Why I Bought an Aston Martin But Still Plan to Retire Early

Updated on February 8th, 2022

My Oldest Dream

Ever since I was a boy I have had an interest in exotic sports cars (supercars). Ferrari’s, Lamborghini’s, Aston Martin’s, you name it.

I don’t know where the interest originated from but it was probably from the movies. James Bond, anyone? Not actually a practical car for a spy, but definitely more exciting than driving a Honda Civic around while fighting bad guys.

And what boy from my generation didn’t have the Lamborghini Countach poster up on the wall?

Then there was Top Gear airing for 2 decades (now The Grand Tour), and when I was in my teens and twenties, I lived in a glitzy city where lots of money was sloshing around during the property bubble and saw plenty of supercars driving around everywhere.

When I would pull behind one at a stoplight, I would wonder what that person’s life was like. Everything must be perfect and his life was amazing, right? It had to be.

Exotic cars inspired dreams.

In some ways, the exotic car was one of the carrots and part of my motivation to succeed. It’s a symbol of success and having “made it” in life, and I wanted that.

I know a lot of people just see cars as cars, probably the way I see handbags as handbags, but only those who desire such possessions can understand the desire.

In particular, I see Aston Martins the same way that people see art. Beauty.

During my travels, even I photographed supercars the same way people might photograph art at a museum:

I’m Not Actually a ‘Thing’ Person

Pretty much this type of car is really the only “thing” I’ve ever really wanted, maybe because they seem so unattainable and glamorous.

I buy stuff for utility and hang onto it for as long as it lasts. I still have gym shirts from 15 years ago and the computer I type this article on is 9 years old, has a broken bracket and a blown speaker. It gets the job done.

I’ve never paid for a smartphone, never have had a data plan and wasn’t even excited when my brother offered to give me my first smartphone as a hand-me-down back in 2012 or so. It wasn’t about the money, I just didn’t see the point. Obviously today’s modern life revolves around the smartphone so I do think it would be hard to give it up now, but not a lot of “stuff” excites me. I’ve learned to live with less.

Prior to the pandemic, my biggest expense other than taxation, was traveling. I’ve always valued the experience of international travel, cuisine and people and since 2012, I have been to 41 countries. But because I haven’t been outside the country in over a year now, I have more cash than usual piling up itching for an outlet of enjoyment.

After being holed up in my home for over a year with Zoom meetings being the extent of most of my human interaction, I’ve found that having an exotic car is a surprisingly social activity with car clubs, fellow enthusiasts, and random strangers chatting you up almost every time you aren’t moving.

I’ve Always Been a Saver

Getting comfortable with the idea of spending this much on a car was not easy for me since I have always been a saver. In fact, there were times when I was convinced that I would never pull the trigger because the amount of money would be too great to spend and the thought of losing the investment income and exchanging it for depreciation wouldn’t be worth the tradeoff.

The thing is, for the ten years after finishing college I lived exceptionally well below my means and saved and invested enough to become a self-made millionaire a couple of years ago. I lived in a 320 sq-ft apartment for several years, and my first condo purchase was a 400 sq-ft studio, in my thirties. I’ve since upgraded, but before doing it, I had never purchased a TV, cable, hung anything on my walls, and basically lived a pretty Spartan life.

In my whole life prior, I had only spent $30,000 buying 3 different cars since turning 16. $30,000 is like the typical new car price today.

Retiring Early is a Longer Term Goal

I too want to retire early. No doubt, spending this much on a car is a step in the opposite direction, I get that. In fact, it’s complete sacrilege in the world of personal finance bloggers. Hell, you aren’t even supposed to ever buy lattes.

While discussing the quandary of retiring early and enjoying life today, this was advice from a fellow traveler and car enthusiast I met on my last trip and kept in contact with; it’s a good philosophy:

Live one dream at a time and just enjoy.

Mark Cilani

I won’t reach my retirement goal for another 5-10 years. Of course, I’ll lose a chunk of change when I go to sell the car some years from now, but when you stick to the rule that you don’t spend more than 10-15% of your wealth on any luxury purchase, then amount lost won’t materially change the timeline.

However it does add a lot of enjoyment during that timeline. Every time I go for a drive, it’s a wonderful experience from the smell of the leather, the $8,000 sound system, the acceleration pushing me into the seat and the sound of the engine. My brother, also a car enthusiast, uses the rating of “smiles per miles.”

Does early retirement have to mean retiring at age 35 in the land of FIRE? The earlier you retire, the greater the amount of assets you need to squirrel away instead of enjoying. Age 45, or maybe even 50, is still quite early in the realm of early retirement where the typical age for my cohort will be 67+.

I know some bloggers out there claim they’ve retired at age 35 with $1 million in investments, but don’t let them fool you, in reality, they have just transitioned to being bloggers and authors. Running a blog is work and the ones that get enough exposure to have articles written about them generally make thousands per month doing it. It’s click-bait – don’t let them kid you otherwise.

What’s the point of being a millionaire if you forever live off of $30,000 per year?

I’ve lived like a pauper for most of my life, and my thinking was maybe I will get a taste of some good old fashioned lifestyle inflation for a few years and work a little bit longer; it’s a fair tradeoff. Aside from my Aston Martin, I still live pretty lean.

So while I would like to leave the rat race early too, there’s the ride along the way that must also be considered (pardon the pun).

The Worst Outcome

You save and invest and do everything “right” for your entire life, but then die early or never enjoy any of your hard work.

How many times have you read about the unassuming janitor that lived in squalor but was actually a diligent investor and bought blue chip stocks for 50 years and amassed $10 million in wealth by the time he died? His children make out like bandits, but you have to wonder if he had any unfulfilled dreams that he wish he would have checked off the list on his last day.

I came to the realization that if I don’t do it now, when would I ever do it?

PRO-TIP: I rolled over a 401k into an IRA, and Capitalize‘s FREE service couldn’t have made it any easier to do. They work with all the major brokerages and handle the paperwork for you.

Now seems like as good a time as ever:

Market’s Excessive Valuation

I previously wrote about the stock market’s excessive valuation and bubble signs, so this seemed like the perfect time to take some risk off of the table. Having experienced both the tech bubble and the housing bubble and remaining 100% invested throughout both ordeals was not fun. You can only fully appreciate the mental anxiety that comes with watching your net worth drop in half or more when you’ve experienced it. “I could have spent the money I lost on X,” is a common thought.

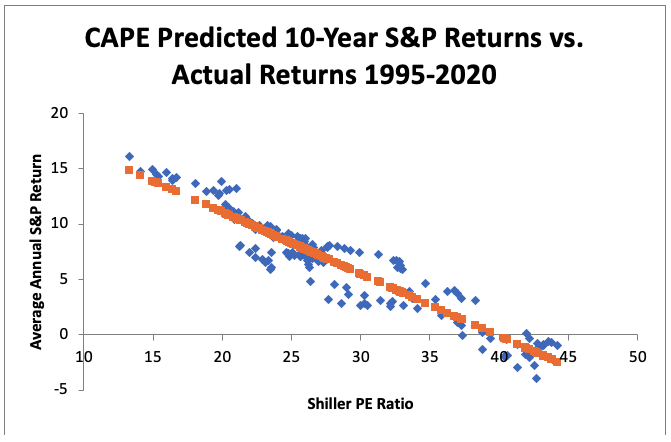

I strongly believe that the stock market has pulled future returns forward and the next 5 or so years will be a dud, if not negative. Look at the regression of the CAPE ratio against the future 10 year market returns. Things look pretty bleak since we are at 35+ now.

Safety does not come in numbers with the stock market. The worst time to buy in is when everyone else already has. I will skip the Warren Buffet platitude about greed since you’ve already read it a million times, but he’s not wrong.

The market could double from here, who knows? But Fear Of Missing Out (FOMO) is what causes people to throw caution to the wind and take on too much risk. I can feel content missing out on some upside and having a new source of enjoyment that’s bought and paid for in the meantime.

Free Investing Tools

- Have Capitalize handle the paperwork for your 401K rollover to any brokerage, for FREE!

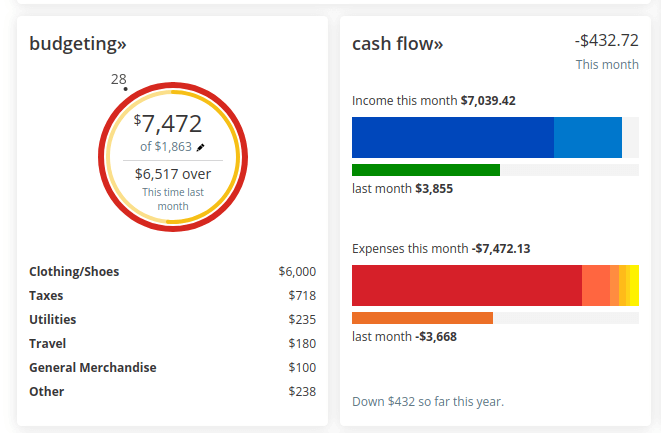

- Where does your money go each month? Track all your accounts and see if you are on track to retirement with Empower, for FREE! I use it myself to monitor my mom’s accounts to make sure she isn’t falling for scams or being defrauded.