Deal Stacking in 5 Steps To Magnify Savings and Discounts

Updated on December 1st, 2023

This article a continuation from Part I where I discuss some uncommon, but easy ways of saving $130 automatically each month. This article continues the money saving theme through deal stacking.

Deal Stacking Explained

Deal stacking is the concept of using multiple steps to multiply savings either through discounts on the purchase or extra cash back on the credit card. Not all steps are applicable to every merchant but for some of the best deals, you can go 3 or 4 levels deep which can bring the discounts to 30% or more.

Usually deal stacking involves online shopping, but some of the options apply to offline goods as well, which we’ll discuss below.

Choose Your Goods and Merchant

The first step in the process is deciding what it is you want to buy, obviously. Basically anything you can buy online whether it be a shirt at Macy’s, or a vacation in Thailand can invoke deal stacking to multiply the discounts.

If you are looking for a bargain with nothing in particular in mind to buy right now, occasionally SlickDeals has some irresistible offers that can be combined with the following steps.

Pick Your Online Credit Card

- Select your best online shopping credit card. My default card offers 2% cash back on everything I buy, but many Chase, US Bank and Discover Cards have a 5% rotating category for online goods that you opt into.

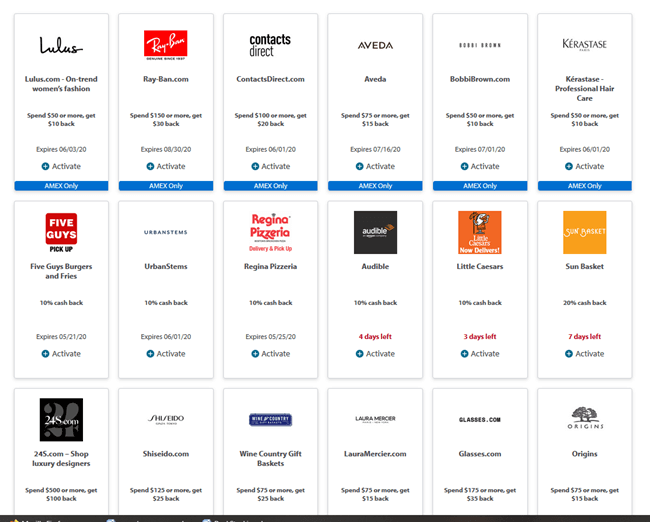

- Check if your card has an online bonus portal for an offer activation. A lot of Chase and AMEX cards have these portals, but a surprising number of people don’t know they exist. They look like:

The Pièce de Résistance: Discounted Gift Cards

Usually the largest discounts in deal stacking come from buying gift cards that are selling for 10-20% off the purchasing power value.

How is this possible?

It is reported that $45 Billion in gift cards remains unspent in the wild. People receive them for birthdays and holidays and naturally, since a gift card is an impersonal gift, the giver probably doesn’t realize that the giftee isn’t interested in the brand on the card. So the gift card sits in a sock drawer for a couple of years. Maybe it gets re-gifted. Eventually, a slice of that money ends up in the hands of bulk buyers who then turn around and sell them to consumers at a discount. This is where you come in, the deal stacking shopper willing to take these deals off their hands.

Choose Discounted Gift Card Retailer Carefully

There are quite a few of these gift card resellers, but you have to be careful. Many of them are fly by night and low budget and many have disappeared at a moment’s notice.

Your 2025 Goal:

Create a new side hustle and start a blog! I’ve tested out a dozen hosts and the one with the fastest speeds and lowest costs is the one I host my site on.

For example, I recently tried to use a password reset on one of these sites and when I couldn’t get it to work I emailed customer service and they told me they no longer had access to that feature and suggested I create a new account. I am not sure how a company cannot have access to their own password reset feature, but that’s certainly not a sign of confidence.

I’ve also had cards canceled on me seemingly at random and when I called up the merchant issuer of the card they informed me that the gift card was purchased with a stolen credit card.

Needless to say, this is why it is critical to look for two things:

- a reputable company

- a long warranty

Not only do you want to be able to get your money back or a replacement card if the balance disappears randomly, you also want to be able to stock up on best the discounts when they show up which might not be the time you are interested in buying at a particular retailer. Calling up your credit card company to rescind a charge might be an option in the short run if your card balance disappears, but its certainly more of a hassle and might not even be possible after 30+ days.

The discounts of the cards ebb and flow just like any other commodity. Sometimes a card for a particular merchant will be 10% off, and at other times with will be 20% off. A long warranty allows you to check the site once in a while and stock up when there is a genuine bargain; you can buy in bulk after the holidays to use as you see fit over the next year.

This is why my favorite deal stacking gift card provider is Raise and if you use that link, you’ll get a free $5 for the referral sign up.

But they are the best because they offer the longest warranty of 1 year and when I have had a problem with a card in the past they refunded my money no questions asked. Most of the other gift card sites only offer a paltry 30-45 days. You put yourself at risk with such a short warranty period and you can’t buy them in advance when the deals are the best, so why deal with it?

The ‘Google’ of gift card discount sites is Gift Card Granny. They aggregate many of the gift card sites and offer rewards on purchases through them.

Shopping Portals

There are several shopping portals that are similar to the credit card portals. You log in and then click through to the merchant and then make your purchase as normal. There’s really no reason to not use one of these sites because its an extra 2 minutes that has the possibility of saving you anywhere from 1% up to 20% or more.

Rakuten

You have probably heard of E-Bates which became Rakuten, but if you haven’t, you can use this link to get a massive $30 sign up referral. They offer straight up cash back on all your online purchases when you click through to the merchant’s website through them.

Bonus: You can actually double-deal stack by first going to Raise, creating an account with the $5 referral sign-up, then heading over to Rakuten and logging in. Once you login to Rakuten, search for Raise in the merchant search at the top and click-through back to Raise and then buy your cards with an extra 3% cash back from Rakuten.

Discounts upon discounts!

ibotta

The one you probably haven’t heard of is ibotta. They also offer cash back with online purchases, but also offer cash back from OFFLINE purchases. To earn it offline, you take a picture of the receipt with their app and get the cash back deposited to your account.

They also offer rebates on individual products, so its like getting manufacturer coupons instantly deposited to your rebate account. Pretty cool.

As of this writing, that link above is worth $20 for signup.

MyPoints

You also probably haven’t heard of MyPoints. They are similar to Rakuten, but offer points redeemable for cash or gift cards. If you use this link, you’ll get started with a free 1,750 points after your first $20 purchase. This is worth at least $11 but potentially as much as $20 depending on the merchant you redeem for.

Rakuten and ibotta are a little more straight forward for deal stacking because you know exactly how much cash back you are getting upon purchase. MyPoints is a little more non-linear because it’s more dependent on your point redemption options. If you like some of the merchants that give you the best redemption offers, then it can be more beneficial to you to use them.

They also have activities that you can do online to earn extra points that don’t require purchases. Such examples include completing a survey, or participating in an online poll, and sometimes even just clicking through to an online merchant’s website.

One advantage that MyPoints has is their browser add-on that applies coupon codes automatically for extra savings. It’s certainly much more convenient than the next optional step.

Promo Code (Optional)

The final step is an optional step because this route has been less lucrative over the last few years. It used to be as easy as googling the merchant’s name + “promo code” and coupon codes for an extra 10-15% off would immediately come up.

These days I have to try multiple codes to get one to work, if at all. Don’t spend too much time here. If you can score a quick 10% discount, consider it a success, otherwise just move on with the purchase.

Or just use the MyPoints browser add-on for the coupon codes that have been verified by the company. It’s a time saver.

Your Total Deal Stacking Savings?

But after the deal stacking all these steps, you’ve likely saved at least 10%, but you probably saved 30% off your online purchase. If you have any ideas to add to these steps, please add a comment below.

With savings you can invest in preferred stock, which earns 7-10% with less volatility than the general market.

Free Investing Tools

For advanced traders who want direct access to exchanges without “payment for order flow” shenanigans choose Interactive Brokers.

I use Axos Bank for its no-fee business account with free bill pay.