Invest In These Alternative Investments? An Overdue Critique

Updated on October 25th, 2023

A plethora of alternative investment platforms have been created over the last few years each promising a new, better way to make money with exposure to an asset class that was hard to get before. Stocks seem so much more boring when you can invest in exotic things like art, wine and ship deconstruction (really!).

All kinds of alternative investments have been doing exceptionally well since the pandemic, and in many ways well beyond what could have been expected even before the pandemic. It all seems pretty easy. Cryptocurrencies have surged 10x in 2021, baseball cards values have soared, and new digital goods like virtual land and artwork have been invented with non-fungible tokens.

So it has become big business for new companies to come into existence talking up the benefits of new investment X.

The Promise of a Better Asset Class

Some of these platforms just tout how they have had better returns than the S&P 500. It might not be their returns, but the historical returns of the asset class. And sometimes they offer a compelling story of diversification.

Some of these platforms have figured out ways to securitize entirely new markets like art, wine and non-fungible tokens. The question is, should you deploy capital to these exotic markets?

I have been researching some of these platforms and generally I lean towards NO on many of them due to the hidden risk that typical investors would not be aware about. Some just make traditional asset classes easier to access, but others repackage, digitize and make more accessible to the average Joe the same strategies that ended up imploding when the housing market was finally crushed in 2007.

And some of them are just so esoteric like investing in virtual land or wine, it just gets a quick laugh about how ridiculous the concept even is.

You used to have to find out about some of these alternative investments through private LPs by word of mouth of a friend or potentially even through a financial advisor. Now, instead of going down to a tenebrous sales office, and signing some paperwork in front of a 55 year old man with a mustache, you logon to a website and check a few boxes about accepting terms and conditions and you are ready to link bank accounts within a few minutes. The risks aren’t mitigated differently but are just put into a new high tech light.

Capital Is Plentiful

They don’t have to fight too hard to get investors because investing is popular right now. Money is flooding the markets and new investors are being minted daily.

Who doesn’t like the idea of making money with money and earning it without putting in any extra effort? Even better is when it appears that the risk of capital is low, or uncorrelated with traditional asset classes.

With government stimulus sending out thousands of dollars now monthly, Americans are flush with cash and looking for places to put it. Some of it has been going into goods and services, but a lot of it has been going into investing platforms.

Capital is Emboldened

And these alternative investment platforms are flourishing because of the perceived lack of risk and the stock market just bouncing back up on every dip.

Investors have been emboldened that there is no risk in investing.

Furthermore, it’s been a long time since there has been a grueling bear market that crushes the investing spirits and these types of alternative “investments” don’t flourish when people are worried about whether or not they will get their capital back because they often have long lock up periods.

Hard to Find Unbiased Information

The first thing that an investor unfamiliar in a new product platform will do is perform a search and see what experience other people have had. Usually the first thing they click on is “Product X: Review”

So, why do you never find negative reviews of these alternative investing platforms?

The answer: Conflict of interest.

Nearly every review article about basically anything on the internet is an affiliate link designed to drive traffic to whatever they are reviewing. Since they want that commission, they won’t write too negatively (if at all) about it. These reviews read like an advertisement about how great the service is. And that’s really what they are, an advertisement.

And quite frankly they probably haven’t thought too hard about risk of the platform they are promoting anyway probably because they don’t even use it themselves.

Some of my links are to affiliates too, but I wouldn’t promote any product or service that I have fundamental concerns with and I didn’t create my site to solely push affiliate products like most bloggers.

But it’s not just blogs that do it; I come across advertisements masked as commentary or reviews on Yahoo! Finance, MarketWatch and CNBC every day. It’s a real problem in the world of financial media. There is a conflict of interest of extolling the benefits of a particular investing platform because of the commission structure.

Anyone can create a financially focused site and start recommending products they have never used, understand the risks of, or even like. People with better marketing skills win in the website game, not the ones with the most thoughtful information or advice.

Seriously though, am I really the only person with a blog out there who doesn’t like Masterworks, Robinhood or Coinbase? All three are heavily promoted by referrals and affiliates.

Unbiased Reviews

So over the next few weeks I plan on reviewing several of these platforms by pointing out any risks that are swept under the rug and whether the diversification is worth it or not

You may want to bookmark this webpage or signup for my newsletter to get the latest information. If you have a preference about any of these in particular shoot me an email to push it up the queue.

These alternative investment platforms fall into various categories:

How Do I Invest in Alternative Investments?

There are a plethora of alternative investment platforms, but be careful as the risks won’t be obvious from the marketing materials.

Masterworks: Investing in Art (read my review)

Crypto-lending platforms like Celsius (I wrote about it being a Ponzi 5 months before it imploded)

PRO-TIP: I rolled over a 401k into an IRA, and Capitalize‘s FREE service couldn’t have made it any easier to do. They work with all the major brokerages and handle the paperwork for you.

Individual Cryptocurrencies (watch out for Ponzi schemes!)

Crypto staking (various)

Vinovest: Investing in Wine. lol.

Peer To Peer Lending Platforms

Prosper, Upstart, LendingClub

Real Estate Crowd Funding

There is no shortage of these:

CrowdStreet, EquityMultiple, Ground Floor Financing, PeerStreet, Realty Mogul and probably a dozen more that I haven’t encountered.

Free Investing Tools

- Have Capitalize handle the paperwork for your 401K rollover to any brokerage, for FREE!

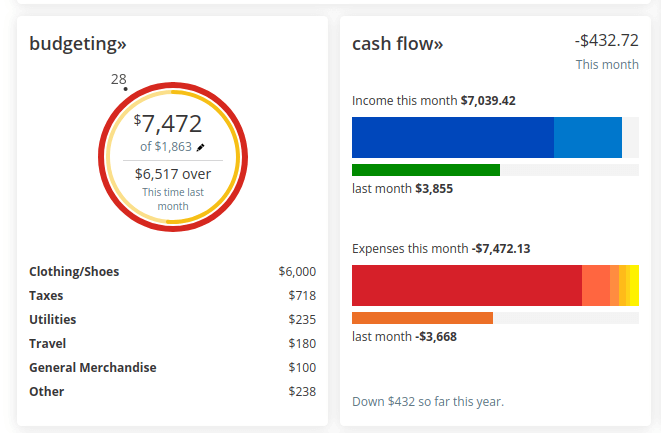

- Where does your money go each month? Track all your accounts and see if you are on track to retirement with Empower, for FREE! I use it myself to monitor my mom’s accounts to make sure she isn’t falling for scams or being defrauded.