Unpopular Truth of the 4% Rule for Retiring Early in 2025

Updated on January 9th, 2025

How Far Does $1 Million Go In Early Retirement ?

Frankly, it depends on how early your retirement is. Are you going to have a 20 year runway, or are you retiring at 40 and might face 50 more years of life?

Encounter enough FIRE (financial independence retire early) blogs and the standard barometer to retire early is $1 million, at age 35. This is justified with the oft cited 4% rule, which we will be picking apart down below.

Before we even get to that, ask yourself how one could live comfortably for 40-50 years, while fighting inflation and having protection against many adverse financial events that will inevitably occur over the long term? They are planning on being retired longer than they have even been alive.

Perhaps the millennial FIRE movement just thinks they can go back to work if it doesn’t work out (someone I know said this, which might be true for some industries but most employers look down on 10 year resume gaps).

Not to mention, you can’t really count on social security later in life to cover any shortfall since social security benefits are based on your top 35 earning years. If you spend most of those 35 years retired, then your social security benefits aren’t going to amount to much.

I’m not saying that you must wait until full retirement age, but be realistic.

Unless there are some extra income streams coming down the pipeline or an inheritance, the standard threshold of $1 million just isn’t going to cut it for the millennial retire early crowd and they are likely to run out of money at the worst possible time: their skills are out-of-date and they are old (mental and physical disadvantages).

They are either hoping for the best or fooling themselves, which is dangerous either way.

Why Is $1 Million the Barometer? The 4% ‘Rule’

I’ve read many times over that the best way to retire early is to put together $1 million in retirement savings and then apply the ‘4% rule.’

PRO-TIP: I rolled over a 401k into an IRA, and Capitalize‘s FREE service couldn’t have made it any easier to do. They work with all the major brokerages and handle the paperwork for you.

The 4% rule from the 1998 Trinity Study, said that you withdraw 4% of your retirement account balance and then increase that amount by inflation every year afterward. The conclusion was basically that a 50/50 portfolio had a 95% chance of lasting 30 years. Thirty years was the longest period reported since financial planners just assumed that the maximum age people would be living until was 90.

With the 4% rule, you are spending a combination of portfolio earnings and the principle. This is okay for a retiree nearing the end of the road, but less okay for someone who has an additional 20 years of kicking back.

Naturally, to make the portfolio last longer than 30 years, you would need to out-earn inflation and your withdrawal rate. In the USA, since the rate of inflation is 8.6% (June 2022), but the longer term targets are around 2%. This requires an average return of about 6% to maintain living standards. At first blush, this doesn’t sound unreasonable until we start digging in to assumptions.

The first of which is what is your portfolio allocation in early retirement to earn that 6%? Are you going to gamble on 100% stocks? Risky. But that is probably what you would need if you were going to retire at age 40, because how else are you going to get an average 6%+ returns from a 60/40 stock/bond portfolio for the next 40 years?

The 4% ‘Rule’ Certainly Does Not Apply Today

The biggest problem with this study was the time it was published and the data they used was from the 1926-1995 US historical return period. Stocks had just completed a massive 14 year bull run, and the post war period was exceptionally fruitful.

Just because something worked in the past, it certainly doesn’t mean that it will work in the future.

Think about it, treasuries alone were yielding 15% in the 80s and 6% in the nineties. You could have had a 100% portfolio of bonds and just lived off the interest alone. The 50/50 stock bond portfolio’s expected average portfolio return was around 7.5% and it would have been pretty stable from that hefty bond allocation. It was all too easy.

Contrast that to today, in Jan 2024, where the ten year treasury is yielding 4% and it was yielding 0.6% in 2020. It’s barely keeping up with official inflation, but the dollar has lost 25% of its value since 2021.

The study would have also failed for the returns data outside of the US where returns have been lower historically. Emerging markets and international stocks have basically returned nothing in the last ten years alone. It wasn’t a great time for an early international retiree.

Furthermore, the forward P/E of the S&P 500 was pushing 19 up until Feb 2020. Schwab forecasted a 6.3% return on stocks over the next decade at the time.

It seems pretty clear that the portfolio return over the next 20 years will be much less than it was in the past up until the late nineties.

You can read the 2013 paper titled “The 4 Percent Rule is Not Safe in a Low Yield World” published in the Journal of Financial Planning if you would like a deeper criticism.

How to Retire Early With $1 Million

How could a stubborn FIRE adherent still retire early with one million dollars? The only solution would be to plan on reducing the distribution from the portfolio.

It’s a foregone conclusion that it needs to be less, but what 2-3%? Does living off of $20,000-$30,000 a year for the next 50 years sound like an awesome time? Not to me. I’d rather just work for another 10 years, making much more than that and enjoying the ride along the way while continuing to save and invest in my portfolio.

I actually recall reading a FIRE blog years ago where the family retired off of $300,000 and used government benefits to make up the rest. C’mon, that’s not retirement! It’s also pretty dishonorable to plan on gaming the system as part of a “retirement plan.”

Foreign Country Retirement Plan

While it is true that if your plan is to live in a cheaper foreign country, your monthly expense will be dramatically lower and you could probably swing a $1 million retirement for a lot longer (I have a friend who is living in Asia with less than a million doing this).

But eventually every country catches up on industrialization and you’ll find yourself continually moving farther away from urban centers and expensive areas until the world has few desirable cheap places to live. Then what is the plan?

And do you really want to be forced to ‘retire’ to a cheaper country just to make the numbers work anyway? Sounds like exile, not retirement.

If you have real assets like rental property, or pipelines that will grow with the rate of inflation in those countries, while still throwing off income that you can live off of, you’ll be able to sustain the lifestyle for longer.

Market Drawdowns

An important lesson of the last twenty years is that 50% drawdowns happen more often than people realize. Market drawdowns during the accumulation stage of a portfolio are great times to acquire additional equity at a discount, but they are disastrous during the withdrawal stage.

On average, these big market drawdowns take 5 years to get back up to the high water mark. It’s important to have a margin of safety to be able to weather such events that you’ll certainly encounter in the next 40-50 years. If you are forced to spend everything your portfolio produces just to live, and you are taking withdrawals during a market correction, you are going to accelerate the decline of your portfolio and years will be ticked off the sustainability.

How Much Is Enough For Financial Independence?

Obviously more is better and each person’s lifestyle will dictate what they are comfortable with and how they define financial independence. Personal finance is well, personal. And also obviously age is a big factor.

A 60 year old might still be able to live comfortably for their remaining retirement on $1 million, especially with social security or any pension coming around the corner, but there’s no way a 35 year old is going to make it. A millennial needs to pump up their saving and investing dramatically before they take that plunge.

Personally, I wouldn’t feel comfortable ‘retiring’ from my desk job until I had at least $2 million in assets. Why two million? Well firstly, I don’t want to live on the edge of poverty on $20-30,000 a year for the rest of my life. At least with 2x the assets, there is twice as much income to generate and enjoy.

More importantly, with two million, you can have extra income that you don’t need to spend, and instead reinvest it for growth, or keep it in cash to use when the market corrects instead of selling equity.

With two million, there is a margin of safety in the event of a large healthcare expense. There is a margin of safety in case one lives too long. There is a margin of safety if future inflation is much higher than it is currently.

Basically it ups the odds of success, but a lot of it depends on what your portfolio is made up of and how much cashflow it generates.

Income Is More Important Than the Size of the Pile

Which brings me to my main point, that ultimately it’s less about the size of the pile that you have and more about the income stream that you can generate from it without taking unnecessary risk. Sometimes it is just about acquiring good assets at a good time that now have a very unusually high yield, such as real estate acquired at fire sale prices in 2009.

Having $2,000,000 in a bank account yielding 1% won’t get you very far, but if you have some awesome real estate investments that you bought years ago and are now yielding 20%, now we’re talking!

Whether you have money on the sidelines or are willing to use leverage to acquire cheap assets when the deal of the decade comes along goes a long way in determining how financially independent you’ll become.

$2 Million and 5% Yield is Conservative

It’s not too hard to earn a nominal 5% a year passively without taking on a lot of risk, especially as interest rates started to climb in the middle of 2022. I’ve always been a fan of regular dividend stocks, preferred stocks, and closed end funds to bring cash flow to my portfolio. And now with interest rates on the rise, there are bonds and bond funds starting to become attractive.

A two million dollar portfolio paying $100,000 in pre-tax income is realistic and quite livable in most countries (but not expensive metro areas)

Of course you’ll have to consider the allocation to your taxable and non-taxable retirement accounts since some of your money will be locked up until you are 65-67. It doesn’t help you much if you are earning $100,000 inside of a retirement account that you can’t access for another 20 years. On that point, I generally prefer the Traditional IRA over the Roth, but with the Roth you can pull out principal early, so it is something to consider.

You can legally start withdrawing from your 401(k) when you hit age 55 from your current employer’s retirement plan if you stop working. This is known as the Rule of 55 and it can definitely help with your “classic” early retirement plan.

Come join the telegram chatroom for some more investing discussion.

Free Investing Tools

- Have Capitalize handle the paperwork for your 401K rollover to any brokerage, for FREE!

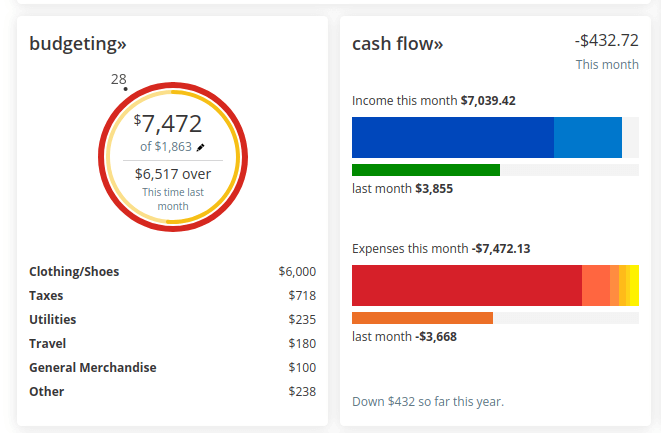

- Where does your money go each month? Track all your accounts and see if you are on track to retirement with Empower, for FREE! I use it myself to monitor my mom’s accounts to make sure she isn’t falling for scams or being defrauded.