Celsius Network Scam: A Technical Ponzi Scheme

Published on January 18th, 2022

July 2023 Update:

It took a YEAR for the CEO to be arrested for fraud. The government is completely useless in investor protections and only pays attention after millions in losses to investors.

July 2022 Update:

Celsius Network files for bankruptcy.

I showed right here why Celsius was operating as a Ponzi Scheme and advised people avoid this investment almost 6 months before it imploded. The most common response to my criticism was, ‘Well, I’ve never had a problem before.’ That is a classic problem with Ponzis: you never have a problem until one day you do.

In this article, I continue my review of alternative investment platforms that have been proliferating because with interest rates low for so long, people have been desperate for investment returns. For many years, savings accounts offered 0% rates, so savers and investors were incentivized to take larger risks for the alternative investment platforms advertising 8-10% rates.

If you’ve been involved with crypto you’ve probably encountered the handful of Centralized Finance (CeFi) platforms like the Celsius Network. In this article I give an honest review of the platform and point out a variety of red flags. I wanted to like them for those juicy 8.5% yields, but there are just too many issues for me to risk capital on this platform.

April 13 Update:

USA users will no longer earn interest on newly deposited funds at Celsius unless they are accredited investors after several state lawsuits. This follows the SEC enforcement and $100 million penalty applied to BlockFi which previously offered the same product (Nexo stopped offering their crypto earn product to USA users on the same day as BlockFi).

Furthermore, there are some unique risks and potential red flags that we will discuss that retail investors might not be getting compensated for when placing their cryptocurrency assets onto this platform.

What is Celsius Network?

As cryptocurrency has expanded in usage over the last few years, plenty of people have purchased Bitcoin, Ethereum and other coins and have just left them sitting in a wallet for years waiting for them to appreciate as part of their investment portfolio. It can sometimes be a very long wait when a cryptocurrency bear market hits and lasts for several years.

It’s dead money just sitting around.

Celsius and a few others including Nexo and BlockFI realized that all these capital assets are just locked away and not doing anything productive and came up with the idea of a marketplace for lenders and borrowers, similar to a bank. Depositors can turn their cryptocurrency into a yield bearing assets and borrowers can convert some of their gains into usable cash without incurring a taxable liability.

The Celsius Network platform also provides the opportunity to lever up a position or short a position, so in a lot of ways they make markets more complete as they unlock capital and fulfill various needs that were not possible before.

Overall I think these kinds of businesses are good for cryptocurrency adoption, if they don’t implode eventually, that is.

How Celsius Reportedly Makes Its Money

The interesting thing about Celsius is that in the US, they are a private, unregulated investment business, not subject to the same rules that would apply normally to a typical bank, investment manager, or publicly traded company. This status offers Celsius the opportunity to engage in a lot of alternative cryptocurrency investments free from regulatory restrictions that would weigh down typical fiduciary investment managers.

They are able to get around the typical banking and money manager rules because they do not deal with USD fiat; their business is strictly cryptocurrency only, which the IRS has ruled to be property, so even USD stablecoins don’t qualify as money. This is was essentially a loophole for a firm like Celsius to get around accredited investor status, which excludes most of the country from participating. After the state lawsuits mentioned at top of this article, their lend product is now only available to accredited investors, but it took a few years.

Celsius does not only connect depositors and borrowers and provide an avenue for investors to lever up and short, they effectively operate like a private equity business with a handful of alternative cryptocurrency investments.

For instance, they recently purchased a cryptocurrency farm, they stake nodes on Proof-of-Stake chains, provide money to DAOs, provide short selling inventory to hedge funds or exchanges, and they trade around their custom CEL token. Their business has a lot of potential revenue streams that are much different than typical investment managers are able to take advantage of.

For an individual investor unable to engage in the same revenue streams on their own, it’s a way to hire a manager to diversify one’s portfolio. But you have to be careful because their investment portfolio is opaque and you don’t have a granular insight into what they invest into or own.

The worry is that they are just doing the same DeFi strategies that you are already doing on your own. For instance, it came out that Celsius had invested $500 million into the Anchor Protocol that recently failed. They reported they got out early so it sounds like they didn’t take much of a hit, but if you also invested money on your own into the Anchor Protocol, you unknowingly risked more capital to the platform than you thought.

Celsius is Currently Operating as a Technical Ponzi Scheme

Unfortunately, the revenues are not currently sustaining the business. When I first started looking into the company, I was very intrigued by the following statement because I have looked at the financials for hundreds of companies:

Celsius returns up to 80% of what we earn (and that’s before we deduct any expenses)

Source

That sentence belies the fact that they are paying out 80% of revenues, not earnings. Very few tech based companies have profit margins even north of 40%, so that was instantly clear to me that their operations are not self-sustaining and they were paying out more interest to investors than they were generating from business operations. If payments are not coming from revenues, it can only come from one other place, other investors. That is a technical qualification of a Ponzi scheme. In a following section we break down some financial reports showing their income and losses.

Now, it is clear that they want to grow into a self-sustaining cryptocurrency investor business by creating income streams in various cryptocurrency arenas, but that still doesn’t absolve them from the fact that current investor returns are not sustainable. Do you wonder why they keep reducing the interest rate they pay over time? Well because they have to attract more investor money to pay the high rates and there is a limit to how fast the platform can attract new money, especially as crypto adoption began to slow towards the end of 2021.

This is a unique business because if they didn’t have crypto investors hoarding their money on the platform to grow their business, they would have to issue debt junk bonds with pesky paperwork, recourse and stipulations. I show below that when you place your money onto the Celsius Network, it becomes their property.

Ask yourself if a regulated fiat money business would be allowed to Ponzi-out for a while until their revenues caught up with the returns they were paying. Most certainly not. Unfortunately most Celsius investors are likely not aware that their returns are coming from other investors and there might not be enough capital to go around to fulfill all withdrawal requests if a large percentage of investors wanted out at the same time.

Several states including Texas and New Jersey have issued cease-and-desist notices to Celsius and similar businesses from operating in their territories.

On one hand you can interpret the optics as a classic tech startup that burns through billions of dollars to grow. On the other hand, since they are taking investor money and paying out more than they are earning it’s a Ponzi scheme for the time being. Take your pick of how you feel about it.

Venture Capital Investments

You might wonder why a large investment manager and other venture capitalists would invest into Celsius if they are currently paying out to investors more than they are earning. It’s because Celsius is being treated like a startup that loses money for a number of years until it one day becomes profitable. They are also likely betting it’s the next Lending Club type platform with greater fools ready to take the IPO off their hands.

However, there’s lot of irony here because Celsius in 2019 published a now deleted blog post criticizing a competitor for using VC funds to subsidize investor returns when they do the same thing.

2020 Financials (Nerd Zone)

You can safely skip this section if your eyes glaze over while reading operating reports.

The financials come from the UK where they also operate. Unfortunately there is a huge lag from the period when they publish the reported period, so we only have information up until Dec 2020 which leaves out some of their recent developments like the cryptocurrency mining farm they just purchased. The financial reports also aren’t as detailed as the reports you will find in the US. Furthermore, they are scanned with horrible formatting making them hard to read.

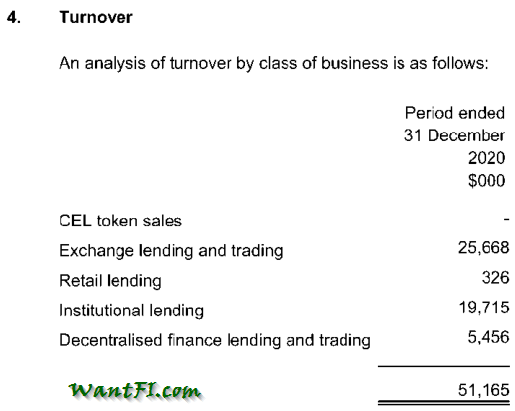

However, we can gain some insights from looking at them. At the end of 2020 they had two primary revenue streams:

1) lending of securities to exchanges, which is basically supplying liquidity to exchanges and

2) institutional lending, which might consist of institutions getting leveraged or short exposure.

PRO-TIP: I rolled over a 401k into an IRA, and Capitalize‘s FREE service couldn’t have made it any easier to do. They work with all the major brokerages and handle the paperwork for you.

Retail lending is a pittance of their income so the democratic “borrow like a billionaire” Pizza HODL argument doesn’t appear to hold much water on their platform. All in all, they made $51 million in revenue in 2020.

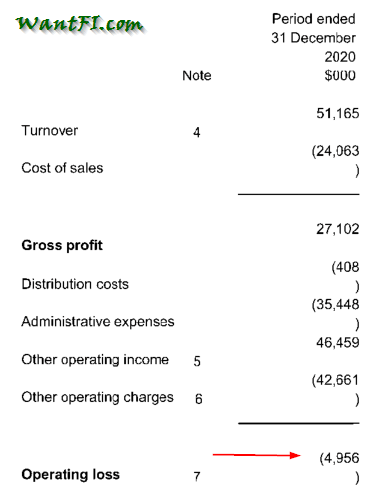

I could not find a breakdown of revenue paid to investors. Cost of sales is only half though, so it doesn’t match up to the advertised 80% figure. Cost of sales could be other things like marketing, or referral signup bonuses.

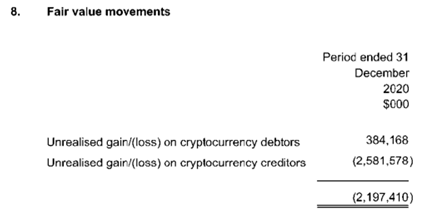

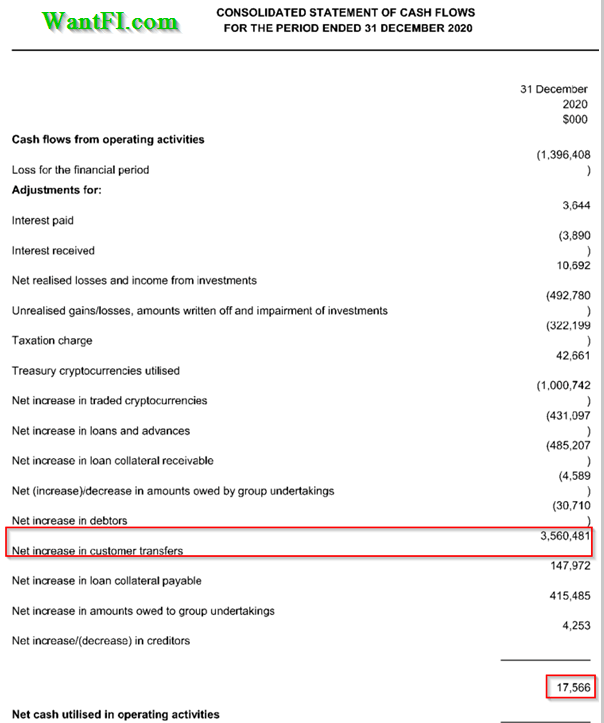

After you remove the cost of sales and the costs to run the business, the end result was an operating loss of almost $5 million, if we ignore two large competing forces of unrealized loss on cryptocurrency in their possession and mark-to-market gains of their CEL treasury tokens which led to a GAAP (presumably) loss of $1.4 billion for the year.

One of the odd things to me from the income statement was the $2.2 billion in unrealized losses from cryptocurrency on their balance sheet. 2020 was an up year for Bitcoin and Ethereum, which are presumably the most plentiful assets stored on their platform, aside from stablecoins. They don’t break out the distribution of their cryptocurrency inventory, but how did the depositors have such large unrealized losses? It’s a little weird.

Also interesting to me was even with the $3.5 billion increase in customer deposits, the cash flow from operations was only $17 million.

I very much look forward to updating this article when the latest numbers are published for 2021, expected in a few months.

The CEL token

As part of their original whitepaper they fed people a line of BS about the necessity of it:

Our lending and borrowing model requires a blockchain and an open ledger technology, it also requires consensus and a global footprint of coin holders in order to really gain traction and complete our mission. Any loan we issue may be collected from thousands of individual coin holders which may be switched at any time. Only a smart contract capable of tracking and paying in micropayments can handle such complexity.

The thing is, they don’t have a blockchain and CEL is only a simple utility token with standard functions on the Ethereum network. Managing a loan ownership profile does not require a blockchain. A simple database for a centralized authority like Celsius does the job quicker and cheaper than a blockchain can.

The real purpose of this token was to create an ICO that netted them $50 million without strings to start financing their operations. But there is one other valuable feature: they can pay investors with this token they minted out of thin air because non-US investors have the option to receive their returns in the CEL token for an extra 2% yield and it costs Celsius effectively nothing.

As such, this token really serves no purpose for investors. If you hold CEL or take earnings in CEL, it’s on you to send it to an exchange and get a favorable conversion to the cryptocurrency of your choice. You are taking market risk that its value will drop, which reduces your effective yield bonus, and exchange rate slippage risk. Additionally, if Celsius as a business goes under, CEL tokens will collapse in value since there will be no market for them.

The worst part of the CEL ICO is that it didn’t give you ownership interest in the Celsius business. It’s not like a share of stock with an equity claim. All the equity claims on their business are accruing to the venture capitalists who will get a big payday when they IPO.

They do get an A for transparency for which wallets they control that contain CEL with direct links to Etherscan though.

Additional Risk of the Celsius Platform

Company Leadership Scandals

I looked into the past of the CEO Alex Mashinsky. The number of patents and his status as the “inventor of VoIP” seems to be embellished in much of their marketing materials, but overall he seems to be a reputable businessman with entrepreneurial accomplishments through a few companies, so nothing really stood out as being a red flag.

The same cannot be said for some high level company officials though. About the worst thing you can think of happening when placing money into a company managing your finances is the Chief Financial Officer getting arrested for a fraud for a pyramid scheme.

Furthermore, when an early advisor to your firm was arrested for a massive fraud involving cryptocurrencies, that’s a definite concern!

But that’s not all folks.

As a registered money service business that requires rigorous anti-money laundering checks, finding out your Chief Revenue Officer established a side business with a convicted money launderer is not a great look.

This is a lot of smoke coming from the leadership of one company, especially when cryptocurrency frauds were involved.

Not Your Keys….

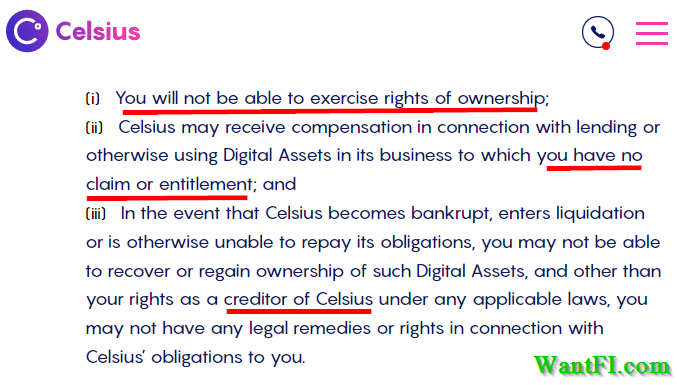

Celsius states in their terms that they act as neither a custodian or fiduciary and “ALL DIGITAL ASSETS TRANSFERRED TO CELSIUS AS PART OF THE SERVICES ARE OWNED AND HELD BY CELSIUS FOR ITS OWN ACCOUNT.” So when you deposit your cryptocurrency to Celsius, it becomes their property to do with as they please and you become an unsecured liability on their balance sheet. Not your keys, not your crypto… to the max!

You may think that they are just pushing out standard legal jargon, but if you put money on a brokerage account and the brokerage fails, you are covered by SIPC insurance.

They Self Insure

In 2021, Mashinsky announced that they are launching a self insurance plan for all.

Another phrase for “Self Insured” is… “Not Insured.”

Celsius recently fell victim to an exploit on the BadgerDAO and lost $54 million in funds. They announced that they would eat the cost and that no customer funds would be lost, which is a good thing, but what happens the next time when it’s 10 times as large of a loss? Cryptocurrency hacks occur ALL THE TIME, with the latest hack stealing $600,000,000 (later returned).

Centralized platforms are complete honeypots for hackers and have shown to be risky places for investors to keep their crypto holdings time and time again.

Rehypothecation

Inside their terms of use, they state that they can “pledge, re-pledge, hypothecate, rehypothecate” the collateral you deposit on their platform.

You might think that if you deposit some BTC and take out 50% of the value as USDC stablecoin, your BTC will just sit there locked away waiting for you to come back and pay off your loan since you have already borrowed against its value. But that’s not what happens. Celsius will then “double dip” and lend out that same BTC you deposited and borrowed from with another loan, potentially to an exchange or institutional investor to short.

Now image that when you borrowed, you chose not to borrow stablecoin to withdraw from the platform but instead decided to borrow additional BTC to lever up your position and leave in on Celsius. You could be in fact borrowing from yourself with rehypothecation and there’s just a database markup for your account balance. By leaving assets on their platform, Celsius has the ability to act as a fractional reserve bank and lever up multiple times through their ability to rehypothecate again and again, in essence expanding the money supply of cryptocurrencies.

This is of course risky, because the cryptocurrency market is ripe with volatility and rehypothecation can create a chain of cascading liquidations of collateral.

How many times do they do this? We don’t know and we have no idea what risk management protocols they have in place. As an unregulated entity, they have a lot of leeway. Prime Trust was worried enough to sever ties with them in 2021 due to this practice and an insider stated that they do it “endlessly,” which doesn’t inspire confidence.

Many of you are probably old enough to remember the market turmoil from the Great Financial Crisis of 2007. One of biggest factors of this calamity was the use of rehypothecation and pledging collateral that was already spoken for again and again. In that case, the collateral was highly illiquid real estate that would have to be fire sold to get cash quickly and led to the housing market meltdown as supply overwhelmed demand. Cryptocurrency is basically a financial product that can be liquidated quickly, but large liquidations can overwhelm the demand, causing the price to plummet, which leads to a further cascade of liquidations and ultimately a death spiral.

Where Rehypothecation Can Go Wrong With Crypto

Opaque Risk Profile

Say a hedge fund wants to lever up their 10,000 ETH position, currently priced at say $3,000 per ETH. They borrow the max $15 million and buy 5,000 more ETH and keep it on the platform. Celsius is earning say 10% on the $15,000,000. They could just stop there and hold custody on the ETH for the 10% interest but instead they decide to rehypothecate the collateral and deposit it on AAVE and earn 4% on the whole 15,000 ETH. The hedge fund is no wiser about where their collateral is at.

The loan looks like a low risk loan to the hedge fund with the only risk being a devaluation of ETH, because they are only borrowing against themselves.

Then say AAVE gets hacked and the entire balance of Celsius ETH portfolio is stolen. Now the true risk profile becomes apparent and not only did they have to worry about devaluation of ETH, and the security of Celsius, but they also had to worry about the security of a third party’s possession.

And that is only one loop of rehypothecation. What if multiple clients are all borrowing off the same asset and the collateral is unavailable?

Bank Run

Since they have recently purchased a mining farm, say it becomes really successful and they start to invest heavily into it. They take another big chunk of their USDC deposits, convert it to USD fiat and buy a mining farm. The mining farm equipment is now a very illiquid asset.

The Fed raises rates, the financial assets including the stock market and cryptocurrency markets tank, and people panic and withdrawal their stablecoins en masse to buy the dip or cover their living expenses. This scenario exposes the potential for a “bank run” on Celsius with them not able to meet the demands of depositors. And Celsius is not FDIC insured.

Is Celsius a Good Investment? Should You Invest in Celsius?

While Celsius may imply they act like a bank, they engage in a lot of alternative investment businesses in the cryptocurrency space that traditional asset managers can not currently get involved in due to regulations. This lends credence to a little bit of portfolio diversification, but the cryptocurrency world is still like the wild west with its own unique risks. You can engage with many of the same cryptocurrency strategies that Celsius is engaging in on your own, but without the centralized risk of your assets.

While Celsius does generate revenues from investing in a variety of cryptocurrency avenues, and they have some new ventures coming down the line, the latest financial information shows they are operating at a loss and customer returns are being paid from new investors. That is the definition of a Ponzi scheme. They might grow out of the deficiency in the future from their real investments, but they could also fail at some point because too many people want their money back and they can’t meet redemptions. (July 2022: I called that one, eh?)

You really have to wonder if the 4%-8% return on your asset is worth the risk you are taking by placing it on their platform, when you can put it onto a DeFi platform yourself without a middleman. When you deposit your cryptocurrency onto the Celsius platform it becomes their property, subject to hacks or mismanagement.

I look at it like this: How many years do I have to place my asset onto the platform to double my money and what is the risk that the investment might go to zero over that time frame? For a compounded return of 4%, it takes 18 years to double. With an 8% APY, it takes 9 years to double. That’s a long time to place your asset on a platform where you aren’t insured from loss.

I would say the risk-reward does not balance and furthermore, you are centralizing your decentralized assets, which is a contradiction of the point of trustless assets in the first place. In all reality you should store your cryptocurrency assets (keys) on a hardware wallet for maximum security and research some DeFi lending platforms if you want to add some extra risk and return.

I can only assume that BlockFi and Nexo operate the same way, but without any publicly disclosed financial documents to go on at all, it’s just a guess (a reader did share that Nexo has real-time independent accountant reports showing they exceed 100% of customer liabilities, which is definitely a favorable piece of information and something that the others CeFi platforms haven’t revealed).

I would suggest that if you are comfortable with these kinds of investments that you split your investment capital across all three platforms to reduce the risk of an implosion by one of them. At least you can diversify your risk profile a little bit, but again, they are probably all doing the same things behind the scenes anyway.

Come join the telegram chatroom for some more investing discussion.

Free Investing Tools

- Have Capitalize handle the paperwork for your 401K rollover to any brokerage, for FREE!

- Where does your money go each month? Track all your accounts and see if you are on track to retirement with Empower, for FREE! I use it myself to monitor my mom’s accounts to make sure she isn’t falling for scams or being defrauded.