Best Hedges Against Inflation Revealed 2025

Updated on February 3rd, 2025

In this article we first take a step back and describe what inflation is, what causes it, and why government statistics deliberately understate it. We discuss what are the positive and negative effects of inflation and who wins and who loses from it. We next discuss how as an investor you can hedge inflation and profit from increases in price.

What Is The Meaning Of Inflation And Why Is Inflation Important?

The definition of inflation is that money you have today loses value over time. It’s a hidden cost because it happens silently without an announcement, prices go up, and the amount of money in your bank account hasn’t changed. It’s effectively a hidden tax that silently whittles your dollars away.

The effects of inflation are subtle and generally only noticeable over years. But it’s a real problem because when enough time passes, you can lose tremendous amounts of purchasing power. It takes twice as much money to buy the same goods as it did in 1990, for instance. This is why it is important to invest your money into assets that will provide a real, after-tax return instead of putting your money under your mattress.

Inflation Has Been High During The 2021-2024 Period

Anecdotally, I’ve been seeing it everywhere from restaurants to smaller packages of goods. Product producers can be equally sneaky in hiding inflation. Instead of giving you 15 ounces of product, they redesign the container to be 14 ounces. Then next year it becomes 13 ounces. Remember when cans of Tuna were 7 ounces? What are they now, 3? This stealth inflation phenomenon is known as Shrinkflation.

But it’s not just me. Producers are reporting excessive price pressure. Warren Buffet reported that his companies are seeing substantial inflation and raising downstream product prices accordingly.

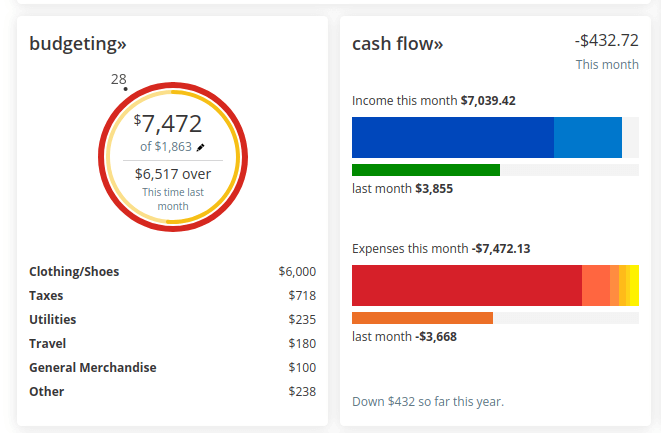

Mentions of inflation during earnings calls was breaking records:

The underlying cost of commodities and transportation has soared.

Crop prices are rallying. Steel prices are rallying. Lumber prices are breaking records. Used car prices are skyrocketing (use incognito mode for that link).

It is not an easy endeavor to create more supply. It takes years to create new mines, harvest trees for lumber or build ships to transport goods.

“Transitory”

The Federal Reserve made multiple statements that inflation was “transitory” in 2021 and that completely fell flat on its face.

Additionally, actual inflation against purchasing power is permanent, not “transitory.” I don’t feel better that my purchasing power lost 7% over the last year, because next year it will only lose another 3%. It’s still a cumulative 10% loss over 2 years! Is anyone getting 5% yearly raises to make up for it?

It’s probably helpful to take a step back and discuss how inflation comes about in both the short term with supply and demand shocks and in the long term with monetary policy.

What Causes Inflation?

The economy is complex and many events can affect pricing in the short term, but we start with the simple reason that everyone can understand for the value of money. Money printed out of thin air:

If you print twice as much money and distribute it into the economy evenly across sectors, twice as much money will be chasing the same goods, forcing prices to rise to twice as much.

Similarly, you could rebase every dollar in existence with an extra zero on the end; people won’t be 10x richer, prices will just adjust 10x.

Monetary Policy Drives Inflation

Monetary policy spans a lot of tactics, but the most straightforward one is the amount of dollars in existence.

In what follows is a condensed explanation but if you would like to read a deep dive on quantitative easing and banking monetary expansion and how it pertains to inflation, read this article.

The Money Supply

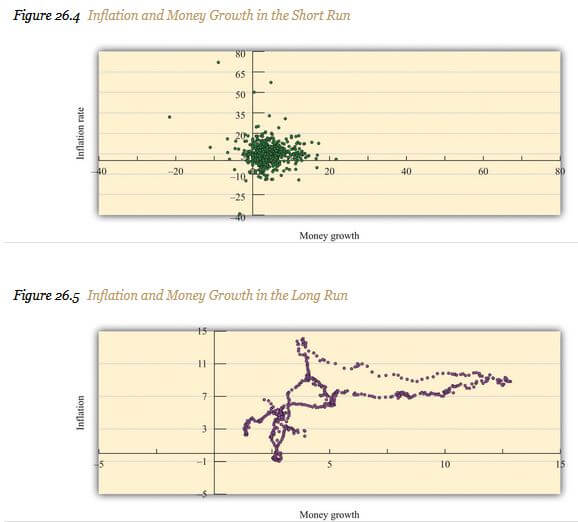

Nobel laureate Milton Friedman once wrote that “Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.” He wrote those words in 1963, but it is clear he meant long-term inflation since supply and demand shocks have always been known to affect prices in the short term.

In other words, long-term inflation is always a monetary policy decision determined by the government, or in this case, the Federal Reserve in the United States.

Short-term inflation is caused by supply and demand shocks, but mean reverts over time based on markets forcing an equilibrium.

We can show this with data.

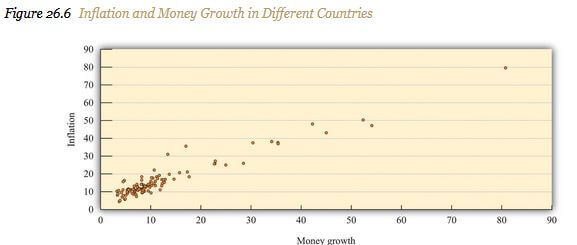

And across multiple countries.

Governments always have an incentive to squeeze a little bit more out of their money supply because each extra bit squeezed out is money that can be deployed. In the olden days, when money consisted of precious metals, governments would reduce the size of the coin or start mixing the metal with a worthless clad alloy but keep the declared value the same.

Today, paper and digital currency are just numbers being created and moved around without any underlying backing it.

There are many ways to define the money supply (from just the paper currency to what is also in people’s checking accounts and more), but as we become more of a cashless society, the digital dollars become more important than just the physical dollar bills and coins out in the world (I rarely pay with physical currency, for instance).

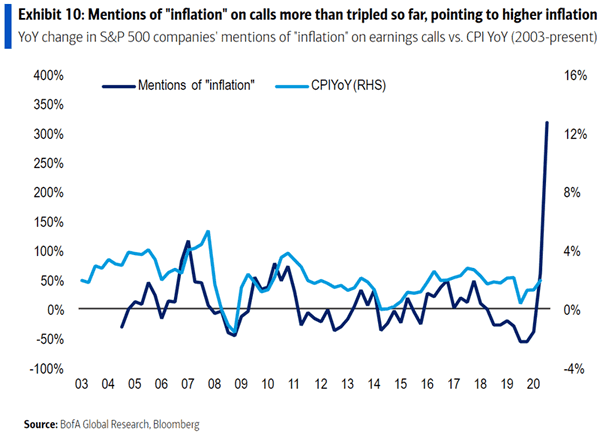

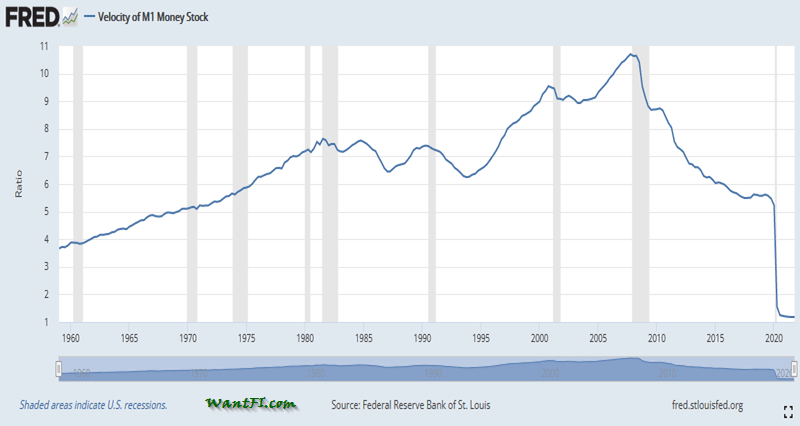

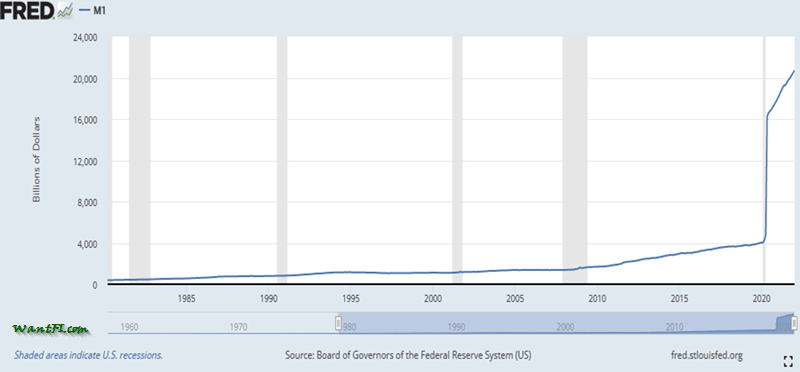

The M1 money stock is a basic measure that includes physical currency and immediately spendable balances (e.g. checking accounts). Look at the dramatic jump in 2021:

The money supply doubled from 2010 to 2020 and the money stock has almost quintupled in the year since then. This is absolutely unprecedented!

Naturally, you might think that prices would have to quintuple to find equilibrium, but an equally important concept on the flip side of how much money is in an economy is how much sloshing around it is doing. This is known as the velocity of money, and it has been decreasing for over ten years and nose-dived in conjunction with the big bump in money supply in 2021.

The dramatic influx of money isn’t being spent at the same rate it had been in the past, and this declining velocity dampens what would otherwise be a massive impact on inflation. People are not spending the newly printed cash… yet.

PRO-TIP: I rolled over a 401k into an IRA, and Capitalize‘s FREE service couldn’t have made it any easier to do. They work with all the major brokerages and handle the paperwork for you.

The Economist attributes the decline in the velocity of money to economic uncertainty and government handouts. Only 28% of stimulus is actually being spent and the rest is being saved or being used to pay off debt.

It is also clear that a lot of the money is being locked into investable assets, such as stocks and real estate, which have risen many times over in ten years.

The Federal Reserve Interest Rate

Physical printing of money is not the main culprit in today’ modern quasi-cashless society. The amount of physical currency pales in comparison to the electronic money that is standing by in the economy. The Federal Reserve “digitally prints” money in numerous ways, but artificially impacting the Federal Reserve interest rate is the most transparent method (why capitalist countries have government bodies that decree what the interest rate is always seemed like a contradiction to me).

The Treasury issues and redeems bonds and the Federal Reserve has bought trillions of dollars of them over the last decade. By buying bonds to hold on their ledger, they force the price of bonds upwards above the face value, which lowers the yield commonly referred to as the “interest rate.” Then when the Treasury issues new bonds, these new bonds are set to the Auction “market rate” at par which means they now have a coupon that pays a lower interest rate than before and the new bond price is reset to par ($1,000).

The Federal Reserve can digitally print as many dollars as they want and buy however many bonds that they want. When they buy the bonds, they are exchanging the bond liability for money, and the seller of the bond receives a deposit into their account either to reinvest or take out and consume.

Conversely, when the Federal Reserve sells bonds, they take the money out of the economy and add it to a ledger. The money doesn’t get put to use other than as an accounting mechanism.

Not only does the bond trading add money to the economy by exchanging the bond liability, the resulting lowered interest rate in turn affects basically everything in the economy related to banking and finance.

Loans become cheaper so individuals are incentivized to borrow more money to spend on cars, houses and investments. Similarly, banks can’t get a return placing their money into the Federal Reserve, so they are also encouraged to lend more. Their lending is only limited by how much risk they are willing to take and the Federal Reserve mandated reserve ratio, again another Fed control mechanism.

Inflation Is Understated

The Bureau of Labor Statistics (BLS), the government organization that calculates inflation, intentionally reports a lower level of inflation in two primary ways, under the guise of accuracy.

The typical “Core CPI” (consumer price index) that the government makes announcements on excludes food and energy, which have a tendency to be subject to supply shocks. OPEC might cause another oil embargo or bad weather might destroy a bunch of crops in the south leading to sharp price rises in those goods, for instance. The government wants to ignore these events since theoretically the prices will go back down after the problems are solved. But of course, consumers themselves don’t just stop buying food and energy because the new prices are inconvenient to them. They are real inflationary costs to them, temporary or not

The second reason is that a couple of decades ago, the BLS decided to switch to “Chained CPI.” They said that they wanted to better model inflation by incorporating the concept of substitution. For instance, if the price of beef doubles, you will correspondingly buy less beef and more chicken, or so that is how the theory goes.

The price of beef still doubled, so whether if you substitute or not because it got too expensive, it is still inflation that affects your grocery basket. Just because you didn’t want to pay the price for the burgers, doesn’t mean it wasn’t a cost that affected you. You’d wanted to buy beef but settled for chicken or you bought the beef anyway and grumbled; that inflation impacted your life either way.

The “Technology Is Deflationary” Myth

The third reason why CPI is understated is because of technological advances. The way the BLS accounts for these is by using “Hedonic” price adjustments.

What this means is that they will account for quality factors of the item and then adjust the price of the previous, lower technology item downwards. The most obvious cases you will see this with is computers, vehicles, and even housing.

This is less nefarious because it is true that older technology gets cheaper but how many times have you ever seen a new car decrease in price? Sure, it now has a federally mandated backup camera, but it’s not free, and good luck buying a new car without one. Did you experience deflation here? No.

Could you buy an IBM 486 and run a modern operating system like Windows 10 on it? No.

Could you run apps on the first generation Android phone today? No, trust me I tried!

Have you bought a new computer in the last ten years and noticed that the CPU speed has barely increased since 2010, but the price has remained about the same but with a few fringe features, like touch screens?

Where’s the deflation?

The cheaper, lower technology goods generally aren’t for sale, new, after a number of years because they aren’t usable, or no longer contain the legally mandated safety features. Obviously anything used will be cheaper from depreciation alone, but that is not in the class of something “new.”

Every year the price of a new car goes up, the price of a new house goes up, and the price of anything with technology only seemingly goes up.

Potentially the only exception to that is computers themselves. The price of a new computer seems to stay about the same from year to year, but the operating system bloat continues to go up, so you have to upgrade to a faster model every few years.

And frankly, people probably don’t even notice most of the incremental changes that occur from year to year for each product, but which cause the prices to “deflate.” Are you really using 100% of the features your phone, computer, or car are capable of? I know I’m not. The only reason why I’ve upgraded over the years is because the prior versions became unusable.

The “technology is deflationary” argument is strictly an accounting mechanism that doesn’t save you any money.

Why Does The Government Understate Inflation?

Unfortunately there are incentives for the government to under-report inflation and there is a conflict of interest when the government creates the inflation and then also reports on it. There are two primary reasons:

- Expectations about inflation drives inflation. The more consumers expect inflation, the more they act upon it. Therefore, they don’t want people to notice it.

- Government benefits, contracts, tax brackets, and treasury inflation protected securities (TIPS) are all tied to the official CPI. Therefore it is a benefit to the government to report lower levels of inflation to pay out smaller amounts.

And truth be told, the Fed is measuring inflation for a basket of consumer goods but completely ignoring inflation everywhere else that are a real cost to consumers. Houses, cars, stocks (Remember those Robinhood traders I wrote about?) and other assets are zooming higher and while some of these might be resold later for a profit, higher mortgage and auto payments are a real cost that must be paid in the meantime.

Why Does The Fed Target Inflation Of 2% And Not 0%?

Optimally 0% inflation is ideal for consumers, because their money doesn’t lose value and they know what their money is worth and what it will buy each time they go to the grocery store. But the government doesn’t target 0%, they target 2%.

So first, let’s start with the backdrop of economic theory to try and see why they target 2%.

If inflation is running hot, say 10%+ a year, consumers will start buying more goods today and storing them for later instead of buying them later and paying a higher price, pulling forward future demand. This puts price pressure on goods today, creating more inflation, and creating a self fulfilling prophecy. Therefore lots of inflation is bad.

If inflation is negative (i.e. deflation), consumers benefit by hoarding money and delaying purchases to get a cheaper price later. This can possibly lead to a recession and cause further price declines exacerbating the deflation trend. Therefore, deflation is bad.

Because there are a lot of factors the determine short term inflation, it would be hard to engineer exactly 0% every year, and they therefore lean on the side of a little inflation.

The government could target 0% inflation by skipping all the financial engineering they do every year and keeping the money supply mostly fixed, or only increasing it as much as the rate of growth in the GDP but they are incentivized not to.

Why does it always have to be positive from year to year? It’s an false constraint that the government creates for themselves. Any short term inflationary and deflationary effects would net out over time.

How Does Inflation Affect Businesses?

In the short term it will negatively impact their profits, but in the long term it can be a benefit.

Businesses pass any extra costs along to the consumer, usually in the form of “shrinkflation,” so that it isn’t as noticeable. Their “menu costs,” or how frequently they can change their pricing determines how much of an impact that inflation will have on their profit margins. Commodity based businesses pass on the cost almost instantaneously, whereas other businesses have less flexibility.

Ben Bernanke, the former Fed Reserve chairman, also wrote about how inflation “greases the wheels” for employers. It’s easier to cut costs when inflation is slightly positive because an employee will accept a 0% increase in raise, but a pay cut will lead to resentment, productivity loss, or resignation. Therefore, this is a hidden method to reduce labor costs at the expense of employees.

Either way, the consumer loses from inflation.

The Government Benefits From Positive Inflation

Think of the reasons why the government would want to reduce the value of money out in the world.

Since the US dollar is a reserve currency, there are pallets of cash stacked in vaults around the world. Each passing year, the value of that liability decreases with inflation.

Additionally, when extra money is printed and spent for government purposes, it doesn’t require a tax increase to pay for it. It’s a hidden tax.

More desperate governments (Zimbabwee, Venezuela, for instance) have learned the hard lesson of hyperinflation when they decide they are going to just print more currency and spend it to pay for their government operations.

2% of a $20 trillion dollar economy is real money!

How To Profit From Inflation: Hedging Investments and Strategies

If you are worried about inflation and want to learn how to hedge against inflation, and which assets are a good inflation hedge and which are not, this section is for you.

I wouldn’t say there is a best hedge against inflation because each has its own pros and cons, but some options are better than others.

Treasury Inflation-Protected Securities (TIPS)

Many investors often think that TIPS bonds are the best investments for an inflation hedge since they are very liquid and issued directly by the government (other countries issue their versions, such as GILTS for the U.K.). You can either buy them directly or indirectly through your brokerage.

The obvious advantage of these is that there is no guesswork for how you’ll be compensated because when you are comparing asset inflation vs CPI, TIPS directly target inflation and not some indirect measure that may or may not match up to the official inflation rate. The government reports the CPI and the principal is adjusted for inflation and your coupon payments are set off that. Easy-peasy.

Unfortunately the cons for these instruments are many. The first of which as already discussed above, is that the official CPI doesn’t reflect the true cost of inflation. So already out the door you are taking a haircut on what your inflation hedge investment is providing you.

Secondly, you must pay taxes on the income that you receive from these annually. This chops off 25-35% of the inflation hedge depending on your tax bracket. So again, you are not actually keeping up with inflation.

The scary thing is that even if you have a zero coupon bond and the principal is just being adjusted by inflation but you aren’t actually receiving income, you still must pay annual taxes on these “phantom” gains! This should be a human rights violation.

And finally, because TIPS are marketable securities, pensions, endowments and other financial players need lots of government securities to secure their future, and TIPS and other government bonds are high in demand. The price paid for these is frequently above par until they are issued with a lower interest rate. As a consequence, for many years their real inflation adjusted return out to 30 years was actually negative. Fortunately in 2024, they have a positive yield of 1.75%+, for now, but its really not enough to make an investment portfolio on.

Because of the last point, TIPS only work well in super high inflationary environments where other assets just can’t keep up with the nominal interest rates.

TIPS ETFs

You can also buy TIPS indirectly through ETFs, such as STIP, but then you are also paying the ETF fee of 0.20% per year, so I don’t advise for that when it is easy to buy them directly for yourself. Additionally, you can hold the TIPS to maturity and avoid a loss, which is not the case with bond funds that roll bonds over to newer issues and can lose money as pretty much all bond funds did in 2022.

Series I Savings Bonds (I-Bonds)

If you have some medium-term emergency cash, this is really where you want to be keeping it. I actually like these a lot and I will explain why.

So again, these are issued by the treasury and you buy them directly from the government, so they are risk free securities (in the sense that the government can always print more money). It takes about 10 minutes to setup an account and link your bank account.

These are special savings bonds that reset semi-annually to the rate of inflation and the interest compounds until your redeem the bond. Technically they have a fixed rate component and an inflation component but the fixed rate component has been either 0% or nil over the last ten years.

These differ from TIPS in a number of ways:

- They are not tradable on the secondary market, so the principle par value does not increase above 100% pushing down the rate of return like they do for TIPS.

- Each individual with a social security number is limited to $10,000 per year (plus another $5,000 if you purchase paper I-bonds with your tax refund).

- You must hold a minimum of 1 year, and if you redeem within 5 years 3 months of interest is forfeited.

- You can hold them for as long as 30 years before interest stops accruing, but the option is yours to hold between 1 and 30 years.

- You only pay taxes on them when you redeem them, not annually (although they give you that option – yeah right, no thanks!) (Tax deferment flexibility is a winning proposition all the time!)

- And while these are taxed at the federal level, there is no state or local taxes.

- You cannot put these into tax advantaged accounts.

The interest rate for bonds issued after Nov 2023 is 5.27%. Where else can you get a risk free return like that?

Bitcoin, Altcoins & Cryptocurrency

I know I have to mention it because if I don’t many will opine that I forgot to do so.

The theory is that since Bitcoin has a fixed supply, it will be a good inflation hedge. So far though, the returns have been driven by anything other than inflation and since the asset has only existed for about ten years and we haven’t had much inflation in that time period, there is really no data to verify it if even acts like an inflation hedge at all. Will it? Maybe, maybe not.

I don’t really think that any millennial and gen-Z buyers buy it as an inflation hedge anyway. Buying crypto today is more of a bet on decentralized finance, a worldwide currency or potentially even the digital gold argument where it’s value is its perceived value.

And here’s really the problem with the “fixed supply” argument. While it might be part of its fixed programming that only a fixed number of Bitcoin can be minted, it’s really only an illusory soft limit.

The first reason is because there have been over 100 forks (software changes where there is disagreement in the direction to go, creating two separate coins) which immediately doubles the number of the coins in circulation and the prices are in-parity until one takes the dominant position. So for instance, Bitcoin has spawned off Bitcoin Cash, Bitcoin SV, Bitcoin BEP2, Bitcoin Gold, and dozens of other active coins each immediately spendable or tradable for other coins.

And that is just Bitcoin. There are now over 9,000 coins and tokens that are all vying for a piece of the crypto money. Each coin that attracts money pulls it away from Bitcoin.

And while Bitcoin might be the coin with the largest market cap today, other coins are quickly catching up and might overtake Bitcoin in the near future because they perform other tasks and have more functionality. Therefore the fixed supply argument for cryptocurrency is flimsy.

If you are going to buy some cryptocurrency, buy it for reasons other than to protect against inflation.

Commodities

Inflation hedging and natural resource commodities go hand-in-hand since inflation is directly tied to the underlying commodity prices.

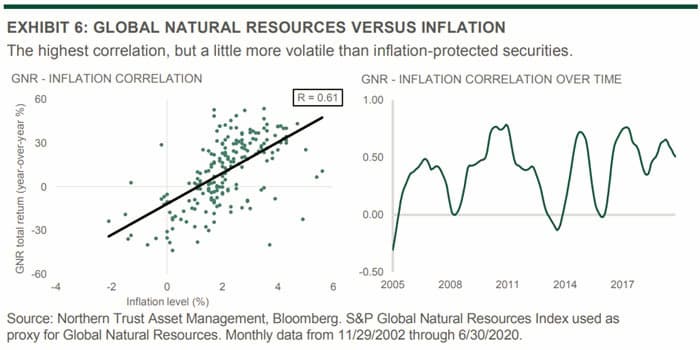

Over time, the correlation of inflation and natural resources is generally strongly positive and the inflation rate explains 61% of commodity returns.

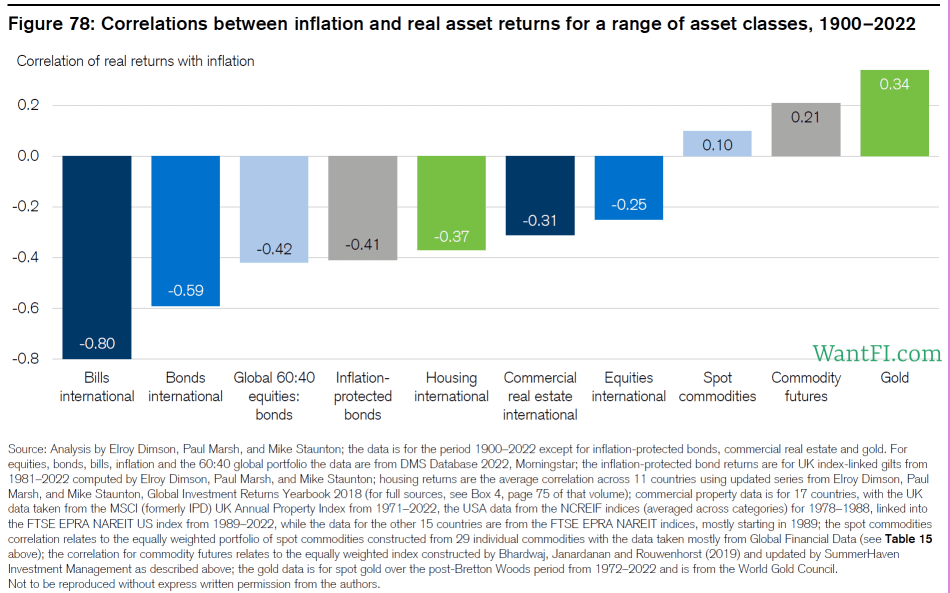

The data show that commodities are the best assets for inflation protection:

Commodities also have less correlation to stocks and bonds, meaning they can add to your portfolio as a diversifier.

However, it’s hard to hold commodities directly because you can’t just buy a lumber mill, farm or an oil tanker and just sit on it and wait for higher prices to sell to someone else.

You can however buy futures of commodities directly in your brokerage or buy ETFs that hold physical commodities or futures.

Unfortunately, most of these futures based ETF products, like the GSCI index, generally don’t perform well as long term holds because of a function of futures term structure known as contango. Each month a little bit of value is sliced off your future’s value and then you have to roll it (sell this month’s and buy the next month’s) at a slightly higher price.

There are some ETFs that try to smartly buy commodity futures while controlling for this negative roll yield by managing which futures contracts they buy and sell along the futures curve or by employing a rules based screen. I generally prefer the latter methodology because the former means they just lose less and are less reactive to sudden moves in the futures contract.

One such product I’ve reviewed the prospectus for is the Direxion Auspice Broad Commodity Strategy ETF (COM). It selects from 12 commodities and weights their allocation by volatility. If the commodity is not in an uptrend, it puts that allocation into cash. Performance has been great relative to typical futures based ETFs and drawdowns have been more limited than most others. Only holding onto commodities that are in uptrends is a real asset, pardon the pun. The expense fee of 0.70% is high, but typical for these kinds of ETFs.

However, as I have mentioned before with my energy article, holding the underlying commodities is a little bit of a one-trick pony. You ride the commodity prices up once and then sell when the commodity reaches what you think is the maximum price.

Conversely, with a commodity producer stock, the commodity can be harvested repeatedly and the company can make large profits for a while even if the commodity price reaches a plateau.

Precious metals are a subset of commodities that are easy to store and are commonly used as inflation hedges.

Is Gold a Good Hedge Against Inflation?

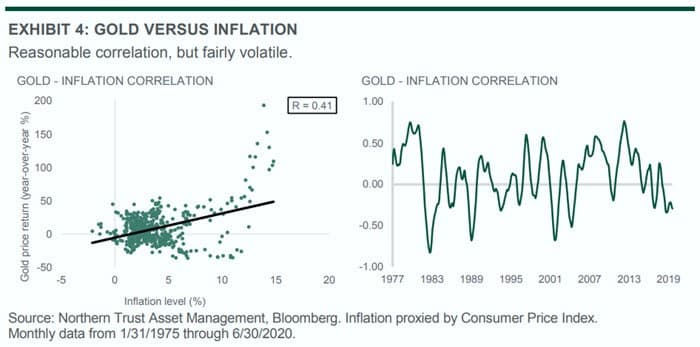

Ahh, the gold inflation hedge myth strikes again as the first inflation protection asset that people naturally gravitate to.

Gold has been a valued part of human history for at least 5,000 years for jewelry and other adornments. But does gold protect against inflation? Not really, except in time periods in the centuries.

In the short term, using gold as a hedge against inflation doesn’t work well, and it’s correlation to inflation can be quite volatile.

Over centuries gold as an inflation hedge has worked sufficiently well, but that timeline doesn’t help us mere mortals.

Asset Diversification

Furthermore, precious metals are another asset class, so they can be thought of as a long-term strategic asset and a diversifier to your overall portfolio holdings. With gold on the ascent again after being stagnant for several years, perhaps now is gold’s time to shine (pardon the pun!), regardless of whether it is responding to inflation concerns or responding to other effects.

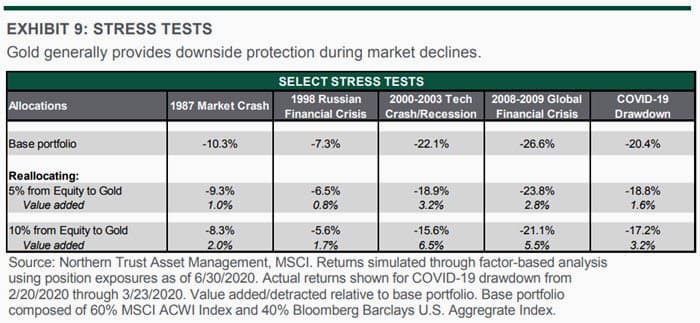

However, one of the largest benefits to owning gold has been because historically it provided some protection during periods of market stress. Since I think we are in the midst of a market bubble, a little allocation could provide some downside protection if and when the stock market pops.

India, China, and Russia have started buying tons of it in 2021, so you also have to ask yourself why do they suddenly see so much value in it and have their purchases been the cause of the recent ascent?

Direct And Indirect Costs For Gold

On the downside, gold also just sits there and doesn’t pay any interest or dividends.

There may even be costs associated with holding physical gold, since if you buy a lot of bullion, you’ll probably want to invest in a safety deposit box otherwise risk losing all your gold to theft.

You can hold it digitally through exchange traded trusts like IAU and GLD but both of these have management fees and you have to put some trust into whether they are properly audited or not (Is a guy walking around a warehouse with a clipboard?).

Holding physical bullion could also be a little bit of an insurance policy in the event that one needs a bearer instrument if the country or region goes into a tailspin from a natural disaster or otherwise. It’s a low probability event but one of the oft cited reasons for buying the physical form of it.

You can legally transport bullion (not legal tender coins!) across international borders without declaration because it is not considered to be a legal tender. Although there’s a high probability that your bag will be inspected because the X-ray machine will show a big black spot that they can’t see through. I advise you to request a private room inspection before you send it through the machine.

Where Do I Buy Physical Bullion?

With bullion, you pay the spot price plus a spread usually around 3-4%, but sometimes less especially if you buy 10 or more ounces at a time. The assumption is that you plan on holding it for 10 years and don’t plan on buying and selling bullion regularly, otherwise the commission spread wouldn’t make it worth it.

Platinum

Platinum has been undervalued for years and with the green movement, this could be a catalyst that ignites the fire. Read the case for platinum here.

Do Stocks Hedge Against Inflation?

As a general rule they do over long periods of time. In the short run a company has to eat the cost of the raw materials, which is bad for the stock, but then will start raising its costs to pass them along to the consumer. Over time this increases nominal earnings and if the P in the P/E relationship stays the same, the stock will rise.

Some stocks have a more direct relationship to inflation, namely commodity producer stocks.

Gold Mining Stocks

Another way to play gold is by buying gold producer stocks, for a somewhat levered exposure.

Whether or not you think physical gold is useless or not, if someone’s buying it from a producer who’s making fat profits, wouldn’t you be interested in owning that business?

This gold price ascent has been great for gold mining and production stocks. The typical all-in-cost of producing gold is around $800-1,100 per ounce and these gold miners are turning around and selling it for $1,800-$1,900 an ounce right now.

Gold mining stocks historically had been pretty bad investments. For the last 20+ years as a sector, they’ve been losing money and stacking up the debt. But a lot has changed over the last couple of years.

You can throw a dart at a list of gold stocks and find a company with free cash flow, a low P/E, low enterprise multiple, low debt, rising revenue, rising profits and probably even paying a small 1-3% dividend.

While gold and inflation might not be a perfect inflation hedge, gold stocks have become a value play.

We can’t know for sure if this is one of those periods where gold does well during inflationary periods, but owning gold mining stocks still makes a lot of sense right now because the price of gold is already pretty high and producers are making big profits. At the same time investors haven’t bid up the price of the stocks because they seem to be interested in all things tech! Even if gold stays flat from here, it is looking good for producers.

Silver Mining Stocks

Sadly I can’t say the same about silver stocks. I haven’t seen any good deals, but there might be some out there. Let me know if you find any high conviction plays.

General Commodity Producer Stocks Such as Oil, Wood, Crops

The nice thing about commodity producer stocks is that they benefit directly from the pricing of the raw materials. In fact, they are generally the ones that set the price and their whole business operation of whether to invest in a new lumber yard, mine, or oil well is directly dependent on the return they will get.

When prices of commodities move up, commodity producer’s businesses flourish.

This is a very broad classification because there are so many companies that produce each commodity. There are timber producers, farmlands, copper miners, oil drillers, and the list goes on.

I spend a huge amount of time digging through the financials of individual stocks, but to research multiple stocks in multiple industries becomes exponentially harder to find time for.

For instance, I wanted to buy some industrial metal producers and researched a couple of the majors RIO and BHP and decided to just buy the ETF PICK which has those two as its largest holdings.

Therefore one solution is to outsource it to portfolio managers.

Inflation Hedge ETFs

These are ETFs that have active managers who buy commodity producer stocks and TIPS and try to create an allocation that will benefit from inflation without you having to form your own inflation hedging portfolio. It’s certainly more convenient than trying to review the financials of 50 stocks when you have a full time job. On the downside the management fees are usually 2-3x what an index fund will get you.

Funds that come to mind are STIP, Horizon Kinetics Inflation Beneficiaries (INFL), which buys a collection of producers and financials, or Western Asset’s (WIA, WIW) which use leverage to buy TIPS and other fixed income instruments.

Ideally it would be nice to be able to compare historical fund returns with inflationary periods, but few funds have spanned the decades necessary to make that comparison, so ultimately it comes down to a judgment call.

Horizon Kinetics started their inflation fund in 2021, so it is really new, but it did outperform the S&P by 10% in 2022. You can only review their firm marketing, the fund holdings, and the portfolio manager’s education and history to make a call whether the future returns of that fund are expected to match inflation or not. It’s hard to really know how it will perform in the coming years.

Also, when you look through the underlying portfolios of these types of funds it’s sometimes not clear why they added certain stocks or bonds when there isn’t a clear link to inflation assets. Again you just have to either trust the judgment of the portfolio manager or do it all yourself.

You can also cut out the middle men and buy ETFs that should respond to an increase in inflation and corresponding rates, such as financials and materials.

Real Estate and Rental Properties

Rental property deserves an entire article, but if you can find a property and a good tenant to make a decent return off your purchase price, being able to adjust the rents up every year is a good hedge against inflation. At the same time, the price of the home should increase in value, keeping up with inflation. In a way it’s like having a personal TIPS bond.

Real estate has some of the best tax benefits in existence and even makes a lot of sense to become a landlord even when you aren’t trying to target inflation, if you are willing to put up with the unique headaches that comes with being a landlord.

Another way to own real estate is through Real Estate Investment Trusts (REITs). Short term duration REITs like hotels and apartments are able to adjust their rents more frequently than commercial tenants. But again, each sector has unique advantages and disadvantages and REITs also deserve their own article to give them fair treatment.

Summary

There are many ways to hedge against inflation, but there are few options that target inflation directly.

The best way to capitalize on inflation is to buy businesses that benefit from higher raw material prices. Become an owner in the production and get some tax favored dividends and long term capital gains along the way. Of course not everyone can be a business owner.

Equities are an inflation hedge over time since they can raise their prices which increases earnings. Dividends will likely also rise at the same time.

The most direct way to hedge inflation is to buy I-bonds. The interest is tax deferred, exactly matches the CPI, and you’ll get a rate that far exceeds any savings account or CD (certificate of deposit) for the time being.

The sad fact is that for assets that get inflation exactly right, you are never really fully indemnified against your loss of purchasing power because you will have to pay taxes on your gains, as the IRS considers all gains to be real gains regardless of reality. But you can only do what you can do, just keep that in mind when hedging for inflation.

If you haven’t already, please sign up for my monthly newsletter and check out the telegram group

Free Investing Tools

- Have Capitalize handle the paperwork for your 401K rollover to any brokerage, for FREE!

- Where does your money go each month? Track all your accounts and see if you are on track to retirement with Empower, for FREE! I use it myself to monitor my mom’s accounts to make sure she isn’t falling for scams or being defrauded.