How To Spot Bitcoin and Cryptocurrency Scams

Updated on December 17th, 2023

Is Bitcoin a scam? Which are the cryptocurrencies to avoid? How to spot a bitcoin scammer? These are all topics we address in this article.

Cryptocurrency Is No Longer Underground

By now most people are familiar with Bitcoin, and maybe even other cryptocurrencies, because it has been all over the news for years and famous Billionaires like Elon Musk and Mark Cuban tweet about it pretty regularly.

Furthermore, any time Bitcoin clears a major dollar figure, the news media starts pumping out daily articles about it. With the recent rise in ransomware, the negative use cases of it have also been plastered all over the web. It seems unlikely that there are people who say, “Bitcoin, what’s that?” But they do exist. I asked my mother about it and she had no idea what I was talking about.

I told her, in a nutshell, Bitcoin spawned an innovative way to send and receive digital money that is pseudo-anonymous and solved the double spending problem through the use of the innovative blockchain. I then gave her a link to my more comprehensive Bitcoin and Cryptocurrency article which I am certain she still hasn’t read.

Is Bitcoin a Scam? Does Cryptocurrency Have a Future?

There are still debates as to whether the most well known cryptocurrency Bitcoin is a scam. I read tons of comments on news articles where people are so angry talking about it on both sides.

I’m in the camp that Bitcoin is not a scam because it is the original cryptocurrency that solved the problem of sending money trustlessly. It is the most established and dominant digital asset valued at around 1 trillion dollars (with a T!).

It has Chicago Mercantile Exchange futures on it, it has multi-billion dollar funds that hold it, some tech companies are buying billions of it to hold on their balance sheets, and now multi-billion dollar companies that trade it are IPOing. While still speculative with a lot of volatility, it has become very established over the last few years.

If it were purely a scam, what would the scam be, enriching the founder? Every founder of a tech company be considered a scammer in that case and furthermore, there is tremendous evidence that the founder of Bitcoin has never even spent any of his $30 billion fortune. That would be impressive restraint for a scammer.

The truth about cryptocurrency is that people always want to know what its intrinsic value is. It doesn’t have a defined value. But then again, most things don’t.

Bitcoin’s intrinsic value is derived from its network effects, but it’s the same for a product like Facebook. It becomes more valuable the more people use it and it’s pretty useless if only a few people use it. Bitcoin’s value also comes from the millions of specialized computers (known as ASICs) securing the network and processing transactions.

Bitcoin’s price is determined by a global free market and the global market is saying it is very valuable.

That being said, I do believe that a few of the newer cryptocurrency projects have more utility than Bitcoin, but you have to be careful to avoid the fake cryptocurrencies, which we will talk about in a later section.

Crypto Is More Than Just Currency

Not every cryptocurrency is actually trying to be a medium of exchange, or “magic money” out to replace the “fiat” currencies of the world. That’s a mistake a lot of newbies make when they think of cryptocurrency as an asset class. Even Bitcoin itself has become a poor medium of exchange given its high cost and slow transaction speed.

Many of the projects are ecosystems run by legitimate businesses or foundations with real venture capital financing trying to solve real world problems. They might not be problems people in a first world country care about, but they are problems that the rest of the world could benefit with solutions solved by cryptocurrency.

There are cryptocurrency apps for costlessly transferring value, micro-lending, escrowed smart contracts requiring conditions to be met before funds are released, synthetic assets that provide price exposure to real world assets, and new digital Non-Fungible Tokens (NFTs) which is like buying a certificate of authenticity for a digital picture.

I don’t agree that everything will find a utility or have staying power. In fact, I think NFTs are completely bizarre where people have spent millions of dollars buying pictures of rocks and other useless things. That one’s a head scratcher to me, but to each his own.

Many of the cryptocurrency projects work in a B2B sense and try to facilitate functionality to other blockchains either by connecting different ones together, or providing independent information for use in smart contracts (Oracles).

Why Are There So Many Cryptocurrency Scams?

Unfortunately, there are a plethora of crypto scams out there and it’s easy to see why because the transfer the value is near instantaneous, non-reversible, and almost non-traceable (if the scammer knows what they are doing). It also doesn’t require a pesky banker to call up the victim and confirm if they really, really want to send all their money to some other wallet address somewhere out in the world.

It’s impossible to create a list of cryptocurrencies to avoid. There are just too many and with hundreds being created every week.

Cryptocurrency handling and operations is also confusing for new entrants. They need to open a new crypto account, get special wallet software and wallet hardware to store it and when transferring it, have to copy and paste 50 character seemingly random strings. The process is prone to mistakes along the way. Oops, you sent Bitcoin to an Ethereum address? There is no 1-800 number helpline.

Cryptocurrency scams take many forms and include copycat projects, ICOs, “double your money” giveaways, direct messaging, and of course ransomware.

Scams come in many forms.

Copycat Coins

This is the most prevalent of the scams. Caveat Emptor.

Open Source Software

To explain why these are so prevalent, we need to discuss the cryptocurrency software. Bitcoin and every other cryptocurrency project is open source, meaning that the source code is available for the whole world to review, modify and copy and do with what they please. The security of cryptocurrency is in the peer reviewed encryption methodology, not trade secrets of the code, which could be reverse engineered. There are four main sources of risk with cryptocurrency:

- Bugs in the code that allow an adversary to steal coins from others, mint fresh coins, or double spend coins.

- If quantum computing matures soon enough to invalidate the security of the encryption.

- The project is abandoned.

- The cryptocurrency serves no purpose other than to scam others.

Not withstanding a major leap in computer technology for the foreseeable future, crypto bugs are the biggest source of risk right now for legitimate projects, but scam coin projects are a risk for anyone who speculates in new cryptocurrencies.

The newest cryptocurrencies are most exposed to code bugs since they haven’t stood the test of time of hackers trying to break them. Polygon recently had $600 million stolen from them, but the hacker ended up giving the money back, lucky for them.

Also, the newer a cryptocurrency is, the less likely experienced crypto developers and the crypto community have vetted the project.

Crypto Forks

How to identify fake cryptocurrency? Start with these.

Because crypto is open source, it is relatively easy to create a copy of the code and make a few modifications and then spin off your own cryptocurrency, known as a code fork, like a fork in the road. You have to convince others to run your modified software or else it is useless because you’d be the only one using it. Running a skilled marketing campaign, or incentivizing others to recruit more people helps a lot to bring others into your project.

PRO-TIP: I rolled over a 401k into an IRA, and Capitalize‘s FREE service couldn’t have made it any easier to do. They work with all the major brokerages and handle the paperwork for you.

Literally thousands of copycat projects have been created. Usually the marketing that seems to work the best to get suckers to come in and buy is to use some affiliation to another established cryptocurrency, like Bitcoin, and then add to the end a modifier to it like “cash” or “gold” to make it sound like a better version of the original. The “Shiba Inu” copycat was created soon after “Dogecoin” started getting promoted by Elon Musk, just to capitalize on the name and enrich the scammer.

For the outright cryptocurrency scam coins that aren’t even attempting to provide an improvement, the scammer will modify the code to benefit their interests in some way. And then once they have accumulated enough suckers, they “rug pull” and disappear with the funds. Then they rinse and repeat. These scams continue to work because suckers repeatedly bet on them thinking that they might ride it high and cash out before the project fails.

One key part that helps bring in other participants is that when a cryptocurrency project forks, the original cryptocurrency holders get free coins in the new forked project, giving them an instant stake in the new project. We’ll come back to this concept in the next article on the Hex scam, because this is a key feature of instantly creating a community with a vested interest right out of thin air.

It would be much harder to convince thousands of random strangers to research your project and commit new money to it if you had to start from scratch on a completely new code base and blockchain. When you fork the code-base, there are already thousands of people who own a stake and will make money with you if it does well. Therefore, there is already an incentive for existing holders to shill it or talk about it on social media.

Initial Coin Offerings (ICOs)

If you are starting a project from scratch and don’t fork, you need to get your cryptocurrency coin or token out into the hands of users, otherwise it is useless. The way that new projects have done that is with an initial coin offering, which are kind of like an IPO for crypto.

The cryptocurrency developer designs the project code to have a certain supply that is minted instantly and usually sets a certain amount that is minted every year afterwards. It’s a way to raise money for the project to spend on development and doesn’t require a electricity intensive mining process.

Now there are some legitimate projects that have ICOed and were real projects backed by real developers and organizations and have gone on to be successful, but the majority of ICOs have been fake cryptocurrency scam-coins playing on people’s greed for getting rich with the “next bitcoin” which instead just turns out to be the next “bitcoin scam.”

Before committing money to any of these you need to do serious due diligence.

“Double Your Money” Scams

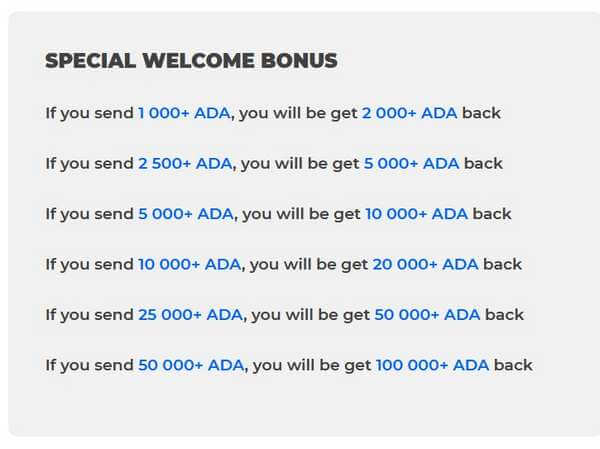

A lot of scams are much simpler and try to prey on people’s naivety that someone is going to give them free money.

If I told you that you for every dollar you wired to me out of your bank account that I would wire back twice as much, would you believe it? No. Then why do so many people fall for it in the cryptocurrency world?

You would think that anyone with common sense wouldn’t fall for these tricks, but often the scammers create fake accounts or webpages that look just like a celebrity or billionaire’s Twitter account. And occasionally they do come from an actual billionaire’s Twitter account!

Twitter was hacked and had messages coming from verified accounts telling victims to send them money and they would send twice as much back. Billionaires didn’t become billionaires by doubling thousands of other people’s money! Use some common sense!

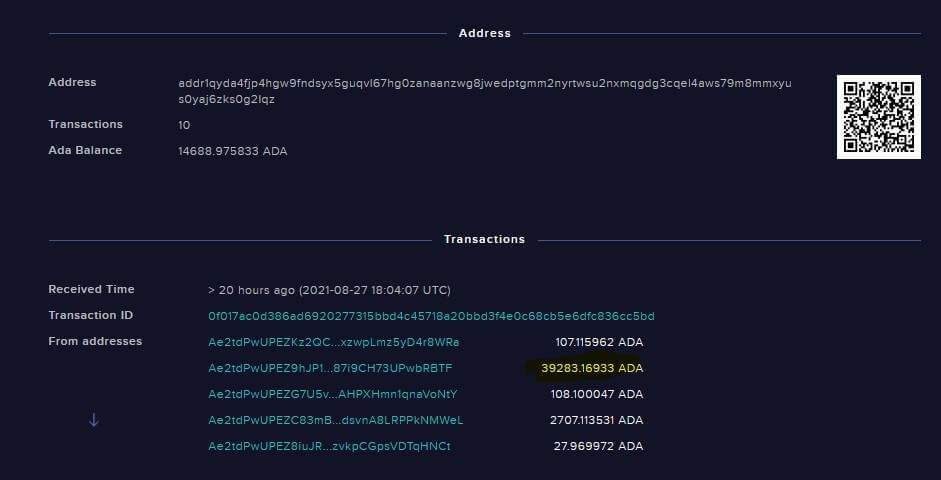

Since almost all cryptocurrency payments are transparent to the world, I use a blockchain explorer to see how many people fall for these kinds of scams. It’s a lot! Hundreds of thousands of dollars are sent to scammers regularly.

Direct Messaging

Direct messaging scams are also very common. I’ve received several creepy emails telling me that my computer was hacked and that the hacker has downloaded all my contact lists from emails and has been watching me through my webcam doing indecent things. If I didn’t pay $3,000 in Bitcoin then he would send the videos to all my contacts. Scary.

Well since I’ve had a piece of electrical tape over my laptop camera since I bought it, it was a dead giveaway that it was a scam. It was conveniently also the email address that I used at Ledger, whose distribution list was subsequently hacked in 2021 and once in 2022, so they already had evidence that I was involved in cryptocurrency.

Sidenote: Avoid the Ledger, and get basically anything else like a Trezor or Tangem, because the Ledger company has had multiple data breeches and their latest “recovery” feature shows that it is possible to extract the seed word from the devices, which was previously said was impossible. They’ve become very irresponsible.

Even though it was an obvious scam, it still gave me a creepy feeling that someone was spying on me.

I also checked out the blockchain explorer for the address the scammer gave me and lots of victims also fell for that scam. It really pays to scam people.

Direct messaging scams also come from chat features on Telegram and Reddit. Usually they wait in a room or message-board and pounce when a user has a problem and needs help. The very friendly scammer butters up the victim with some technical jargon before asking them for their wallet seed phrase (essentially a password to their funds).

The New Pyramid Scheme

Which are the cryptocurrencies to avoid? Start with this one being advertised as a digital certificate of deposit called Hex. It’s such a brilliant scam that I decided to dedicate an entire article on it.

Free Investing Tools

- Have Capitalize handle the paperwork for your 401K rollover to any brokerage, for FREE!

- Where does your money go each month? Track all your accounts and see if you are on track to retirement with Empower, for FREE! I use it myself to monitor my mom’s accounts to make sure she isn’t falling for scams or being defrauded.