standard deviations away from its average discount since they do have a tendency to revert to the mean.

Usually if the fund has a manager with a good reputation, and the assets they hold have a higher than average yield for the perceived risk profile. As mentioned before with the PIMCO closed-end funds, those assets they scooped up after the GFC are no longer seen as risky as they once were, and they have well above average cash flow yields. PIMCO also has a good reputation. Most of their funds trade at premiums.

Are Closed End Funds a Good Investment?

They can be if chosen properly utilizing the criteria in this guide but the majority of CEFs are rather bad investments for the following reasons:

High Fees

Since closed-end funds are usually small niche funds, they generally have a much higher management fee than you will find in ETFs. Often the fees range from 1%-3% of net assets. Compared to SPY’s expense ratio of 0.09%, you are paying a lot for the active management.

Now, having a high management fee doesn’t automatically mean it is a poor investment. If the strategy is good, management is skilled, and the leverage is kept within safe risk tolerances, it can be worth paying for it. But just understand that the high management fee is a big hurdle that they have to overcome to make it worthwhile.

Return of Capital (ROC)

Why don’t closed-end funds buy back their own shares since it would be immediately accretive to the fund if it were trading at a discount?

Because most closed-end funds pay out more income than the fund is generating internally. This income gap is what makes a majority of closed-end funds poor investments.

There are some “interval funds” that buy back CEF shares from shareholders on a semi-regular basis but they aren’t listed on exchanges and they are usually credit funds that have maturing securities inside them.

Investors prefer stability of income and therefore most CEF managers set a managed distribution policy where it pays the same dividend, usually monthly, regardless of how much income the fund actually makes. They cover the distribution through a combination of income, capital gains, and return of capital.

The return of capital concept is very important when buying closed-end funds and those that have a lot of it should generally be avoided because if the CEF is paying out more than their assets are generating, you are being paid back with your own money, after a management fee is first applied, of course. The value of the fund will continue to decline each year leading to a capital loss upon its eventual sale.

It might appear that you are getting a 10% yield, but if the CEF only generated 5% in income and capital gains, the extra 5% has to come from the assets in the fund. If a fund has a very large discount and the market is not currently experiencing stress, you need to tread carefully and figure out why. It’s probably a return of capital issue.

The CEF May Invest in an Unattractive Area

The CEF might focus on an area of the market that is not trendy or attractive. In 2020, energy stocks and funds have lost a lot of money and investors, naturally leading to depressed closed-end fund prices for those funds that invest in this sector.

The CEF May Employ an Expensive Strategy

If the closed-end fund trades frequently and has a lot of short term capital gains that will be passed down to the fund owners, this tax liability will be unattractive to many owners, especially for owners with a high marginal tax rate. They will sell out of the fund, which puts downward pressure on the CEF share price.

The CEF May Routinely Have Secondary Offerings

CEFs have secondary offerings for a number of reasons:

- They want to pump up their NAV for extra fees.

- They have had so much NAV destruction that the fund is no longer profitable to run, so they need to bring in assets.

- The fund managers see an opportunity that they would like to capitalize on with fresh capital.

- The fund is trading at a large premium to NAV

Only the last two are good reasons.

Secondary offerings are usually the kiss of death for any asset because they are raising additional capital and to do that they have to offer the new investors a discount to the current trading price. If the fund is already discounted, the new investor gets a discount upon a discount.

You might think that it is good that new investors are confident to buy in, but Mr. Whale is actually earning himself a risk-free profit by first taking out a short position on the same day that he is acquiring these new fund shares. This puts downward pressure on the CEF.

And you have to remember that offerings at a discount are dilutive for existing owners. More investors are dividing up the pie and they paid less than the assets are worth to get theirs.

Conversely, it is accretive to the fund to have a secondary offering when it is trading at a premium, but this is also why premiums are less common – fund managers routinely capitalize on the demand.

Closed-End Funds Need to be Carefully Chosen

There is a little bit of an art to the selection process and a lot of details need to be considered.

You can’t just pick the highest yields and largest discounts without examining what the distributions consist of and how much capital is returned every year. If you do, you’ll likely just pick a CEF that has a ton of ROC and eventually you’ll be stuck with a big capital loss. While the ROC reduces your cost basis, much of the decline will come from investors throwing in the towel. You don’t want to save your long term tax preferred rates for losses.

There is actually a fund that uses this as its strategy, YieldShare’s YYY and its performance has been pretty horrendous. See for yourself:

The red line is YYY, the blue line is the S&P 500 while the green line is another CEF fund (FOF).

Stock Based Closed-End Funds

I generally prefer bond or preferred stock closed-end funds because the funds have a tendency to only pay out income and bonds drift towards par as they get closer to maturity. The best high yield closed end funds are all going to be levered fixed income or consist of high yield assets that pay out most of their income, like REITs.

Stock CEFs have to rely on capital gains to make up their distributions since the dividend yield on the stocks they hold seldom average more than 2%. During a market draw-down, the stock based funds have a tendency to have their capital permanently impaired since to maintain their distribution, they have to start selling assets with capital losses. Unless they drop their distribution, which funds are loathe to do, the NAV will start spiraling downwards and losing value.

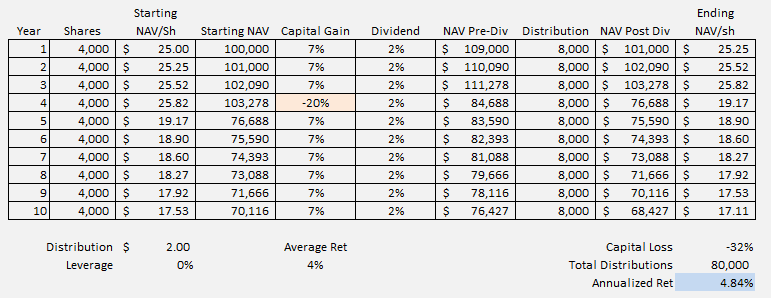

I can illustrate with a very simple example. Ignoring premiums/discounts and compounding, say you have a stock based fund that earns 7% capital gains and 2% dividends (=9%) consistently. Their policy is to be conservative and pay out only 8% per year without leverage, leaving 1% in the fund.

In the 4th year, a pandemic hits and their super stable stocks lose 20% that year, but after that, they return to their 7% yearly gain and 2% dividend. If you look at the table below, once the market drawdown occurs, the share NAV starts spiraling down, leading to a capital loss upon sale of the investment. Less money is available for the rebound because capital is paid out during a down period. On paper, you were still earning your 8% a year on the original investment but once you sell, you’d incur a capital loss which brings your annualized return down from 8% to 4.8%.

Once the capital is impaired on a single drawdown, unless the fund immediately reduces its distribution, it will continue to lose NAV because the distribution becomes oversized relative to it. We had two 20%+ drawdowns in 2018 and 2020 and the vast majority of stock based CEFs didn’t recover to old highs as a result even though the S&P500 hit a record high in Feb 2024.

You will also notice that most stock based funds gradually reduce their dividends every few years as the fund continues to lose NAV and the distribution becomes unsustainable.

Bond and preferred share closed-end funds usually just invest in high yield assets and don’t have to sell capital to pay the distribution and there is a better chance of the asset going back to par if they hold to maturity.

What is the Undistributed Net Investment Income (UNII)

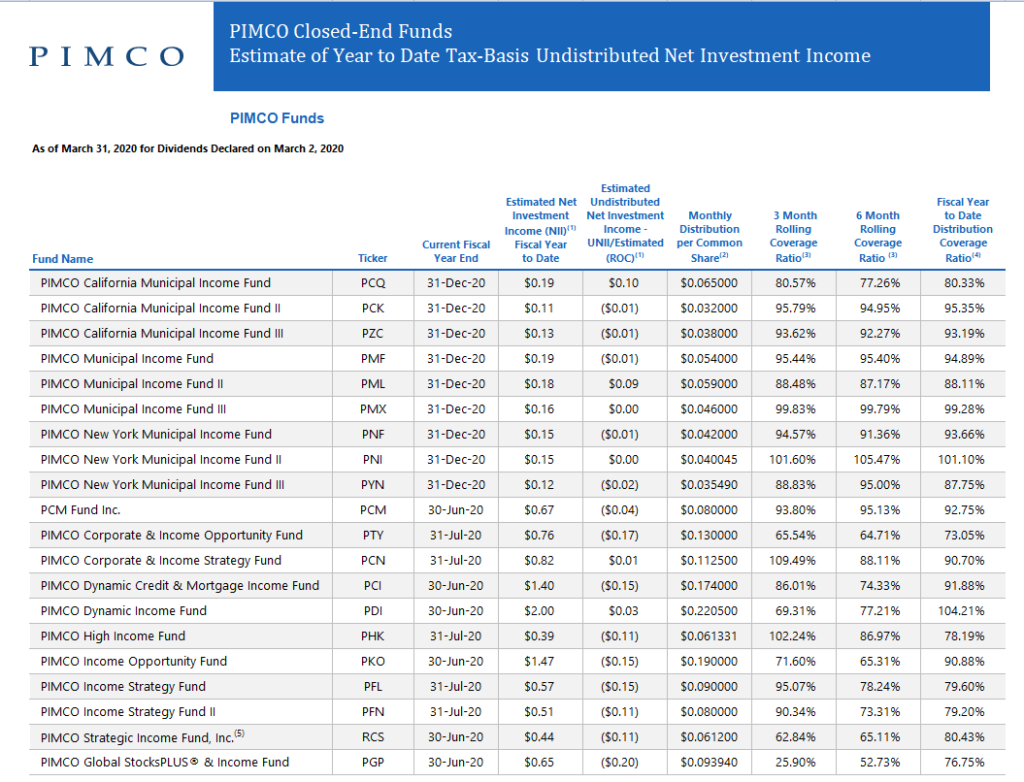

By far the most critical factor when choosing a CEF is that the Undistributed Net Investment Income (UNII) is positive. What this number signifies is that their distribution has been less than the income that their assets have been generating. Preferably you will want the fund to have several months worth of distributions in reserve. A negative UNII means they have been paying the distribution from other sources such as ROC or capital gains and the dividend is at risk of a cut.

UNII is a look-back number; in the past they may have generated a large one time NII windfall. The preferable scenario is that the closed-end fund is adding to UNII incrementally every month or quarter. UNII will continue to grow each period if the coverage ratio of net investment income to distribution is greater than one. This is a current rate of change number.

If the UNII becomes large enough, the CEF will usually pay a bonus distribution at the end of the year, which juices the yield, responsibly.

Some of the screeners I discuss below provide this information right on the screen itself, but often this information is out-of-date. You really should check the semi-annual report on the SEC.gov website.

Other fund families, such as PIMCO, provide a report for all of their funds every month in a nice excel file.

I know I have mentioned PIMCO multiple times in this article. I am not being paid to mention them or anything like that. It is just my opinion that they offer some of the best high yield closed-end funds. I have invested in several of their funds over the years and currently own PAXS and PDO (not listed on the table below) and I appreciate how they make their UNII report so transparent. I wish every fund family would do it this way.

Closed-End Fund Selection Criteria

We finally arrive at the pièce de résistance. Consider these points before making a purchase:

- Coverage ratio of net investment income / distribution > 1

- UNII is positive and preferably has several months worth of distributions in reserve.

- There is no, or minimal, return of capital (if #1 and #2 are met, there shouldn’t be)

- Avoid funds with negative returns on NAV over many years.

- CEF Connect (discussed below), and other tools have NAV plots since inception where you can easily see if its valuation declines every year.

- If a fund’s asset base is consistently declining, it becomes harder to generate the fund’s yield and the current yield will be artificially inflated with pressure to cut it.

- A chart is the easiest way to see this quickly.

- Use the Z-score to determine how relative the discount or premium is to its own history. Extreme values generally revert to the mean.

- Stick to distribution type of ‘Income Only’ and not managed distribution funds that make it a policy to purposely distribute return of capital every year.

- If you are a late stage retiree, you might be okay with a managed policy.

- Generally speaking, stick to bond and muni funds that don’t have to rely on capital gain distributions to meet their yield.

- You can make exceptions if their distribution is responsible or the manager has shown selection skill. Use judgment.

- Stick to broad categories and not niche funds, unless you have some good reason to believe that a niche sector will outperform.

- Know what the underlying holdings are. Each fund provides a semi-annual report that you can access on either SEC.gov or their website. If it is loaded to the gills with a bunch of risky shale drilling type stocks, decide if the yield and discount is worth the risk.

- Don’t choose funds with extreme leverage.

- Remember, too much leverage amps up returns and yields, but also multiplies the effect on the downside.

- As a guideline, it starts to get dicey when a fund is using more than 30% leverage.

- Don’t get too aggressive with yield seeking.

- 7-8% is probably sustainable depending on the fund specifics.

- 12% likely isn’t.

- Make a judgment call if the yield is worth the leverage.

- Levered 40% and only yielding 5%? Might be okay if the underlying assets are safe, low yield munis.

- Check Morningstar.com and look at the risk characteristics.

- What’s its best fit index?

- Does it have positive alpha to that index?

- How does its downside and upside capture ratio look like?

- Is the Sharpe ratio higher than the reference index?

- Does it have a termination date coming up with a big fat discount that you’ll be able to capture?

Notice that none of the qualifications is that the fund has a large discount, unless it has a termination date on the horizon that can juice the return. There are funds worth buying that have a premium, which is often why they have a premium in the first place.

CEF Screener Examples

My favorite CEF fund screener, CEF Connect, is run by Nuveen, who are big players in the closed-end fund world.

Another one I like is CEF Analyzer. They have different ways of displaying the data, like heat maps and have direct links to the portfolio holdings held on the SEC website.

Both are free to use.

It’s a little bit of an art to use CEF fund screeners. Sometimes if you set the criteria too strict, you will exclude a fund that you might have otherwise considered. Play around with the settings to get a feel for it and look for the funds that keep coming up in the list for further review.

Again, don’t blindly buy a fund that pops up on a screener, dig in further to make sure it passes the qualifications above.

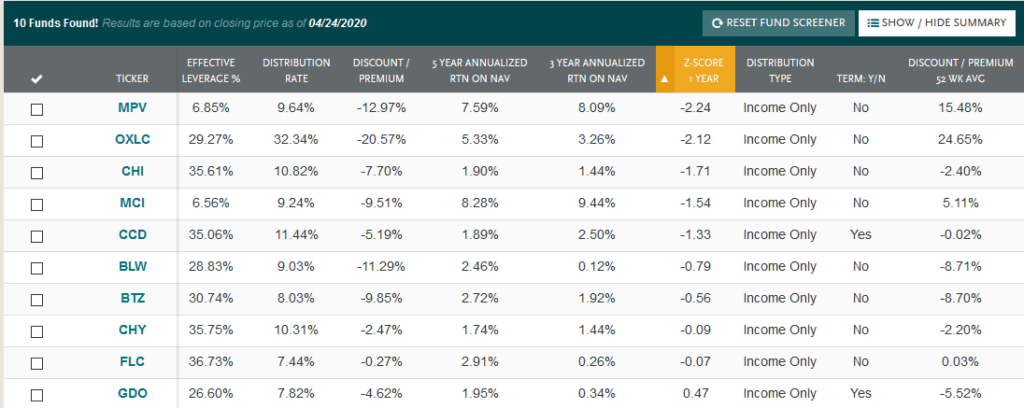

So for instance, my screener might look like this after selecting CEFs with positive NAV returns, at an above average discount, income only and yields greater than 7%. Consequently, I have owned 4 out of the 10 names that popped up on this list over the last couple of years, but as of this writing I don’t own any of them.

When you run the screener at different times of the year, different funds will pop up based on their relative Z-scores, and how the fund has been doing as of late.

Remember though, screeners don’t guarantee quality from your settings, so don’t treat them as closed end fund recommendations. Case in point is the biggest outlier on the list, OXLC. It has a distribution rate of 32%… gee, you think that is sustainable?

Even though the NAV returns have been positive according to the screener, the fund has been paying out fund capital to meet its massive distribution as shown by its non-total return chart. That fund would require a 32% annual return just for the assets to stay flat after paying out its distribution. Since inception the fund has lost 66% of its capital, not including distributions, but its total return chart including distributions isn’t so great either.

One final point I should mention that I didn’t address anywhere else is:

How are Closed-End Fund Dividends Taxed?

The tax treatment really depends on the mix of the assets in the portfolio and the closed-end funds’s distribution policy. For most funds, it will be a mix between ordinary income, capital gains and return of capital. You will receive a 1099 at the end of the year and it will have the breakdown.

Summary

Overall closed-end funds can be great investments to add to your passive income generating portfolio if you perform the proper analysis before adding them. The space is awash with bad CEFs though, so you have to be really critical in your selections. When you follow the criteria laid out in this guide it will help you find the safest closed-end funds that yield reasonable levels without return of capital.

Don’t buy into any closed end fund recommendations that you may have come across on the web unless you have delved down into its Z-score, discount/premium, payout structure, return of capital and what it invests in.

If you find closed-end funds that have more net investment income than they distribute, don’t lose NAV every year, don’t get too crazy with the leverage, have had a consistent conservative dividend policy since inception, and you use the Z-score to time your buys and sells, you’ll increase your chances of doing well with your selections.

It’s always a smart idea regardless of investment to take a gander at the SEC filings just in case you come across anything suspect. Also, with closed-end funds, the fund manager will write some commentary in the beginning of their semi-annual reports and what they expect for the fund in the future which can be insightful.

Free Investing Tools

- Have Capitalize handle the paperwork for your 401K rollover to any brokerage, for FREE!

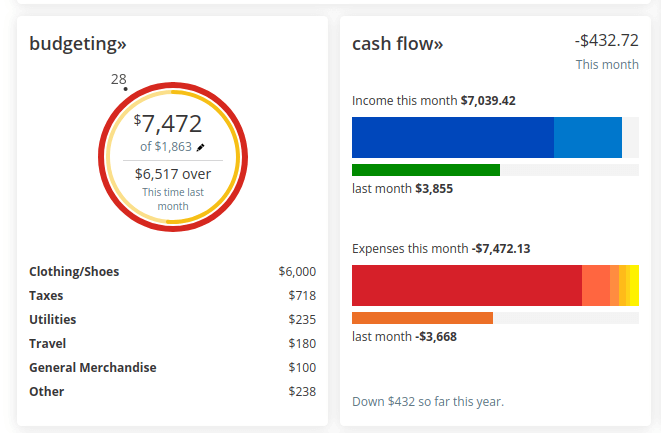

- Where does your money go each month? Track all your accounts and see if you are on track to retirement with Empower, for FREE! I use it myself to monitor my mom’s accounts to make sure she isn’t falling for scams or being defrauded.