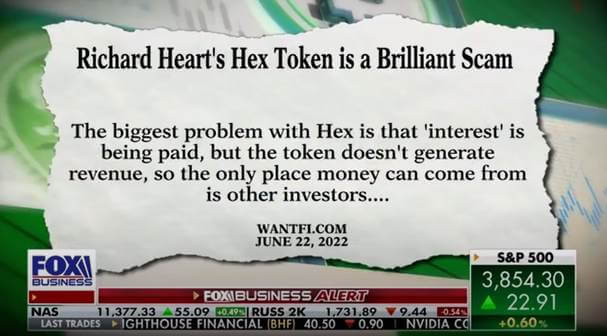

Richard Heart’s Hex Token is a Brilliant Quasi Ponzi Scam

Lots of copycats and Youtubers copy my material and research but don't give me a reference link. Don't be that guy.

Updated on March 13th, 2024

This article also featured prominently in the The Highest of Stakes documentary that showcased Richard Heart and his followers.

March 2024 Update:

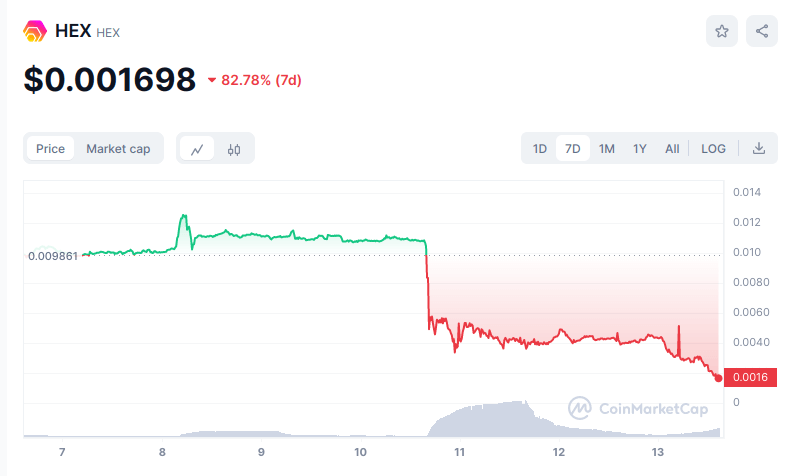

Over the last 7 days Hex on the Ethereum chain has plunged another 83%, effectively making it worthless. It’s now down 99.66% since I first published this article.

The focus is now solely Hex on Richard Heart’s scam chain Pulsechain. Everyone got a copy of their Ethereum Hex when Pulsechain was launched in early 2023. It’s doing slightly better and investor losses are “only” 97%.

Irrational greed and hopium seems to be keeping it ‘alive.’

July 2023 Update:

SEC charges Richard Schueler with securities fraud.

Hex dropped another 50% immediately after. The project has lost more than 99% of its value since its all time high.

June 2023 Pulsechain Update:

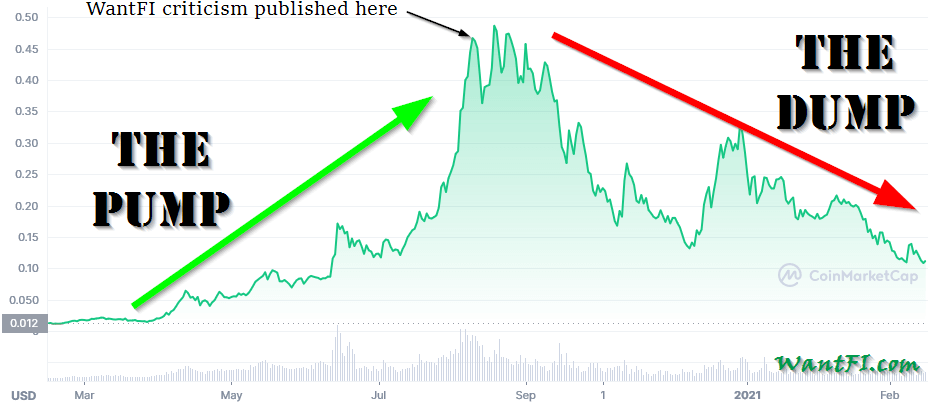

It’s been about a year and eight months since I first published my exposé on the Hex decentralized Ponzi scheme and during that time hundreds of comments were dropped below debating the merits of the contract and the future of Richard Heart’s projects and community.

Since I published this article, the Hex price has continuously dropped and is now down 98%+. Even if you factor in the purported ‘interest’ in extra tokens received over that same time period and include the doubled Pulsechain copies, one still lost over 93%.

You’re welcome.

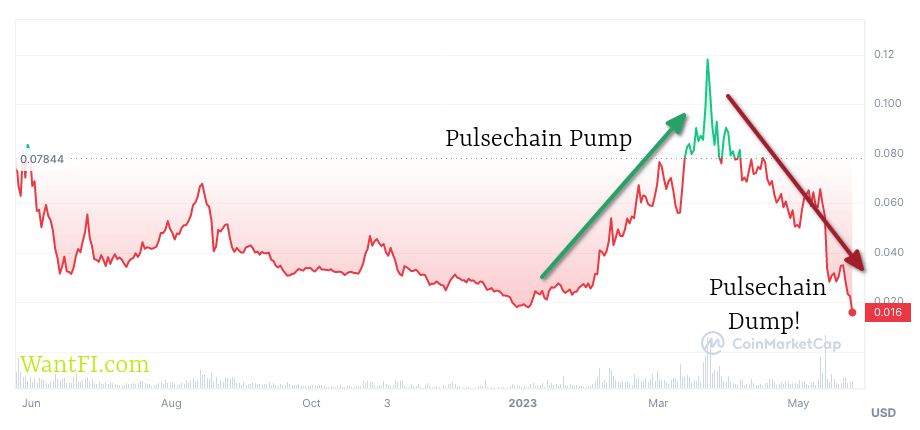

The big reveal that every ‘Hexican’ was waiting years for, which was supposed to push Hex to new highs, was the launch of the Ethereum fork Pulsechain.

Like we don’t already have enough of those? What value does a copy and paste of Ethereum really bring to the cryptocurrency world that the plethora of L1 ETH forks with teams of developers failed to do in 2021? Gullible Hexicans fell for the hype.

This last ditch pump of Hex was promptly annihilated right after the launch.

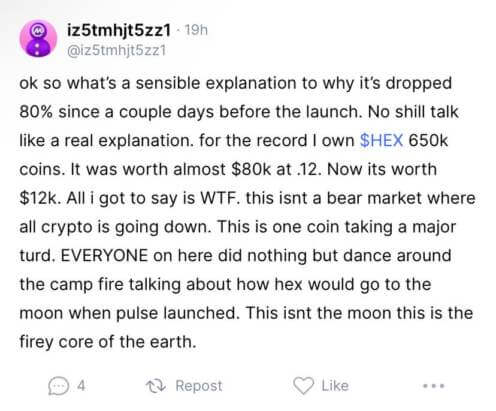

Hex is now down 80% over the last month and even former die-hard believers are starting to have their doubts about the project. The freakout has been amusing:

The answer is because there was so much hype about it for almost 2 years that everyone who was going to buy in, already did and there was no more fools left to buy to prop up the price. Classic buy the rumor, sell the news strategy.

If you are still wondering “is Hex a scam?” continue reading to understand why Richard Heart’s cryptocurrency has always been. Or skip to the bullet points in the TLDR section if you’d rather not read a long critique of this investment scheme.

Hex Introduction

For starters, it’s not a legitimate investment product and certainly not a certificate of deposit since no revenues are generated to pay the purported interest being advertised. In a later section, we explain the mechanics of how the scheme works and where the “interest” comes from.

The Hex crypto token should go down in the textbooks as one of the greatest cryptocurrency scams in history due to the amount of capital it has roped in and transferred to its earliest entrants. Its features include a high interest rate ‘hook’ to draw new investors in, a product design to create resistance to getting out of it, and it is heavily marketed by a large shilling army who understand that “on boarding” new entrants is good for their own crypto bags.

99% of cryptocurrencies are scams (Hex shillers have comically criticized me for saying that, but Coinmarketcap shows 24,000+ coins in existence!), so there isn’t really anything new here, but most cryptocurrencies sell themselves to average crypto speculators as being some utility token for an ecosystem that is going to be the next great thing (which never pans out, of course) or the token has some variation of a dog theme all trying to copy the original joke coin, Dogecoin (why no cat coins?). These buyers are probably aware that they are gambling and not investing; it’s fine if they accept that.

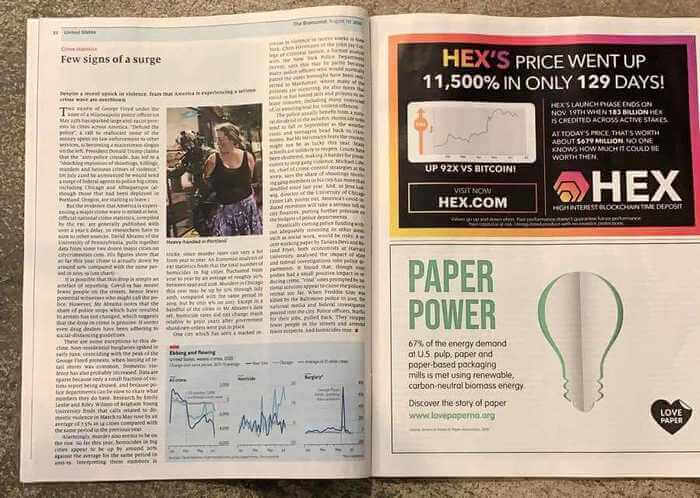

Hex is different because it’s being sold as an investment furnishing returns, uses banking terminology, and is heavily marketed out in the real world through billboards and print advertisements attempting to draw in people who don’t know what to look out for when it comes to crypto scams.

What Is Hex Crypto?

Hex is a token on the Ethereum network executed by a smart contract and the website advertises itself as a place to earn 40% per year with “certificates of deposit.”

You think that the 40% per year “interest” is your first clue that this is a scam?

The CIT Savings Account pays 5% a year, but it isn’t not paying 40% because “crypto is special” or it can somehow defy the laws of finance.

Hex has been very careful with the marketing language on the website and product design features to both appear legitimate to hesitant buyers and attempt to avoid legal trouble.

There is even an entire page on the Hex token dedicated to why the product isn’t a scam and generously educates the reader on what technically constitutes an illegal Ponzi scheme and a Pyramid scheme and why this product doesn’t legally qualify.

To paraphrase, “This illegal security I’m selling and promoting, really isn’t a security.”

Usually legitimate investment products don’t need an entire section educating you on scams and why their product doesn’t meet the technical requirements due to a crypto loophole.

Crypto is largely unregulated at this point in time so a lot of sketchy stuff continues to exist out in the world and with contracts being decentralized, it’s hard to squash them out.

Remember that just because a project exists, it’s not a badge of legitimacy! Financial authorities only seem to get involved long after billions are already lost to these kinds of scams.

PRO-TIP: If you are US based, trade cryptocurrency and want to avoid the tax hassle see the Alto Crypto IRA. They support 150+ coins, there are no monthly or annual fees, no LLC setup fees, no processing fees, and they charge only 1% on each trade. Any cash waiting in your account is insured by the FDIC.

Hex Volatility

Hex is just like any other a volatile cryptocurrency, unlike a typical bank CD priced in dollars where your investment principal doesn’t change. Here’s a clue that “Certificate of Deposit” is a poor naming choice for Hex because in a bank CD it is impossible to lose money. This is clearly not the case with Hex because the later participants end up buying the top and losing 95%+ of their money as they lock-in:

Audited

Since it’s marketed to lots of everyday people, I want to make a distinction about what an audit on a cryptocurrency smart contract means, since Hex mentions frequently in its marketing materials that three different auditors have audited its contract.

To a layman, they might think that the statement means that a professional auditor like PricewaterhouseCoopers came in and reviewed it and found out it’s not a scam, or something to that effect. But that’s not what it means.

Auditing in the crypto world means developers who specialize in cryptocurrency smart contracts evaluate the computer code for bugs. Having sound code doesn’t absolve it from being a scam if the code is written to be… a scam.

Get Rich With Hex Media Blitz

Hex has been successful in convincing enough new buyers to drive up the token price since inception through its highly aggressive marketing tactics.

The Richard Heart scam token is the only cryptocurrency that I have ever heard of to use ads to market in magazines, buses, taxis, physical mail, hold shady airport seminars, and use TV trying to bring in a whole new barrage of people outside the regular cryptocurrency speculators.

Volume in the beginning of Hex was $50 a day and at its peak was in the millions. Very few people sold for anything close to a “6748x” return, but those later entrants who bought the top paid for those early entrant’s gains.

Additionally, multiple people have reported receiving physical Hex spam mail to their homes with their names from the Ledger hack (here, here, here, here and here). Creepy, and unethical.

Then watch this comical TV commercial that aired on MSNBC with yachts and money flying around with the spokesman saying “people are getting rich, truly rich” before it even officially launched. Hex is designed to cater to your greed.

You have to ponder the incentives and return on investment for those willing to spend millions of dollars shilling to you a digital token created from nothing.

Who Founded Hex?

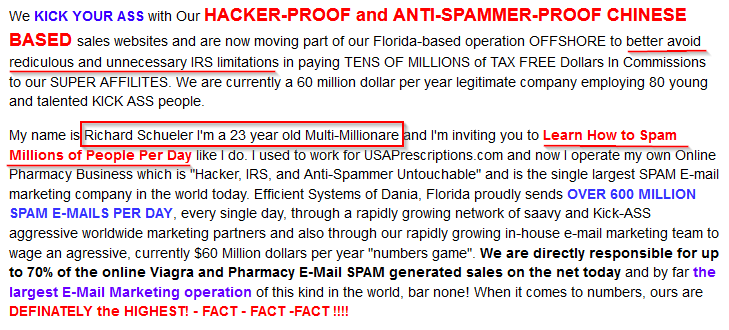

The founder who goes by Richard Heart for marketing (his real name is Richard J Schueler). There’s nothing wrong with using a pen name except when the point is to hide a long history of shady businesses involved in spamming Viagra and anti-aging pills (which he was successfully sued for in the early 2000s) and legal trouble in Panama.

He was even spamming courses on “how to spam” and avoid paying taxes on the spamming earnings. Fear of Missing Out (FOMO) is a great sales tactic that Richard Schueler uses continuously in everything he is involved with. Here in 2003 he offers up that he was a 23 year old multi-millionaire from spamming.

Furthermore his own blog documented other shady businesses such as selling stereo equipment he didn’t own and then turning around and giving the buyer sub-par equipment.

Does a scammer ever reform, or are they always out looking for their next mark? Who do you think he’s looking to make rich here?

It is no surprise that since the crypto world is largely unregulated and is like the Wild West, that he would have gravitated to this space to enrich himself. And enrich he has…

One of the ways he promotes Hex is by flashing Rolexes and Louis Vuitton luxury items and comically attributing them to his own product, as if his wealth actually came from investing in Hex, and not from selling Hex to others.

Well, yeah, Hex.com has been amazing for HIM. Bernie Madoff’s scam business was amazing for him and early investors for dozens of years. Bitconnect and OneCoin were also amazing Ponzi schemes for their creators as well.

Where were all of Richard’s Rolexes and fancy cars before Hex? How did Richard Heart make his money?

By selling millions of tokens created out of thin air to poor saps who think that 40% a year returns can just be invented with a token. We’ll get to the math and mechanics in a later section to explain where its interest comes from.

CFD Token

Hex is not Richard Heart’s first foray into cryptocurrency. He launched CFDToken on the BSC chain a couple of years before Hex.

You really have to visit the website directly to experience the comedy (it’s surprisingly still live as of this writing).

The CFD Token was the “Blockchain Enhanced Distributed Computational Fluid Dynamics Supercomputing Network” and it was the answer to nuclear fusion, traditional power generation, space travel, extinction level events, and more!

There are a lot of large corporations named on the webpage that imply there was some kind of relationship to the CFDToken, when of course there never was.

Not surprisingly, it went to zero just like Hex is doing.

He has had a pretty public persona for the last few years doing podcasts, and showing up to cryptocurrency conferences and harassing presenters about their cryptocurrency backgrounds. For instance, when Craig Wright falsely claimed to be Satoshi Nakamoto (anonymous Bitcoin founder), Richard Heart, who was sitting in front, very aggressively called him out on this in front of the whole crowd. This led to a big surge in social media followers.

Ironically, he has called basically anything other than Bitcoin a scam until he launched his own offering.

Since his large group of social media followers were the first ones to get into Hex and have the most to gain from its success, his product came with its own army of Hex shillers and defenders, who call themselves ‘Hexicans.’

Hexicans are a pretty toxic group and seem to take it personally if you say anything bad about Hex. Of course, this makes sense, since if you get in early enough on any scam, you too can make a lot of money at the expense of later investors and you want to protect your pile of gains. They roam around on social media advertising it to others and attacking anyone critical of it, usually in coordinated brigades.

They all seem to parrot each other from the same script: “100% uptime, no middle men, and you hold your own keys!” As if they don’t understand that every token on Ethereum’s platform has had the same 100% uptime, and most tokens don’t have “middle men” either, since that’s the actual point of a smart contract. Furthermore, getting a cold storage wallet allows anyone to securely hold keys to any Ethereum token (and most other coins too).

They follow the ABC‘s and are always looking for additional ways to market Hex to others, including creating thousands of Twitter accounts and YouTube videos. The odd thing is that they only ever talk about Hex, and all have either Hex logos incorporated into their profile pictures or have Hex as part of their screen names. Are they just bots or cult members? It’s strange. I have not seen any other crypto community shill as much as they do.

They even commissioned a documentary (as mentioned at the top of this article) on Hex and Richard Heart. The funding was only trickling in for the first 50 days until someone (guess who!) contributed about $450,000 in one go, which greenlighted the project. That generous contributor’s account balance shows more than $330,000,000 in value – 90% in Ethereum. I wonder who controls that wallet…

The Hex Disclaimers

Hex was carefully crafted to avoid the various outdated legal tests of typical pyramid or Ponzi scams. For instance, it can’t be considered a multi-level marketing program or pyramid scheme because it only had one level of referrals built in to the adoption phase during its first year.

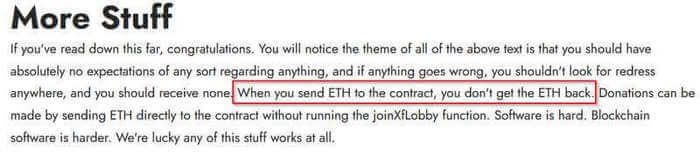

It doesn’t technically constitute a Ponzi scheme because new investor money isn’t flowing directly to existing investors, but this is something we discuss in a later section.

Hex also doesn’t promise returns, it says that its returns are “designed by the code” as if simply decreeing investment returns could work in the real world.

At the very bottom of the page, you will see the disclaimers page where Richard Heart has put in a copious amount of them.

It’s not a security, I swear! They’re just numbers in a database!

I’m not selling you anything, it’s just code out on the blockchain!

You do your own work because you are the one pressing the button!

He can personally decree that it is not a security but that does not constitute what a legal authority would ultimately rule on what it actually is if they are even bothering to look.

During The First Year of Hex

The following four parts only applied during the first year of Hex’s existence, but it is important to point them out in order to explain some later points and also to understand the techniques and shenanigans that Richard Heart engages in to get around legal requirements, promote Hex and enrich himself.

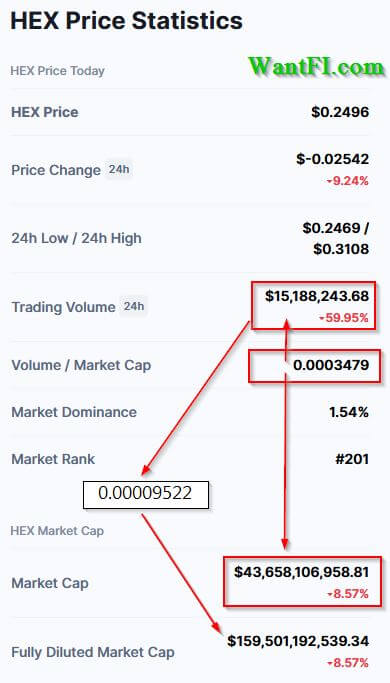

The Richard Heart Initial Coin Offering (ICO)

During the first year’s claim period, you obtained Hex by sending Ethereum to the contract address, known as the “origin address.” If you wanted to change your Hex tokens back to Ethereum, you’d have to go somewhere else. Heart’s origin address offered no refunds, which again refreshes why the term “Certificate of Deposit” is a poor naming choice. He kept everything you sent him, scot-free and if you wanted out, then you had to find an exchange offering liquidity.

In interviews he always dodges the question of who controls the Hex origin address or he says he doesn’t know who owns it. Well obviously he controls it since its his own smart contract!

The reason why he will avoid that question is because the ICO was deemed a security by the SEC and he conducted an illegal one for an entire year without a filing and registration. He received an asset in exchange for his own creation, it’s an ICO without question. This is just another case where he tries to use obfuscation to get around legal rules.

About $7 million of Ethereum was withdrawn from the Hex origin address about a month after launch. It was conducted with 36 transactions of 1,337 ETH. 1337 is “leetspeak” for leet, which means “elite.” Hackers in the 1990s referred to others as elite if they had the best hacking skills being able to infiltrate corporate servers and websites. To me this looks like a cocky message basically bragging about how he bilked millions of dollars out of suckers.

Also, during the first year, there was nothing stopping Heart from creating a continuous loop by sending Ethereum to the origin address, receiving Hex, then sending the received Ethereum to a different address (maybe even through a laundering mixer to obfuscate this activity), and then sending it right back to the origin address for more Hex. He could mint himself as much Hex as he wanted and he did. We’ll talk about how much Hex he owns in a later section.

How could anyone ignore that fact alone and not see how much of a scam it is?

Instant User Base

To get it started with an instant user base, Heart offered free Hex tokens to anyone who had Bitcoin by a deadline and then submitted a claim to the website.

He advertises it like it was some great act of magnanimity, but in reality Hex would have no value if only he owned 100% of it. These Hex tokens were minted out of thin air and it didn’t cost him anything to give them out. It gave the appearance to outsiders that there was a thriving community with thousands of Hex participants, which is again a standard marketing tactic for “social proof” (as mentioned in my crypto scams article).

Furthermore, those early entrant’s gains are paid for not by Richard, but by later entrants who provide their exit liquidity.

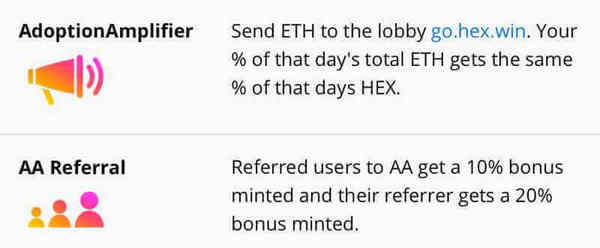

Adoption Amplifier & Referral Program

Heart incentivized people to “act fast” to get a bonus and the longer you waited, the smaller the bonus would be. He used the same tactic with his latest project, PulseChain.

Users were also incentivized to bring in others through its referral program. Your referrals become your marketing shillers for free. A few websites started up affiliates just for the purpose of getting the 20% referral. They didn’t have to commit any of their own money to shill the product and earn.

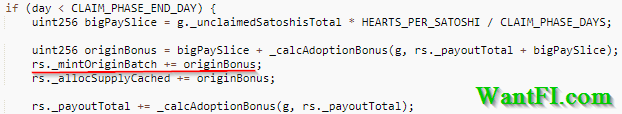

Richard Got a Copy of Adoption Bonus and Referral Bonuses

During the early adoption phase he gave himself a copy of all Hex. When someone purchased Hex with Ethereum, Heart got both a copy of the Hex value and also the full Ethereum value.

Isn’t the point of sending the Ethereum an exchange for the Hex? Why did he get additional Hex too? Double dipping.

And when someone was referred by another Hex user, he also got a copy of what both the referrer and referree got. Why did he also get a copy from other people’s marketing efforts?

In case it’s not obvious by now, each time someone used the adoption method or was referred, it was further dilutionary to the Hex token pool by 2x the claim amount.

It should be pretty obvious from the points I laid out above that the only significant whale in the Hex system is Heart himself. We’ll come back to this point in a later section.

Marketing

It’s the never ending story here with this one.

Hex not only has lots of marketing through traditional print and online media as I showed at the beginning of this article, but Richard Heart also paid for professional press releases to show up on financial news sites with comical claims like “Hex has the potential to eradicate middlemen payment companies such as PayPal and Venmo, as well as impact credit card companies like Visa and MasterCard.”

So which is it, a payment app or a certificate of deposit? In fact, Hex doesn’t have the ability to do any of that because the infrastructure for sending tokens or payments comes not from his token, but the platform his token is built on, Ethereum. It’s simply more grandiose claims to lure in buyers hoping to jump aboard the next Bitcoin, Tesla or transformative technology.

As stated before, this is unusual for a cryptocurrency project to advertise because search engines usually outright ban any advertisements related to crypto and print media is expensive.

Furthermore, the original name of the project was going to be “BitcoinHEX.” In the previous article I mention that usually crypto scammers seek to exploit name recognition and legitimacy by using another crypto’s name. Hex has absolutely nothing to do with Bitcoin, since it is built on the Ethereum network. But basically everyone by now has heard of Bitcoin, and the massive success it has had, so he wanted to give the impression that Hex was somehow related to it to those who weren’t experienced in cryptocurrency.

FOMO: When Lambo?

No scam would be complete without advertising how rich people are getting along with some Lambo shilling. In addition to a bunch of exotic cars purportedly paid for with Hex winnings, there is a whole cache of items on the webpage.

Try to imagine a legitimate investment product posting pictures of exotic cars.

What he forgets to mention is that the McLaren on the left with the HEX1 License plate is his own car as you can see on his personal website.

The other items may or may not have been purchased with Hex gains, or they may be just random photos from the internet, who knows? Either way it is just a marketing ploy hoping to snag “get rich quick” hopefuls. Early investor experiences will not match yours even though that is the implication from this style of marketing.

Supply Reduction: Time Lock

This is really the crux of the brilliance of this scam. It’s like Hotel California: Your money checks in, but doesn’t check out. The main product feature is to lock up your Hex tokens for a chosen period of time with the purported interest rate increasing along with the lock-up period.

Technically, Hex converts to T-shares during the time-lock, which reduces circulating supply figures and is a computational efficiency to avoid account balance tracking for thousands of wallets. It is clear that most Hexicans do not understand its purpose and often try to move the conversation in that direction (“T-shares only go up!”). At the end of the time-lock, the T-shares are converted back to Hex. The efficiency is not unique to Hex as Anchor Protocol had the aUST, for instance, and the inclusion of T-Shares doesn’t change any of the criticisms I make in this article.

By incentivizing Hex buyers to lock up their tokens for a number of years, and heavily penalizing them if they unlock early, it removes selling pressure and reduces the float. This provides the opportunity for the marketing efforts to have a more powerful effect, since with more buyers than sellers, the price will be pressured upwards. This, in turn, lures in additional buyers catching the FOMO bug.

The goal of course is to remove as many retail sellers as possible from the process so that the only people who are left to sell are the earliest investors and promoters who have large bags to dump on new entrants. “Longer pays better” because they want to incentivize you to not think about getting your money back until years after you’ve contributed it.

A key point is that early investors in every Ponzi and pyramid scheme make money along with the pinnacle scammer and they will defend the product to protect their newfound wealth.

Heart’s Use of The Word ‘Staking’

We need to discuss Heart’s use of the word ‘stake’ here when referring to time locked Hex tokens.

Older cryptocurrencies like Bitcoin and Monero require millions of computers (i.e. ASICs) running specialized number guessing hardware all competing against each other to secure the network. It uses up an enormous amount of electricity and only those who can afford the hardware get the rewards. This is referred to as Proof-of-Work.

In contrast, the staking concept where investors lock up their funds for a period of time is the norm with newer Proof-of-Stake styled cryptocurrencies. It’s democratized as anyone can participate in rewards with any amount of money and is more energy efficient because people bet on datacenters which don’t require random number guessing hardware.

Ethereum is the only cryptocurrency to switch from Proof-of-Work to Proof-of-Stake.

The staker needs to research the datacenter to make sure that it has a legitimate group running it, won’t behave against the interests of the network, and doesn’t have long periods of inactivity, because if it does, the staker’s money will be slashed. Therefore, it is a decentralized way to secure a network where people put money where their mouth is, and as a reward, they earn a portion of the datacenter’s fees from processing transactions.

When you ‘stake’ with Hex, you aren’t securing a network, voting on governance or facilitating any underlying economic activity at all. It’s a complete misuse of the term and there is no Proof-of-Stake at all. You are just agreeing to lock up your funds so that there won’t be selling pressure.

What a convenient product feature.

How Does Hex Make Money?

In short, it doesn’t. This is where we really get to the crux of the Hex scam. Let’s compare two models:

The Banking Model

When banks give you interest, it stems from economic activity. A bank creates loans, earns fees from ATMs and services and then pays you part of the profit. A commercial bank’s basic business model is to capture a spread between short term and long term interest rates. They borrow short, and lend long. That’s the core of their business and why they offer savings and checking accounts in the first place: They leverage other people’s money.

Everyone is familiar with Certificates of Deposit: you put in dollars, and you get more dollars back later. Banks don’t offer CDs as an act of chivalry, they exist for the benefit of the bank, just like savings and checking accounts do. Banks offer them because they can plan better around their federally mandated capital requirements and lending portfolio by penalizing money that leaves too soon.

This is how revenue is generated in the real world. In DeFi, fees can be generated from trading activities.

For a more in depth discussion of banking mechanics involving money expansion and the impacts of quantitative easing, read this article. Richard Heart and Hexican trolls love to name drop the “Bank of England paper” as evidence that Hex “is just like the banking system,” and I point out why that reasoning is incorrect.

The Hex Model

With Hex, there is no underlying economic activity happening at all. It’s not even real interest.

All the Hex contract code does is mint new inflationary tokens every year and then distributes the inflation to those who have agreed to lock theirs up.

This whole scam could not work if the requirement was to lock up an asset and get paid interest in that asset for an asset that Richard Heart didn’t control and create out of thin air.

Where’s the DeFi certificate of deposit that pays 40%, or even 10%, in Bitcoin or Ethereum? It can’t exist.

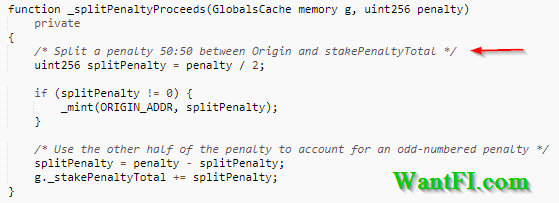

Those who lock up tokens also get half the penalties from those who unlock their funds early, or get this, forget to unlock their funds within two weeks of the agreed upon period. Heart generously gives himself the other half.

The sole purpose of the Hex contract is to redistribute value from some token holders to other token holders.

Inflation is Dilutive

Inflation is never a good thing, but in the case of Proof-of-Work (PoW) cryptocurrencies like Bitcoin and Ethereum, it is a necessary evil to incentivize miners to secure the network. Someone has to pay for the infrastructure and electricity and without a centralized authority to provide funds, inflation acts like a tax to pay for it.

Because cryptocurrency adoption multiplied over the last decade, the growth in demand vastly outweighed the effects of inflation and the price rose.

However, the inflation in Hex does not stem from computer work in the form of electricity like in the case of Bitcoin or Ethereum. Inflation in the Hex system is completely arbitrary, unnecessary and solely exists to create funds out of thin air to pay people. Likewise, if Heart and the Hexicans can rope enough new investors into the scheme to drive up the token price or keep it level, investors won’t notice the effects of inflation either. Now you can understand the vast marketing and shilling efforts.

Everything else being equal, the expected return to total Hex capital from generating inflation is 0%. You have more tokens, but each token is worth a little less if you hold demand constant.

When an publicly traded company conducts a 2-for-1 stock split, shares double, but the stock value doesn’t suddenly double along with it – the price halves because the underlying equity didn’t change.

It’s like cutting up a sandwich into smaller pieces – you don’t have a bigger sandwich.

Hex is like buying a foreign country’s currency that only printed extra bills to pay “interest.” At some point you have to convert it back to your own currency to spend it. When you make that conversion, supply and demand will reduce the value of what you thought you earned.

There’s nothing magical about the chosen inflation rate of 3.69%; it could have been 1%, 2%, 5%, 10% or anything in between to create a different perceived rate of interest with a differing level of token dilution. When you grasp that concept, you will realize how pointless Hex really is.

Heart could have written the smart contract to say that every year a zero will be added to every locked account balance. Would anyone actually believe that they were 10x richer? Of course not, so why does the more subtle way that Hex uses this principle fool so many people?

Fool’s gold does not turn into real gold.

What Makes Hex Effectively a Ponzi Scheme

From the SEC, the technical definition of a Ponzi scheme is an investment fraud that involves the payment of purported returns to existing investors from funds contributed by new investors.

When Ponzi schemes were defined 100 years ago, private currency ones like Hex didn’t exist, so it doesn’t quite meet the exact legal definition since the cashflow of new investors doesn’t directly cross the table to another investor’s pocket.

That’s where Richard Heart and his followers stop the discussion: “See, not technically a Ponzi, therefore not a scam!”

You aren’t investing with dollars, euros or even another crypto and being paid back the same currency as you would in a classic Ponzi scheme here. There’s an additional step in the process.

Since Hex controls its own seigniorage and just mints more tokens to pay out according to the smart contract, the Ponzi link is the cash transfer from new investor to old investor, the “purported returns.”

Hex can mint new tokens until the end of time, but herein lies the gist of the problem: by constantly increasing supply, there will always be negative price pressure on the value of what those tokens are worth. Yes, the laws of economics and debasing a currency still apply to the world of crypto.

Otherwise, imagine if immense wealth could just be created by printing more tokens and distributing them; everyone would be millionaires…. Venezuela style.

The amount of new capital that needs to be brought in to absorb these new tokens is quite sizeable as we will see in a later section.

A technical Ponzi scheme eventually collapses because the earnings aren’t really being generated and the scheme always needs new investors flowing in to pay off the older investors. The collapse can be delayed for years though because the mechanics behind the scenes are opaque and investors wait years to collect their purported earnings. Bernie Madoff’s scam lasted for decades, for instance, because most people just continued to hold their investment with him and never demanded capital back until 2008.

In contrast to Hex, the purported returns are paid with inflationary tokens and these additional tokens need to be absorbed by new investors to maintain the price. You can’t hide the price, and the price of it will eventually collapse without a constant stream of fresh money supporting it (Hex is now down 90%+, and should continue to drop now that crypto has entered a bear market).

This is what what makes Hex analogous to a Ponzi scheme, only that there is one additional step where both new and existing investors are transacting indirectly with each other through a fresh token that is subject to supply and demand.

The average lockup time is about two years, so there is a long delay before the impact of the freshly minted tokens takes effect on the Hex supply, but the earliest entrants are now using fresh investors for exit liquidity.

The Hex Token Distribution

Inflated Address Count

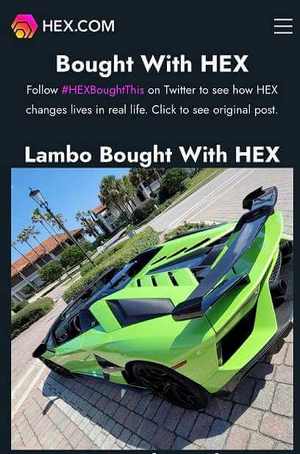

In an effort to pretend that there are more investors than there really are, someone, guess who, sent HEX to 173k addresses in large batches, mostly small amounts of 100 and 101 HEX and the addresses have no further activity.

These are throw-away amounts since the Ethereum gas would cost more than the value given to actually sell it. Heart loves to brag about how many unique wallet addresses have Hex, so here’s your reason why. The owners of the addresses probably don’t even know Hex is in their address since you have to manually import tokens into your wallet to actually see them.

Centralization

Heart loves to talk about how Bitcoin and other blockchains are so centralized.

The irony is apparently lost on him, but in reality he is just preying on people’s ignorance to be unaware that he created a huge number of wallets to hold his own Hex stash to give the illusion of decentralization.

Remember all those first year features we discussed above? They were important to explain how he has so much Hex in this next section:

How Much Hex Does Richard Heart Own or Control?

Etherscan provides a tool to look at the top 500 token holders. Almost all of them were created in blocks on the same day, within the same hour. Try to find a single account in the top 150 that wasn’t funded by the origin account. Furthermore, there is a whole block of accounts that all have the same exact amount in them.

Yup, you guessed it, all funded by the origin account.

In fact, I couldn’t find a single Ether account in the list of 500, from randomly clicking, that had any activity beyond just funding Hex. Geee, suspicious.

Then check out this Ethereum address, with funds originating from a money laundering mixer all paying the gas fee on 200 accounts each worth 350-400 million dollars in Hex tokens. See for yourself and do the math.

These simple observations show that Richard controls the majority of the entire supply of Hex. His laziness to use a single account to fund the gas fees on 200 other massive accounts is much appreciated because it made the analysis much easier to collate.

So how much Hex does he control in total? I originally speculated from the above points that an automated account analysis program would show his ownership of up to 80%. Well as it would turn out, someone has actually managed to collate the addresses funded from the origin address and Richard’s token database shows he controls 88% of all Hex! 88%, just wow!

If Richard himself didn’t want to pay a 20% founder’s tax on a coin, why does he deem it acceptable for you to pay an 88% founder’s tax? He didn’t even attempt to make the product remotely fair and he’s playing anyone who buys into it for fools.

I’ll note that he can’t get that value out of the system unless lots of future suckers buy in to prop up the price while he is unloading, which is why the marketing efforts are more broad than you typically see for cryptocurrency.

But why obfuscate his holdings? Would there be fewer Hex token buyers if everyone knew he controlled so much and the main point of the token was to enrich himself? I think you know the answer.

Why Is The Hex Interest Rate 38-40%?

The 38% number (Dec 2022) comes from the requirement that only people who lock up their funds get paid the inflation and currently only about 10% of Hex token buyers have locked up their funds.

As we showed before, Richard Heart owns about 88% of the token pool and he has not locked them up in order to keep the advertised rate high. That’s the only purpose these tokens serve and since he didn’t pay for them, losing 3.69% of their value every year to inflation is of no consequence if it attracts more buyers clamoring for the 38% APY and therefore drives up the price far higher than his inflation losses.

Over time the rate will continue to decrease as Heart’s ownership percentage is whittled away through inflation.

A founder having a large cache of tokens is a two way street of course. Since ~90% is freely available, your biggest risk is that large quantities of Hex will be dumped and the price of the token will drop to a level far lower than your cost basis and inflation earnings.

Thought Experiment, an Improved Hex Without a Rug-Pull Risk

Even the often advertised “only 3.69% inflation” is a deceptive shell game to give an appearance that the arbitrarily chosen contract inflation rate isn’t terribly high in the grand scheme of things.

Would as many people buy into the token if the advertised rate of inflation were 38%? I think not.

Let’s start with a thought experiment. Say that Heart sent all his unlocked Hex holdings, the ones keeping the advertised rate high, to a burn address and then he no longer had access to them or the ability to sell them into the market. This would reduce the rug-pull red flag risk significantly (he still primarily controls the DEX liquidity, so not 100% in the clear, but less risk overall).

The ‘interest rate’ would still be 38%, and all newly generated tokens would still be still funneled to the retail lock-up class. For all intents and purposes, Hex would work exactly the same as it does today without his ability to rug-pull. Basically it would be a slightly improved version of Hex.

But in that scenario you have to ask yourself, what is the purpose of all these superfluous tokens laying around in a burn address for? The contract could just be re-written to skip generating them in the first place for the same effect. But then of course for the contract to be able to pay the 38% rate, the inflation rate would also have to be 38% and the nature of the scam would be very obvious to all.

Do we understand the deception now?

The key point is that all these extra tokens that Heart controls were minted and not locked just to give the appearance that total inflation in the Hex system is low, while at the same time maintaining a high rate of inflation to those who time lock. The 35% rate difference doesn’t come from magic. He could have doubled his tokens and we could pretend that there’d then be a 76% APY to the retail class while maintaining a 3.69% contract rate.

The effective inflation rate to the circulating supply is 38% since all newly minted tokens are being funneled to the retail class. Of course, some people have chosen multi-year lockup periods and those tokens won’t flood the market for some time, but eventually they will come. Hex is only about three years old and the maximum lockup period is comically 15 years, older than cryptocurrency itself.

But here’s the rub, this improved version of Hex doesn’t even exist! He still controls the 88% share and there is only downside risk to his massive ownership. He can either dump these tokens onto the market, or lock them up and reduce the “interest rate” for everyone else. If he locked up his whole share, the interest rate would drop to the same 3.69% rate of contract inflation (ignoring 1-2% of retail Hex shares in transition or not being locked for other reasons).

So, is Hex crypto risky? Yes!

You have to trust that Richard Heart won’t do either of these things, which violates a central principle of decentralized finance: trust.

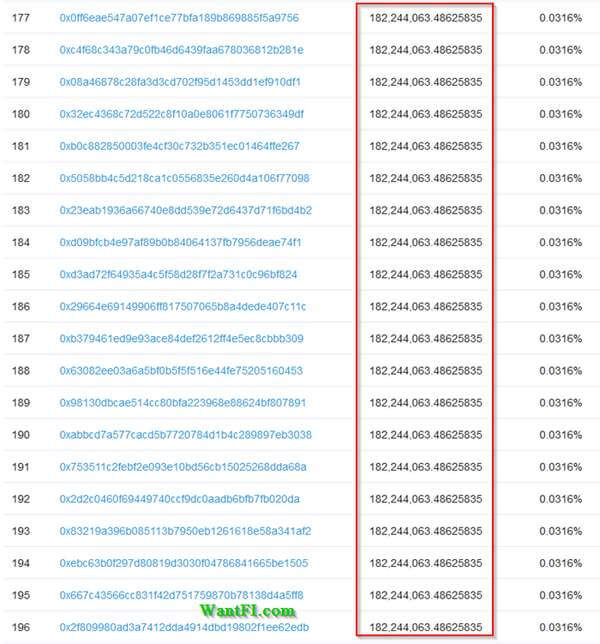

Problems With The Size of Hex

Hexicans used to love to brag about how Hex was at one point the third largest crypto by market capitalization when it peaked at $159 billion, or about $15 billion for the retail class. It has dropped 95% since publishing this article back in Sept 2021 and with most Hexicans now underwater, the greed has turn to despair.

- Hexican’s preferred coin ranking list is basically anything other than the gold standard, CoinMarketCap, because it lists Hex at #203.

- CoinMarketCap has an evaluation process that attempts to weed out low quality projects that try to jump to the top of the list with artificially large marketcap gaming, where a token is minted with a trillion supply and then the creator wash trades the price up to $1. To list in the top 200, a token must be listed on a centralized exchange with material volume, such as Coinbase or Binance.

- It’s curious why these retail exchanges will list hundreds of other tokens, but specifically exclude Hex when it is so large. I’m pretty sure the reason is that listing any Ponzi token that advertises itself as a “certificate of deposit” earning interest is a securities regulatory risk for the exchange and when investors lose money it’s an easy lawsuit.

- Hexicans comically attribute the #203 rank to a conspiracy theory that Binance (who owns CMC) is keeping Hex down because they are threatened by it. lol.

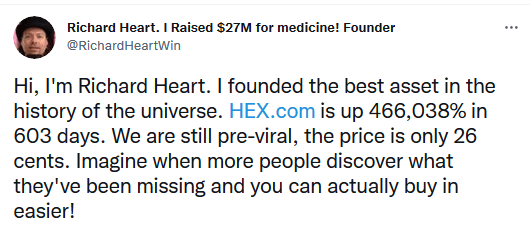

- It’s so large, but Heart and Hexicans always invoke the low price fallacy. He once tweeted: “It’s pre-viral because it is only $0.26.” Bank of America could split their shares 100-to-1 and have a stock market price of $0.47 but that wouldn’t make it any less of a $250 billion company. Price has no bearing on future opportunity or cheapness without considering how much supply exists along with it.

- The 88% founder’s share he owns gives it more relevance than it deserves which is then used in marketing: “it’s bigger than Solana and Cardano combined!” Size often is perceived as a stamp of quality or social proof when taken at face value without considering non-circulating holdings.

- At its peak, Hex was getting close to challenging the valuation of the platform it’s built on, Ethereum (which reminds me of the Palm Pilot craziness of the Tech Bubble).

- Having a large market capitalization combined with permanent inflation is an issue. Think about how $13 billion*3.69% (Dec 2022) is about $500 million in new tokens a year that must be absorbed from new buyers. It’s a dynamic relationship with price; as the price increases it becomes much harder to maintain, but as the price drops, the threshold is easier to meet. Presumably many will ‘re-stake’ again and again keeping the supply off the market for a while, but that is only delaying and stacking up the eventual unwind.

- Trading volume for a token of this size is quite low. Price discovery comes from volume and basically any other coin in the top 100 has multiples more. You can compare apples-to-apples by taking the volume and dividing by the marketcap. A typically this number is between 2-6%. As of this writing, Hex’s volume ratio is less than 0.035% which means it has 1/57th of the trading volume of its peers.

- This low volume is NOT a reflection of Scheuler’s outsized ownership interest or the lock-in product feature keeping supply off the market because CoinMarketCap’s volume calculation only considers the circulating supply.

- If you consider the entire supply, it’s 0.009522%, or about 1/210th its peers.

- This volume disparity is somewhat of a result of not being listed on centralized retail exchanges since some inexperienced crypto buyers still don’t know how to get it through DeFi.

- The point is that low volume assets are easier to manipulate since a little buying goes a long way.

Heart tries to lead you away from these inconvenient points in his YouTube videos and he constantly claims that market cap and volume do not matter, because “you can’t make money from the market cap or volume.” But of course it matters.

Market cap is essentially the “account balance” of all token holders in the system and the average volume roughly shows twice the capacity of how much could be unloaded on any particular day without adversely affecting the price (technically, the LP liquidity and slippage). And as mentioned, the market cap combined with the inflation rate determines how much capital must be brought in just to keep the token price level over time.

Whataboutism

Watch a few Youtube videos of Richard Heart getting interviewed by someone critical of Hex and see his replies. When he takes a break from all the name calling and insults, you’ll find that he is very adept at manipulating semantics and introducing red herrings into his arguments.

If you watch enough of his material you’ll see that the same script is uttered ad nauseum and then regurgitated by the Hexican underlings.

False Analogy to Bitcoin

I am NOT a ‘Bitcoin maximalist’ as some have claimed in an attempt to undermine the points I make in this article, and I only bring up Bitcoin throughout this article because Heart is constantly comparing it to Hex and inventing reasons why Hex is supposedly much superior. It’s his favorite rhetorical device likely due to Bitcoin’s name recognition and its established background.

He claims that Hex offers the best opportunity to buy now because it’s ‘just like Bitcoin in the beginning.’ In its beginning, Bitcoin had:

- Low liquidity.

- Large founder’s share.

- In hindsight, those who held the longest had the best return.

And Hex has low liquidity, a large founder’s share and had a quick initial gain! See, same same! Buy, buy, buy!

But here’s the difference: cryptocurrency was in its infancy 11 years ago, few people had heard of Bitcoin, it was the only digital currency available, you could only trade it peer-to-peer, and you could mine it on your own home computer. It was a big gamble that cryptocurrency would even have any value at all many years into the future because digital currencies had been tried before and failed.

When you only had a handful of people experimenting with a new technology that had a limited practical value at the time, of course, there is going to be low liquidity and a large founder’s share. However, Bitcoin wasn’t engineered to have those features like Hex was.

There are now over 2,000,000 cryptos covering $1.6 trillion in value, dozens of retail crypto exchanges, ETF like trusts that buy and hold Bitcoin, and futures contracts on it: cryptocurrency has not been in its infancy for 5+ years now.

Additionally, Bitcoin exists by itself. Hex depends on another cryptocurrency, Ethereum, because it isn’t even an independent coin; it’s a token.

To make the jump that Hex is like Bitcoin because they both, well, use blockchain, is completely nonsensical, but it has the contrast about the size of the Grand Canyon.

What Does Hex Crypto Actually Do?

Ask yourself, what innovation does Hex add to the table aside from being a self enrichment scam?

Bitcoin’s purpose wasn’t to furnish its users with investment returns. In contrast, this is Hex’s only purported purpose.

Bitcoin was invented to facilitate digital payments and solved a double spending problem for digital money. Bitcoin was the genesis of cryptocurrency and it didn’t require sending the founder money to participate in it. Bitcoin is also disinflationary and has a fixed terminal supply.

Hex is none of these features and anyone can clone it with a few mouse clicks. See Rex, for instance, on the Binance Smart Chain (lower gas fees).

What does Hex actually do? Spawns more Hex. That’s it. Anyone can write a contract to do that and it doesn’t require any technical innovation.

Richard Heart saw that other scammers were getting rich creating scam-coins and just wanted in on the action as he stated. He only put a little more thought into the story-line of why you should buy and understands marketing tactics better due to his extensive internet marketing experience.

Hex Token Review Summary: Is Hex a Good Investment?

No, Hex is not a good investment.

The biggest problem with Hex is that ‘interest’ is being paid, but the token doesn’t generate revenue, so the only place that investment returns can come from is other investors. That’s a Ponzi scheme no matter how much spin you put on it, and boy is there a lot of spin laid on thick.

Over time, Hex will need to bring in over $500 million (at Dec 2022 price) in capital each year to keep the token price level. That’s a tall order. Surely plenty of existing investors will defer selling their interest tokens and will lock them up for additional time making the new capital requirements a fraction lower, but the additional supply will continue to stack up until eventually it gets sold onto the market.

Furthermore, Hex is the largest smart contract token because the founder baked in a lot of perks and loopholes for himself leading to an obscene 88% ownership of all Hex tokens today. Try to go into the mindset of someone who creates an ‘investment’ product, but didn’t actually contribute his own capital to obtain that level of ownership. Who’s he really trying to make rich, you or himself?

While Richard Heart likely won’t ‘rug pull’ because a smart parasite doesn’t kill its host, he will dump his massive holdings onto the masses over time in order to cash out if he is successful in gaining wider adoption through the extensive marketing efforts.

Additionally, Richard Heart’s large social media following led to a lot people who got in on the ground floor and also stand to make a lot of money from future buyers and therefore contribute to the shilling and advertising effort through social media.

When a token pumps 2,000x+ in two years as a result of aggressive marketing, there are a lot of people who contributed minimal amounts of their own capital, but showed a life-changing account balance and were counting off the days until their lock up period ended so that they could sell to someone else and realize a massive gain. Think about it: when a $1,000 investment turns into a $2,000,000, the holder needs 2,000 new $1,000 investors to buy his or her coins to cash out. Now multiply that by the hundreds of early investors and realize that Hex’s only value proposition is to find buyers to dump on.

Simply put, Hex investors are not going to tell you to hold off on buying it. It’s best not to ask the ones who benefit from your ignorance whether you should buy.

As such, the only rebuttal from Hex shillers about why Hex isn’t a scam seems to be because their account balance has gone up since they bought in (well back in 2021, anyway). People also thought that they were getting rich with Bitconnect (which peaked at #7 and still trades), Bernie Madoff, and the Celsius Network (which I called out as a Ponzi scheme 5 months before it imploded), but only those that cashed out before the bottom fell out actually made any real money. The same scenario will pan out with a majority of Hex investors who bought the top.

Yes, you too can make money in scams if you buy earlier than the majority and sell before they do, but the trouble with these kinds of schemes is that usually by the time you find out about them, you are one of the later investors buying close to the end of the line while the earlier investors are selling their bags to you.

It’s right in the name: You are being Punk’d.

Now read about Pulsechain, Richard Heart’s next iteration.

TLDR

2. Poor reputation in crypto community as seen on Reddit or Twitter.

3. Uses semantics and deception to sidestep legal requirements for the selling of securities.

4. Purported interest returns from Hex are illusory – tokens are just minted and paid out without actual revenue generation.

5. The entire value proposition is “on-boarding” new users to drive up token price (i.e. shilling) and to absorb supply of newly created tokens.

6. Able to sidestep SEC definition of a Ponzi scheme (maybe) because outdated legal tests didn’t consider private currencies that just mint new units for payout when written.

7. If product doesn’t generate revenue but is paying out ‘interest,’ realized returns can only come from other investors, which is still “Ponzinomics.”

8. Incredibly vast marketing efforts worth millions of dollars to advertise the investment scheme.

9. Founder controls ~88% of the entire token supply and would need millions of new entrants to be able to dump it all, but he has already cashed out millions and proudly showcases his newfound wealth on his YouTube channel and Twitter.

10. Cultish community attacks any criticism of project.

11. Token down 98%+ from its highs reached in Sept 2021 shortly after this article was published (not unique to Hex, but most alts peaked a few months later in November)

Free Investing Tools

For advanced traders who want direct access to exchanges without “payment for order flow” shenanigans choose Interactive Brokers.

I use Axos Bank for its no-fee business account with free bill pay.