Should You Payoff Your Mortgage Early? No, 5 Good Reasons

Updated on October 25th, 2023

October 2023 Update

Much of this article depended on the rock bottom interest rates of yesteryear. If you have a 6-7% mortgage, it likely makes sense to pay off the risk-free return.

If you’ve ever asked “is it a good idea to payoff your mortgage early” or “how can I payoff my mortgage early” or then this is the discussion for you.

There is a debt-free revolution that spans a lot of blogs and advice from financial gurus (like Dave Ramsey) that says that you should achieve that debt-free goal and pay off all your debt including your mortgage. But should you?

When it comes to high interest rate credit cards, then absolutely pay those off, but mortgages are more nuanced to your age and investment horizon.

If you are retired and don’t have decades of runway ahead of you and are seeking conservative investments, then sure go ahead. Paying off a mortgage is a risk-free return of your mortgage’s interest rate and will free up one of your largest bills when you have paid it off.

However, for everyone else, they should keep that mortgage debt around and invest the difference.

Here’s why:

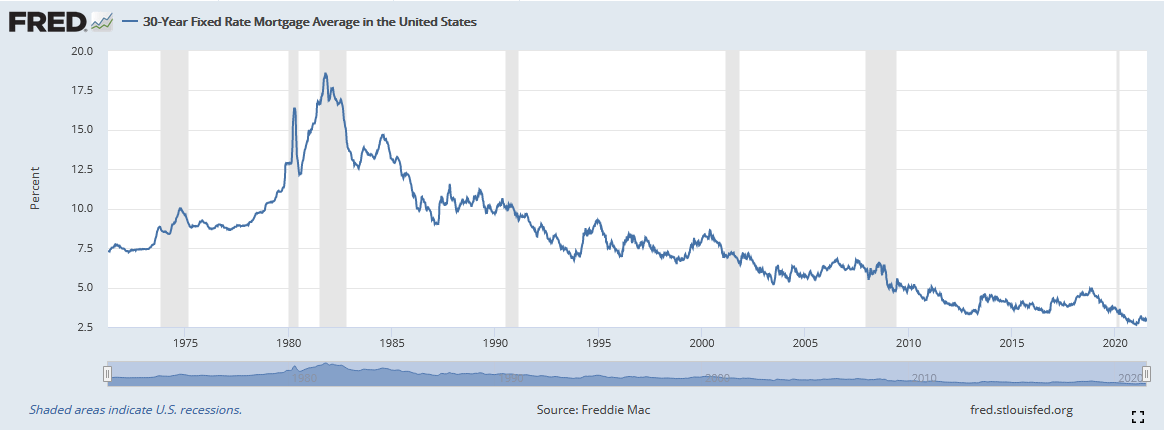

Mortgage Rates are Rock Bottom

(Mortgage rates as of May 2022 have doubled to around 5%, which is still low by historical standards)

I recently just refinanced and scored a 30 year fixed mortgage rate of 2.65%. 2.65%! For 30 years! Check your local rates.

I couldn’t believe how low this rate was. I can’t think of any other type of loan that allows you to borrow hundreds of thousands of dollars for such a pittance.

And the terms of the loan are fixed for the life of the loan! There is no margin call if the home value drops and the lender can’t take it back when its favorable to them. It’s really low risk financing where you can put excess capital to use in other areas of your life.

Will the rate of mortgages revert at some point over the next 30 years? Maybe, but why not lock in these rates while you can?

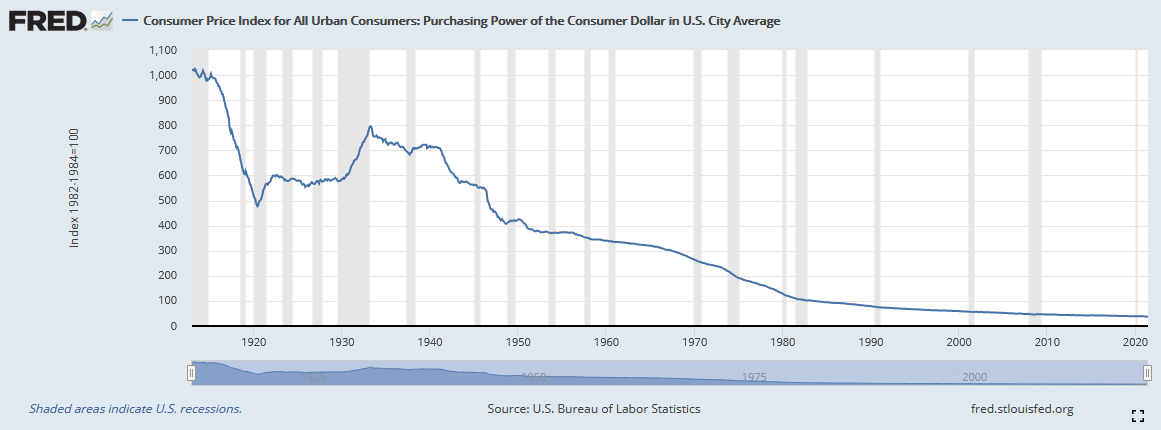

Inflation

Inflation eats away the value of debt a little bit each year. High inflationary environments eat away this debt the fastest, but even a little inflation causes the value to drop dramatically over long periods of time.

Here’s the value of the dollar over 100 years:

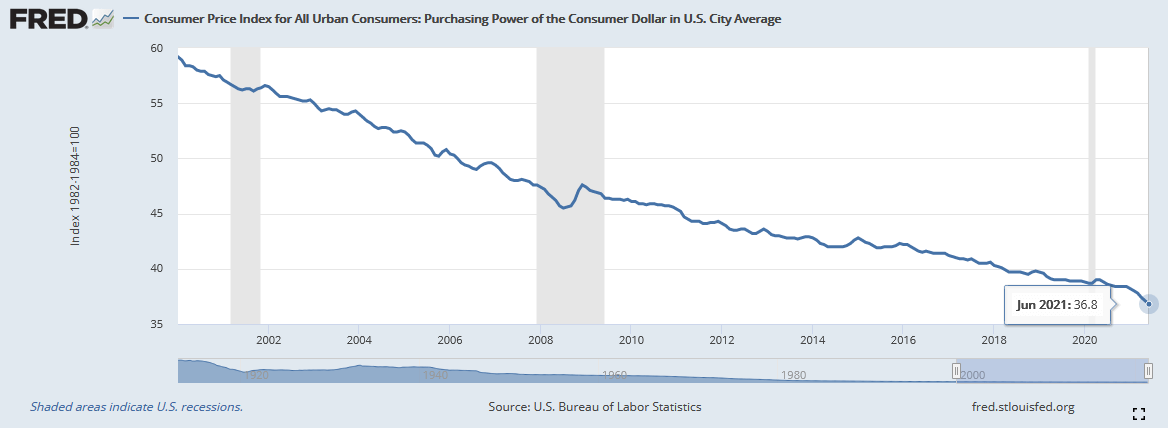

And for a more recent look, over a 20 year span, the dollar has lost about 40% of its value to inflation.

In other words, over the life of a mortgage, the value of the debt is going to be worth about half or less than it was when you originated it.

And if you’ve read my article on inflation, I don’t buy into the ‘transitory’ argument and I expect a higher than normal level of inflation for the next couple of years.

Another way to think about it is if your mortgage is 3% and inflation is 3%, you are essentially getting the mortgage loan for free (assuming your raises keep up with inflation, of course).

Mortgage interest is tax deductible

Another factor is if you itemize deductions, up to $750,000 of mortgage debt is tax deductible. So if your family is in the 25% tax bracket, your 3% rate effectively becomes 2.25%, making the loan even cheaper.

Again, lower than the cost of inflation.

Only about 11% of filers itemize these days however, so this tax break is often exaggerated by real estate agents during the sales process. But if you live in state with a high income tax and expensive housing, a little savings is there.

Opportunity Cost: Payoff Mortgage or Invest?

A key piece of this puzzle is what you do with the money you would have spent paying down the mortgage. If you keep it in cash just sitting around, then that clearly doesn’t help you out that much (although you would have a lot of liquidity, which can have its own benefits for emergencies or investment prospects).

It also doesn’t help you if you just end up levering up on depreciating toys and junk.

But the assumption is that you will invest the money you were going to pay your mortgage down with in an asset that returns a higher rate than the effective rate you are paying on the loan. This could be stocks or real estate, or another asset class.

This is one of the key reasons why real estate investors do so well over long periods of time. They lever up and capture property value increases while the level of their debt is decreasing in value. Then after a number of years of asset appreciation, they do a cash out refinance, and buy more property, resetting the clock and doing it again.

Again you need to compare the rates of return in after-tax terms.

If you are in the 25% tax bracket and have a 3% mortgage and invest in an S&P 500 index fund earning 8% (long term average), the appropriate rates to compare are 2.25% to 6% if you itemize or 3% to 6% if you don’t. Therefore, by not paying off your mortgage, and investing into the stock market instead, you are earning an extra 3-3.75% per year.

Since the standard mortgage term is 30 years, the appropriate investment horizon to consider is also 30 years. People generally don’t live in the same home for 30 years, but they generally live in a home, so as long as they continue to get similar levels of mortgage rates, they can consider the time horizons of 30+ years to be comparable.

PRO-TIP: I rolled over a 401k into an IRA, and Capitalize‘s FREE service couldn’t have made it any easier to do. They work with all the major brokerages and handle the paperwork for you.

So to find out if it is better to payoff mortgage or invest, the key point here is that every 20+ year period of investing, there was a positive return, and the average return was 8-9%. The worst 30 year return in the S&P 500’s history over the last 100 years was 3.6%, which was still better than today’s mortgage rates.

Of course past results are no guarantee of future results, but that is strong evidence that a 30 year holding period of stocks is going to outperform the investment of paying down one’s 3% rate mortgage.

Diversification

A home is generally the largest asset that one owns. If you only focus on paying off your mortgage, you are focusing all your assets into a single asset which lacks investment diversification.

Your city could face a negative long-term consequence of the local economy, a nuclear power-plant could meltdown contaminating the area, or some other black swan could ruin your home’s value and then all those extra years of shoveling cash into paying off your mortgage would have been for nothing.

So should you payoff a mortgage with a 401k? Definitely not! You don’t want the only asset that you own to be your home.

By keeping a mortgage an contributing more into your 401k, you have a valuable option to default in the future if you need to.

Payoff Mortgage Early? No Extra Credit From Your Lender

So say you’ve lost your job and suddenly cash becomes tight. But wait, you’ve made 12 months of extra payments on your mortgage, so you are all set for the next year, right?

Wrong!

Your payments are still due on schedule regardless of how many extra payments you’ve made. The principal is reduced, but the time-frame is not altered (until you get to that last payment).

So even if you dumped another $30,000 of extra payments into your mortgage balance, all you have done is reduced risk for your mortgage lender. Right after they file your foreclosure paperwork they will jump up in the air and click their heels because you reduced their loan-to-value ratio and they are all but guaranteed to not take a loss on the loan.

Emergency Cash

The above reason is why you should have some emergency cash.

Some people say that you should have 3 months of expenses, others say 6 months and some just say use your credit cards for emergencies. Well you can’t put your mortgage on a credit card!

Nobody really agrees on the amount to save because its custom to each individual. If you are in an industry that is strongly in demand than you can have a smaller cushion than others.

When Should I Try to Pay Off My Mortgage Early?

If you are already a senior citizen and don’t have the runway of a 20 or 30 year investment horizon to outperform the mortgage rate in the stock market or other investments, then paying off your mortgage is a conservative investment to make.

Another reason is if you refuse to invest in the stock market or invest in real estate or any other asset class that will outperform your mortgage rate because you are very risk averse. That’s okay! Everyone’s tolerance for risk is different.

In either scenario, you still need to have some emergency money set aside that can cover your mortgage payments and living expenses in the event that you lose your primary income stream.

If you haven’t already, sign up for my monthly newsletter and please share with your friends or social media:

Free Investing Tools

- Have Capitalize handle the paperwork for your 401K rollover to any brokerage, for FREE!

- Where does your money go each month? Track all your accounts and see if you are on track to retirement with Empower, for FREE! I use it myself to monitor my mom’s accounts to make sure she isn’t falling for scams or being defrauded.