The Stock Market, Unstoppable? 3 Risks Remain

Published on July 5th, 2021

Where’s the market risk?

Will the stock market crash in 2021? I’ve been reducing risk since the beginning of the year, but so far the stock market keeps churning higher. It seems unstoppable in the face of high unemployment, soaring inflation, and technical indicators pinging off as a result of the commitment from the Federal Reserve to keep interest rates low for another 2-3 years. “Don’t fight the Fed” is a common refrain, and that has been a successful strategy for over ten years of zero to nil interest rates.

Many of us that have written about the risk of a serious market correction for the last few months or even longer are starting to look like the broken clock that isn’t even right twice a day. I guess that makes us digital clocks.

Recently a Zoomer who started investing in 2020 said that the long term capital gains rate should be eliminated because you can’t lose with index funds and you’ll get 9% a year eventually. Ignoring inflation, that’s not an inaccurate statement with the long term return for the American stock market.

However, will that always be the case?

United States stock market history: an outlier

One of the things that a lot of people here in the US don’t realize is that they’ve been a serious beneficiary of the well documented home-bias, where people invest in the country they live in (despite financial advisors recommending a well diversified portfolio).

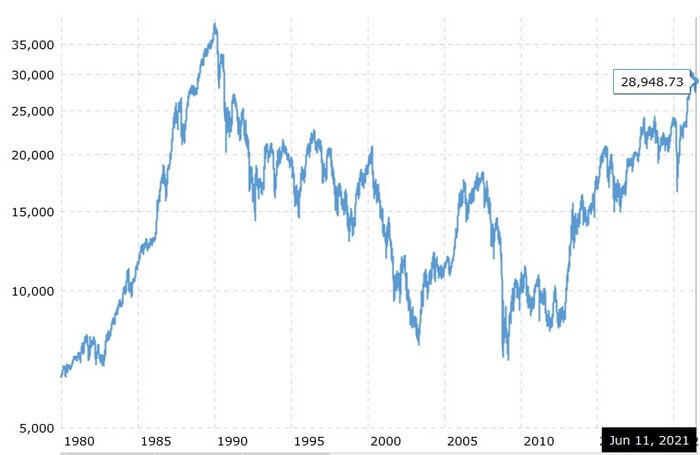

The S&P 500 has returned 300% (about 9% a year compounded) over the last 13 years and you can see that a large part of that advance has been the contribution from a single sector, US technology. The All-World Ex-US fund has barely managed a 50% return over the same time period and most of that return occurred in the past year.

Then take a market like Japan that has never since returned to stock market highs from 1989.

That’s 30 years of negative returns for those who started investing near the peak and very minimal returns for those who started investing before or afterwards.

Where are the bears?

Who needs stock market risk management when there doesn’t appear to be any risk?

Most Zoomers and Millennials of today have never experienced a real bear market. In fact, 15% of investors today started investing in 2020, so they haven’t experienced any significant drawdowns.

You would think that a global pandemic would make some bears out of people, but it had the opposite effect because instead of putting the S&P500 out to pasture for a while, after falling 35% in a two week period, it bounced up sharply in a V-shape and soared even beyond the levels it was even before the crisis, despite the economy being in worse shape.

The shortest bear market in history was just a blip and further strengthened the viewpoint that investing is relatively riskless. Heck, even if you bought at the top, you only had to wait a few months to get all your money back.

But that’s not all. Investors now expect 17.3% returns above inflation. Those expectations are even higher than the last ten years of exceptional returns, so it’s not even recency bias, it’s just plain madness.

These types of expectations, along with the other various signs of a stock market bubble, are what concern me the most. We are in the “be fearful when others are greedy” stage of the market cycle.

Is a Japanese style market correction in our future? I’m not sure, but the long term record even for the US stock market has shown periods of 15-20 years where the market didn’t make a new high.

To feel the pain of losing 50% of your net worth to a bear market is hard to describe and to feel it twice in a 8 year period is a very humbling experience that makes you appreciate risk management in your portfolio. Think about it, it took over 14 years to get back to the record highs reached in the year 2000. That is a long time to be holding for capital appreciation.

But for many today, getting a “risk free” return of 9-17% seems inevitable.

Stock market risks

Inflation

The $64,000 question is whether inflation is in fact transitory or not.

Rising inflation, by the special way the Fed measures it, appears to be the only thing that can stop this freight train of a stock market because it would force them to get their foot off the gas from the Quantitative Easing and 0% interest rates that have defined the last decade and has driven up every asset class.

A lot of the market return would look like Europe if not for the Fed artificially inflating assets. Eventually they will have to stop expanding their balance sheet, but every time they have started to pump the brakes, the market has responded with a taper tantrum. The bubble inflates and inflates. At some point the chickens will come home to roost.

Conveniently, the basket of goods that the CPI consists of is specifically engineered to ignore the inflation that impacts people the most. Paying an extra $500 a month for a mortgage because the prices of homes have soared has a bigger impact than the $0.50 increase in the package of Oreos.

Today is a bet that interest rates will not rise for many years down the road. Interest rates will be zero so the present value of future earnings and cashflow are essentially realized today. Inflation will not get out of control in spite of $6 trillion in government spending and 1/3rd of all dollars in existence being created in the last year.

Signs of irrational exuberance

Today is a bet that all the various signs of market excessiveness and exuberance are no longer contrary indicators and the madness of crowds will be correct from now on.

That valuation will begin to matter again

There is a plethora of academic investment research out there on the long term outperformance of value stocks over growth stocks. Growth stocks have outperformed for the last ten years, so right now is a bet that all the decades long investing research on value versus growth was wrong and is no longer relevant.

At some point, some large sophisticated investors are going to get out of the door before everyone else and reduce their risk while stock values are at premium levels. Hedge funds of the past used to have a large outsized influence on the stock market due to the leverage they used, but the modern stock market seems to be driven by retail investing these days.

No longer does one buy a stock because it’s a company that earns a lot of money, and you can buy it for a fair price today; it is bought because it’s a cool idea or product, or maybe, just maybe, in the far future it might earn a lot of money.

Think about it. Say you invented a cool gadget and were thinking about starting a company to start selling this gadget to the public. Would you just go for it and dump $100,000 of your life savings into it because it’s a cool product or would you spend a lot of time performing market analysis to see what kind of return you might earn on your invested capital?

Because ultimately that is what investing is. You put money in, and hope to get a certain amount of money out of it from the return on invested capital. Will the business internally generate enough profit to provide a return?

With public companies, they have the luxury of risking other people’s money on an idea that may or may not fare in the marketplace. And right now people seem to be willing to pay any price for an idea, profits be damned.

PRO-TIP: I rolled over a 401k into an IRA, and Capitalize‘s FREE service couldn’t have made it any easier to do. They work with all the major brokerages and handle the paperwork for you.

Think of a company like Tesla. I had a co-worker tell me that he owned Tesla because “Elon Musk is an interesting guy.” That was his reasoning, not some thought out projection of how Tesla will sell 1 million cars a year by 2026, and they will make 20% margin on each car sold and that GM, Toyota and the other car markers were 5 years behind. Nope, nothing like that at all.

And then the stock went up over 1000% in a year and he along with millions of other people were rewarded for that style of reasoning.

Tesla has an enterprise value far greater than a basket of the largest automakers. These other automakers produce 100x as many cars and have made profits for decades, all have EV cars either in the works or being sold today. Tesla has made 5 quarters of profits and it wasn’t even from selling those cars (mostly regulatory credits, and sales of Bitcoin).

Or think about companies that were part of the meme stock revolution, like Gamestop and AMC theaters. These are dying retail businesses that haven’t made money in years, but you wouldn’t know that from their record high stock prices.

How much longer will people be rewarded for basing investing decisions on anything other than market economics?

We can’t know the answer to that, but rationality will eventually return.

If you haven’t already, sign up for my monthly newsletter where I share investing insights and ideas.

Free Investing Tools

- Have Capitalize handle the paperwork for your 401K rollover to any brokerage, for FREE!

- Where does your money go each month? Track all your accounts and see if you are on track to retirement with Empower, for FREE! I use it myself to monitor my mom’s accounts to make sure she isn’t falling for scams or being defrauded.