Anchor Protocol’s Unsustainable 20% Yield

Published on December 12th, 2021

May 2022 Update: UST grew too large in relation to LUNA and suffered a bank run. When I first wrote about the LUNA/UST ecosystem, LUNA was valued at 5 times more than the value of UST which left plenty of safety for the peg mechanism to work.

Unfortunately Do Kwon pursued growth of UST at any cost and not only converted too much of the LFG holdings to UST, he also entered into a partnership with the scammer of Abracadabra to allow leverage into the system. Excessive leverage always ends badly!

The Anchor Protocol is a high yield savings account, referred to as anchor protocol staking, offered on the Terra stablecoin UST that currently offers a 19.5% 18% APY.

Proposal 20 passed in March which means that the interest rate will drop 1.5% per month until an equilibrium that balances the income and expenses of the protocol is reached. The first rate drop started May 1, 2022 and each month it will drop another 1.5%. In a later section I show that the equilibrium rate is about 3%.

In this article, we start with some financial theory about what makes an interest rate sustainable and then move onto the Terra ecosystem. Next we dig into the raw numbers of the protocol and show that the Anchor Protocol is being heavily subsidized for adoption making its current high interest rate artificial.

The Anchor Protocol is having tremendous growth and the income & expense figures are constantly shifting around from its demand. As such, I have updated the tables several times since I first published this article, and I plan to update the tables as needed to incorporate the latest information.

Magic Internet Money

People have a way of believing in magic internet money. I like to call it the Alchemy of DeFi that gets people to believe that the traditional rules of finance just don’t apply, apparently, only because “there’s no middle man.”

Anchor pays 20%, because there is no middle man, that’s the power of DeFi!

Random Internet User

Understandably, crypto can be confusing and requires a lot of financial gymnastics to acquire it, convert it, stake it and store it and a lot of people get lost in the details. In all reality, people just want to believe that unusually high returns are sustainable based on magical thinking. They don’t understand why and instead are just willing to believe someone smart invented something amazing and that it “just works.” Unfortunately some things are just too good to be true.

If any of these claimants ever bothered to look at a statement of income on a standardized 10-Q/K for any major bank, they’d quickly realize that CEOs, employees and ‘middle men’ are not the reason why they aren’t earning 20-40%+ interest rates on their money. Certainly there would be some savings, on the order of 30% by removing those cost centers, but it’s really not the reason. Furthermore, about half of bank revenues are fees for services that don’t even involve loans and can’t be replicated by DeFi products, such as overdraft fees or ATM charges. So where do the magic internet money believers think their DeFi interest comes from?

What Determines a Savings Account Rate In Traditional Finance?

Ultimately the rate you receive on a standard savings account is roughly determined by financial gerrymandering by central bankers. They set the rate that banks can borrow money at from other banks through the Federal Reserve rate and that rate has been basically nil for the last ten years at around 0.25%. Why are banks going to pay you more than 0.25% when they can borrow at that rate?

Frankly, there are more deposits than banks know what to do with and only lend out about 70% of their deposits, so they aren’t even maximizing the amount of collateral they can loan out which is why the largest banks only pay a 0.01% APR. They don’t need any more of your money and certainly aren’t going to pay more than they have to.

Why aren’t banks lending? Banks took some sizeable historical charge-offs during the Great Recession, so perhaps they haven’t wanted to take as much risk since then. Or maybe the question is why aren’t borrowers borrowing? Up until the economic collapse, the ratio of debt-to-income was increasing, but has dropped and stabilized since. The personal savings rate has also been growing. Ultimately the answer to the question of why banks don’t loan more is outside the scope of this article, but it is a relevant point to realize because the Anchor Protocol only lends out a portion of its deposits as well.

The Terra Luna Ecosystem

One of the reasons why I like the Terra Luna ecosystem is its emphasis on stablecoin economics. Bitcoin has failed to be used as a medium of exchange because the volatility of the asset and the transaction fees make it impossible for that purpose. People buy Bitcoin now as an investment, with sort of a digital gold with limited supply argument.

Various other competitors have come along to joust for the title of value transfer coin, including Ripple, Stellar, Monero, Z-cash, Nano and others. While they have all improved on the transaction fees, they still suffer from the same problem of a lack of a peg, and go up and down with the waves of the crypto market.

If you have a contract, you want to know what the value is going to be worth at the end of that contract in your own currency. If you want to save some money or load a payment app to use on groceries later, you don’t want to put on market risk before you get to the grocery store. Stability and low fees is what will drive cryptocurrency to mainstream adoption beyond simple speculation which drives most of it now.

Right now there is $162 billion in stablecoins and it has been growing along with the general crypto market, but it is still a drop in the bucket of nearly $3 trillion in total cryptocurrency valuation.

Terra USD (UST)

One of the major problems of stablecoins for decentralized finance (DeFi), is that most of them are issued by centralized authorities. USDT is controlled by the Bitfinex exchange, USDC is issued by the Circle foundation, BUSD is issued by the Binance exchange, and GUSD is issued by the Gemini exchange.

This is a problem because these centralized authorities have the power to invalidate any of the stablecoins they have issued, based on whatever criteria they decide. Maybe a government wants to seize the assets, or a hacker’s bounty is to be invalidated, but money is freedom and centralized authorities could use their power to censor opponents or serve their own interests, such as printing more coins than they have backing for as is claimed about Tether.

Herein lies one the advantage of the Terra USD (UST) stable coin. It is decentralized and its value is determined algorithmically through its relationship to its sister coin, LUNA.

When a cryptocurrency buyer trades another crypto for UST, that transaction forces up the value of UST a little bit based on supply and demand. If there are enough buyers of UST relative to sellers, the price of UST will start to deviate from its peg and become larger than $1. At that point, UST holders can swap 1 unit of UST for LUNA and get that extra value. Similarly, if UST is trading less than $1, LUNA holders can burn $1 of LUNA value for 1 unit of UST, getting a slight discount. Arbitrage forces the UST to track $1.

Terra Anchor Protocol

The second major advantage of the Terra Luna ecosystem is their savings account protocol. Since its inception in early 2021, it has been paying around 20% APY interest. The basis of this article is why that rate is unsustainable.

Some people refer to this as “Anchor Protocol staking,” but staking is not the proper term here as you are loaning your UST.

Anchor is literally the anchor (hence the name!) for a lot of other dApps that are coming down the line that will provide users with a full money management solution from savings and investing to payments for goods and services.

Terra Mirror Protocol

There are a lot of other noteworthy dApps on the Terra ecosystem, but I quickly want to mention the Mirror Protocol which allows you to buy synthetic assets like stocks and exposure to commodities using your UST. While most people in 1st world countries already have brokerage accounts, this is the kind of innovation that opens up the investing universe to the world that doesn’t require paying large foreign transaction fees or having minimum investment amounts.

The three concepts of a USD based stablecoin, saving and investing is a powerful decentralized concept.

Where to get UST

UST has only been around a little longer than a year so not as many exchanges carry the native version of it but instead carry the wrapped ETH version. Coinbase, for instance, carries the wrapped version and if you buy it there it requires a whole lot of extra steps and fees to get it to Terra station via bridges.

Crypto.com carries only native LUNA, which you can send to your Terra station directly and swap for UST for small fee. Using their app, you’ll pay a 1.5-2% mark-up on every trade, so I can’t recommend them.

The largest cryptocurrency exchange Binance announced on Christmas Eve it will list UST, so if you already have them you are all set. Readers on Reddit complain about Binance constantly, so I wouldn’t recommend opening a new account with them though.

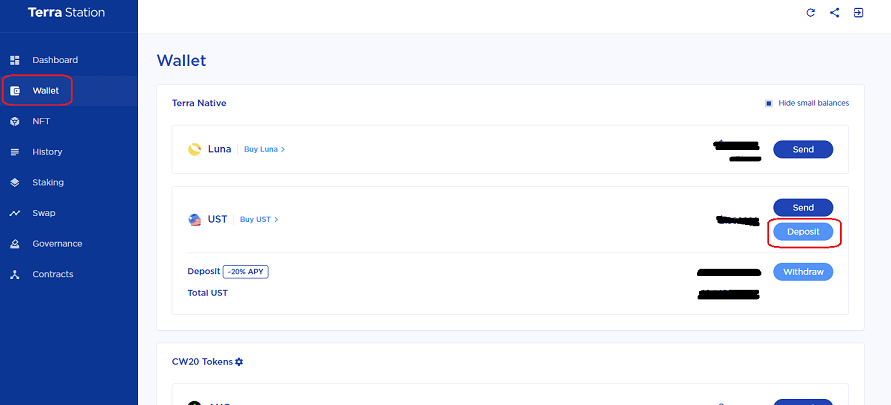

As such, once you acquire UST, you simply withdrawal it to your Terra Station wallet address and click on the “Wallet” tab and then “Deposit.” It’s that easy.

Of course, if you are contributing any significant amount of money, make sure you use a hardware wallet to keep your funds safe. You’ve probably already read about crypto hacking and scams repeatedly, so don’t become another victim.

Is Anchor Protocol Safe? 3 Primary Risks

Before we talk about the economics of Anchor in the next section, I first want to bring forth the various crypto risks that you don’t face in traditional finance. How safe is anchor protocol?

PRO-TIP: I rolled over a 401k into an IRA, and Capitalize‘s FREE service couldn’t have made it any easier to do. They work with all the major brokerages and handle the paperwork for you.

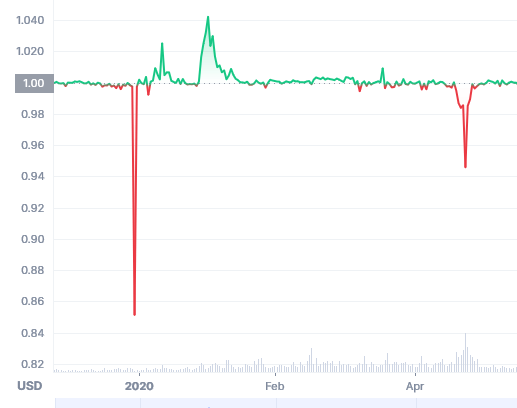

UST De-Pegging Risk

Since UST is determined algorithmically and is only backed by the value of its sister coin LUNA, the conversion ratio can deviate from 1:1 during periods of market stress. Bringing UST back to $1 requires burning LUNA for UST, which makes fewer LUNA available to sell and provides an arbitrage opportunity for when the peg returns for those willing to take the bet.

UST has only been around for a year, so it really hasn’t been battle tested during the worst periods of market volatility. Back in Dec 2020, the UST lost 15% before later recovering. It also had another episode in May 2021.

The real concern is if the recovery does not occur and UST just spirals down to zero. This actually happened to a similar USD pegged coin IRON, from Iron Finance, over the summer of 2021 that used a similar model of having a sister coin as collateral. Shockingly, 75% of IRON was collateralized by USDC and the system still failed.

Will that happen to Terra UST? While it is impossible to rule it out entirely, there are some reasons why it is less likely to end up with the same fate.

Firstly, the only purpose that Iron Finance seemed to encourage was yield farming and using leverage in a recursive way to get 100%+ APYs. There are some people that use Anchor to borrow UST to buy LUNA and then deposit it again to lever up, but as we will see in the next section total UST borrowing inside the ecosystem is less than 20% of the UST value.

IRON didn’t really have a use case other than yield farming, whereas the usage of UST is spread across the whole Terra ecosystem in Anchor, Mirror, Pylon, and a growing number of dApps.

The second reason is that real money is being made in the Terra ecosystem with Chai (payment app in Korea) and blockchain transactions, so Luna has inherent value with cashflow, unlike the TITAN coin that backed IRON. You basically just had to believe that TITAN was worth something on faith. What is the true intrinsic value of LUNA? That is not known, but if real business revenues are accruing to stakers, then you know it is at least worth something.

Thirdly, there are daily limits on how much LUNA can be minted (with Proposal 90) to stabilize the UST peg. IRON and TITAN death spiraled because an infinite amount of TITAN could be minted on the day of the crash. Sometimes things need to calm down to prevent the panic selling into a self fulfilling prophecy. This should be changed to be a percentage of total value, not a fixed limit, otherwise there won’t be enough arbitrage activity to force the peg as UST grows larger and larger.

The emerging concern: For the burn and mint mechanism to work properly, there must be enough value in LUNA to make sure that UST is able to maintain its peg. At any point, crypto can flash crash or otherwise decline rapidly and if the value of LUNA falls significantly below the value is UST, there is risk to a total collapse as LUNA can enter a death spiral supporting UST until there is nobody left. It’s a bit concerning about the growth of UST relative to LUNA. When I first started researching it in 2021, LUNA was valued at more than 5 times the value of UST leaving a huge margin of safety. Before it collapsed, LUNA was less than 50% more.

UST is Now Backed by Partial Reserves

A pretty major development that caused a surge in the price of the Terra Luna sister-coin is that the Luna Foundation Guard raised $1 billion to create a UST Bitcoin reserve fund. During periods of extreme volatility, these reserves can be used to support UST. Founder Do Kwon has expressed interest in eventually getting the reserves up to $10 billion.

With UST assets currently at $16 billion and growing, it’s only a small portion of the total value, but for an algorithmic stablecoin without any underlying backing other than the burning mechanism between it and Luna, this is extra support from another cryptocurrency without a direct relation to the project. This gives a huge boost of confidence to the Terra UST ecosystem future.

Is Anchor Protocol Secure? UST Smart Contract Risk

This is always a risk in every blockchain that there might be a bug in the code that allows a hacker to steal funds. While Anchor has been audited by Certik, so was Poly Network that was hacked for $600,000,000 this year (loot was later returned).

Auditing, while nice to know that a 3rd party reviewed the code, is not the final say on whether there is a bug that can provide an opportunity for theft of funds. Hackers are clever people and always trying to figure out new ways to probe security. Additionally, new major security bugs that span the whole internet come out all pretty regularly, so no bugs in the past does not guarantee no bugs in the future. Log4J anybody?

The good news is that there is a $1,000,000 bug bounty out for anything critical, which is strong faith from the Terra team that the system is secure today. Furthermore, if a hacker or software engineer does eventually discover something critical, they have an opportunity to get street cred and a legitimate payout without stealing funds.

Crypto Flash Crash

Crypto flash crashes happen pretty regularly where the entire crypto market drops 20% in a day and more over longer periods of time.

Anyone who has borrowed money on the Anchor Protocol by bonding their assets is at risk of losing their collateral when this happens. Furthermore, when these loans are liquidated, the borrowers are no longer paying interest to the depositors which pressures the interest rate.

Is Anchor Protocol a Ponzi Scam?

In any inflationary token system that only uses that inflation to pay earnings, that is essentially what you are dealing with. If you can grow demand to outrun this inflation, the effects aren’t felt until growth peaks.

That’s not the case with Anchor as there are real, but subsidized (as we will see below), revenues coming in. Furthermore, since Anchor pays out UST on UST, and not some utility token that involves market risk back to USD, it doesn’t require a constant stream of buyers to prop up the value of your earnings.

Furthermore, Anchor is open source and there is nothing to suggest that there is some hidden mechanism inside Anchor that is just robbing Peter to pay Paul.

Luna Inflation Rate

It’s also worth looking at its sister-coin Luna since it is where UST derives its value.

Prior to the Columbus-5 upgrade, LUNA was obviously inflationary through a percentage of burns being paid to validators (most cryptocurrencies are inflationary), but governance removed that mechanism.

The Terra documents do describe an inflationary mechanism based on the staking ratio, but I haven’t been able to find any current specifics how it actually applies today. Messari pegs the inflation rate at 3.5%, but again it is not clear to me where that data comes from.

At least since the Col-5 upgrade, Terra Luna has become deflationary according to this Luna Total Supply History chart.

Inflation or deflation, LUNA holders bear this risk and reward. But a strong LUNA all but guarantees a strong peg for UST.

Insurance

Inside the Anchor Protocol they link to some third party insurers where you are able to purchase insurance for both depegging and smart contract risk for about 7.32% a year total.

Ultimately the insurer decides what they will pay out and it is currently unclear if these insurers will even have enough solvency to payout to all their holders if the entire system goes under. There’s about $10 billion in UST value but it is unclear how many are insured.

In DeFi, few things are regulated. Can you insure the insurer? And is the 7%+ a year cost worth it to you?

The Anchor Protocol Interest Rate Explained: How Does It Pay 20% Yield?

This should come as no surprise to anyone who has worked in finance, but the Anchor Protocol APY is not sustainable in the long run. The greatest investors in the world earned 20% yearly and had to take market risk to do so, so it is unrealistic to think that this would come risk free for a deposit account.

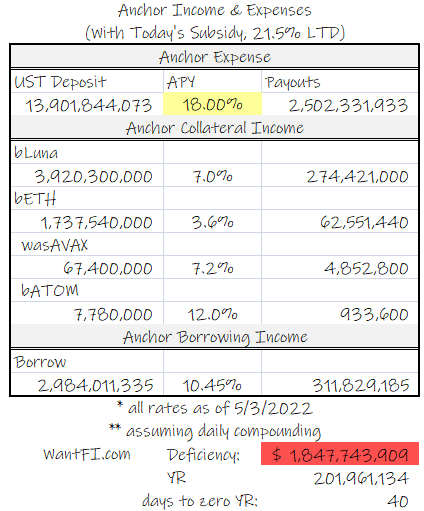

How does the Anchor Protocol work? Anchor earns income through 3 primary sources: Borrowings, Collateral and 1% of liquidations and I detail the cause of the income deficiency at the end of these short descriptions.

Borrowing Interest

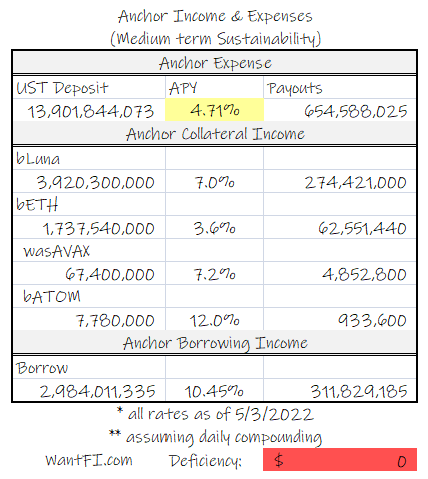

The rate that borrowers are currently charged is about 10.45% APR and there is about $3 billion being borrowed.

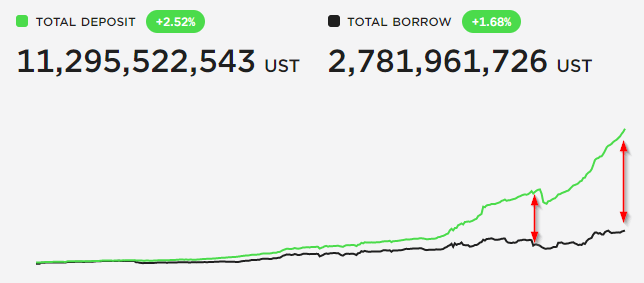

We can see one of the chinks in the armor is that the deposit amount that the Anchor protocol has to pay interest on has been growing at multiples faster than the borrowings that they can earn income with. This widening gap negatively pressures the interest that can be paid to depositors.

Collateral Staking Interest

Collateralized loans are really the only type of loans that can be made in DeFi since the actor behind a wallet could be anyone and there is no way to establish riskless credit. The first lender to offer such loans without collateral will declare bankruptcy the following day since there would be no incentive to pay them back.

However, since each loan is a collateralized loan, the Anchor Protocol can turn around and stake or loan these assets and generate income to pay depositors.

Why would anyone borrow against their crypto holdings instead of just selling them outright? This comes back to the 10,000 BTC pizza argument where those who HODL crypto don’t want to sell and miss out on further gains, but they want to be able to use some of the money today.

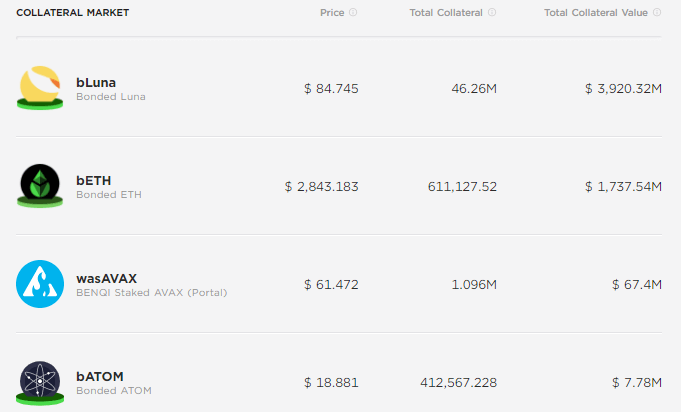

bLUNA, bETH, wasAVAX and bATOM are accepted collateral types, and support for more cryptocurrencies is on the way.

The average loan to value (LTV) ratio on the Anchor protocol is about 47% currently and the maximum leverage allowed is 60%.

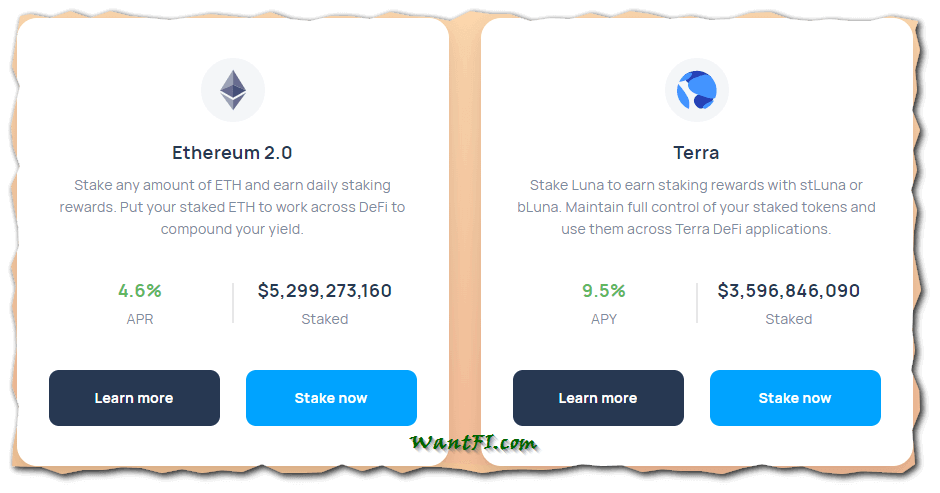

The Luna staking return fluctuates pretty regularly, but it is currently earning around 9.5% a year, and bonded Ethereum is earning a 4.6% rate through their partner Lido.

One concern that has been raised is that 50% of the bLuna collateral is concentrated in 4 wallets.

Anchor Protocol Can Not Pay The Current Yield Indefinitely

The Old Static Interest Rate System

This is what the table used to look like before May 2022 when there was a static rate (the dynamic rate table is after the next section):

The Anchor Protocol has $13.3 billion in deposits and would need to payout $2.5 billion in interest per year. Most of their income comes from bonded assets, but even with the borrowing rates tacked on, herein lies the problem: there would be a $1.8 billion a year deficiency, at today’s rates, deposit and loan levels.

Yield Reserve Under Pressure

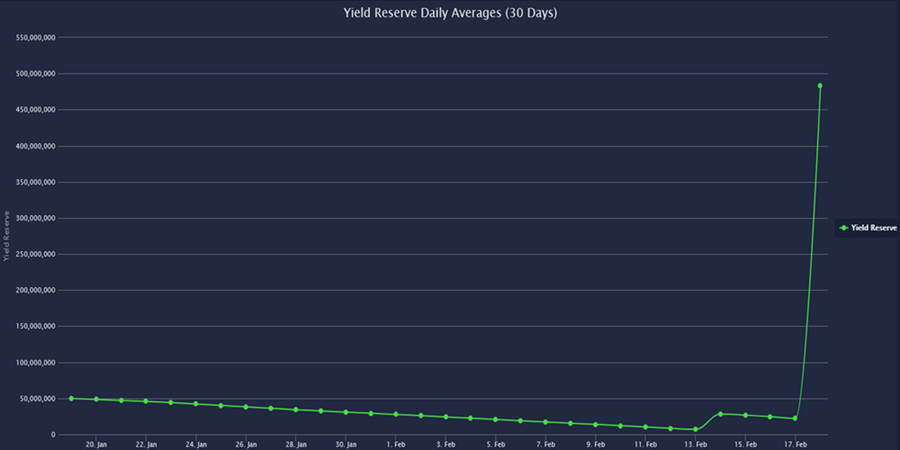

When there is a deficiency, it must pull from the yield reserve. When there is no yield reserve, the deposit rate will be forced to the market clearing rate, which we will estimate in the next section.

The yield reserve has been under constant pressure since Anchor was launched because deposits have vastly outrun borrowings as investors clamor for the near 20% interest rate on a stablecoin.

Back in July 2021, Terra Form Labs injected $70,000,000 UST into it because it was at risk of running dry at the time. The yield reserve was projected to last 1.5 years, but deposit assets tripled in only a few months afterwards which drained reserves nearly to depletion. Then Terra was forced to come up with another bailout solution on Feb 18, 2022 to the tune of $470,000,000!

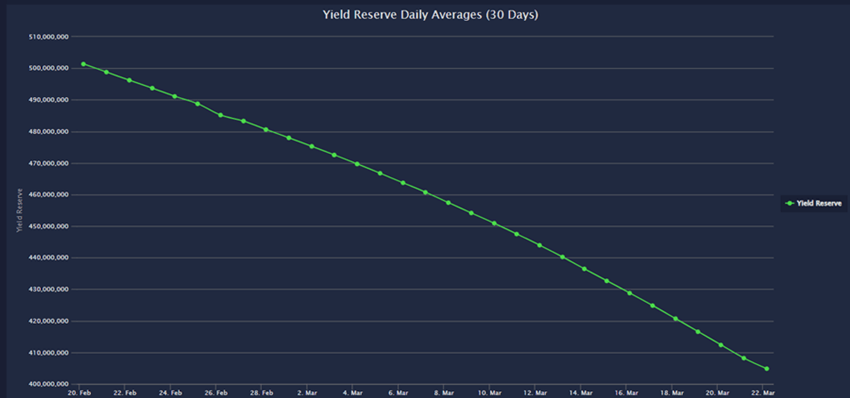

They pulled that rabbit out of a hat, but the depletion continues:

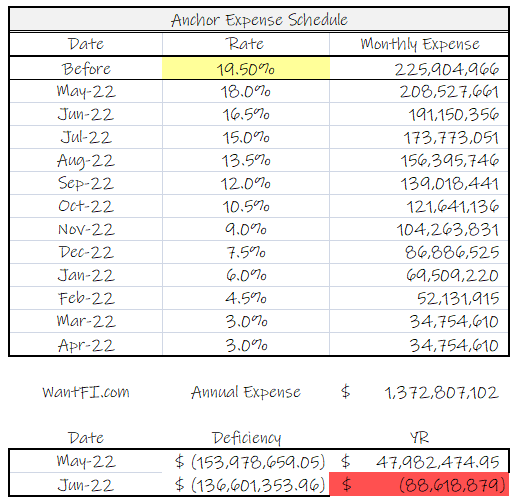

Without a dynamic rate adjustment system, the yield reserve would have run out in less than 2 months after May 2022.

Dynamic Interest Rate System

Because crypto investors have been clamoring for yield and various blockchain partnerships have been announced that creates leverage in the system, the growth in deposits has created a huge interest expense without a corresponding increase in borrowing and collateral income. Eventually the Terra Luna Foundation will run out of money to subsidize Anchor Protocol yield reserve if the rate is not lowered to something more realistic that balances the income and expenses.

As mentioned in the introduction, Proposal 20 is their first attempt to create that balance. The interest rate is now somewhat dynamic and adjusts the interest rate up (lol) or down a by maximum of 1.5% based on if the yield reserve grew or shrunk. I think that they capped it at 1.5% to ween investors off the high interest rate expectation over a year instead of dropping it down 10% immediately and creating panic.

The lower interest rates should slow down growth, but we will have to see by how much and if the rate gets to a point where deposits actually shrink.

In the next section I show that the long term sustainable rate is about 3%, so I project that the yield will keep falling until it reaches that rate.

Unfortunately the rate reduction is not enough and comes a little too late. The yield reserve is still scheduled to be depleted in June since it is currently blowing through $4 million per day.

That is, of course, unless more magic internet money shows up to again top off the yield reserve.

Subsidized Borrowing

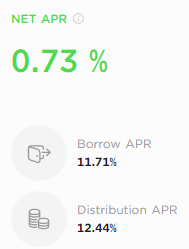

One of the reasons why Anchor is able to generate a big portion of their income is because borrowers are being heavily subsidized to take out loans. As of this writing, borrowers were being paid 0.73% to borrow! (Loans currently cost 5% in May) Obviously that doesn’t make sense from a long term economic standpoint, but Terra is paying for Anchor growth and adoption.

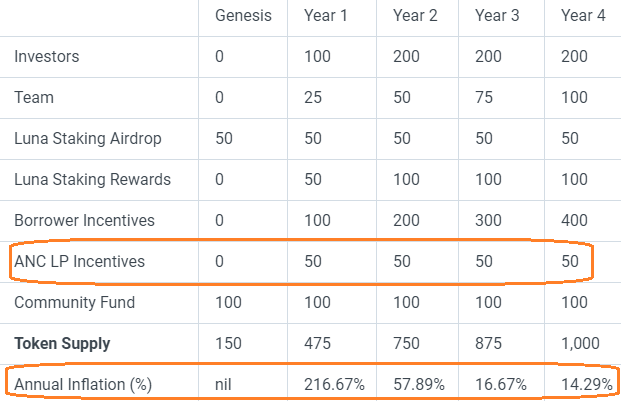

The following is the inflation supply schedule, which means that ANC token buyers are diluted every year that there are incentives and the price of the ANC token will face headwinds in the short term. Again as a UST holder, this is not your problem, but it is important to realize why borrowers are paying such an outsized interest rate and when that gravy train will start slowing down.

The goal of course is that when the subsidies run out by 2024 there will be a lively ecosystem for savings and loans on the Anchor Protocol. The interest rate will have to drop to be self-sustaining because people will no longer receive payment for borrowing and without free loans, borrowing activity will also decrease.

The previous borrowing rates which made up a majority of their income was about 20%. Frankly, few people are going to borrow at a 20% rate and have to post 2x collateral for the privilege. Other platforms such as Celsius, a technical Ponzi, or Nexo allow you to choose your Loan-To-Value (LTV) ratio, but with 2x collateral, the rate is just under 9%. MyConstant offers loans with a 1.5x collateral ratio where one can borrow $10,000 at 7% APR with $15,000 posted collateral. So it looks like a 7-9% rate is about where the market rate will clear with 2x collateral.

The current (unsubsidized) borrow rate is about 10.45%, which is reasonable.

Scenarios For Sustainability

We can estimate what market clearing interest rates are by using today’s data and just finding the rate that doesn’t have a deficiency to the yield reserve. This is the rate that Anchor will be able to pay after the yield reserve is no longer topped up with extra reserves and is the medium term sustainability forecast.

For future, longer term forecasts, we can estimate what the market clearing interest rates will be by making changes to the loan-to-deposit (LTD) ratio. We don’t know what levels of deposits and loans will be in the future, but changing the ratio estimates the balance between income and expenses the Anchor Protocol has to maintain as deposits and loans grow in relation to each other.

Medium Term Sustainability

We take the current levels of deposits, loans and interest rates and compute what a sustainable payout will be until the ANC rewards run out in mid 2024. Because deposits vastly outweigh borrowings and the borrowing rate income has been halved since last year, the mid-term sustainable rate is now about 4.7%.

Of course there are two competing forces that at some point deposits will likely pull out if the interest rate gets low enough but more growth will occur because people will hear about Anchor over time, it will have more trust from longevity of not failing, and frankly it still beats any regular savings account rate.

Long Term Sustainability

We can make some modeling assumptions about what might occur when the ANC rewards run out and taking loans is no longer subsidized. Since the borrowing rate has come more in line with competitors, I feel like maintaining 70% of the borrowing ratio is not unreasonable.

So if we assume that 30% of the loan volume disappears, then a sustainable rate would be just about 3.3%, which is still currently better than most other DeFi yields like AAVE and Compound.

If deposits double or triple by 2024 and the spread between depositors and borrowers continues to widen, this forecast might be too optimistic.

If the borrowings end up being half the current ratio of loans-to-deposits, then the sustainable yield will be about 2.35%. So as you can see, the rate starts to converge to other DeFi platform rates, which shouldn’t be a surprise.

Anchor Protocol Review Summary

The Terra ecosystem offers an interesting set of growing dApps and one of the most useful to cryptocurrency adoption is the Anchor Protocol savings account on a stablecoin. You can park your profits and still get a decent return without taking on extra market risk.

While Anchor is currently paying just under 20% 18% APY, the rate is scheduled to drop 1.5% per month until a rate that balances the yield reserve is found.

The Anchor Protocol has won significant adoption in deposits, but now with the first marginal interest rate drop, we have yet to see how much this will affect the demand for UST. The long term stable rate of interest is around 3%.

This rate is still superb compared to traditional savings accounts and other DeFi lending platforms and therefore it will continue to attract capital to the Terra blockchain ecosystem.

Always remember in crypto you face risks that you don’t face in traditional finance such as currency depegging and smart contract hacks. You can buy insurance for these two risks, but do you trust the insurer and is the cost worth it to you? These are all things to think about.

As the crypto market matures, gets poked and prodded, and people get more comfortable with DeFi, Anchor has a real shot at becoming the defacto savings account of the DeFi universe.

Just be mindful of a “bank run” situation near the end of the yield reserve depletion. It could cause a lot of pressure on the UST peg if billions of dollars of capital are racing out the door at the same time, so you might want to get ahead of that by a couple of weeks before zero.

Free Investing Tools

- Have Capitalize handle the paperwork for your 401K rollover to any brokerage, for FREE!

- Where does your money go each month? Track all your accounts and see if you are on track to retirement with Empower, for FREE! I use it myself to monitor my mom’s accounts to make sure she isn’t falling for scams or being defrauded.